Annuities | Principal Protection & Lifetime Income

In working with consumers related to insurance and financial services, conversations often turn to planning for retirement. Whether you are just starting to save for the future or are currently transitioning into retirement, this can be a complicated and confusing topic. Common questions related to annuities often include… What is an annuity? When should someone consider an annuity? Or… What is the right type of annuity for my specific situation?

This article discusses retirement annuities, providing an overview of how annuities work, explaining the different product options, annuity taxation, and other key elements associated with annuities as a retirement planning vehicle.What is an annuity?

What exactly is an annuity or retirement annuity? In its simplest form, an annuity is a financial product that provides regular income either immediately or beginning at a future point in time.

In reality, annuities have been around for thousands of years dating back to Roman times as a means of providing financial security. Today, common forms of annuities include company pensions, military retirement, and even Social Security benefits.

However, this article is focused specifically on annuity products offered by insurance companies. In this context, an annuity is a contract between an insurance company and a policyholder, whereby the annuity owner pays a premium, or series of premiums, in exchange for regular income payments in the future.

This process is often referred to as the accumulation (growth) phase and the annuitization (income) phase. The disbursements from an annuity can begin immediately, in the case of an immediate annuity, or at a point to be determined in the future, as with deferred annuities. The income provided by an annuity can be for an entire lifetime or a specific period of time designated by the policyholder. Essentially, an annuity can transfer the risks associated with ensuring that an individual has lifetime income from the policyholder to the insurance company.

Annuity Riders

Given that annuities are technically insurance products, they also contain many of the features commonly associated with life insurance. A key difference to understand when comparing life insurance and annuities is that where life insurance provides protection against dying sooner than expected, an annuity can provide protection against outliving your money in retirement.

It is also important to understand that annuity products are issued by insurance companies and are not insured by the federal government. Therefore, reviewing the financial strength of an insurance company, through A.M. Best, Fitch Ratings, Standard & Poor's, or other sources, should be considered. Product features shared by both life insurance and annuities include:

Free-look – When purchasing life insurance and annuity products, consumers are given a “free-look” period during which time they can cancel the policy without penalty. This evaluation period is required by law in all 50 states and is routinely 10 days or more.

Annuity Riders – Similar to life insurance policies, annuities may include and/or offer additional riders, or add-on benefits, to the policyholder. These riders routinely enhance annuity income, long-term care features, and/or legacy benefits. Typical annuity riders may include guaranteed withdrawal, guaranteed accumulation, guaranteed income, guaranteed death benefit, disability income, impaired risk, long-term care, cost of living, return of premium, or others. It is also important to be aware that some annuity riders come at an added cost and should be evaluated based on the cost to benefit.

Policy Fees – Insurance products provide a range of valuable benefits, but not without charging an equally wide range of fees and charges. Fees and charges associated with annuities can include commissions, administrative charges, surrender charges, investment fees, distribution charges, contract fees, and others. It is extremely important to understand all fees and charges associated with an annuity product before purchase. In many instances, annuity owners are allowed to access a percentage of the accumulated value each year without surrender charges (typically 10%).

Favorable Taxation – Insurance products traditionally enjoy favorable taxation, with annuity values routinely growing tax-deferred. Essentially, if an annuity is purchased with after-tax dollars, only the growth will be taxable when withdrawn. Also, annuities may be purchased as either qualified or non-qualified plans related to tax status, which can impact taxation. It is important to understand how an annuity will be taxed and to contact a qualified tax professional with questions specific to your individual situation.

Beneficiaries – As with other insurance-based products, annuity owners may designate policy beneficiaries to receive accumulated values or remaining payments, depending on the death-benefit provision. Typical beneficiary payment options include receiving a lump sum, payments based on life expectancy, or incremental payments. Additionally, as an insurance product having a named beneficiary, annuities typically avoid the probate process.

Considerations for Annuities

Since a major focus of an annuity is to provide future income, these policies are primarily used in planning for retirement.

