Designating Life Insurance as a Charitable Gift

Are you passionate about a meaningful charity or religious organization? Do you want to make an impact that extends beyond your lifetime? If so, then it’s time to explore the rewarding benefits of designating life insurance as a charitable gift. By harnessing the power of life insurance, you can ensure that your legacy lives on and continues to make a positive impact, even after you’re gone.

This article highlights the advantages of using life insurance as a charitable gift, from supporting causes close to your heart to providing financial security, this unique approach allows you to leave behind a meaningful and lasting legacy.

How Life Insurance Can Make an Impact

Life insurance is often seen as a financial tool designed to provide security and peace of mind for your loved ones in the event of your untimely passing.

However, it has the potential to be so much more. By designating your life insurance as a charitable gift, you can extend its reach and make a lasting impact on causes that are important to you.

One of the key advantages of using life insurance for charitable giving is the significant amount of funds it can generate. Life insurance policies often have a high face value, meaning that the amount donated to charity can be substantial. This allows you to support causes that are close to your heart and make a meaningful difference, even if you may not have the means to do so during your lifetime.

Another way life insurance can make a lasting impact is by providing ongoing support to charitable organizations. By naming a charity as the beneficiary of your policy, you ensure that they receive a steady stream of financial resources that can be used to further their mission and create positive change. This long-term support can have a transformative effect on the organization and the communities they serve.

In addition to the financial impact, life insurance can also raise awareness about causes you care about. By publicly designating your policy as a charitable gift, you inspire others to consider doing the same. This ripple effect can lead to increased support and visibility for causes that matter to you, creating a lasting legacy that extends far beyond your lifetime.

