How Life Insurance Works | 13 Frequently Asked Questions

The majority of Americans would agree that owning life insurance coverage is an extremely important part of their overall financial plan, yet many consumers are unsure exactly how life insurance works. This confusion is completely understandable given the complicated marketplace and sheer number of life insurance companies in the United States. In considering coverage, it can be extremely helpful to review common consumer questions and insightful answers in order to make informed decision related to life insurance coverage and planning.

This article discusses how life insurance works and highlights 13 questions frequently asked by consumers, providing an overview of life insurance basics and allowing you to become a more informed consumer when considering coverage.

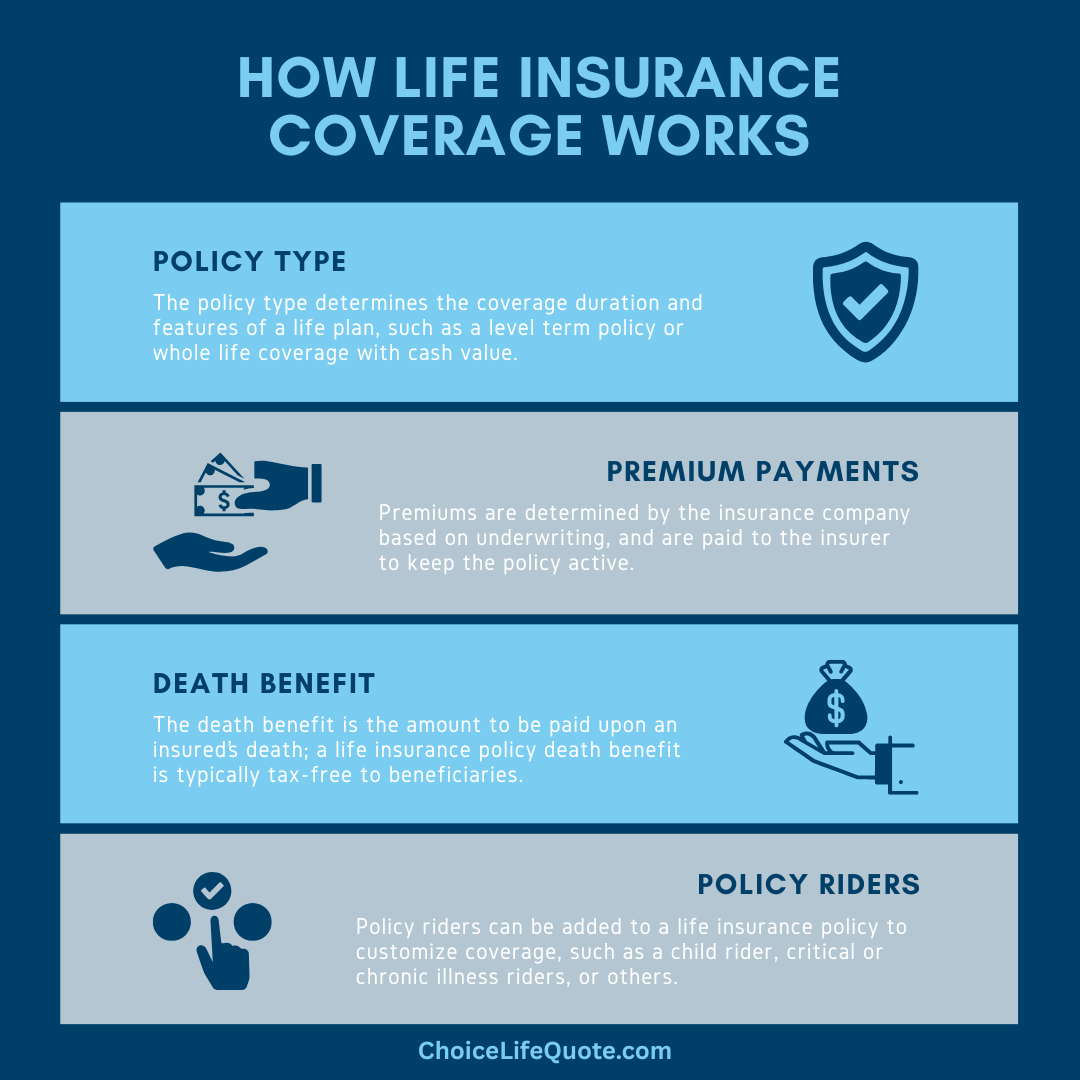

How Life Insurance Works (FAQs)