Similar to traditional retirement accounts and other qualified plans, money in a deferred annuity accumulates on a tax-deferred basis. Likewise, there are also routinely both surrender charges and tax penalties associated with early withdrawals.

According to Stan Haithcock, annuity expert, and author, annuities are designed to contractually solve for principal protection, income for life, legacy planning, and long-term care.

Immediate vs. Deferred Annuities

In the world of annuities, there are essentially two types based on the time horizon for income payout.

These include immediate annuities, which begin providing a guaranteed income stream immediately or a deferred annuity that is designed to grow tax-deferred and provide an income stream at a future point in time.

Income from annuities can be structured to provide guaranteed income for a specific number of years, for your entire lifetime, for the lives of both you and your spouse, or for life with a period certain. The type of annuity that is appropriate essentially depends upon the individual financial objectives of the policy owner. Premiums for annuities can be paid as a lump sum or over a period of time during what is known as the accumulation phase.

Given that traditional company pension plans are nearly extinct, an annuity can provide retirees an alternate source of lifetime income to supplement social security, investments, and other sources of retirement income. Annuities are essentially the only financial product that can guarantee lifetime income, ensuring that you do not outlive your money.

Immediate Annuities

Immediate annuities provide an immediate source of income beginning once a lump-sum premium is made. This income is typically paid monthly and may be designed to last for a lifetime or a specific period certain (guaranteed period). Since this income amount is based on life expectancy, the longer the expected payout, the lower the income amount. In other words, for younger recipients and/or longer periods, income payments will be less than for older recipients. Common features of immediate annuities include the following.

Immediate Annuity Highlights

- Single Premium

- Immediate Payout

- Lifetime Income

- Period Certain Options

Deferred Annuities

Deferred annuities provide tax-deferred growth of principal during an accumulation period and lifetime income once annuitized. Premiums for deferred annuities may be paid as a lump sum or as flexible premiums over a period of time. Flexible premium deferred annuities allow policy owners to accumulate funds over a number of years, take advantage of tax-deferred growth, and receive lifetime income beginning at a selected point in the future.

Deferred annuities are commonly used to supplement traditional company or individual retirement plans since there are traditionally no Internal Revenue Service contribution limits. As with immediate annuities, since income calculations are based upon life expectancy, the longer an individual waits to begin taking income the higher the income payments. In some instances, insurance companies may offer a “premium bonus” of a certain amount or percentage of annuity premiums.

It is also important to fully understand the surrender penalties, rider charges, management fees, and other expenses associated with an annuity being considered. Common features of immediate annuities include the following.

Deferred Annuity Highlights

- Flexible Premiums

- Principal Protection

- Tax-deferred Growth

- Lifetime Income

- Period Certain Options

Types of Deferred Annuities

In addition to the immediate and deferred categories of annuities related to income payout, there are also different types of annuities with regard to interest crediting methods and/or investments held within annuity contracts.

Essentially, the three basic types of annuities related to interest crediting include fixed, indexed, and variable.

These annuity types each have specific benefits, limitations, and risks which should be considered and aligned with a policy owner’s financial objectives. It is important to remember that annuities are first and foremost insurance contracts designed to provide lifetime income that an annuitant cannot outlive.

Annuities are often inappropriately compared to other financial products with differing features and objectives. The following provides general information related to each type of annuity.

