Getting the Best Life Insurance Rates | 13 Insider Savings Tips

In considering life insurance to protect your loved ones, it is important to get the best rates possible. However, finding affordable life insurance can sometimes be easier said than done for consumers navigating the complicated and ever-changing world of insurance. These challenges are completely understandable given the complexity of different policy options and the overwhelming number of insurance companies in today’s marketplace. However, it is possible to save up to 70% on your life insurance using a few simple strategies.

This article discusses life insurance premium rates and provides insight into getting the best possible rates on coverage, providing actionable tips and recommendations for preparing for and navigating the application process.

Getting the Best Life Insurance Rates

Ensuring that you get the best life insurance rates and most coverage possible for can often be difficult as well as somewhat frustrating for consumers.

Individuals shopping for life insurance routinely ask questions such as... What type of life insurance policy is the best? How much coverage do I really need?

Or, which insurance company should I choose? However, ensuring that you get the best rates possible and most coverage for your money can often be difficult as well as somewhat frustrating. Individuals shopping for life insurance routinely ask questions such as: What type of life insurance is the best? How much coverage do I really need? Or, which insurance company should I choose?

Factors Influencing Life Insurance Rates

Life insurance rates are determined by various factors that reflect the risk profile of the insured individual. These considerations play a pivotal role in shaping how premiums are set and what areas insurance companies prioritize when assessing applicants.

Age and Health - The age and health of the insured are primary determinants of life insurance rates. Younger individuals typically enjoy lower premiums as they statistically pose a lower risk of mortality. Conversely, older applicants or those with pre-existing health conditions may face higher premiums due to an increase in mortality risk.

Lifestyle and Habits - Factors such as smoking, alcohol consumption, and participation in high-risk activities significantly influence life insurance rates. Insurers closely assess these lifestyle choices as they directly correlate with life expectancy and overall health outcomes.

Occupation and Risk - Certain occupations entail higher occupational risks, impacting life insurance rates accordingly. Jobs involving hazardous conditions or extreme physical exertion may lead to higher premiums due to increased likelihood of accidents or health issues..

Medical and Family - A comprehensive evaluation of medical history, including family health background, helps insurers gauge inherited genetic risks and chronic conditions. This information assists in predicting future health outcomes and potential claims.

Policy and Coverage - The chosen coverage amount and type of policy also dictate insurance rates. Term life policies, offering coverage for a specified period, tend to be more affordable initially compared to whole life policies, which provide lifelong coverage and potential cash value accumulation.

13 Insider Tips for Premium Savings

Tip #1 – Choose the Right Type of Policy

In purchasing life insurance, the type of policy selected is an important consideration.

Is the need for coverage temporary or permanent in nature? Are you concerned with the accumulation of cash values and by association interest crediting, investment options, or other elements?

In many instances, the type of policy needed can be determined by the length of time the coverage will be required.

Quick Tip: Choose the “right” type of life insurance coverage. One of the best ways to purchase inexpensive life insurance is to select the shortest “term length” that will adequately meet coverage needs.

