Protect Your Business with Key Person Life Insurance

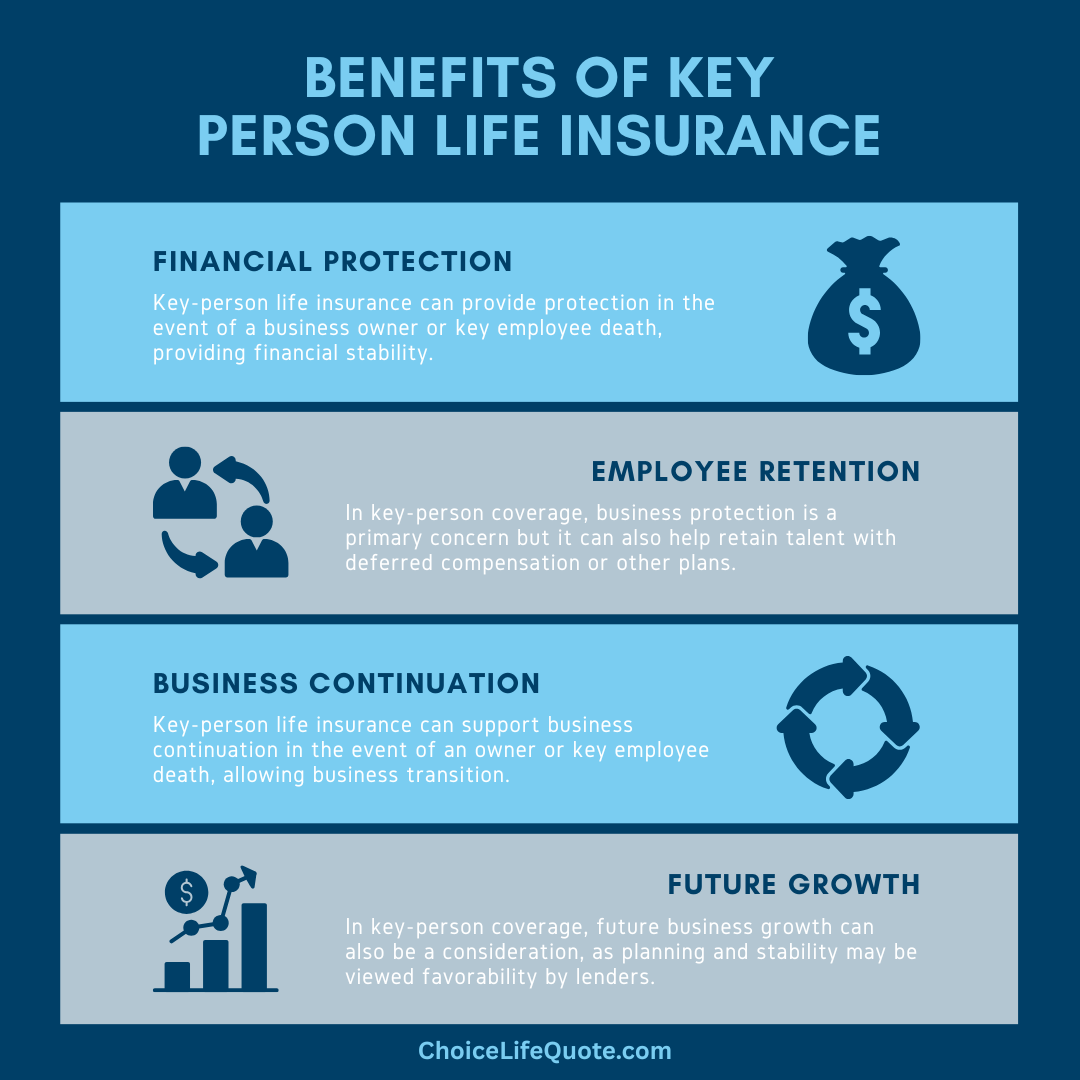

In the fast-paced and competitive world of business, safeguarding your company's future is of utmost importance. While most entrepreneurs focus on insuring their assets and liabilities, many overlook a crucial aspect – protecting the value of key employees. That's where key person life insurance comes into play. Key person life insurance provides financial protection in the event of the untimely death of a key employee, ensuring that your business can continue to thrive even in the face of adversity.

This article discusses the benefits of key person life insurance, exploring how it can safeguard your business and help to build financial security, providing resources ranging from business liquidity to recruitment and training resources.

Understanding Key Person Life Insurance

Key person life insurance is a life insurance strategy that protects a business against the financial loss that may occur due to the death of a key employee.

A key employee is typically someone who possesses specialized skills, knowledge, or experience that is crucial to the success of a business. This could include key executives, managers, or even technical experts.

The policy is owned by the business and the premiums are paid by the company. In the event of the insured key employee’s death, the policy pays out a predetermined sum of money to the business. This payout can be used to cover various expenses such as hiring and training a replacement, paying off debts, or compensating for the loss of profits.