Fixed Annuities

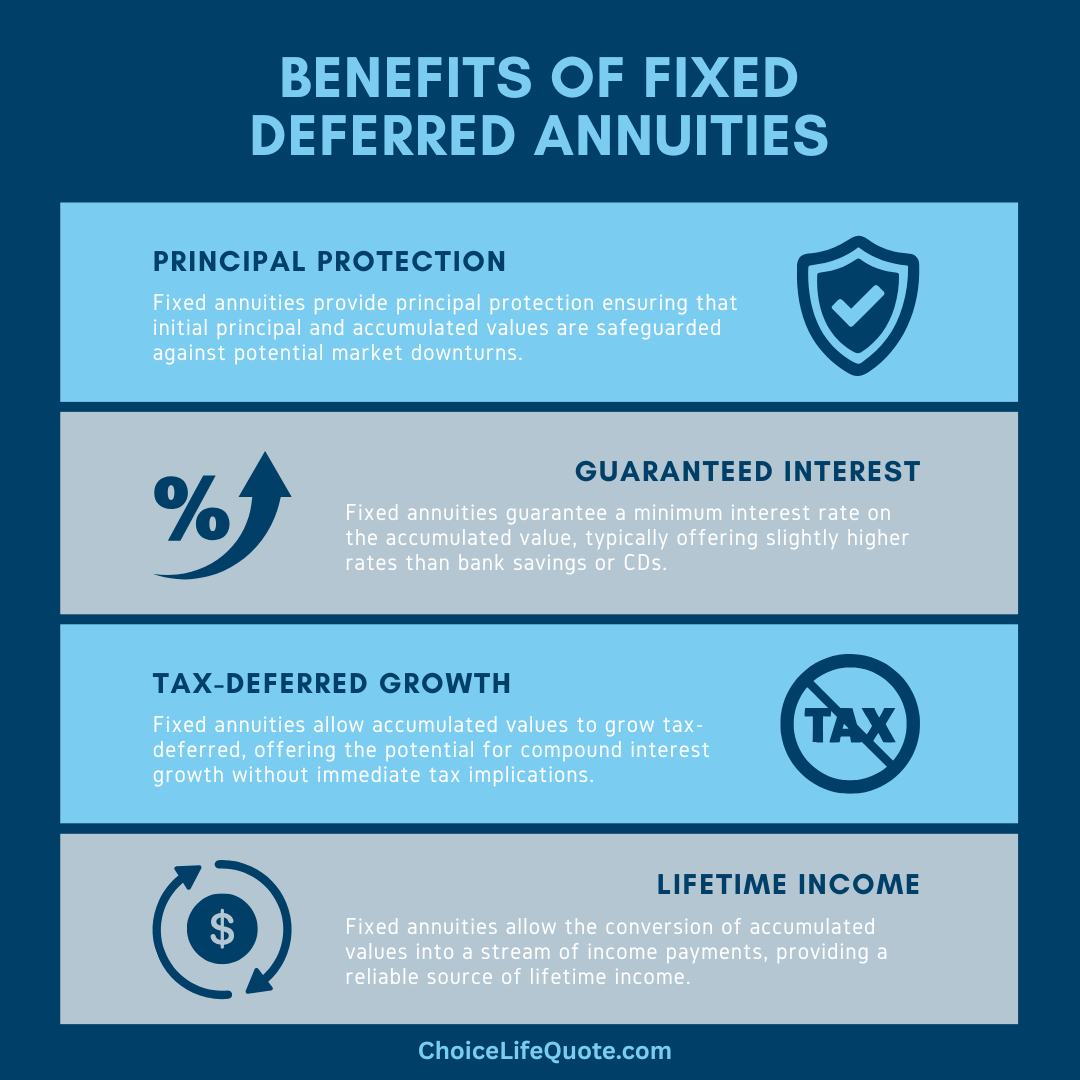

Fixed annuities provide principal protection and pay a guaranteed minimum interest rate on accumulation values. These policies may be annuitized at a predetermined point in the future to provide lifetime income. Interest rates paid on fixed annuities are relatively conservative, typically slightly higher than the rates paid on Certificates of Deposit (CDs) at a bank.

Insurance companies routinely offer a variety of fixed annuity products, such as multi-year guaranteed annuities (MYGA). This type of fixed deferred annuity offers a guaranteed interest rate for a set period of time, typically three, five, or seven years. MYGAs are often a great fit for individuals who are interested in principal protection and a competitive interest rate for a relatively short period of time.

