Final Expense Life Insurance | Affordable Burial Coverage

Most people hate the thought of being a burden to family members and friends later in life. Yet, an individual’s final expenses and last wishes are often the responsibility of those left behind. In planning for final expenses, many people choose to purchase final expense life insurance. The need to make final arrangements is a common concern among seniors as they enter their golden years. This concern is often compounded when people learn that Social Security’s lump-sum death benefit is only $255. Intended to help consumers in planning for final expenses, final expense life insurance can provide needed security and peace of mind. Of the various types of life insurance, final expense is frequently the right fit for burial coverage.

This article discusses final expense life insurance, providing an overview of final expense or burial life coverage, benefit types, premium rates, and best life insurance companies for final expense when shopping for coverage.

Final Expense Life Insurance

Final expense life insurance, or burial coverage as it is commonly known, is life insurance coverage purchased for the purpose of paying a person’s final expenses and other obligations. These plans are typically whole life insurance policies with a death benefit of between $5,000 and $25,000 to cover funeral or other final expenses.

According to the National Funeral Directors Association, “the national median cost of an adult funeral including a viewing was $8,755, with most funerals costing over $10,000.”

Based on the type of coverage and policy amounts, final expense plans often have simplified underwriting standards, requiring minimal health questions and no medical examination. Many life insurance companies in the marketplace offer final expense coverage, and there are typically a number of policy options depending on an applicant’s coverage needs, health considerations, and budget.

Types of Final Expense Coverage

There are several different types of final expense life insurance plans available to consumers depending upon an applicant’s health considerations. For individuals who are healthy or have moderate health conditions, level benefit policies provide immediate coverage for the full death benefit at the best premium rates.

For those with more severe health conditions, graded benefit, modified benefit, and guaranteed issue plans offer coverage with a waiting period before the full death benefit can be paid to designated beneficiaries. Insurance companies often offer the different types of final expense life insurance policies, placing an applicant in the best policy for which their individual health conditions qualify. It is important to work with an experienced independent agent to help in selecting the best insurance company and policy for your individual circumstances.

Level Benefit

Level benefit final expense policies provide immediate coverage for the full death benefit amount.

A level benefit plan is the only final expense policy option that provides coverage for 100% of the death benefit from the day the policy is issued.

Highlights

This type of final expense policy is ideal for those who are in good health or have minor to moderate health conditions. Premium rates for level benefit plans are typically lower than graded benefit, modified benefits, and guaranteed issue policies.

Graded Benefit

Graded benefit plans initially provide a graded death benefit for a certain period, after which the full death benefit amount is paid.

As an example, a graded benefit final expense policy may pay 30% of the death benefit year one, 70% in year two, and 100% in years three and beyond.

Highlights

It is typical for insurers to pay the full death benefit in the event of accidental death with a graded benefit policy. This type of final expense policy can be a good fit for those having moderate health conditions not qualifying for level benefit coverage. Premium rates for graded benefit plans are typically higher than level benefit policies but lower than modified benefit and guaranteed issue policies.

Modified Benefit

Modified benefit plans provide a return of premiums plus a percentage if death occurs during a waiting period, after which the full death benefit is paid.

Highlights

As an example, a modified benefit policy may return premiums paid plus 10% for a death occurring in year one, return premiums plus 20% for a death occurring in year two, and pay the full death benefit for years three and beyond. This type of final expense policy can be a good fit for those having moderate to severe health conditions not qualifying for graded benefit coverage. Premium rates for modified benefit plans are typically higher than level and graded benefit policies, but lower than guaranteed issue policies.

Guaranteed Issue

Guaranteed issue final expense plans work like modified benefit policies, only they are guaranteed issue.

Highlights

Best Candidates for Final Expense

Final expense life is best suited for those between age 50 and 80 who have a need for life insurance coverage to pay burial and/or other final expenses.

Though more mature applicants traditionally have an interest in this type of coverage, many companies also offer final expense plans to individuals much younger.

As funeral costs continue to rise, these expenses often create anxiety and financial challenges for many aging Americans. This type of coverage can provide financial security and peace of mind related to an individual’s final expenses and wishes.

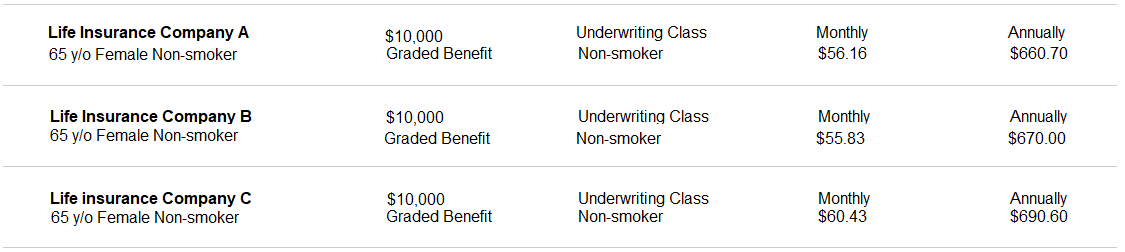

Sample Final Expense Life Rates

The following illustrations provide sample premium rates for level benefit, graded benefit, and guaranteed issue final expense life insurance policies on a 65-year-old female non-smoker. These sample rates are intended for illustration purposes only. Please contact us if you are interested in quotes based on your individual situation.

Sample Rates

Level Benefit

Note: The rates illustrated above are for a $10,000 level benefit final expense life insurance policy on a 65-year-old female non-smoker.

Sample Rates

Graded Benefit

Note: The rates illustrated above are for a $10,000 level benefit final expense life insurance policy on a 65-year-old female non-smoker.

Sample Rates

Guaranteed Issue

Note: The rates illustrated above are for a $10,000 level benefit final expense life insurance policy on a 65-year-old female non-smoker.

Best Final Expense Companies

Many companies in the marketplace offer final expense life insurance policy options. The following companies are recommended in our experience based on company ratings, underwriting standards, premium rates, customer service, and other factors.

Applying for Final Expense Life

Applying for final expense life insurance can be much simpler than applying for many other types of life insurance coverage with simplified underwriting.

Since these products routinely offer extremely simplified underwriting, an application and potential phone interview are often all that is required.

In evaluating your application, the insurance company will review the information provided as well as medical information bureau and prescription database information. It is important to ensure that complete and accurate information is provided on your application since conflicting and/or missing information can result in declined coverage. Given the simplified nature of final expense life insurance underwriting, approval decision times typically ranges from minutes to a few days.

Case Study: Burial Coverage

Case Study

Final Expense Life Insurance

Betty is a 65-year-old retired widow who lives on a fixed income from Social Security and a small pension. After her husband's passing a year ago, she began considering arrangements for her own final expenses. Since she does not want her three grown children to have to cover the costs associated with her funeral service and burial, Betty has decided to purchase a final expense life insurance policy. Working with an experienced independent agent, Betty chooses a $10,000 final expense policy from a leading insurance company. In this case, final expense life insurance has given Betty financial security and peace of mind in knowing that when the time comes, her arrangements are covered.

Conclusion

In conclusion, final expense life insurance offers a crucial solution for individuals seeking to alleviate the financial burden of their end-of-life expenses on loved ones. As highlighted, the costs associated with funerals and other final arrangements can be substantial, often exceeding what Social Security provides. By opting for final expense coverage, individuals secure peace of mind knowing their wishes will be respected and expenses covered without imposing financial strain on family members. With various policy options tailored to different health conditions and needs, final expense life insurance stands out as a practical and accessible choice for ensuring financial security in one’s golden years.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.