Benefits of Life Insurance as a Charitable Gift

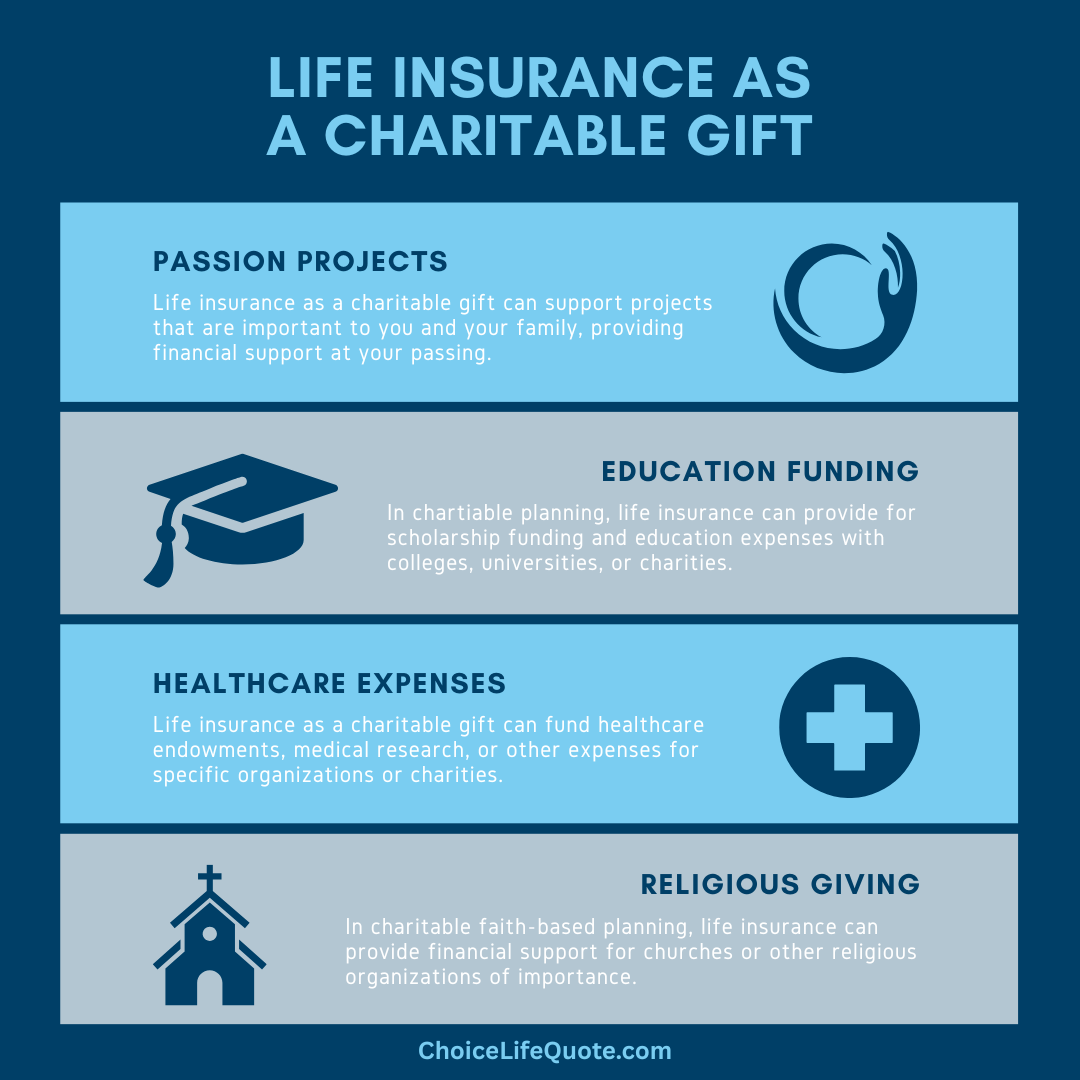

Designating life insurance as a charitable gift offers a range of benefits that make it an attractive option for those looking to make a difference. One of the primary advantages is the ability to support causes that align with your values. Whether it’s education, healthcare, or environmental conservation, you have the power to make a meaningful impact.

Another benefit of charitable giving through life insurance is the flexibility it provides. You have the freedom to choose how your gift will be used, whether it’s to establish a scholarship fund, support ongoing research, or fund specific projects. This level of control ensures that your charitable gift is utilized in a way that aligns with your goals and values.

Tax Advantages of Charitable Life Insurance

When it comes to charitable giving through life insurance, understanding the tax advantages can significantly enhance the impact of your gift. In some instances, the premium payments made towards a gifted life insurance policy can be tax-deductible. This means that you can possibly reduce your taxable income by the amount of your premium payments, resulting in immediate financial benefits.

Furthermore, the charitable donation made through your life insurance policy may also be tax-advantaged. This can potentially allow you to further maximize the impact of your gift. The specific tax benefits and deductions available to you will depend on tax laws and guidelines, so it’s essential to consult with a tax professional to ensure you fully understand the implications and opportunities.

It’s also worth noting that the tax advantages of charitable giving through life insurance can vary depending on the type of policy you have. For example, if you have a whole life insurance policy, the cash value of the policy can be donated to charity, providing an immediate tax deduction. On the other hand, if you have a term life insurance policy, the charitable donation can be made by designating the charity as the beneficiary of the policy.

Choosing the Right Charity for Your Gift

In designating your life insurance policy as a charitable gift, it’s crucial to choose a reputable charity that aligns with your internal values and overall passion.

There are countless charitable organizations across the United States, each with its own unique mission and vision. To ensure that your gift has the greatest impact, take the time to research your selected charity..

Consider factors such as the organization’s track record, financial stability, and transparency. Look for charities that have a proven track record of effectively utilizing funds and achieving their stated goals. It’s also important to assess the financial stability of the organization to ensure that your gift will be used as intended and have a lasting impact.

Transparency is another crucial factor to consider when choosing a charity. Look for organizations that are transparent about their financials, impact, and use of funds. This level of transparency not only ensures accountability but also allows you to see the tangible results of your charitable gift.

In addition to these factors, it’s also important to consider your personal connection to the charity. Choose organizations that resonate with you on a deep level and align with your passions and values. This personal connection will not only make your charitable giving more fulfilling but also ensure that your gift has a lasting impact in areas that matter most to you.

Steps for Life Insurance as a Charitable Gift

Designating your life insurance as a charitable gift involves a series of steps to ensure that your intentions are carried out effectively. While the specific process may vary depending on your insurance provider and local regulations, the following are general steps to consider when making this important decision.