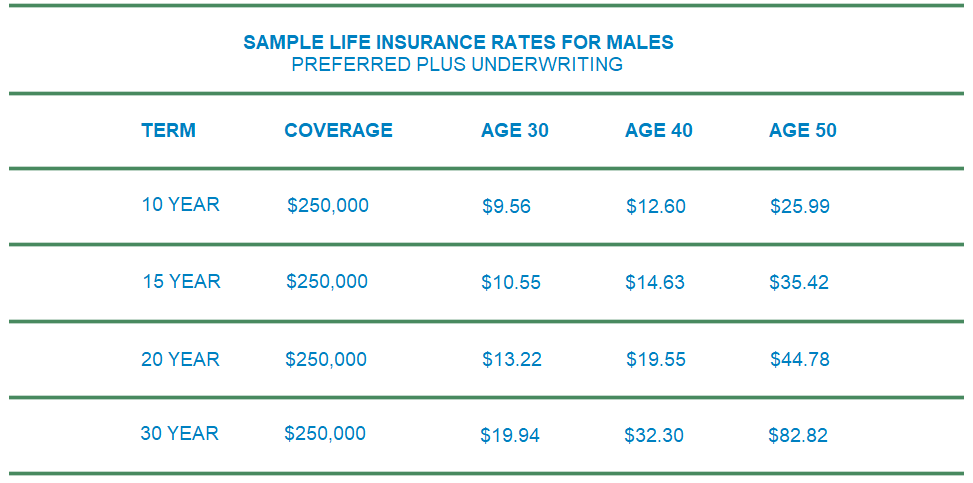

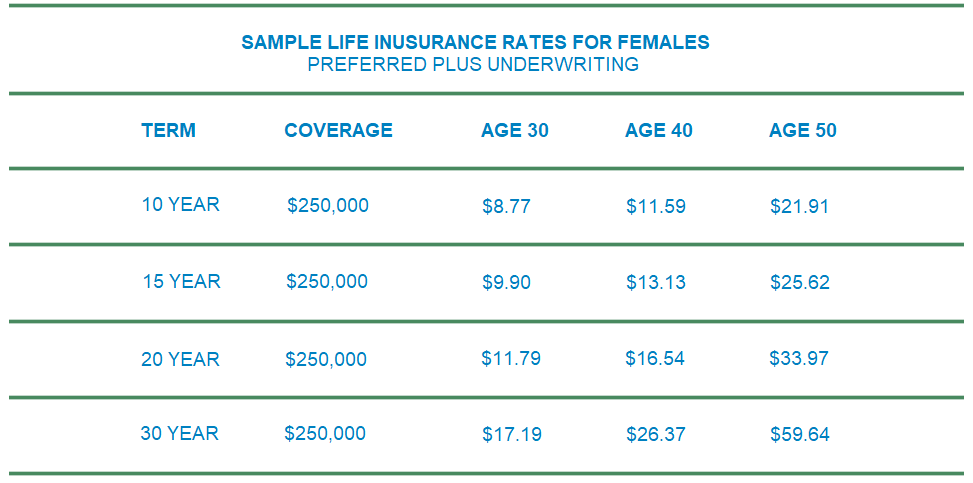

Term life insurance is routinely less expensive (initially at least) than permanent coverage given a similar face amount. Even among term plans, policies with shorter guaranteed periods generally cost less. As an example, a 10-year term plan would have lower rates than a 20-year term, and the 20-year term would be less expensive than a 30-year plan.

One effective, but not so common strategy, is to “ladder” term insurance policies purchasing policies with different lengths to meet specific needs. The important thing is to get the type and length of coverage that you truly need at the best rates possible, whether that be level term life insurance, guaranteed universal life insurance, or other coverage.

The following sample rates provide an example of potential cost savings based on selecting shorter coverage periods (or terms).

Note: Sample rates provided are based on rate information at the time of publication and are subject to change without notice. Company underwriting makes the final decision concerning rate class and/or policy approval.

Tip #2 – Select Appropriate Coverage

The amount of coverage, or death benefit, for a life insurance policy is an extremely important consideration for individual and family financial security.

Though the primary reason for selecting the right amount of life insurance is to ensure adequate protection, it can also help in getting the best rates possible.

The amount of coverage, or death benefit, for a life insurance policy is an extremely important consideration for individuals and their families.

Though the primary reason for selecting a life insurance coverage amount is to ensure adequate protection, it can also help in getting the best rates. You obviously want to meet coverage requirements but also don’t want to purchase more insurance than is needed.

Quick Tip: Select an appropriate amount of coverage (no more, no less). Conducting a comprehensive needs analysis can help to determine an appropriate death benefit for your individual situation.

You may have heard agent say that an individual should own life insurance equal to seven, eight, or even ten times their annual income. However, these “rules of thumb” are often flawed in that they do not take individual financial considerations into account.

According to Life Happens, life insurance needs essentially depend on two variables: “How much will be needed at death to meet immediate obligations? And, how much future income is needed to sustain the household?”

The best method of determining the appropriate amount of life insurance coverage is to conduct a comprehensive needs assessment. This process involves identifying immediate cash needs, income replacement, debt requirements, educational funds, and other needs, and considering continuing income, current assets, and other resources available to offset life insurance requirements.

Tip #3 – Choose the Best Insurance Company

In considering the purchase of life insurance, another important variable is the actual life insurance company that you choose to do business with overall.