A basic understanding of how life insurance works is essential to ensuring that you have appropriate coverage for your family, business, or other obligations. When considering life insurance, it is important to choose the right type of policy, an appropriate amount of coverage, and the best insurance company for your specific situation. The following frequently asked questions can be helpful in determining coverage needs, evaluating policy options, and selecting the best insurance company for your individual situation.

What is the purpose of life insurance?

Simply stated… Life insurance can provide financial protection for those you care about and other financial obligations in the event of an unexpected or untimely death. A life insurance policy pays a tax-free death benefit to designated beneficiaries at the primary insured’s passing. Policies are often primarily used for income replacement.

However, they may also serve other purposes such as paying off a mortgage, funding a child’s education, making charitable contributions, business continuation, tax-deferred cash value accumulation and other objectives.

Who should own life insurance?

Essentially, if someone depends upon you for financial support you likely have a need for life insurance. Coverage needs often change throughout an individual’s lifetime based on certain “life events.” These events may include, but are not limited to, getting married, purchasing a home, having children, planning for college, owning a business, saving for retirement, planning for final expenses, or transferring wealth to future generations.

At some point in their lives, most people have a need for life insurance protection.

According to Life Happens, a nonprofit organization promoting consumer education, “if someone will suffer financially when you die, chances are you need life insurance...”

Life Events

What are different types of coverage?

Though the different types of life insurance coverage can seem complicated as times, life insurance policies can essentially be divided into either temporary (term) or permanent coverage. Within these two basic categories, there are several policy options offering features designed to meet specific needs. Highlights of term life insurance vs. permanent life insurance include the following:

Term

Permanent

What is a term life Insurance policy?

Term life offers basic life insurance coverage, traditionally at the lowest initial cost. This type of coverage provides temporary protection in the form of a death benefit for a specific period, or “term,” during which premiums remain level. Common term life policies offer level premiums for 10, 20, or 30 years and are typically renewable at higher rates after the initial term expires. Some companies offer customizable term lengths to meet the insured’s individual coverage needs. Many term plans may also be converted to a permanent policy if the insured has a need for continued coverage.

The bottom line is that term life insurance offers pure coverage (death benefit) at the lowest initial cost, with premiums remaining level for a specific period.

- Policies

Term Policy Highlights:

- Lowest Initial Premiums

- Temporary Coverage

- Tax-free Death Benefit

- Benefit Riders Available

- No Cash Value Accumulation

What is permanent life Insurance?

Permanent life insurance is designed to provide lifetime protection for the primary insured. This type of coverage is initially more expensive than term life plans due to being priced for lifetime coverage. Unlike term insurance, many permanent policies accumulate tax-deferred cash value, which may be accessed by the policy owner.

There are a variety of types of permanent plans which offer different features to policy owners. As an example, whole life premiums are permanently fixed, while universal life allows for flexible premiums. Additionally, interest crediting methods vary by type of permanent policy, ranging from fixed interest rates to rates linked to a selected market index.

Essentially, permanent life insurance offers a lifetime death benefit, tax-deferred cash value accumulation, and often living benefits.

- Policies

Permanent Policy Highlights:

- Higher Initial Premiums

- Lifetime Coverage

- Tax-free Death Benefit

- Living Benefits Available

- Tax-deferred Cash Value

How much coverage do you need?

In determining an appropriate amount of life insurance coverage, you should essentially consider those you love and what you owe. Calculating the replacement of your income for a certain number of years, your outstanding mortgage and other debts, estimated future education costs, and final expenses will give you a quick snapshot of your coverage needs. It is often recommended that a multiple of 7 to 10 times a person’s income be used to estimate required coverage. However, an individual analysis of your personal situation can be much more accurate.