Also, an additional advantage that this type of annuity has over a traditional CD is that accumulation values grow tax-deferred. Fixed annuity highlights include the following.

Fixed Annuity Highlights

- Principal Protection

- Guaranteed Interest Rate

- Tax-deferred Accumulation

- Lifetime Income

Indexed Annuities

Indexed annuities provide principal protection and credit interest to accumulated values based on the performance of a market index, such as the Dow Jones Industrial Average, S&P 500, or others, but with a minimum guaranteed interest rate. Like fixed annuities, these policies may also be annuitized at a future date to provide lifetime income. It is important to understand that though interest credited with indexed annuities is linked to a market index, the interest credited is typically less than the actual index performance.

Basically, in exchange for a guaranteed minimum interest rate, insurance companies incorporate caps, participation rates, and other limitations on credited interest. In other words, though indexed annuities do offer the potential of higher rates based on a given index, actual interest credited will likely be more in line with competitive CD interest rates.

These products should not be compared to direct investments in the underlying index or market. It is important to remember that annuities are primarily focused on principal protection and providing a lifetime income. As with fixed annuities, accumulation values in indexed annuities grow tax-deferred increasing overall return. Indexed annuity highlights include the following.

Indexed Annuity Highlights

- Principal Protection

- Indexed Interest Rate

- Tax-deferred Accumulation

- Lifetime Income

Variable Annuities

Variable annuities provide the opportunity for potentially higher returns through market participation, but this opportunity for greater returns comes with increased risk. Unlike fixed annuities, variable annuities allow policy owners to invest in mutual fund like subaccounts. As equity investments, accumulated values may either increase or decrease in direct relation to the underlying funds.

Though these types of investments offer potentially higher gains than traditional fixed annuities, there is also a risk of loss of principal, as with other equity investments. The premise behind variable annuities is to allow investors to participate in market growth but also benefit from the tax-deferral and lifetime income features of traditional annuities. Like fixed and indexed annuities, these contracts may be annuitized to provide lifetime income. However, the point cannot be stressed enough that with variable annuities, the owner bears investment risks which could include principal.

It is also important to consider that there are routinely higher fees associated with variable annuities due to the inclusion of management charges and other expenses. Essentially, variable annuities are focused on the potential growth of principal and providing lifetime income. As with other deferred annuities, sub-account values in variable annuities grow tax-deferred increasing overall return. Variable annuity highlights include the following.

Variable Annuity Highlights

- Equity Investment

- Sub-account Selection

- Tax-deferred Accumulation

- Lifetime Income

Qualified Longevity Annuity Contracts

Qualified Longevity Annuity Contracts (QLAC) are a type of deferred annuity funded using the money within an individual retirement account or other qualified retirement plan, which is designed to provide guaranteed lifetime income. These contracts allow individuals to set aside a portion of the money in their retirement accounts to provide guaranteed income at a point in the future.

One key benefit to a QLAC is that the annuity is not subject to required minimum distributions until age 85. This allows the QLAC owner to reduce RMDs while guaranteeing income for the future. In fact, based on the way annuity payments are calculated, the longer a QLAC owner waits to begin taking income, the higher the income amount. As with other retirement plans, the IRS limits the amount that an individual can contribute to a QLAC, currently the lesser of 25% of retirement assets, or $135,000, whichever is less.

Taxation of Annuities

Tax-deferred growth can significantly increase annuity values over the long term, allowing the entire accumulation value to compound at the credited interest rate. However, distributions from annuities are typically taxed at the annuitant’s income tax rate.

This differs from taxation of other investments, such as mutual funds or real estate, held long-term, where gains are taxed at the lower capital gains tax rate. A deferred annuity can also be designated as either qualified or non-qualified with regard to tax status.

Qualified Annuities are annuity contracts that are funded using pre-tax dollars, such as an IRA or other retirement plan. Essentially, a qualified annuity can be set up as an IRA, or other retirement plan, for ongoing contributions or as a rollover from an existing plan. The “qualified” designation allows the owner to contribute pre-tax dollars to the annuity, which grows tax-deferred, with eventual withdrawals in retirement being taxed as ordinary income.

