Corebridge Financial Company Review

Corebridge Financial, formerly AIG Life and Retirement, is a well-known brand in the insurance and financial services industry.

But... How does it compare to other companies offering similar products? What are the company's industry ratings?

These questions are frequently asked by consumers when comparing the company’s rates and products to those of other competing insurers.

In our experience, Corebridge is a high quality and highly rated insurer, offering a diverse portfolio of life insurance and annuity products and services to consumers.

This article highlights Corebridge Financial, providing insight into company financials, industry ratings, product portfolio, premium rates, and other considerations when selecting the best life insurance companies.

Corebridge Financial Company

Corebridge Financial, based in Houston, Texas, formerly AIG Life and Retirement, offers life insurance, annuities, and other financial products and services.

The company has offered quality life insurance, accident coverage, other insurance products dating back to it's American General origins in 1926.

According to Corebridge leadership, “We help individuals protect their loved ones with a wide range of life insurance solutions."

Corebridge Financial, formally AIG Life and Retirement, originated in 1926 as American General and has since evolved and established itself as a global leader in the insurance and financial services industry. As of 2024, Corebridge Financial highlights included organizational assets of $404 billion, with total revenue of over $18 billion. This included life and retirement premiums and deposits of $9.9 billion for the fiscal year. Given Corebridge Financial's asset base and diverse product portfolio, the organization continues to be a significant provider of insurance and financial services products. From a human capital standpoint, Corebridge employs over 5,000 team members through its operations.

Corebridge Financial by the Numbers

Source: Corebridge

Corebridge Financial Ratings

In the financial services industry, a company’s ratings serve as a “report card” of the organization’s fiscal stability and overall ability to meet both current and future financial obligations. These ratings can be extremely important to consider when purchasing insurance products with the intention of providing financial security for those you care about the most. Rating services considered insurance industry standards include A.M. Best, Standard & Poor’s, Moody’s, and Fitch. Corebridge Financial ratings are as follows from the perspective rating agencies.

Source: Corebridge

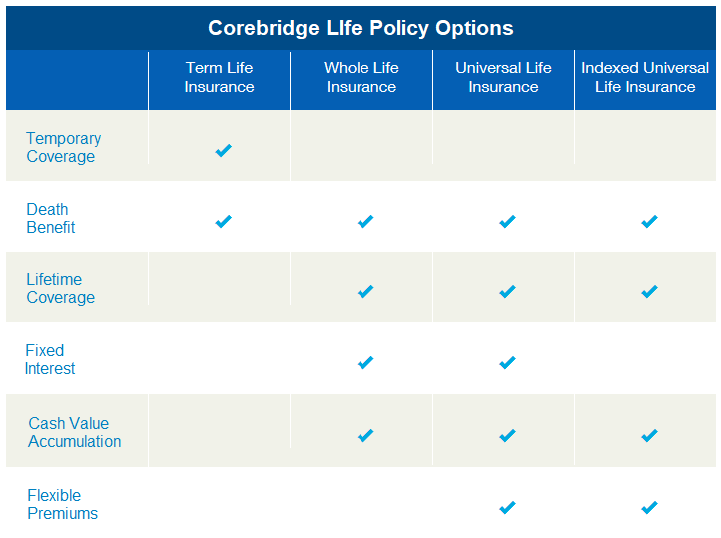

Corebridge Financial Life Products

As a key player in the life insurance market, stands to reason that the company would offer a diverse and robust insurance product portfolio.

In an ever-evolving marketplace, Corebridge continues to provide life insurance and other financial products to meet the needs of consumers.

Term Life Insurance – Term life insurance provides protection for a specified period or term. This type of life insurance does not typically accumulate cash value and is often initially less expensive than other policy types. Term life coverage can be a great fit for an individual who needs temporary life insurance coverage, such as income protection, mortgage protection, or other obligations with a specific time horizon.

