Indexed Universal Life | Protection & Indexed Growth

Indexed Universal Life (IUL) insurance is a unique financial product that combines the security of life insurance with the potential for cash value growth. Unlike traditional whole life or term life policies, IUL allows policyholders to benefit from market gains without directly investing in equities. This means that while the policyholder's funds are linked to an index such as the S&P 500, they are also shielded from losses when the market declines. Many people consider IUL an attractive option for long-term financial planning, as it offers both protection for beneficiaries and opportunities for wealth accumulation.

This article explores how IUL works, its benefits and risks, who should consider it, and how it compares to other life insurance products in providing both protection and the potential for significant cash value accumulation.

What is Indexed Universal Life Insurance?

Indexed Universal Life (IUL) insurance is a type of permanent life insurance designed to provide policyholders with both death benefit protection and a cash value component.

The distinguishing feature of IUL is that its cash value accumulates based on the performance of a market index, rather than a fixed interest rate like traditional products.

This means that policyholders have the opportunity for higher returns while still enjoying downside protection, as most policies guarantee that the cash value will not decrease due to poor market performance.

How Indexed Universal Life Works

Understanding how IUL works is crucial before purchasing a policy. The primary advantage of IUL is that it offers policyholders the ability to grow their cash value without the risks associated with direct stock market investments. The policyholder pays premiums, a portion of which covers insurance costs while the remainder is allocated to a cash value account. The growth of this account is tied to a market index but does not directly invest in equities. Instead, insurers use a specific formula to credit interest based on the index’s performance.

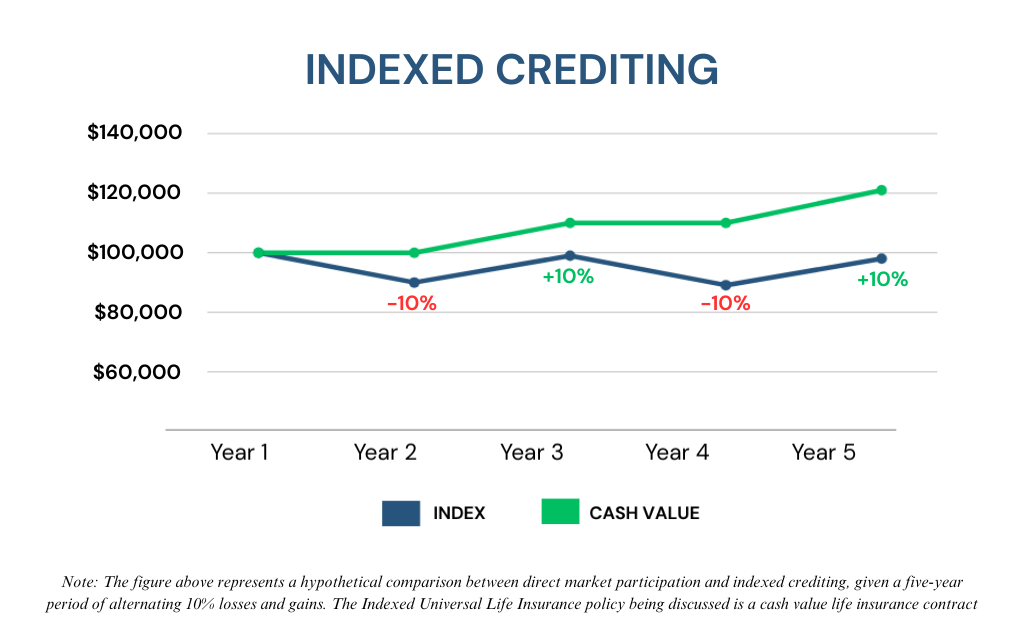

Indexing Feature: The indexing feature is what makes IUL policies unique. Instead of earning a fixed interest rate, the policy’s cash value benefits from stock market gains while being protected from losses. However, growth is limited by certain policy features:

- A Cap Rate – The maximum interest rate that can be credited, even if the index performs exceptionally well.

- A Participation Rate – The percentage of the index’s gain that is credited to the policy for a given period.

- A Floor Rate – The minimum interest (often 0% or 1%), ensuring policyholders do not lose money during market downturns.

