Mutual of Omaha Insurance Company Review

Mutual of Omaha has a long history of providing quality insurance and financial products to consumers, as well as an organizational focus on community service.

But, how do the company’s products and services compare to their competitors in an ever-evolving marketplace?

What types of insurance products and services does Mutual of Omaha offer?

In our experience, Mutual of Omaha is a highly reputable company offering a variety of insurance and financial products to consumers nationwide. In addition, the organization has a rich history of community service and charitable giving.

This article provides an overview of Mutual of Omaha company financials, ratings, products, service, and other factors to consider when selecting the best life insurance company to meet your individual, family, or business needs.

Mutual of Omaha Insurance Company

Mutual of Omaha is a Midwest-based insurance and financial services company headquartered in Omaha, Nebraska.

The product portfolio includes a variety of insurance offerings such as life insurance, long-term care, disability income, critical illness, medicare supplements, and others.

According to Mabel Criss, Mutual of Omaha’s first female Vice President and General Manager elected in 1929, “the key to our longevity is simple, be kind to our customers and our community.”

While financial services available include investments, banking, and mortgages. A household name, the company has developed a century-old reputation as an insurer of choice for both individuals and employers. The company is also a commonly recommended carrier by independent agents and brokers in servicing clients.

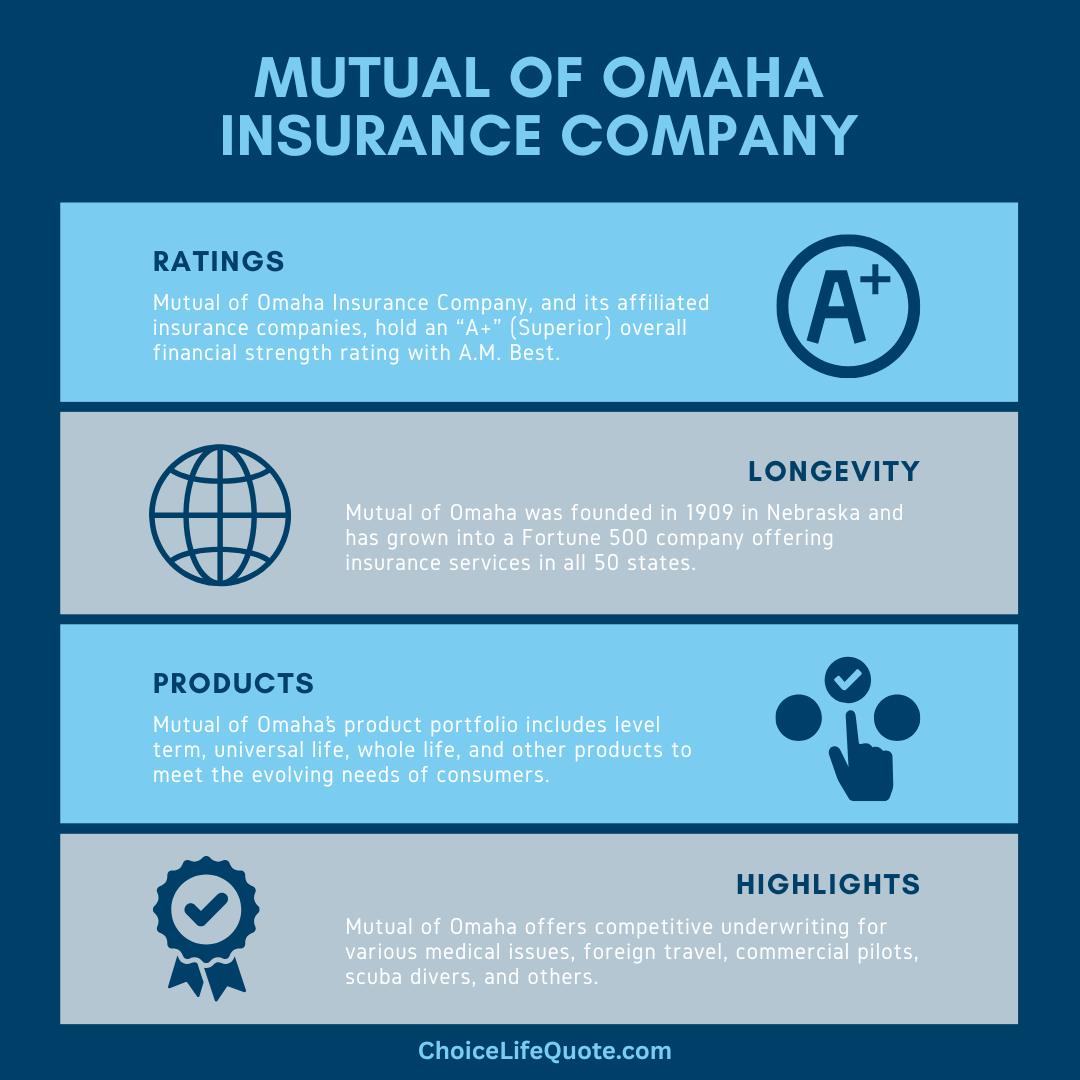

Mutual of Omaha was founded in 1909 in its home state of Nebraska and has grown into a Fortune 500 company offering insurance and related services in all 50 states. Insurance and financial products offered are provided through affiliated companies to include United of Omaha Life Insurance Company, Companion Life Insurance Company, Mutual of Omaha Investor Services, Omaha Financial Holdings, and others. As of 2019, Mutual of Omaha’s Company Snapshot reflects a customer base of over 4 million individual consumers, 10 million total members, and 36,000 employer groups nationwide.

Mutual of Omaha by the Numbers

Source: Mutual of Omaha

Mutual of Omaha Company Ratings

An insurance company’s industry ratings provide a snapshot of overall financial stability and fiscal trustworthiness related to financial obligations.

These ratings are often valuable to consumers when considering life insurance, annuities and other financial products and services offered by various companies. They can serve as an indicator of strength and stability providing peace of mind in an otherwise unsure world.

In evaluating insurers, consumer confidence in an organization’s ability to meet currant and future financial obligations is extremely important. Mutual of Omaha Insurance Company, and its affiliated companies, currently hold an “A+” (Superior) rating with AM Best, as well as very strong and good ratings with Standard & Poor’s and Moody’s, respectively.

In addition, the company has held accredited with the Better Business Bureau since 1940 and maintains an “A+” rating. Mutual of Omaha’s financial strength ratings by leading rating services have been provided below for review.