As a qualified retirement plan, contributions are subject to annual IRS limits with the exception of a rollover. Like other “retirement” plans recognized by the IRS, withdrawals before age 59 ½ routinely incur both taxes and penalties (with certain exceptions), and required minimum distributions typically begin at age 73 (review current IRS guidelines).

Non-qualified Annuities are annuity contracts that are funded with after-tax dollars, with contributions not being tax-deductible. These plans can be set up as standalone financial vehicles in planning for retirement and are often recommended after an individual has fully funded pre-tax retirement accounts. The “non-qualified” designation allows the owner to contribute after-tax dollars to the annuity, which also grows tax-deferred, with only the gains being taxed as ordinary income when withdrawn.

A significant benefit to non-qualified annuities is that there are no contribution limits, unlike the IRS limits on qualified plans. Similar to qualified annuities, withdrawals from non-qualified annuities before age 59 ½ routinely incur both taxes and penalties (with certain exceptions). However, there is normally not a requirement for minimum distributions. As a note, though there is no IRS requirement for minimum distributions, various states may have different guidelines.

Annuity Case Studies

Case Study #1

Lifetime Income

Jeff is a 65-year old business executive entering retirement and is considering options for his retirement savings. He and his wife Misty have consistently saved throughout their careers and have accumulated a sizable nest egg for retirement. Based on family histories, both Jeff and Misty expect to live many years into retirement and are concerned about the possibility of outliving their money. They both have 401K plans from their employers and will receive a modest amount in Social Security but are also looking into sources of monthly income. In speaking with a financial advisor, Jeff and Misty learn that an immediate annuity can provide a guaranteed income that the couple cannot outlive. After considering their overall financial goals and resources, they decide to purchase an immediate annuity with a portion of their retirement savings, which will provide a lifetime guaranteed income for both of their lives. Their insurance agent ensures that the couple also keeps enough in their other retirement accounts to cover unexpected emergencies and other possible liquidity needs. By shifting a portion of their retirement savings into an immediate annuity, Jeff and Misty have a source of guaranteed lifetime income that they cannot outlive.

Case Study #2

Principal Protection

Jennifer is a 62-year old business owner who plans to retire from active business in the next couple of years. She is heavily invested in the stock market and has seen significant gains in her portfolio. Given her plans to retire and recent market volatility, Jennifer is interested in shifting a portion of her portfolio to a safer option. She is willing to trade the potential market gains for significant security for a portion of her money. In speaking with her financial advisor, she learns that an indexed annuity offers principal protection, a market-linked return, and the option to convert the annuity to a lifetime income stream in the future. She is also happy to learn that she can withdraw up to 10% of the accumulation value in any given year without a surrender penalty. After reviewing her circumstances and objectives with her insurance agent and accountant, Jennifer transfers a portion of her stock portfolio into a fixed indexed annuity with interest crediting linked to the S&P 500. She likes the opportunity to participate in a portion of the market growth but with a guaranteed minimum rate of interest. By shifting a portion of her stock market gains into an indexed annuity, Jennifer receives the principal protection she is interested in while still earning a competitive rate of return. Additionally, based on current IRS guidelines, Jennifer’s annuity values will grow tax-deferred.

Conclusion

In conclusion, navigating the world of annuities requires careful consideration of individual financial goals and retirement needs. Whether planning for immediate income or deferring payments for the future, annuities offer a unique balance of principal protection, tax-deferred growth, and guaranteed lifetime income. Ultimately, annuities can serve as valuable tools in a diversified retirement strategy, offering peace of mind by ensuring a stable income stream throughout retirement years.

Our team can assist in choosing the right plan and the best insurance company for your individual situation. Get the guarantees you need to ensure that you will not outlive your money. Give us a call at (800) 770-8229, or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.