This decision can cause significant confusion given the overwhelming number of options available in the modern life insurance marketplace. And, it is fair to say that all insurance companies are not created equal.

According to the Insurance Information Institute, there are almost 6,000 different insurance companies doing business in the United States alone.

Quick Tip: Choose the “best” insurance company, in other words, the insurer that looks most favorably at your specific situation. It is important to consider how different companies evaluate your individual health and lifestyle considerations.

Since each insurance company designs and prices individual products offered to consumers, it is possible to have significantly different pricing from one company to another. There are also variances in underwriting standards with some companies that can make a significant difference in rates for certain health considerations.

As an example, one insurer may consider an applicant taking high blood pressure medication for Preferred Plus (best) rates, while another may not. Or, Company A may consider a family history of cancer differently than Company B. It is also important to check the financial ratings for the insurance companies being considered.

Tip #4 – Lose a Few Pounds, Be Conscious

The general pricing for life insurance is based on age, gender, tobacco use, health, lifestyle, and other individual considerations..

While some of these elements are beyond our control, others may be influenced to improve our “risk level” and, therefore premium rates. In addition to potentially lowering the rates on your life insurance, a few simple choices may also improve your health and quality of life overall.

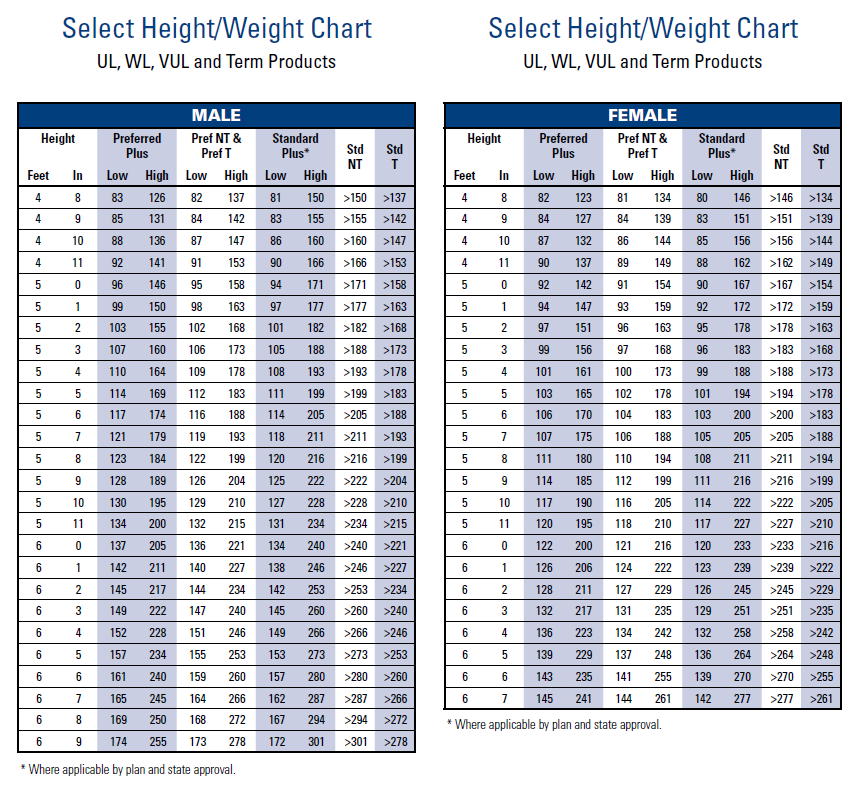

Quick Tip: Lose a few pounds and be health-conscious. Even subtle improvements in an applicant’s weight, blood pressure readings, or cholesterol levels may help in qualifying for lower life insurance rates.

In comparing the different underwriting classifications offered by most insurance companies, the “cutoff” values from one category to another can be minor. In other words, relatively minor differences in an applicant’s weight, blood pressure, cholesterol readings, and other factors can affect premium rates. The following chart shows hypothetical differences in underwriting based on height and weight considerations.

Tip #5 – Quit Smoking or Explain Tobacco

The use of tobacco and tobacco products is a significant contributor to health concerns and associated healthcare costs.