Source: Mutual of Omaha

Mutual of Omaha Life Products

Mutual of Omaha Insurance Company, and its affiliated companies, offer a comprehensive portfolio of insurance products to include life, long-term care, disability, critical illness, medicare supplements, and other related coverage.

The following information highlights the company’s life insurance products offered.

Mutual of Omaha’s life insurance offerings include both term and permanent coverage to align with different stages of financial life and varying consumer needs. The following chart provides highlights of features and benefits associated with different types of life insurance policies offered by Mutual of Omaha Insurance Company and its affiliated companies.

Note: Please review individual life insurance policy details for specifics related to products, features, and benefits.

Term Life Insurance

Term life insurance can provide affordable coverage designed to last for a specific period or “term.” Traditionally, with level term plans premium rates remain fixed for the length of the selected term. Term life insurance highlights and common uses for coverage have been provided below for review.

Term Life Highlights

Term Life Uses

Permanent Life Insurance

Permanent life insurance can provide protection designed to last a lifetime or for the life of the selected policy. Traditionally, permanent life plans will accumulate cash value and may offer additional living benefits. Two common types of permanent life insurance are whole life and universal life plans. Permanent insurance highlights and common uses for coverage have been provided below for review.

Whole Life Highlights

(Level Benefit Plan)

(Graded Benefit Plan)

Universal Life Highlights

(Guaranteed Universal Life)

(Indexed Universal Life)

Permanent Life Uses

Mutual of Omaha Life Insurance Rates

In comparing life insurance rates from different companies, it is important to ensure that your individual health and lifestyle variables are taken into consideration. Mutual of Omaha is a highly rated insurer offering competitive premium rates.

In fact, when compared to other leading carriers with similar products and ratings, the company’s rates are often among the most affordable. Offering outstanding ratings and competitive premiums, the company is routinely a carrier of choice for both price and quality-conscious consumers. The sample rates below have been provided as an example of Mutual of Omaha term life premiums.

Conclusion

In conclusion, Mutual of Omaha stands out not only for its robust lineup of insurance and financial products but also for its steadfast commitment to community service and financial stability. With over a century of operation, Mutual of Omaha has earned a stellar reputation, backed by top-tier ratings from AM Best, Standard & Poor’s, and Moody’s. Whether you're considering term or permanent life insurance, Mutual of Omaha offers a comprehensive range of solutions tailored to meet diverse individual, family, and business needs. Choosing Mutual of Omaha means choosing reliability, quality, and a partner committed to serving its customers and communities.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.