Buying Life Insurance Online | Convenience and Transparency

In today's digital age, nearly everything can be done online—from shopping for groceries to managing bank accounts. Buying life insurance is no exception. Online platforms have revolutionized the insurance industry, offering convenience, a wide range of policy options, and streamlined application and underwriting processes.

This article highlights the benefits of buying life insurance online, as convenience and transparency can help to ensure that you get quality coverage at affordable rates.

Buying Life Insurance Online

In an increasingly digital world, the process of purchasing life insurance has undergone a remarkable transformation from in-person to online research, sales, and service.

Gone are the days of lengthy meetings with insurance agents; today, consumers have the power to explore, compare, and purchase policies online from the comfort of their homes or offices.

Benefits of Buying Insurance Online

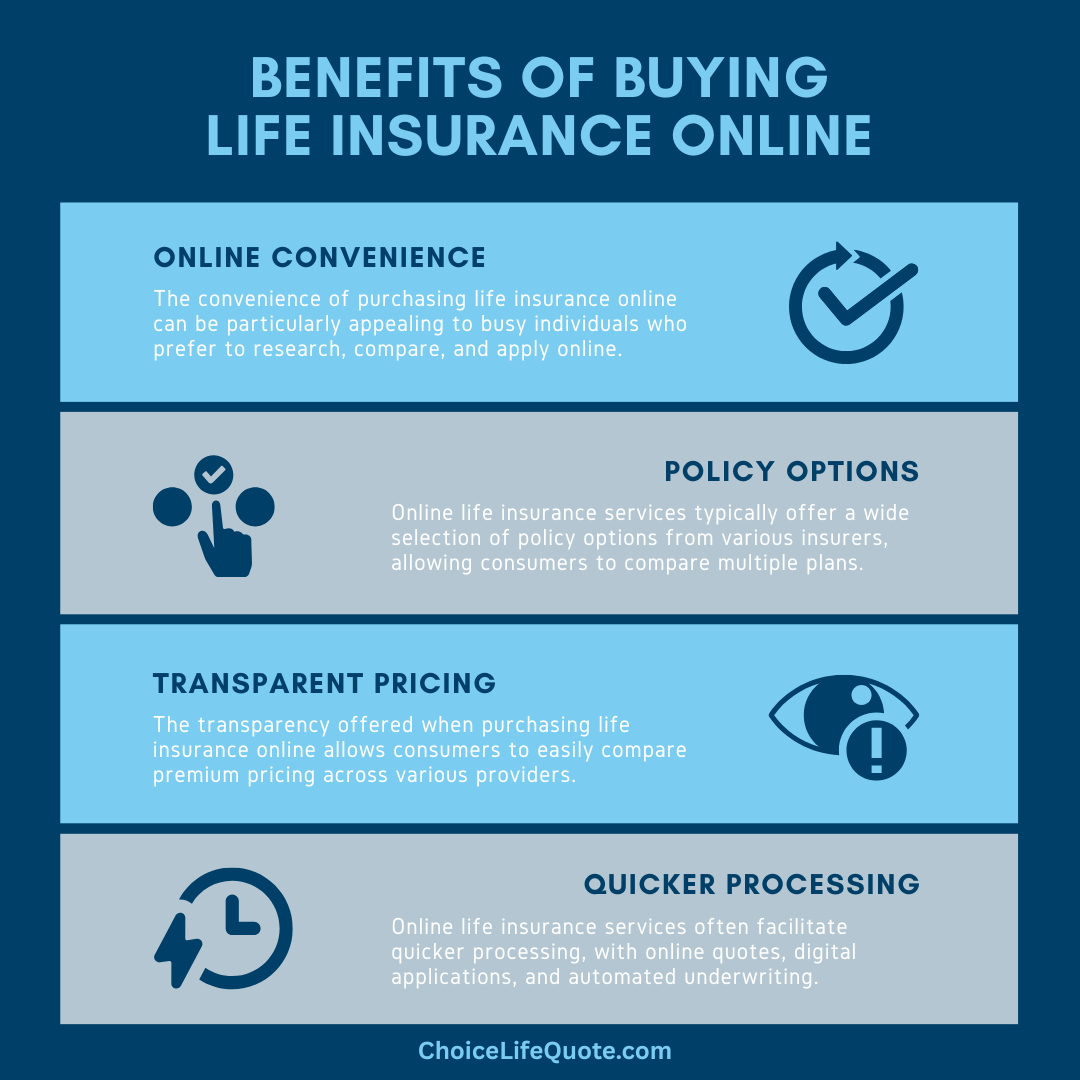

Buying life insurance online offers unparalleled convenience and accessibility, allowing consumers to get quality coverage ate affordable rates. No longer bound by the constraints of traditional face-to-face meetings with agents, consumers can now research, compare, and apply for policies from the comfort of their homes or offices. Online platforms operate 24/7, empowering individuals to initiate the insurance-buying process at their convenience, without the need to schedule appointments.

