Banner Life Insurance Company Review

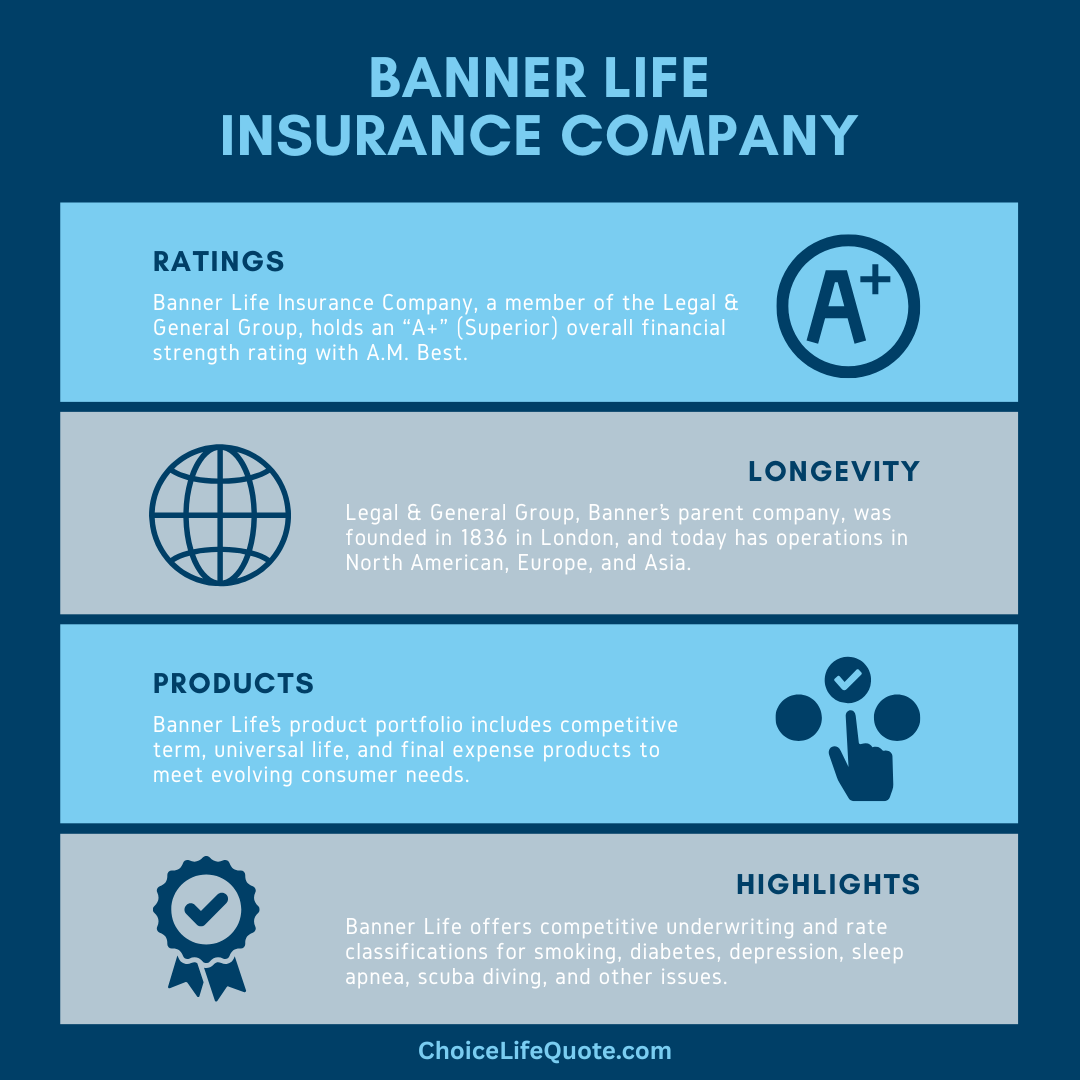

Banner Life Insurance Company has a well-earned reputation for financial strength. affordable life insurance products, and fair underwriting.

But, how competitive are the company’s products and services in today’s ever-changing life insurance marketplace?

What types of life insurance products does Banner Life offer for consumers? And, how does the quality of customer service match the company’s ratings?

In our experience, Banner Life Insurance Company is a highly rated insurer offering a solid portfolio of life insurance and annuity products. In comparing premium rates for leading carriers, Banner is routinely among the best, as well as being a “go to” carrier for tobacco users and other underwriting niches.

This article provides an overview of Banner Life Insurance Company, including financial strength, industry ratings, company history, product portfolio, underwriting niches, and other relevant when comparing life insurance companies.

