No Exam Life Insurance | Non-Medical Coverage Options

Is it possible to get life insurance without taking a medical exam or completing medical requirements? The short answer is... YES, with no exam life insurance. No exam life insurance provides a simple method of obtaining needed coverage. Applying for traditional coverage can be a somewhat complicated process that may include completing a medical exam, providing medical records, the review of medical, prescription, and driving records, and other requirements. If you have a need for coverage quickly or just don’t like needles, a no exam life insurance policy can be a great option.

This article discusses no exam life insurance, providing an overview of non-medical coverage and highlighting no exam coverage types, recommended non-medical insurers, and recommendations on the application process.

No Exam Life Insurance

In considering an application for life insurance, insurance companies evaluate your personal information, medical background, driving record, credit history, and other relevant information.

This traditionally requires you to take a company-specific medical exam. The exam consists of a series of medical and lifestyle questions, a blood pressure check, height and weight, blood and urine samples, etc.

If you are in relatively good health, completing this exam offers the opportunity to qualify for the best premium rates. However, many companies also offer life insurance policies that require no medical exam. These policies use a simplified underwriting process which allows the company to evaluate your application without an intrusive examination.

No exam policies allow you to have coverage in force quickly with no medical requirements. These policies can range from simplified issue to guaranteed issue plans to meet a variety of coverage needs. If you need fast coverage or simply don’t like taking physicals, no exam life insurance may be right for you.