Key person life insurance is not only limited to the death of a key employee but can also provide coverage in the event of terminal or critical illnesses (depending on the policy) that prevent the key employee from working. This ensures that the business can continue to operate smoothly even if the key employee is unable to contribute.

Importance of Key Person Life Insurance

Many businesses rely heavily on the expertise and contributions of key employees. These individuals possess unique skills, knowledge, and relationships that are integral to the success of the company. As a result, the sudden loss of a key employee can have a significant impact on the business.

Key person life insurance provides a safety net for businesses by offering financial protection in such unfortunate circumstances. It ensures that the company can continue operations without facing major disruptions or financial hardships. The payout from the policy can be used to cover various expenses, including recruitment and training costs, paying off debts, and even compensating for the loss of profits during the transition period.

Moreover, key person life insurance can also help businesses retain key employees by offering additional benefits such as cash value accumulation, which can be used as a form of deferred compensation. This can serve as an incentive for key employees to stay with the company, knowing that their contributions are valued and protected.

Determining the Appropriate Coverage

When considering key person life insurance, it is essential to determine the appropriate amount of coverage needed for your business. This involves evaluating the financial impact that the loss of a key employee would have on your company’s operations and profitability.

To assess the appropriate coverage amount, consider factors such as the key employee’s role and responsibilities, their contribution to the company’s revenue and profit, and the cost of recruiting and training a replacement. It is also important to consider any outstanding debts or loans that would need to be settled in the event of the key employee’s absence.

Working with an experienced insurance professional can help you analyze these factors and determine the ideal coverage amount for your business. They can guide you through the process, ensuring that you have adequate protection to safeguard your business and secure its future.

Choosing the Right Key Person Policy

When choosing a key person life insurance policy, it is crucial to consider the specific needs and requirements of your business. There are various types of policies available, each with its own features and benefits. Some policies offer term coverage, while others provide permanent coverage with cash value accumulation.

Term life insurance policies provide coverage for a specific period, such as 10, 20, or 30 years. These policies are typically more affordable and offer a straightforward solution for businesses that require coverage for a specific period, such as a key employee’s working years or until a specific milestone is reached.

Permanent life insurance policies, on the other hand, offer lifelong protection. These policies have the added benefit of cash value accumulation, which can be utilized as a form of savings. This can be particularly beneficial for businesses that want to offer additional benefits to key employees or want to build a cash reserve that can be accessed in the future.

Considerations for Key Person Life

Applying for key person life insurance requires careful consideration and preparation, in both the business assessment and insurance company approval.

The process typically involves providing detailed information related to the key employee, such as their age, health history, job responsibilities, and other personal and business considerations.

The insurance provider will assess the risk associated with insuring the key employee and determine appropriate premiums. To improve chances of securing a favorable policy, it is important to provide accurate and up-to-date information about the employee. This includes disclosing any pre-existing conditions or lifestyle factors that may impact their insurability.

It is also worth noting that the application process can take longer than traditional life insurance policies. This is because the insurance provider needs to assess the unique risks associated with insuring a key employee and determine appropriate coverage. Therefore, it is advisable to start the process well in advance to allow for any potential delays.

When it comes to key person life insurance, it is also important to understand the tax implications. In general, the premiums paid by the business are not tax-deductible. However, the proceeds from the policy are generally tax-free if used for legitimate business purposes, such as covering recruitment costs or paying off debts. It is important to consult with a qualified tax advisor to ensure compliance with tax regulations and maximize tax benefits.

Case Studies: Key Person Life Insurance

The benefits of key person life insurance can significantly influence a business's bottom line and potentially long-term sustainability in the event of the passing of an owner or key employee. To further illustrate the benefits and impact of key person life insurance, let’s explore a few case studies. The following case studies have been provided for review and consideration.

Case Study #1: XYZ Corporation: XYZ Corporation, a technology startup, had a brilliant Chief Technology Officer (CTO) who was instrumental in the development of their flagship product. Unfortunately, the CTO passed away unexpectedly, leaving the company in a state of shock. However, thanks to their key person life insurance policy, XYZ Corporation received a substantial payout that allowed them to hire a new CTO and continue their operations without major disruptions.

Case Study #2: ABC Manufacturing: ABC Manufacturing was a family-owned business that heavily relied on the expertise of its founder and CEO. When the CEO suffered a stroke and was unable to work, the company faced significant challenges. However, their key person life insurance policy provided them with the financial resources to hire a temporary CEO and implement a succession plan. This ensured the smooth transition of leadership and allowed the company to continue its growth trajectory.

These case studies highlight the real-world impact of key person life insurance and how it can be a lifeline for businesses facing unexpected challenges. It demonstrates the importance of being proactive and taking steps to protect your business and secure its future.

Conclusion

In conclusion, key person life insurance is a powerful tool for protecting your business and securing its future. By providing financial protection in the event of the death of a key employee, this often overlooked insurance policy can ensure business continuity and peace of mind for entrepreneurs. By unlocking the potential of key person life insurance, you can safeguard your business against unforeseen events and ensure that your company thrives, even in the face of adversity.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.