Roth IRAs for Retirement Savings

The Roth Individual Retirement Account (IRA) has gained widespread popularity as a retirement savings vehicle since its introduction under the Taxpayer Relief Act of 1997. Offering a unique set of benefits compared to its Traditional IRA counterpart, the Roth IRA provides a powerful way to build a secure financial future while enjoying both tax-free growth and tax-free income in retirement.

This article highlights the features, benefits, and advantages of the Roth IRA as a retirement savings vehicle, and delves into how this type of account can support comprehensive savings and retirement planning.

Introduction to the Roth IRA

A Roth IRA is a individual retirement savings account that is funded with after-tax dollars by the account owner and is a popular retirement savings vehicle.

Unlike a Traditional IRA, contributions to a Roth IRA are not tax-deductible for the account owner. However, the earnings within the account grow tax-free, and qualified withdrawals are entirely tax-free.

Contribution Limits & Eligibility

As of 2025, the annual contribution limit established by the Internal Revenue Service (IRS) for a Roth IRA is $7,000, with an additional $1,000 catch-up contribution for individuals aged 50 and older. These limits have historically been subject to inflation adjustments. Eligibility to contribute is based on modified adjusted gross income (MAGI). Single filers can make full contributions if their MAGI is up to $153,000, with a phase-out to $168,000. For those who are married and filing jointly, full contributions are allowed for MAGI up to $228,000, with a phase-out to $243,000. Individuals whose income exceeds these limits may consider a "backdoor Roth IRA," which involves contributing to a Traditional IRA and then converting it to a Roth IRA.

