Buy-Sell Agreement Using Life Insurance for Succession

As a business owner, you have committed countless hours of hard work and dedication to build your company from the ground up. However, have you ever stopped to think about how the business would survive if something unexpected were to happen to you or your business partner? Planning for the inevitable is crucial for the long-term success of a business, and that's where a buy-sell agreement using life insurance comes into play.

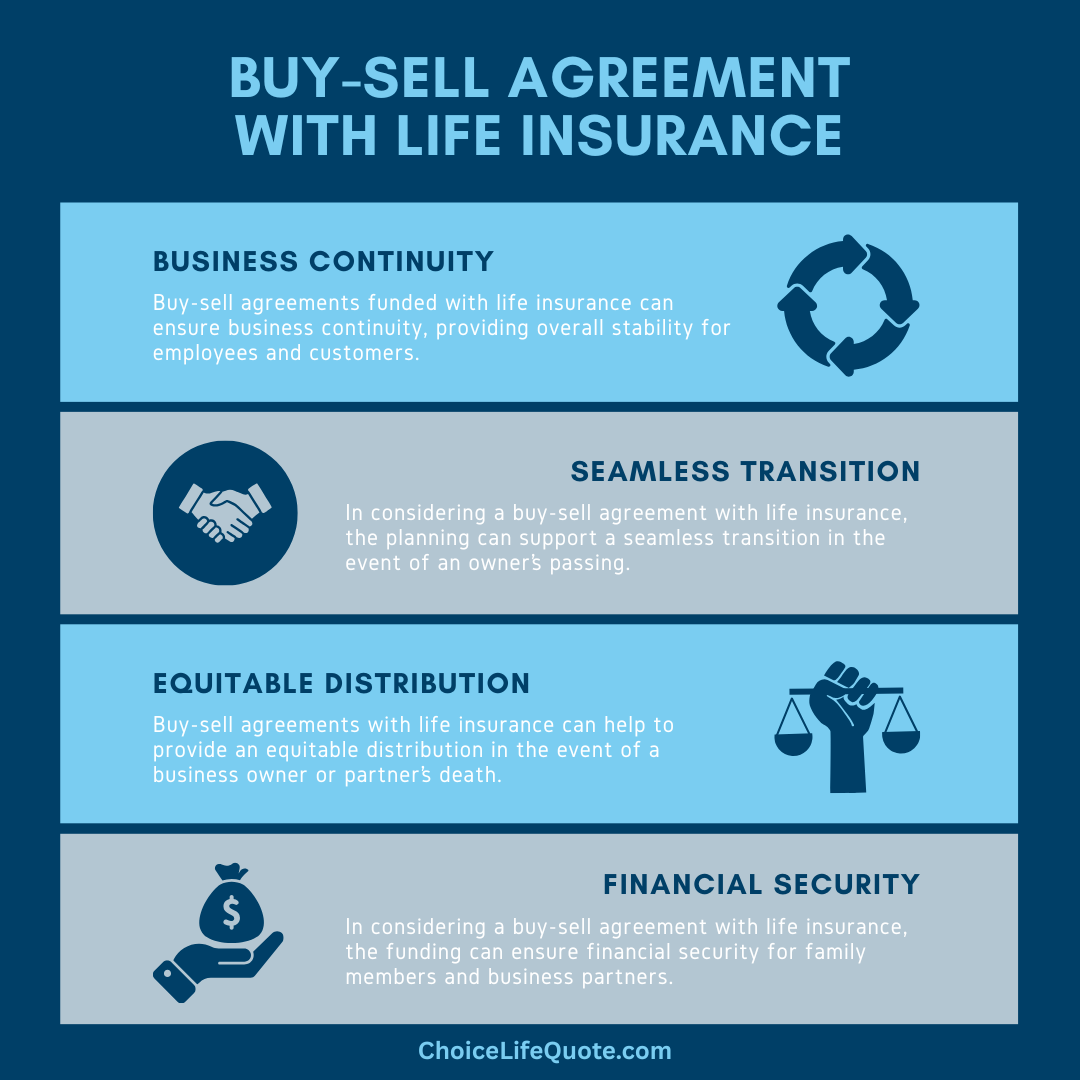

This article highlights how buy-sell agreements and life insurance can be critical components of a business succession plan and how they can provide peace of mind for you and other business stakeholders.