According to the Centers for Disease Control and Prevention, almost 40 million adults in the United States smoke cigarettes, and annual medical costs for tobacco-related diseases run nearly $170 billion.

Quick Tip: Quit smoking or explain other types of tobacco use. Quitting cigarette use can improve life insurance rates after just one year and may even qualify an applicant for non-tobacco rates within five years. Also, smokeless tobacco users, the occasional cigar smoker, and others may be considered for non-tobacco rates with certain insurance companies.

Given the potential health and mortality risks associated with smoking, it makes sense that tobacco use would be a significant consideration for life insurance companies. In fact, cigarette smokers are often shocked to learn that life insurance premiums for tobacco users can be twice that of non-smokers. Even ex-smokers who quit within the past few years may still pay higher rates for the same coverage.

On the other hand, smokeless tobacco users and the occasional cigar smoker are often pleased to learn that some insurers will consider them for non-tobacco underwriting classifications. This designation as a “non-tobacco user” can significantly reduce premium rates, in many instances cutting the cost of coverage in half.

Tip #6 – Take the Insurance Exam

In evaluating an application for coverage, life insurance companies routinely consider the overall lifestyle, general health, and medical history of a proposed insured to assess insurability and determine rates.

This process often involves the applicant completing a basic “insurance exam,” as well as providing health and medical information.

Quick Tip: Take the life insurance exam to apply for fully underwritten coverage. If you are fairly healthy or have medical issues that require explanation, taking the examination allows the insurance company to have a complete picture of your current health.

These mini exams routinely take less than an hour and involve a series of medical questions, medication documentation, height and weight check, blood pressure reading, collection of blood and urine samples, and other tests. The insurance company may also request medical records or attending physician statements for any potential areas of concern.

The medical exam process allows you to provide the insurance company with a complete picture of your situation. It can also be beneficial to include a cover letter or physician’s statement to provide additional details which would be to your benefit. In preparation for your life insurance exam, it can be helpful to gather the required information and take steps to ensure the best results possible.

Preparing for Your Exam

- Make a list of current medications

- Have doctors contact information

- Schedule exam early in the morning

- Drink plenty of water prior to exam

- No caffeine or nicotine prior to exam

- No alcohol the day before exam

- Limit sodium and fat prior to exam

- Get plenty of rest the night before

- Be open and honest with examiner

Tip #7 – Buy Life Insurance While Young

If you have a need for life insurance coverage, it makes sense to buy sooner rather than later as a consumer.

Since age is one of the primary considerations in the pricing of life insurance, it stands to reason that those of us who are slightly more “seasoned” can expect to pay slightly higher premiums.

It is also important to consider the increasing chance of health issues as we age. These factors combined can significantly increase the cost of life insurance for a primary insured, often beyond the point of affordability.

Quick Tip: Buy life insurance while you are young to save significant money on premiums. The earlier you buy life insurance coverage, the better. You will not only qualify for lower premiums based on age but can also avoid higher premiums or possible insurability issues due to unexpected medical issues in the future.

Younger shoppers are often pleasantly surprised to learn how inexpensive life insurance coverage can be at younger ages. But even a one, three, or five-year delay can make a difference in premium rates. The following sample rates provide an illustration of the impact of waiting to purchase life insurance, given a $500K 30-year term policy and a preferred plus underwriting class.

$500,000 30-year Term Life Policy Rates

Male Insured (Preferred Plus)

- 30-year-old male – $30.92 per month

- 40-year-old male – $50.52 per month

- 50-year-old male – $127.73 per month

Female Insured (Preferred Plus)

- 30-year-old female – $25.89 per month

- 40-year-old female – $41.39 per month

- 50-year-old female – $94.24 per month

Note: Sample rates provided are based on rate information at the time of publication and are subject to change without notice. Company underwriting makes the final decision concerning rate class and/or policy approval.

Tip #8 – Backdate Policy Date to Save Age

In determining an applicant’s age, insurance companies may use either the proposed insured’s actual age (current age) or nearest age (age closest).

As an example, a 40-year-old born in January is closer to their 40th birthday until the end of June, by in July they are technically closer to their 41st birthday.