The wide range of options available on online insurance marketplaces is another significant advantage. These platforms host diverse policies from various insurers, enabling consumers to compare multiple plans, coverage levels, and premium rates effortlessly. This variety allows buyers to make informed decisions based on unique needs and financial circumstances, without feeling pressured by a single provider.

Online Convenience: Purchasing life insurance online often eliminates the need for in-person meetings. This convenience is particularly appealing to busy individuals who prefer to research, compare, and apply for policies from the comfort of their homes or offices.

Policy Options: Online insurance services typically offer a broad selection of policy options from various insurers. This variety enables consumers to compare multiple plans, coverage amounts, and premium rates to find the policy that best suits their needs and budget.

Transparent Pricing: Online life insurance services or agencies routinely offer transparent pricing information. This transparency allows consumers to easily compare premiums across multiple providers to find cost-effective options that align with their financial goals.

Quicker Processing: Online applications for life insurance are often processed faster compared to traditional methods. Automated underwriting systems can provide instant quotes or quickly assess applications, reducing the time from application to policy issuance.

Considerations in Purchasing Online

Before purchasing life insurance online, it's crucial for individuals to assess their specific needs and financial goals. Understanding the purpose of the insurance—whether it's income replacement, mortgage protection, or legacy planning—forms the foundation for selecting the right policy type and coverage amount. By clarifying these objectives upfront, buyers can navigate the options available on online platforms more effectively.

Comparing policies and providers is essential when buying life insurance online. While the breadth of choices is a significant advantage, not all policies are created equal. Buyers should scrutinize coverage features, benefits, riders, and terms among different insurers to ensure alignment with their needs. Additionally, factors such as the insurer's financial strength ratings and customer service reputation should be considered to make an informed decision.

Coverage Needs: Before purchasing life insurance online, it's crucial to assess your financial situation, future obligations, and long-term goals. Understanding your coverage needs (e.g., income replacement, mortgage protection, educational expenses) helps in selecting the appropriate policy type and coverage amount.

Comparing Policies: While online platforms offer a variety of options, not all policies are equal. It's essential to compare coverage features, benefits, riders, and terms among different insurers. Pay attention to factors like the insurer's financial strength ratings and customer service reputation.

Policy Details: Before committing to a policy, carefully review the terms and conditions, including exclusions and limitations. Understand what is covered and any circumstances under which benefits may be denied. Clarify any doubts by reaching out to a licensed insurance agent.

Customer Service: Evaluate the online platform's customer support and responsiveness. Reliable platforms provide accessible customer service channels for inquiries, claims processing, and policy management. Responsive support can make a significant difference during the life of the policy.

Steps in the Online Buying Process

Navigating the process of buying life insurance online involves several straightforward steps designed to simplify the purchasing experience.

From initial research and comparison of policies to completing an application and undergoing underwriting, each step is specifically designed to ensure clarity and simplicity for the consumer.

These steps typically include gathering personal and health information, selecting the desired coverage amount and policy type, reviewing and comparing quotes from different insurers, and finally, submitting the application digitally. The online nature of these transactions enables swift processing and approval, often providing instant quotes and facilitating quick policy issuance, making the journey from research to coverage seamless and efficient.

Step 1 - Research Policies: Start by researching different types of life insurance (e.g., term, whole, universal) and understanding their pros and cons. Utilize online comparison tools to compare policies from multiple insurers based on coverage, premiums, and other features.

Step 2 - Compare Quotes: Obtain quotes from several insurers to get an idea of the cost associated with different policies. Online quote generators provide estimates based on the information you provide (e.g., age, health status, desired coverage).

Step 3 - Complete Application: Once you've chosen a policy, complete the online application form accurately. Provide truthful information about your personal details, health history, and lifestyle habits. Inaccurate information can affect policy approval and rates.

Step 4 - Underwriting Process: The insurer will review your application, which may involve automated underwriting or manual review by underwriters. They may request additional information or medical exams depending on the policy type and coverage amount.

Step 5 - Premium Payment: Upon approval, review the final policy documents carefully and make the initial premium payment to activate coverage. The policy documents outline coverage details, premiums, customer service contacts, and other information.

Conclusion

In conclusion, buying life insurance online offers convenience, extensive options, and transparency in an evolving digital landscape. By understanding your needs, comparing policies, and following a structured approach, you can make informed decisions that protect your loved ones financially. Online platforms facilitate a smoother purchasing process while empowering consumers with essential information to secure their financial future.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.