Corebridge Financial's term products offer coverage ranges from $50,000 to $1,000,000 and is unique in that consumers can select a specific term period from 10 to 35 years. This allows clients the flexibility to structure their policy to meet future financial goals and milestones without paying for unneeded coverage.

Universal Life Insurance – Universal life insurance provides flexible long-term protection which can be adjusted to meet changing coverage needs over time. This type of life insurance can provide lifetime coverage and potential cash value accumulation. Universal life coverage is a great option for those who need long-term life insurance protection and the flexibility to adapt coverage based on life changes.

The company’s universal life products range from Guaranteed Universal Life, providing guaranteed lifetime coverage, to Indexed Universal Life, offering cash value accumulation tied to market index performance, as well as Variable Universal Life providing clients separate account investment options.

Variable Universal Life Insurance – Variable universal life insurance, like traditional universal life, provides flexible long-term protection but differs in that it allows for investment in selected separate accounts. This type of life insurance can also provide lifetime coverage and potential cash value accumulation. Variable universal life coverage can be an option to consider for individuals who have a need for long-term life insurance protection and are interested in cash value accumulation through equity investments. It is important to note that with this type of policy cash surrender value is not guaranteed and will fluctuate based on the market value of the separate accounts.

Guaranteed Issue Whole Life – Guaranteed issue whole life insurance provides lifetime protection with guaranteed approval regardless of medical history. This type of policy offers lifetime coverage with smaller face amounts at surprisingly affordable rates. Guaranteed issue whole life can be a great fit for those who are unable to qualify for traditional life insurance and need a smaller amount of permanent coverage for final expenses such as funeral costs, medical bills, and other obligations.

Corebridge Financials' guaranteed issue whole life offers coverage ranging from $5,000 to $25,000 for those between ages 50 and 85, with guaranteed acceptance. This type of policy allows clients who are otherwise uninsurable to obtain affordable lifetime life insurance coverage. It is important to note that with this type of policy, the death benefit is graded and does not pay the full face amount until year three.

Accidental Death & Dismemberment – Accidental death and dismemberment insurance provides coverage in the event of an accident causing death or dismemberment. This type of insurance is surprisingly simple and extremely affordable. Accidental death and dismemberment coverage can be ideal for individuals who want quick accident-only coverage or need to supplement a high-deductible health plan. The company’s accidental death and dismemberment product offers a quick and easy way for clients to secure accident-only coverage, and acceptance is guaranteed for ages 18 to 80.

Corebridge Financial Life Rates

In comparing premium rates within the life insurance arena, there are consistently a handful of familiar companies that offer the best value to consumers. Corebridge Financial is one of those organizations. In running rate comparisons for prospective clients, Corebridge is routinely within the top five or so carriers offering the most affordable premiums. And, in many instances, the difference can be only a matter of a few cents. The following sample rates are provided as an example of Corebridge premiums for the level term products.

Sample Male Rates

Note: Sample rates provided are based on rate information at the time of publication and are subject to change without notice. Company underwriting makes the final decision concerning rate class and policy approval.

Sample Female Rates

Note: Sample rates provided are based on rate information at the time of publication and are subject to change without notice. Company underwriting makes the final decision concerning rate class and policy approval.

Conclusion

In conclusion, Corebridge Financial, formerly known as AIG Life and Retirement, stands out as a prominent figure in the insurance and financial services sector. With roots dating back to its American General origins, the company has evolved into a global leader. Boasting substantial assets of $404 billion and annual revenues exceeding $18 billion as of 2024, Corebridge exemplifies financial stability and reliability. Offering a wide array of life insurance and annuity products, including term life, universal life, variable universal life, and guaranteed issue whole life insurance, Corebridge caters to diverse consumer needs. With competitive premium rates and strong industry ratings from A.M. Best, Standard & Poor’s, Moody’s, and Fitch, Corebridge Financial continues to be a preferred choice for individuals seeking quality insurance solutions to safeguard their financial futures.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229, or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.