This can be somewhat confusing, but welcome to the world of insurance. However, many insurance companies will allow an insured to “backdate” the effective date of a newly issued policy to “save age” or have the premium rates based on their previous age. Though one year difference may be minimal for younger insureds or short-term policies, this difference in premium can really add up for older insureds over a long period of time.

Quick Tip: Consider whether backdating a new policy’s effective date to save age is in your best interest. Though it may cost a little more upfront to pay back-premiums, backdating a policy can potentially save you a significant amount of money over the long term.

So, if you are thinking this sounds too good to be true and that there has to be a catch, you would be correct. An insured who requests that a policy be backdated can usually only do so for a certain number of months (typically 6 months), and they must also pay all premiums for the backdated period. Essentially, it is important for a policy owner to do the math to see if this strategy is worthwhile in their specific situation. In many instances, backdating can make sense for older insureds or larger life insurance policies.

Tip #9 – Pay Annually for Lower Premiums

The premium rates for life insurance policies are traditionally calculated based on annual premiums for a given policy year.

But since many consumers prefer to pay insurance bills monthly or quarterly, the premiums are further broken down into periodic or model payment amounts.

However, the convenience of “monthly premiums” is not without added cost. Essentially, the insurance company is financing the annual policy premium allowing policy owners to make “easy monthly payments,” which often increases the total amount paid.

Quick Tip: Pay life insurance premiums annually to avoid higher periodic monthly rates. Forgoing the convenience of monthly life insurance premiums can save you money since the insurance company will not be “financing” the annual cost.

As an example, a 60-year-old male qualifying for preferred plus underwriting on a $1,000,000 guaranteed universal life (permanent) policy would pay around $1,481 per month. But if the policy owner agreed to pay annually, the premiums would run about $17,365 per year. This ability to pay premiums upfront each year could save the policy owner over $400 a year. Again, it is important to discuss premium options with your insurance professional to develop the best plan based on your individual situation.

Tip #10 – Ask About Multiple Policy Discounts

In situations when life insurance is purchased through an existing insurer, such as your auto or homeowner’s insurance carrier, make sure to ask about any multiple policy or multi-line discounts that are available.

These incentives are common among several of the major insurance companies insurers offering various lines of coverage.

Insurance companies know that there is increased loyalty among consumers having multiple policies with the same insurer, and you can believe that they want your business.

According to The Balance, discounts can range from 15 to 25 percent depending on your particular insurance company and type of policies owned.

Quick Tip: Ask insurance companies that you currently do business with about multiple policy discounts. Information related to multi-policy benefits, in addition to independent life insurance quotes, can help in making an informed decision that best meets your needs.

In conducting a quick search, a number of reputable companies to include Allstate, Geico, Liberty Mutual, Nationwide, Progressive, and others, offer multi-policy savings. Though these discounts may not always apply to life insurance, it never hurts to ask, and sometimes the savings on other policies can help to offset life insurance costs.

Tip #11 – Consider Group Life Coverage

A quick review of your employee benefits at work will often reveal at least some amount of life insurance coverage.

It is common for employers to provide a “base” of coverage, possibly linked to annual salary amount, and also offer options for purchasing additional life insurance at the employee’s expense.

This coverage can be extremely affordable and routinely does not require evidence of insurability up to certain policy limits. Given these benefits, group life insurance can be a blessing for those who are otherwise uninsurable due to health considerations.

According to the Bureau of Labor Statistics, employer sponsored group life insurance benefits are available to over 90% of full-time workers in the United States.

Quick Tip: Consider employer-sponsored group coverage when evaluating life insurance policy options. Group coverage routinely offers affordable premiums with no proof of insurability, but it is important to understand that coverage traditionally ends with employment.

For this reason, it is recommended that individuals purchase life insurance coverage separate from group benefits, essentially having “portable coverage.” Group life insurance can be a cost-effective way to quickly and easily get needed coverage, however, it is important to consider benefit limitations and restrictions.

Tip #12 – Take Free Life Insurance Offers

In considering ways to save money on life insurance, it is hard to beat FREE or complementary coverage offered by some businesses and organizations.

There are a number of ways to essentially get no-cost life insurance through banks, financial institutions, or other organizations with which you already do business.

In many instances, institutions such as banks, credit unions, and credit card companies may others offer small amounts of coverage associated with accounts, products, or services.

