Critical Illness Insurance | Financial Support for Recovery

Life can change in an instant, and a critical illness diagnosis can potentially be one of those life-altering moments. While medical advancements have significantly improved treatment outcomes for conditions like cancer, heart attacks, and strokes, the financial burden associated with these illnesses often lingers long after the initial diagnosis. Critical Illness insurance offers a solution, providing policyholders with financial support so they can focus on recovery rather than worrying about expenses.

This article explores the purpose, benefits, and mechanics of critical illness insurance, making a case for why this type of insurance coverage is a valuable addition to a comprehensive financial plan.

What is Critical Illness Insurance?

Critical illness insurance is designed to provide a lump-sum payment to policyholders diagnosed with a qualifying medical condition, as opposed to life insurance which pays a death benefit in the event of your death.

Also, this contrasts with traditional health insurance, which covers medical bills and routinely pays directly for service providers.

Critical illness insurance pays a one-time cash benefit based on a qualifying diagnosis that policyholders can use however they see fit. The policy usually includes a predetermined list of illnesses that qualify for coverage, such as heart attack, stroke, cancer, and organ failure. Each insurance provider may have different definitions and requirements, so it’s crucial for potential policyholders to understand what is included in their specific plan.

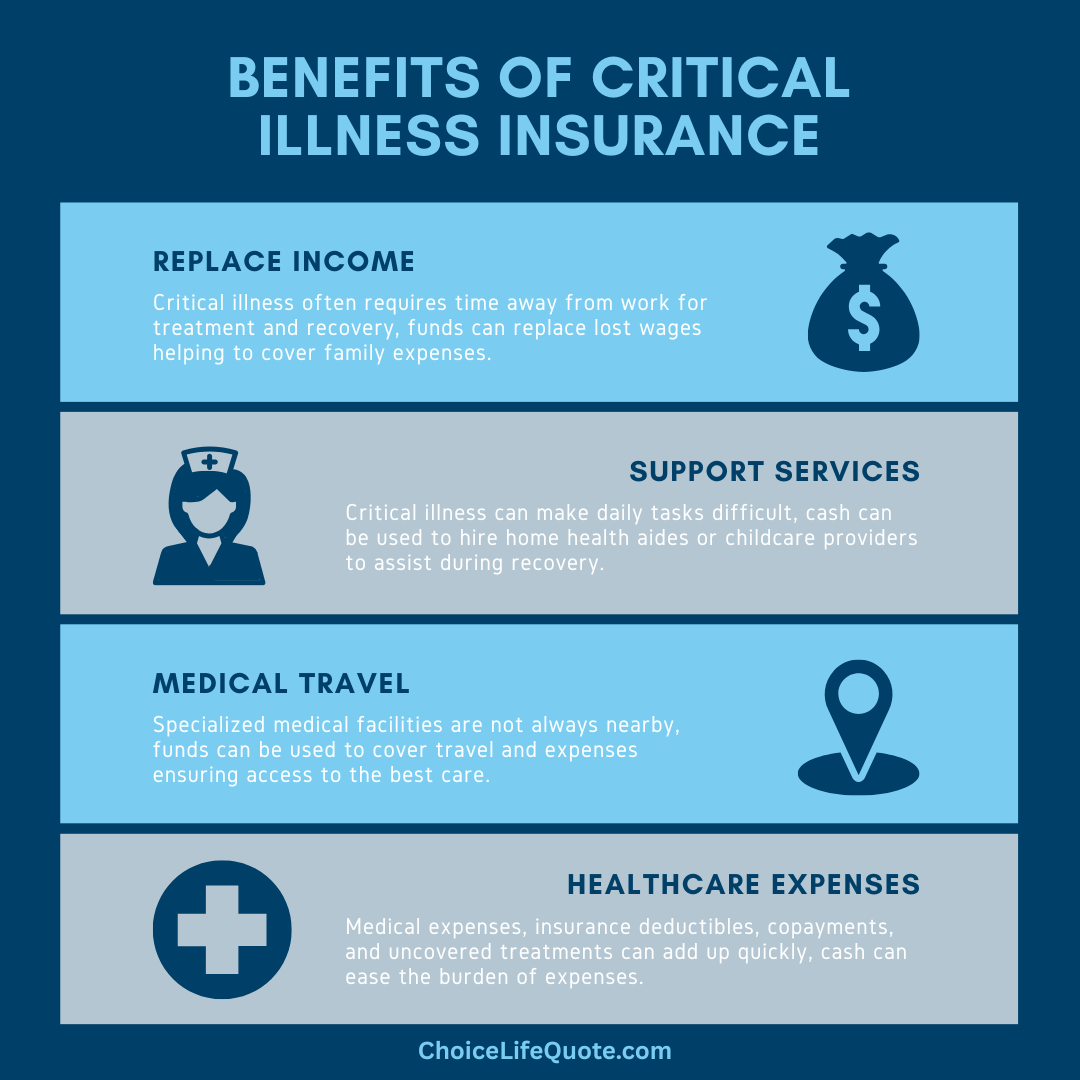

One of the key advantages of critical illness insurance is its flexibility. This flexibility allows individuals to cover expenses that often fall outside the scope of standard health insurance policies, such as:

Replacing Lost Income

A critical illness often requires time off work for treatment and recovery. The insurance payout can replace lost wages, ensuring that families can maintain their standard of living.