Benefits of Indexed Universal Life

Indexed Universal Life Insurance offers a wide range of benefits making it an attractive option for individuals looking for financial security and long-term cash value growth. It provides the policyholder with the flexibility to adjust premium payments and death benefits, while also allowing tax-deferred cash value accumulation, and potential protection from creditors..

Additionally, IUL policies offer the potential for tax-free “income” through policy loans, which are generally not taxable as income as long as the policy remains in force. These loans can be a strategic way to leverage the policy's cash value for various financial needs while potentially minimizing tax liabilities. Given these benefits an IUL policy can be a valuable component of a comprehensive financial plan. Here are some of the primary benefits of IUL policies for review and consideration:

- Tax-Free Death Benefit – Ensures that beneficiaries receive a tax-free payout, providing financial security.

- Flexible Policy Premiums – Allows policyholders to adjust payments based on their financial situation.

- Market Indexed Crediting – Offers the ability to accumulate cash value based on market index performance, with protection from downturns.

- Tax-Deferred Growth – Enables cash value to grow without immediate taxation, and also may offer tax-free policy loans.

- Protection from Creditors – In many states cash values held within a life insurance policy are not accessible by creditors.

Risks of Indexed Universal Life

While IUL insurance offers numerous advantages, it also comes with certain risks and limitations. One of the primary concerns is that policyholders may not fully benefit from market gains due to cap and participation rates. Additionally, IUL policies involve various fees and charges that can impact cash value accumulation over time. The complexity of these policies can also make them difficult to understand, and without proper funding, they may lapse, leaving the policyholder without coverage. It’s important to be aware of these potential drawbacks before committing to an IUL policy.

- Cap on Earnings – Limits the amount of growth that can be credited to the cash value, even if the stock market performs well.

- Policy Fees and Charges – Includes administrative costs, mortality charges, and other expenses associate with IUL policies.

- Complexity – Requires a solid understanding of how IUL work and careful ongoing management of policy, premiums, and values.

- Risk of Underfunding – Insufficient premium payments may result in a policy lapsing and loss of both coverage and Cash Value..

Considerations for IUL Policies

IUL is not the right choice for everyone, however this type of policy can be a great option for certain individuals.

If you are looking for a life insurance policy that also offers cash value accumulation, an IUL may be an attractive option.

It is particularly beneficial for high-income earners seeking tax advantages.

An IUL may also be a great fit for business owners considering succession planning, or others interested in supplemental retirement income. However, for those who prioritize simplicity and low-cost coverage, term life or whole life insurance might be better choices. It is important for consumers to select the policy that best meets their objections. Considerations for IUL have been provided below for review.

- High-income earners looking for tax advantages – IUL policies provide a tax-free death benefit and tax-deferred growth.

- Business owners – Entrepreneurs can use IUL for tax-deferred accumulation and business succession planning.

- Individuals seeking life insurance with growth potential – Those interested in supplemental income in retirement.

Choosing the Right IUL Policy

Selecting the right IUL policy requires careful consideration of several factors. Since policies can vary significantly in terms of cap rates, participation rates, fees, and company reputation, it’s essential to do thorough research before purchasing a policy. Working with an experienced insurance advisor can help you navigate these complexities and ensure that you choose a policy that aligns with your financial goals.

- Minimum Interest Rate – Ensure that the policy has a strong minimum interest rate to protect against losses during down markets.

- Cap & Participation Rates – Look for policies with higher caps and participation rates for better growth potential.

- Policy Fees and Charges – Understand the policy cost structure, including policy fees, administrative charges, and mortality costs.

- Company Strength Ratings – Choose a financially stable insurer with a strong track record of financial strength and stability.

Conclusion

In conclusion, Indexed Universal Life Insurance is a versatile financial product that offers the benefits of permanent life insurance with the potential for market-linked growth. While it provides flexibility, tax advantages, and downside protection, it also comes with limitations such as earnings caps and policy fees. Whether an IUL policy is right for you depends on your financial goals, risk tolerance, and need for flexibility. Before committing to a policy, it’s wise to consult an experienced insurance professional and carefully evaluate the long-term benefits and potential drawbacks of a specific plan.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.