According to Life Happens, “When purchasing life insurance, the question really isn’t how much you need, but how much your family will need at the time of your death?”

Complete a FREE Needs Assessment!

How to select an insurance company?

When purchasing life insurance, choosing the right insurance company is extremely important. With literally hundreds of life insurance companies to choose from, this can be an overwhelming task. When evaluating an insurance company, we recommend that you consider the company’s product offerings and industry ratings. From a product perspective, you want to make sure that the company’s product portfolio includes policy options that meet your individual or business needs. Company ratings may seem a bit more complicated but can be easily navigated by sticking with highly-rated insurers.

Working with an independent insurance professional can provide you with an advocate in navigating the complicated world of insurance.

How are insurance companies rated?

Insurance companies are evaluated based on financial strength and creditworthiness by well-respected credit rating agencies such as A.M. Best, Standard & Poor's, Fitch Ratings, and Moody's.

Within the life insurance arena A.M. Best serves as an industry standard for company ratings. According to A.M. Best, “a Best’s Financial Strength Rating (FSR) is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations.” Experienced independent agents traditionally recommend “A” (Excellent) or above rated companies to their clients.

A.M. Best Ratings

Which companies are recommended?

Now that is truly the “million-dollar question!” Given hundreds of insurance companies offering literally thousands of life insurance products, there are a number of outstanding options for today’s consumers. As previously discussed, company ratings are extremely important in choosing a life insurance company. However, underwriting standards and customer service are also significant considerations in how life insurance works. When considering different underwriting practices, one company may offer flexibility related to certain medical conditions or tobacco use, which can potentially lower an insured’s premiums when compared to another company.

Working with a trusted independent agent can be extremely helpful in choosing the right type of policy, amount of coverage, and best insurance company. In providing the following insurance company recommendations, company ratings, product portfolio, underwriting policies, customer service, and other factors have been taken into consideration. Recommended companies have been provided below for review.

How to apply for life coverage?

When applying for life insurance, the company you choose will need to evaluate your application for coverage. This process differs depending on the type of policy and individual company underwriting standards. Non-medical life insurance policies can be approved in minutes, while fully underwritten policies may take 4 to 6 weeks for approval. Fully underwritten policies traditionally require an in-depth application, medical exam, medical review, DMV check, and other requirements. These policies are normally best for healthy individuals who want to get the lowest premium rates or those who have medical issues which need to be evaluated.

No exam policies routinely include an application and medical, motor vehicle, and pharmacy reports; but do not require an intrusive medical exam. No exam policies offer quicker coverage without a medical exam for a slightly higher premium. Key features for both the fully underwritten and no exam life insurance options have been provided below.

Fully Underwritten

Life Policy

No Exam

Life Policy

How to get the best exam results?

If you are applying for a fully underwritten policy, the life insurance company will require a medical exam or physical.

This exam allows the company to evaluate your current health history and often includes a series of medical questions, height/weight, blood pressure, blood and urine collection, and possibly an EKG.

From a positive standpoint, you get a free medical exam out of the deal, and if you are relatively healthy, this can qualify you for lower rates.

On the other hand, concerns related to the exam may cause the insurance company to increase your rates or even deny coverage. Based on the exam’s potential impact on policy approval and premium rates, it is important to get the best results possible. The following are a few pointers for getting the best results on your life insurance exam or physical.

Exam Best Practices

Schedule your exam in the morning. You will be required to fast (not eat) for six to eight hours prior to the exam, so early morning will likely work best since any food or drinks could potentially affect your lab results.

Prepare a list of current medications. The paramed examiner will need to know what medication you are currently taking. Preparing a list of current prescription and over-the-counter medications will be helpful and save time.

Take it easy prior to your exam. Strenuous exercise prior to your exam may cause elevated blood pressure and pulse, so no workouts the morning of your exam. It may also be helpful to get a good night’s rest the evening prior.

Drink plenty of water the evening prior. Staying hydrated the day prior to your exam will help facilitate the required blood and urine samples.