Considerations in No Exam Life

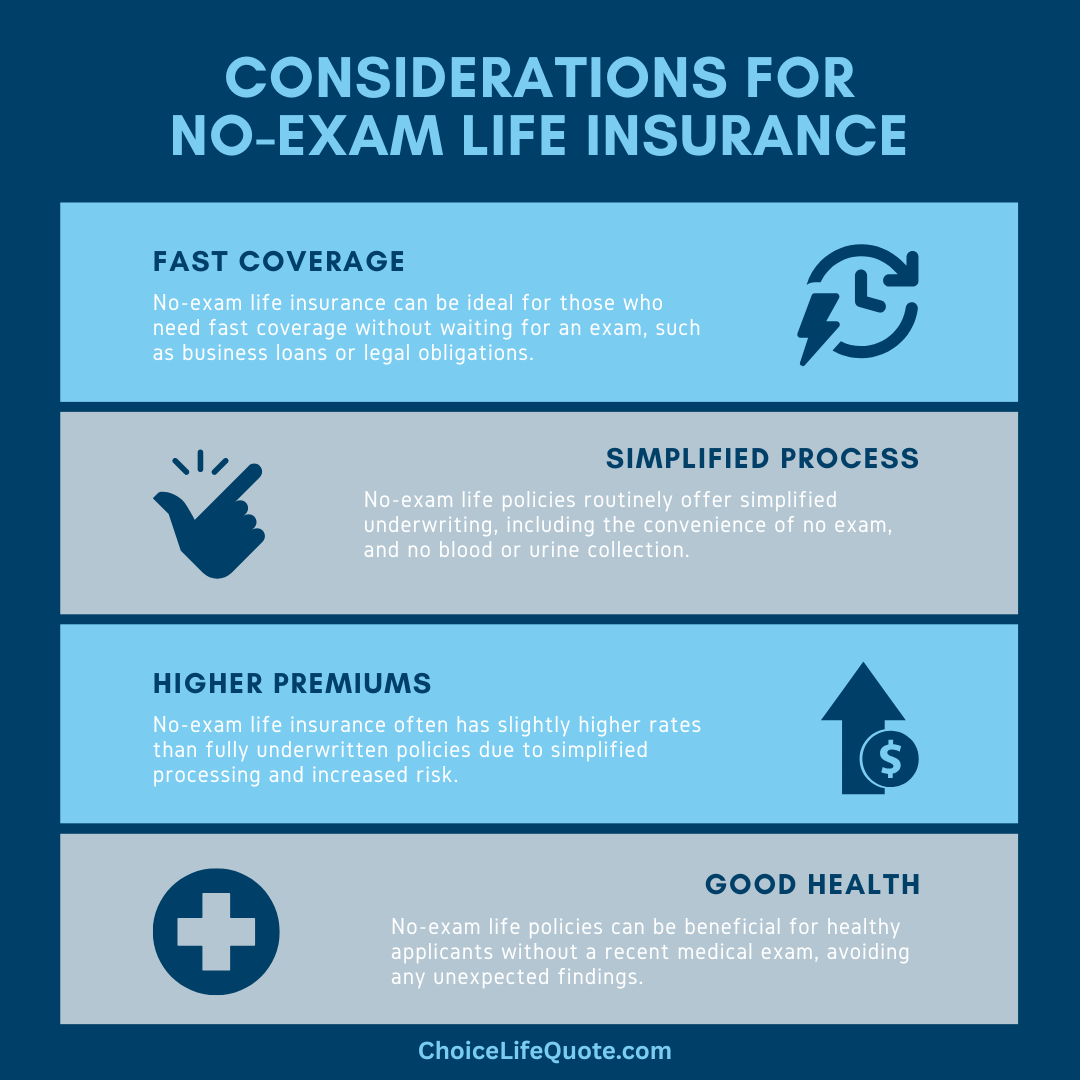

When should you consider no exam life insurance coverage? The answer varies by individual, but basically, if you need fast coverage without the hassle of a medical exam, no exam life may be a good fit.

In many instances, no exam life policies can be placed in force within a few days, if not the same day you apply.

However, you should be aware that you will pay for this convenience in the form of slightly higher premiums. These types of policies are often used when an applicant needs coverage quickly for business or legal purposes, such as a Small Business Administration (SBA) loan, family court judgment (divorce, child custody, etc.), or other similar situations.

No exam life insurance policies are also recommended if you are in reasonably good health but have not seen a doctor in the past few years. During a life insurance exam, an applicant’s lab results may show values outside normal ranges, such as elevated blood pressure, cholesterol, or other abnormalities. In some instances, these relatively minor issues can increase premiums significantly. Choosing the right no exam policy will include consideration of your individual health and medical history, as well as company underwriting standards.

Types of No Exam Policies

The term “no exam life insurance” is often used related to several different types of life insurance policies. Many insurer's offer some type of non-medical coverage.

These plans may include simplified issue, graded benefit, or guaranteed issue policies ranging from term life insurance to final expense (burial) policies.

These policy types are listed in sequential order of increasing applicant risk and premium rates. An experienced independent agent can help to identify the most advantageous policy type for your individual situation.

Simplified issue life insurance is coverage that can be obtained without taking a medical exam or physical. These policies typically offer term and/or permanent coverage of $250,000 or below and may be placed in force very quickly (often the same day). Simplified issue policies require no medical exam; however, insurance companies do routinely check your medical information bureau, medication database, and motor vehicle reports as part of the underwriting process. Simplified issue plans may also include smaller level benefit permanent policies of $25,000 or less used for final expense (burial) coverage.

Graded death benefit life insurance is coverage that can be obtained without an exam and with minimal underwriting questions. These policies typically offer permanent coverage of $25,000 or below used for final expense coverage. Graded benefit policies initially provide a graded or partial death benefit for a certain period, after which the full amount applies.

Guaranteed issue life insurance is coverage that can be obtained without an exam or underwriting questions. These policies also typically offer permanent coverage of $25,000 or less used for final expense (burial) coverage. Guaranteed issue policies provide guaranteed coverage after a waiting period determined by the insurance company.

Recommended No Exam Insurers

Applying for No Exam Coverage

When applying for a no exam life insurance policy, you will complete an application that includes personal data, medical background, lifestyle information, family history, and other information. This application may be completed over the phone or in person, depending on the agent and/or insurance company. Often payment and/or banking information may be required when submitting the application.

Once the insurance company receives your application, it will be evaluated based on relevant underwriting standards. Additional information that may be reviewed in evaluating your application including Medical Information Bureau (MIB), Department of Motor Vehicle (DMV), and Pharmacy reports. As previously stated, an underwriting decision is typically made on these types of policies within a few days of the application being submitted.

Conclusion

In conclusion, no exam life insurance offers a valuable alternative for those seeking quick coverage without the hassle of a medical exam. Whether due to time constraints, aversion to needles, or the need for expedited protection, these policies provide options for securing coverage. From simplified issue to guaranteed issue plans, there are various choices tailored to different needs and health conditions. While premiums may be slightly higher for the convenience of bypassing a medical exam, the speed and ease of obtaining coverage make it a compelling choice for many. In considering no exam life insurance, it's essential to review coverage options and consult with an experienced agent to find the policy that best fits your specific financial goals and objectives.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.