- Review life insurance policies: Start by reviewing your current or proposed life insurance policy to determine if it allows for charitable giving. Some policies may have restrictions or limitations, so it’s essential to understand the terms and conditions of your policy.

- Research charitable organizations: Take the time to research and identify charitable organizations that align with your values and mission. Consider factors such as their impact, financial stability, and transparency. This research will help you make an informed decision about where to direct your charitable gift.

- Contact your insurance provider: Reach out to your insurance provider to discuss your intention to designate your policy as a charitable gift. They will guide you through the necessary paperwork and provide you with the required forms to make the designation.

- Consult with a tax professional: Before finalizing your decision, it’s crucial to consult with a financial advisor or tax professional to understand the tax implications and benefits specific to your situation. They can provide valuable guidance and ensure that your charitable giving aligns with your overall financial goals.

- Complete necessary paperwork: Once you have chosen the charity and consulted with the relevant professionals, it’s time to complete the necessary paperwork to designate your life insurance as a charitable gift. This typically involves applying for coverage or filling out a change of beneficiary form provided by your insurance provider for existing policies.

- Inform your loved ones: It’s important to communicate your decision to loved ones so that they are aware of your intentions. This will help prevent any potential confusion or conflict regarding the distribution of your life insurance proceeds.

By following these steps and working closely with your insurance provider, financial advisor, and chosen charity, you can ensure that your life insurance becomes a powerful tool for charitable giving, creating a lasting impact and leaving behind a meaningful legacy.

Resources to Assist in Charitable Giving

When it comes to charitable giving through life insurance, there are numerous resources and organizations available to assist you in making a meaningful and impactful gift. Consulting related organizations and professionals can help ensure that your charitable giving is impactful and aligns with your goals and values. Here are a few resource organizations that can provide guidance and support:

Charity Navigator: Charity Navigator is a trusted resource that evaluates and rates charitable organizations based on their financial health, transparency, and accountability. Their website provides valuable insights and information to help you make informed decisions about where to direct your charitable gift.

Charitable Gift Planners: The National Association of Charitable Gift Planners is an organization that brings together professionals involved in charitable gift planning. They offer resources, education, and experts who can provide guidance and assistance in navigating the complexities of charitable giving through life insurance.

Community Foundations: Community foundations are nonprofit organizations that work to connect donors with charitable causes in their local communities. They often have expertise in charitable giving and can help you explore options for designating your life insurance as a charitable gift.

Case Studies: Real-life Scenarios

In the United States many charities and endowments depend financially upon the generosity of individual supporters. The gift of life insurance can optimize this giving.

To truly understand the transformative power of designating life insurance as a charitable gift, let’s explore some real-life case studies that highlight the impact and rewards of this unique approach to giving.

Case Study 1: The Education Empowerment Fund: John, a successful businessman, was passionate about making quality education accessible to underprivileged children. He designated his life insurance policy as a charitable gift to the Education Empowerment Fund, a nonprofit organization dedicated to providing scholarships and educational resources to children from low-income backgrounds. John’s generous gift ensured that countless children were given the opportunity to pursue their dreams and break the cycle of poverty.

Case Study 2: The Environmental Conservation Foundation: Sarah, a nature enthusiast, wanted to ensure the preservation of fragile ecosystems and wildlife habitats. She named the Environmental Conservation Foundation as the beneficiary of her life insurance. The financial resources generated through her gift enabled the organization to acquire and protect critical land, support scientific research, and raise awareness about the importance of environmental conservation. Sarah’s gift continues to make a lasting impact on the planet she loved.

These case studies illustrate how designating life insurance as a charitable gift can create tangible and lasting change. By aligning your resources with causes that are close to your heart, you can make a significant difference in the world, even after you’re gone.

Conclusion

In conclusion, designating your life insurance as a charitable gift is a powerful way to create a lasting impact on causes that matter most to you. By harnessing the financial resources and tax advantages of life insurance, you can support organizations and initiatives that are making a positive difference in the world. Whether it’s a charitable organization, environmental conservation, or another cause close to your heart, your charitable gift has the potential to transform lives and create a meaningful legacy.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.