No caffeine or nicotine prior to your exam. Drinking coffee and/or smoking cigarettes can elevate your blood pressure and negatively impact lab results. Avoiding both the morning of your exam is highly recommended.

No alcohol prior to your exam. Drinking alcohol prior to your exam can leave you dehydrated, affect liver functions, and negatively impact other lab results. It is best to limit alcohol intake 24 hours prior to your scheduled exam time.

Limit sodium and fat intake. Excess salt and/or fat in your diet can affect blood pressure and cholesterol levels. For the best results, limit excess salt and fat 24 hours prior to your scheduled exam.

Be straight forward with your examiner. It is important to provide complete and accurate information concerning your medical history to the paramed examiner. The information you provide will be evaluated along with your exam findings, lab results, medical information bureau reports, prescription checks, and other data. Any discrepancies or inconsistencies can potentially impact the underwriting process, and ultimately policy approval.

What if life coverage is denied?

If you are denied coverage for either a fully underwritten or a no medical exam life insurance policy, you may be able to apply with another company that would view your medical condition, or other challenges, more favorably. There are also additional coverage options available in the form of simplified or guaranteed issue life insurance.

These plans are more expensive than traditional policies but offer an opportunity to secure needed coverage. There can also be a wide range of premium rates from one policy to another, so it is important to work with an experienced independent agent who can assist in evaluating appropriate coverage options.

Why use an independent agent?

Independent life insurance agents have access to multiple companies, as opposed to a "captive" agent who works for a single insurer. An experienced independent agent can assist you in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your specific situation. Veteran agents often have decades of experience in working with clients who have less than perfect health and can be extremely knowledgeable about the underwriting requirements of different insurers.

Working with an experienced independent agent gives you a significant advantage in navigating the life insurance buying process.

Conclusion

In conclusion, understanding how life insurance works is crucial for anyone looking to secure their financial future with coverage. This article has explored the fundamental concepts of life insurance, addressing 13 common questions that consumers often ask. By clarifying these key points, it empowers individuals to make informed decisions when selecting coverage that aligns with their needs. Whether you're considering life insurance for income replacement, mortgage protection, or other financial obligations, this knowledge equips you to navigate the complexities of the insurance marketplace confidently.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.

8 Comments

rachel frampton

My mother is planning to obtain life insurance because she heard that this will help pay off the funeral expenses just in case she passes away. It's a great thing that you were able to share here that the term coverage has tax-free death benefits. Thank you for also informing your readers that the permanent one has higher initial premiums.

James Shiver, DBA

Good morning, thank you for the comment. It is important to consider financial needs and objectives when purchasing life insurance. This process can help in selecting the right amount of coverage and type of policy. Please let us know if we can ever be of assistance. Have a great weekend!

Taylor Hicken

I appreciated it when you shared that life insurance is crucial as it provides financial protection to your beneficiaries, in the event of unexpected death. My friend just told me last week that she is worried about her son since he has no one else in case she passes away someday since her husband had left them for good a few years ago. I will advise her to get a life insurance policy to provide a financial solution for her son in case anything happens to her.

James Shiver, DBA

Good morning, thank you for the feedback related to the article. I am glad that you found it helpful. I will be happy to assist however possible. Have a great day!

Eli Richardson

I'm glad you mentioned everyone needs to have life insurance. My little sister started to work recently, and I told her it's important that she gets insured as soon as possible. She's strong-headed and says she doesn't need it. That's why I believe reading your piece might change her mind. I appreciate your information about how life insurance works and why having it is a must.

James Shiver, DBA

Good morning, thank you for the comment and referral to your sister. Also, I am glad that you found the information helpful. Take care.

Fred Gibbons

Thank you for pointing out that life insurance can help make sure that your family is taken care of if you die unexpectedly. I want to make sure that my family's future is secure, so I'm thinking about buying life insurance this year. I'm going to look for a good business in the area that can sell me some life insurance.

James Shiver, DBA

I am glad that our article was helpful in understanding the value of life insurance. Your local agent should be able to help with a needs analysis and coverage if appropriate. Please let us know if we can ever be of assistance.