American National Insurance Company Review

American National Insurance Company has excellent ratings and a long history of providing high quality products and services to consumers.

But... How do the company's life insurance products and customer service compare to other insurers?

And... What types of personal and business insurance plans and policies are available through American National?

In our experience, American National Insurance Company is among the best of insurance and annuity companies and comes highly recommended when comparing life insurance products, customer service, and other elements within the insurance industry.

This article highlights American National Insurance Company, providing an overview of the company's history, financial strength ratings, premium rates, and other relevant considerations when selecting a life insurance company.

American National Insurance Company

American National Insurance Company is an insurance and financial services company headquartered in Galveston, Texas.

A member of the American National group of companies, the organization was originally founded in 1905. The company offers a wide range of life, accident, and health insurance, retirement annuities, and other products.

American National insurance products and services are distributed through independent marketing organizations, career agents, and direct channels throughout all 50 states. The organization has over 3,000 employees based in Texas, Missouri, and New York.

As of 2018, American National’s annual highlights reported over $26 billion in assets, $103 billion of life insurance in force, and over 5 million policyholders worldwide.

According to Founder William Moody Jr., “"American National was to be a company that operated on the core ideals of “strong management, prudent investment, and financial strength.”

American National by the Numbers

Source: American National

American National Company Ratings

Industry ratings provide a method of assessing an insurance company’s overall financial strength and stability.

These ratings allow consumers to compare competing companies based on an independent analysis by respected rating agencies. An organization’s financial strength ratings allow consumers to have confidence in the products and services offered as well as the company's creditworthiness.

Source: American National

American National Life Products

American National has a long history of offering quality insurance products and services, providing security and peace of mind to consumers nationwide.

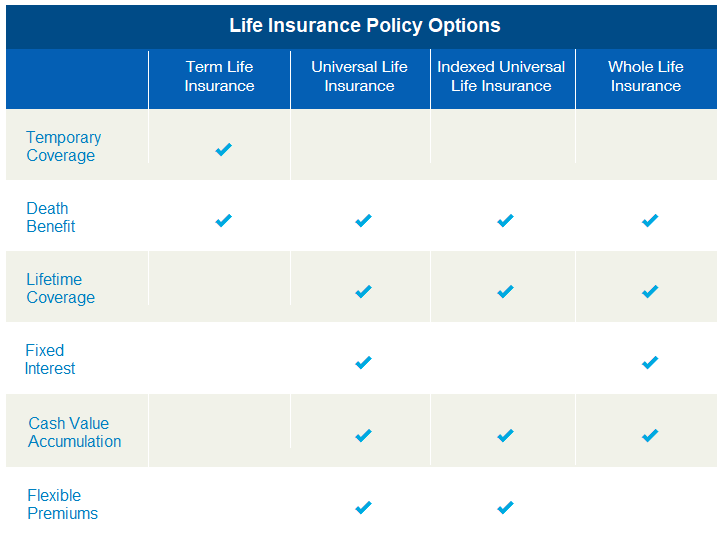

The company’s life insurance product portfolio includes a variety of life insurance coverage options, and many policy types offering non-medical underwriting.

Universal Life Insurance

Indexed Universal Life Insurance

Whole Life Insurance

American National Life Rates

In comparing life insurance premiums among top-rated companies, consumers must balance product pricing and company quality. American National offers policyholders both excellent ratings and extremely competitive pricing.

Based on these factors, American National Insurance Company is often a carrier of choice among independent agents and brokers. It is also important to consider relevant health and lifestyle considerations when applying for life insurance coverage and evaluating rates offered by a particular company.

Conclusion

In conclusion, American National Insurance Company emerges as a leader in the insurance sector, renowned for its outstanding financial strength and diverse portfolio of life insurance products. With over a century of dedicated service, the company has established a solid reputation for reliability and customer satisfaction. Whether seeking universal, indexed universal, or whole life insurance, American National offers flexible options to suit various needs, supported by competitive pricing and comprehensive coverage. For individuals and businesses alike, American National Insurance Company stands as a trusted partner in safeguarding futures with integrity and expertise.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

James Shiver is the founder of ChoiceLifeQuote.com and a multi-state licensed independent life insurance agent serving the individual family and small-business markets. Dr. Shiver also serves as a university business professor, as well as being an Accredited Financial Counselor®.