Quick Tip: Take advantage of free life insurance offers through credit unions, credit card companies, and other institutions. It is important to be aware of any complementary and/or supplemental coverage options when evaluating overall insurance needs.

This coverage is routinely fairly minimal, but every little bit helps. For younger consumers with no dependents and/or limited financial obligations, free coverage offered through a credit union and a couple of credit card accounts may be adequate.

Also, there may be increased coverage amounts for accidental death, travel-related incidents, and other considerations. The main point is that it is important to understand the perks and benefits associated with products and services you already use.

LifeBridge Program

Another valuable source of free life insurance for those who qualify is also available in the form of corporate social responsibility initiatives, such as the MassMutual LifeBridge Program.

According to MassMutual, “LifeBridge is a unique free life insurance program that helps children of income-eligible families pay for education expenses if their insured parent or guardian passes away during the term of the policy.”

To date, this program boasts over 14,000 in force policies with $700 million in coverage supporting the educational goals of low-income families. For details and eligibility requirements, please visit the MassMutual website or review the LifeBridge Eligibility Flyer.

Tip #13 – Partner with an Experienced Agent

The life insurance marketplace can be somewhat confusing as products, services, and insurance companies can continually evolve.

It can be extremely helpful to have the support of an advocate when shopping and applying for the life insurance coverage you need for your family or business.

Independent agents routinely have access to a number of top-rated companies and may also have valuable experience in aligning client needs with appropriate solutions.

Quick Tip: Partner with an experienced independent agent to help in choosing the right type of policy, appropriate amount of coverage, and best life insurance company for your individual situation.

Independent life insurance agents, unlike “captive agents” who work with only one company, routinely have access to a wide variety of insurance carriers and products. This “independence” allows them to recommend the products and services that are in the best interest of their clients, as opposed to being limited to a single product provider.

Additionally, their experience in working with multiple carriers often results in expertise related to company underwriting niches, processing trends, and other considerations that may benefit their clients. Working with an experienced independent agent can be extremely helpful in navigating the complicated landscape of the life insurance marketplace.

Implementing a Coverage Plan

In navigating the world of life insurance careful planning and informed decisions can be important in securing the best rates without compromising on coverage. The journey begins by identifying your specific needs and selecting the right type of policy—whether temporary or permanent—tailored to your circumstances. It’s crucial to determine the appropriate coverage amount to ensure adequate protection while avoiding unnecessary expenses.

Choosing the right insurance company is paramount, considering how each evaluates health and lifestyle differently. Health improvements, such as weight loss and quitting smoking, can impact premiums by reducing perceived risks. Undergoing a thorough insurance exam provides insurers with vital health insights, potentially qualifying you for lower rates.

Timing can play a crucial role, as purchasing life insurance at a younger age often results in more affordable premiums over the policy's lifespan. Backdating policies can further optimize costs by leveraging lower age brackets. Opting for annual premium payments and exploring multiple policy discounts can also yield financial benefits. By following these steps and leveraging insider tips, individuals can effectively navigate the complexities of life insurance, ensuring financial security for themselves and their loved ones.

Conclusion

In conclusion, finding affordable life insurance that meets your needs can be crucial for securing your family's financial future. It is also importance to balancing cost-effectiveness with comprehensive coverage. Whether you're looking for term life insurance or permanent coverage, the tips highlighted can help to guide you through the selection and application process. By comparing quotes and understanding options, you can make an informed decision and safeguard your family's future confidently.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.

3 Comments

Kate Hansen

It was really helpful when you said to look into finding an experienced agent. My sister was telling me a couple of nights ago about how her husband is wanting to look into getting life insurance, and that they want to make sure that they can find the right agent. I'll make sure to pass these tips along to her so that they can know what to look for when searching for an insurance agent.

James Shiver, DBA

Thank you for the response and feedback. Also, thank you for passing our information along to your sister and brother-in-law. Please let us know if we can ever be of assistance. Have a great day!

Eli Richardson

It's interesting to know that making an annual payment helps us avoid high monthly premiums. A few days ago, we found out we're expecting our first child. We think it's time to get life insurance to ensure our family is protected, so we'll follow your tips to help us choose the best plan for us.