Paying Everyday Expenses

From groceries to utility bills, the costs of daily life continue even when health challenges arise. The lump-sum payment provides relief by covering these essentials.

Hiring Support Services

Critical illnesses can make daily tasks difficult. Funds can be used to hire home health aides or childcare providers, making recovery less stressful.

Traveling for Treatment

Specialized medical facilities are not always nearby. Critical illness insurance benefits can be allocated to cover travel and accommodation costs, ensuring access to the best care.

Managing Medical Expenses

Deductibles, copayments, and uncovered treatments can add up quickly. The lump-sum benefit helps ease this burden.

In essence, critical illness insurance is about bridging the financial gap and ensuring peace of mind during a challenging time. It’s also important to recognize that this type of policy is not a substitute for regular health insurance. Instead, it complements existing coverage by providing additional financial support when it is most needed. It acts as a safety net, allowing policyholders to focus on recovery rather than worrying about the financial implications of a serious illness.

Why Critical Illness Insurance Matters

The importance of critical illness insurance cannot be overstated, particularly in today's unpredictable world. With rising healthcare costs and an increasing number of chronic diseases, having a safety net in place is more essential than ever. Many Americans face significant financial strain when diagnosed with a life-threatening condition, even if they have health insurance. While employer-based health insurance plans provide essential coverage, they rarely cover all the associated costs of a critical illness. In reviewing statistics, serious health conditions affect millions of Americans each year. These statistics highlight the likelihood of encountering a critical illness at some point during your lifetime.

Critical illness insurance offers protection against the financial instability that can accompany such diagnoses, providing a direct, lump-sum payment. Having a critical illness policy can alleviate some of that stress, ensuring that individuals have the resources needed to focus on their health and recovery. Moreover, critical illness insurance is vital for those who may not have sufficient savings to cover extensive medical treatment or time off work.

How Critical Illness Insurance Works

The mechanics of critical illness insurance are routinely straightforward, making it an accessible option for individuals looking to protect themselves against financial risks. Critical illness insurance typically covers a specific set of illnesses, which can vary by insurer and policy. Common illnesses included in most plans are heart attack, stroke, various forms of cancer, and other conditions. Critical illness insurance policies vary in scope, but most plans cover a wide range of serious medical conditions, including:

- Heart attacks

- Strokes

- Cancer

- Kidney failure

- Major organ transplants

- Alzheimer’s disease

- Paralysis

- Blindness and deafness

However, the actual list of covered conditions can differ significantly between insurers, so it's essential to review and compare policies carefully. With these comprehensive coverage options, policyholders gain peace of mind knowing they have financial support for a variety of health challenges.

It’s important for potential policyholders to pay attention to the definitions of the illnesses covered in their policy. For instance, not all cancers may be included, and some policies may only cover invasive cancers while excluding non-invasive forms. Understanding these specifics can help individuals choose a policy that aligns with their health risks and concerns.

Case Study: Critical Illness Insurance

Kate’s Diagnosis and Recovery

Based on her cancer diagnosis the policy paid a lump sum critical illness benefit allowing Kate to keep the family business afloat while focusing primarily on her medical treatment and health recovery. Five years later, Kate has fully recovered from her illness and is completely cancer free, while the family business continues to thrive and provide for her family.

Conclusion

In conclusion, critical illness insurance is a powerful tool for protecting your financial future in the face of life’s uncertainties. With its ability to cover a range of serious conditions and provide immediate financial relief, it stands out as an essential component of a comprehensive financial plan. Don’t wait for the unexpected to happen—consider critical illness insurance today. It’s a decision that can make all the difference when you need it most.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

FAQs

Critical illness insurance is a type of policy that pays a lump-sum benefit if you are diagnosed with a covered serious illness — such as cancer, heart attack, or stroke — during the policy term. You can use the payout however you choose, including covering medical bills, everyday living expenses, or lost income.

Most critical illness insurance plans provide coverage for major conditions, including cancer, heart attack, stroke, organ failure, and other specified conditions listed in the policy. Coverage details and definitions vary by carrier, so it’s important to review the policy terms to understand exactly what is covered.

Critical illness insurance can be valuable for individuals who want financial protection beyond traditional health insurance, especially if they are concerned about paying high out-of-pocket costs or replacing income during recovery. It may be especially helpful for people with family histories of serious illness or limited emergency savings.

Critical illness insurance is not a substitute for health insurance. Health insurance covers medical treatment costs, while critical illness insurance pays a cash benefit when you’re diagnosed with a covered illness. This cash can be used for any purpose, such as travel for specialized care, bills, or daily expenses.la elementum consequat. Fusce velit erat, convallis scelerisque aliquet ut, facilisis egestas tellus. Quisque sit amet sapien placerat, ultricies sapien ut, vestibulum ex.

Yes. Most critical illness policies include specific definitions, waiting periods, limitations, and exclusions. For example, pre-existing conditions may be excluded, and some policies may not cover all stages of a disease or certain illnesses. Reviewing policy details and working with an experienced agent can help you understand these limitations before you buy.

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers for ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help provide consumers with a variety of educational content on life insurance and annuities.