Business Succession Planning

Business succession planning is the process of preparing for the transfer of business ownership and management to another person or entity in the event of retirement, disability, or death.

While no one likes to think about the worst-case scenario, it’s important to plan for the unexpected to ensure that your business can continue to operate smoothly.

Buy-Sell Agreement with Insurance

Types of Buy-Sell Agreements

In business succession planning, the buy-sell agreement is a popular strategy to ensure that the business operations and revenue continue for new or existing existing owners, employees, and other stakeholders. There are several types of buy-sell agreements, each with its own advantages and disadvantages. The most common types routinely include:

Cross-Purchase Agreements: In a cross-purchase agreement, the remaining business owners agree to purchase the departing owner’s interest in the business. This type of agreement is typically used in small businesses with a limited number of owners. The advantages of a cross-purchase agreement include simplicity, flexibility, and the ability to fund the purchase with life insurance.

Entity-Purchase Agreements: In an entity-purchase agreement, the business entity agrees to purchase the departing owner’s interest in the business. This type of agreement is typically used in larger businesses with multiple owners. The advantages of an entity-purchase agreement include simplicity, the ability to fund the purchase with life insurance, and the ability to avoid potential tax issues.

Wait-and-See Agreements: In a wait-and-see agreement, the type of agreement is not determined until a triggering event occurs. This type of agreement is typically used in businesses with a small number of owners and uncertain future circumstances. The advantages of a wait-and-see agreement include flexibility and the ability to tailor the agreement to the specific needs of the business.

Advantages of Buy-Sell Agreements

As a business owner, it is important to strategically plan for not only your business and operations today, but also to consider sustainability and succession for generations into the future. Having a solid buy-sell agreement in place can provide several advantages for business owners and their organizations. Some advantages for businesses including:

Ensuring Business Continuity: A buy-sell agreement can ensure that the business can continue to operate smoothly in the event of the departure of a business owner. By outlining the terms and conditions for the sale of a business interest, the agreement can prevent disputes and ensure a smooth transition of ownership.

Providing Financial Security: A buy-sell agreement can provide financial security for the departing owner and their family by guaranteeing a fair price for their interest in the business. By funding the purchase with life insurance, the agreement can also ensure that the remaining owners have the necessary funds to purchase the departing owner’s interest.

Avoiding Business Disputes: A buy-sell agreement can prevent disputes between business owners by outlining the terms and conditions for the sale of a business interest. By establishing a clear process for the sale, the agreement can prevent disagreements and ensure a fair price for all parties involved.

Life Insurance & Succession Planning

In addition to a buy-sell agreement, life insurance can also be an important component of comprehensive business succession planning.

Life insurance can provide financial security for the departing owner’s family and ensure that the remaining owners have the necessary funds to purchase the departing owner’s interest in the business.

There are several types of life insurance policies that can be used for business succession planning. In addition to a buy-sell agreement, life insurance can also be an important component of business succession planning. Life insurance can provide financial security for the departing owner’s family and ensure that the remaining owners have the necessary funds to purchase the departing owner’s interest in the business. There are several types of life insurance policies that can be used for business succession planning.

Term Life Insurance: Term life insurance is a type of life insurance policy that provides coverage for a specified term, typically 10-30 years. The policy pays out a death benefit if the insured dies during the term of the policy. Term life insurance is often used for business succession planning because it is affordable and can provide a large death benefit.

Whole Life Insurance: Whole life insurance is a type of life insurance policy that provides coverage for the insured’s entire life. The policy pays out a death benefit if the insured dies, and also includes a cash value component that accumulates over time. Whole life insurance is often used for business succession planning because it provides permanent coverage and can be used as a savings vehicle.