Banner Life Insurance Company

Banner Life Insurance Company, along with William Penn Life Insurance Company of New York, is owned wholly by Legal & General America, a subsidiary of the worldwide Legal & General Group.

Based in Frederick, Maryland, the insurer offers life insurance and annuity products in 49 states and the District of Columbia.

Its parent organization, Legal & General Group, was founded in 1836 in London and today has operations in North America, Europe, and Asia. A less well-known insurer than many of its competitors, Banner Life Insurance Company, is highly and frequently recommended by independent agents and brokers based on both financial strength and competitive pricing. With a focus on affordable insurance and high-quality service, Banner is somewhat of an industry insider favorite.

In fact, Legal & General Group is among the top 10 largest insurers in the world, with over 10 million customers globally and in excess of $1.3 trillion in managed assets.

Banner Life by the Numbers

Source: Legal & General

Banner Life Company Ratings

In considering a prospective life insurance company, financial security is often a primary concern. Industry financial strength ratings provide consumers with an overview of an insurer’s fiscal stability and general ability to meet current and future financial obligations.

These financial strength ratings, can be valuable to consumers in evaluating prospective companies and providing peace of mind related future stability.

Legal & General Group, and its affiliated insurers Banner Life Insurance Company and William Penn Life Insurance Company of New York, hold “A+” (Superior) ratings with A.M. Best, “AA-“ (Very Strong) ratings with Standard & Poor's, and “AA-“ Very Strong ratings with Fitch Ratings.

In addition, the company holds a COMDEX Score of 94 out of 100, which averages all financial strength ratings received by a given insurer. Legal & General Group’s respective financial strength ratings have been provided below for review.

Source: Legal & General

Banner Life Insurance Products

Banner Life Insurance Company offers a variety of high-quality life insurance and annuity products to consumers through both direct and agency channels.

The company’s focus on “keeping life insurance affordable” and providing “high-quality efficient customer service” shows through in their policy offerings and service.

Banner’s life product portfolio includes term, universal life, and final expense coverage to meet the evolving needs of both individual and business consumers. The following information highlights the company’s life insurance product portfolio.

Note: Please review individual life insurance policy details for specifics related to products, features, and benefits.

Term Life

Term life insurance provides the most coverage for the least initial premium and is ideal for those who need the maximum amount of coverage on a limited budget. This type of life insurance provides “pure” protection for a specified period or “term.” Term lengths can range from one to forty years, with 10, 20, and 30-year plans being the most popular. Term life insurance highlights and common uses for coverage have been provided below for review.

Universal Life

Universal life insurance can provide lifetime coverage with significant flexibility. This type of life insurance policy offers flexible premiums and an adjustable death benefit to meet ever-changing protection needs. Universal life can provide permanent life insurance so long as adequate premiums are paid but also allows a policy owner to pay lower periodic premiums for shorter-term coverage. Additionally, an increase in premiums paid will often result in higher cash value accumulation subject to policy guidelines. Universal life insurance highlights and common uses for coverage have been provided below for review.

Final Expense

Final expense life insurance can provide permanent protection to cover funeral costs, medical bills, and other expenses. This type of policy offers a guaranteed death benefit, level premiums, and lifetime coverage so long as premiums are paid. Additionally, final expense policies may accumulate cash value subject to policy guidelines. Final expense insurance highlights and common uses for coverage have been provided below for review.

Banner Life Insurance Rates

In considering the purchase of life insurance, it is smart to compare premium rates for different insurers.

It is also important to identify any specific underwriting classifications or "niches" that may be beneficial to your individual lifestyle considerations and overall health.

Banner Life Insurance Company is not only a highly rated carrier but offers exceptional premium rates as well. In comparing Banner life insurance rates to other leading insurers, the company is routinely among the best based on both financial stability and affordability. This insurer also offers extremely competitive rates for smokers, ex-smokers, and applicants with a history of various medical conditions. Based on these considerations, Banner is often highly recommended by independent insurance agents and brokers.

The sample rates below have been provided as an example of Banner Life Insurance Company’s term life premium rates.

Conclusion

In conclusion, Banner Life Insurance Company is a financially strong and highly rated insurer known for its affordable life insurance options and excellent customer service. Backed by Legal & General America, it offers competitive term, universal, and final expense policies to meet diverse needs. With high ratings from A.M. Best, Standard & Poor’s, and Fitch, Banner Life provides reliable coverage and peace of mind. Its competitive pricing, especially for tobacco users and certain medical issues, makes it a top choice among independent agents.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.