Benefits of the Roth IRA

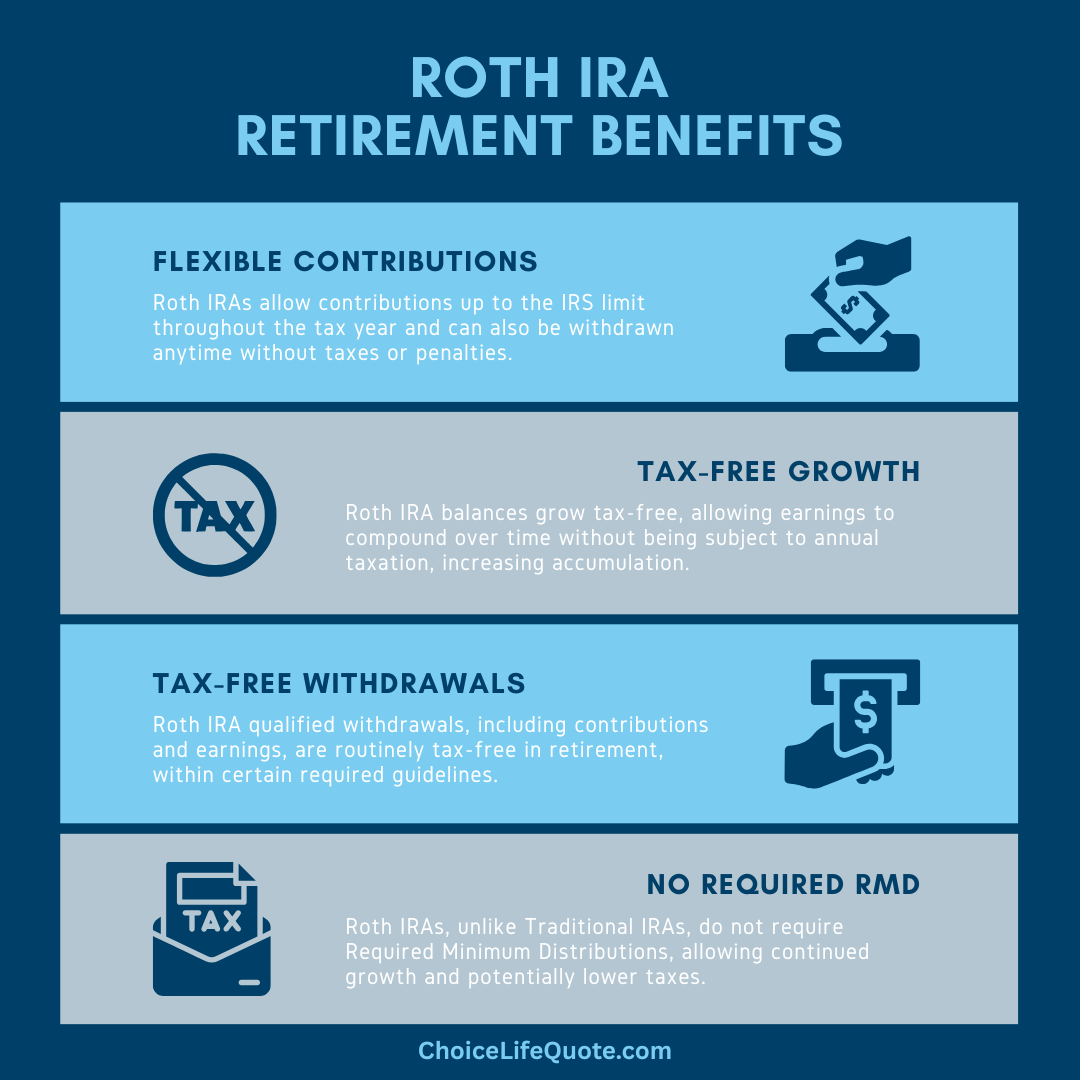

Roth IRAs provide several advantages for retirement planning, particularly for those seeking tax-free withdrawals and flexible contribution options. Unlike Traditional IRAs, Roth IRAs are funded with after-tax dollars, meaning qualified withdrawals in retirement are completely tax-free. While they offer significant benefits, Roth IRAs also carry investment risks, as account performance depends on the chosen investments. Safer options like certificates of deposit provide guaranteed returns, whereas stocks and mutual funds are subject to market fluctuations. Additionally, changes in tax laws or personal circumstances may affect the overall effectiveness of a Roth IRA. Consulting a qualified financial professional is recommended. Key benefits of Roth IRAs are outlined below.

- Flexible Contributions: Contributions can be withdrawn at any time without taxes or penalties, making Roth IRAs a valuable tool for financial flexibility.

- Tax-Free Growth: Investments grow tax-free, allowing earnings to compound over time without being subject to annual taxation.

- Tax-Free Withdrawals: Qualified withdrawals, including both contributions and earnings, are completely tax-free in retirement, provided certain conditions are met.

- No Required Minimum Distributions (RMDs): Unlike Traditional IRAs, Roth IRAs do not require withdrawals at a certain age, allowing funds to continue growing.

- Estate Planning Advantages: Since RMDs are not required, Roth IRAs can be a strategic wealth transfer tool, allowing heirs to inherit tax-free income.

Roth IRAs Withdrawal Rules

Withdrawals from a Roth IRA follow different tax rules than Traditional IRAs. Since contributions are made with after-tax dollars, they can be withdrawn at any time, tax and penalty free. However, withdrawing earnings tax-free requires that the account has been open for at least five years and that the account holder is at least 59½ years old. These are considered qualified withdrawals, which include both contributions and earnings. Exceptions to the age requirement include withdrawals for a first-time home purchase, disability, or death of the account holder.

Non-qualified withdrawals of earnings—those that do not meet the five-year rule or age requirement—may be subject to income taxes and a 10% penalty unless an exception applies. Common exceptions to the early withdrawal penalty include:

- Qualified higher education expenses

- First-time home purchases (up to $10,000)

- Unreimbursed medical expenses exceeding 7.5% of AGI

- Disability or death of the account holder

- And other exceptions as specified by the IRS

Comparison to Other Accounts

Roth

IRA

Traditional

IRA

- Roth IRA: Contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement. Unlike Traditional IRAs, Roth IRAs do not require required minimum distributions (RMDs) during the account holder’s lifetime.

- Traditional IRA: Contributions may be tax-deductible, providing an immediate tax benefit, but withdrawals in retirement are taxed as ordinary income. Additionally, RMDs must begin at age 73.

- 401(k): Employer-sponsored retirement plans often allow for higher contribution limits and may include employer matching contributions. However, investment options are typically more limited compared to IRAs.

How to Optimize a Roth IRA

Maximizing a Roth IRA involves strategic planning to take full advantage of its tax-free growth and withdrawal benefits. By implementing smart financial strategies such as starting early, making consistent contributions, and utilizing backdoor Roth conversions, you can optimize your retirement savings. These approaches will help ensure your Roth IRA grows efficiently and provides long-term financial security. Key strategies for maximizing a Roth IRA have been provided below for review.

- Start Contributing Early: The sooner you begin contributing, the more time your investments have to compound tax-free.

- Contribute Consistently: Making regular contributions throughout the year can help smooth out market fluctuations and maximize long-term growth.

- Utilize Catch-Up Contributions: Individuals aged 50 and older can take advantage of additional contribution limits to boost their savings.

- Consider a Backdoor Roth IRA: If your income exceeds the eligibility limits, you can contribute to a Traditional IRA and convert it to a Roth IRA.

- Leverage Tax-Free Withdrawals: Since qualified withdrawals are tax-free, strategically planning withdrawals in retirement can minimize overall tax liabilities.

Estate Planning Benefits

The Roth IRA is a powerful tool for intergenerational wealth transfer. Since RMDs are not required during the account holder's lifetime, the account can continue to grow tax-free and be passed on to beneficiaries. Heirs generally must take distributions, but these remain tax-free under the "10-year rule" for non-spouse beneficiaries. These features of the Roth IRA can help support tax-efficient estate planning.

Conclusion

In conclusion, the Roth IRA can be a versatile component of a comprehensive retirement strategy. Its tax-free growth, flexible withdrawal rules, and lack of RMDs, offer unparalleled benefits for individuals seeking long-term financial security. Whether you are a young professional starting to save for retirement or an experienced investor looking to optimize tax strategy, the Roth IRA can be an effective retirement planning vehicle.

Our team can assist in choosing the right plan and the best insurance company for your individual situation. Give us a call at (800) 770-8229, or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.