Universal Life Insurance: Universal life insurance is a type of life insurance policy that provides flexible coverage and premium payments. The policy includes a death benefit and a cash value component which ab grow over time. Universal life insurance is often used for business succession planning because it provides flexibility and cash value growth.

Benefits of Insurance for Succession

Having life insurance as part of your business succession plan can provide several ongoing benefits. The first and potentially most important of which is to provide the required funding for the overall plan and eventual transition.

Financial Security: Life insurance can provide financial security for the departing owner’s family by ensuring that they receive a death benefit if the owner dies. This can help to ease the financial burden on the family and ensure that they are taken care of in the event of a tragedy.

Business Funding: Life insurance can also be used to fund the purchase of the departing owner’s interest in the business. By purchasing a life insurance policy on the departing owner’s life, the remaining owners can use the death benefit to fund the purchase of the owner’s interest. This can ensure that the purchase is funded without the need for outside financing.

Tax Benefits: Life insurance can also provide tax benefits for business owners. The death benefit is typically received tax-free, and the cash value component of the policy can grow tax deferred. This can provide additional funds for retirement or other business purposes.

Implementing Buy-Sell Agreements

Implementing a buy-sell agreement with life insurance for your business can be a complex process, but it’s important to ensure that your business is protected in the event of unforeseen circumstances. Here are some steps to take when implementing a business succession plan:

Consult with Professionals: Consulting with professionals, such as an attorney, accountant, or financial advisor, can help you to understand your options and develop a plan that is tailored to your business needs.

Determine the Value of Your Business: Determining the value of your business is an important step in developing a buy-sell agreement. This can be done through a business valuation or by using a formula based on the business’s earnings or assets.

Choose the Right Type of Buy-Sell Agreement: Choosing the right type of buy-sell agreement for your business depends on several factors, including the number of owners and the size of the business. Working with a professional can help you to determine the best option for your needs.

Choose the Right Type of Life Insurance: Choosing the right type of life insurance policy for your business depends on several factors, including the age and health of the insured and the size of the death benefit. Working with an insurance professional can help you to determine the best option for your needs.

Conclusion

In conclusion, planning for the inevitable is crucial for the long-term success of your business. By implementing a buy-sell agreement using life insurance as part of your business succession plan, you can ensure that your business can continue to operate smoothly in the event of unforeseen circumstances. Working with professionals and avoiding common mistakes can help to ensure that your plan provides peace of mind for you and your loved ones. Remember, it’s never too early to start planning for the future of your business.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

FAQs

A buy-sell agreement is a legal contract between business owners that outlines how a partner’s share of the business will be handled if they die, become disabled, or choose to leave the business. Life insurance is commonly used to fund these agreements by providing the cash needed for the surviving owner(s) to buy out the departing owner’s share without significantly straining business finances.

Life insurance ensures that liquidity is available immediately when a triggering event occurs, such as the death of an owner. The death benefit provides funds to complete the buy-out as specified in the agreement, helping preserve business continuity and preventing forced sales or financial stress for remaining owners.

The most common life insurance types used in buy-sell funding are term life insurance (for a cost-effective, time-bound buy-out) and permanent life insurance (for long-term or indefinite buy-sell arrangements). The best choice depends on the business’s structure, owners’ ages, and financial goals.

The coverage amount is typically based on the agreed-upon business valuation in the buy-sell contract. This valuation can be a fixed dollar amount, a formula based on revenue or earnings, or a professional appraisal. The policy should provide a benefit to cover that value so the buy-out can occur smoothly.

When a triggering event occurs (such as the death of an owner), the policy’s death benefit is paid to the surviving owner(s) or the business according to the contractual agreement. Those funds are then used to purchase the departing owner’s interest as outlined in the buy-sell contract. After the benefit is paid, the policy will expire, and the business will continue with the surviving owners.

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers for ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help provide consumers with a variety of educational content on life insurance and annuities.