How much life insurance do I need? “Rules of Thumb”

The majority of Americans agree that life insurance is an important part of their overall financial and estate planning. However, determining an appropriate amount of coverage can be challenging for many consumers. In working with clients, we are often asked questions related to life insurance and policy coverage such as... How much life insurance do I need? What should be considered in selecting coverage? Or... Should I purchase a life insurance policy for my non-working spouse? These and other similar questions are completely understandable as consumers attempt to navigate the often-confusing landscape of life insurance.

This article provides an overview of the basic need for life insurance, guidelines for determining coverage amounts, instructions on how to conduct a comprehensive needs analysis, and other information about how life insurance works.

How much life insurance do I need?

In answering the question of “how much life insurance do I need,” it is first important to understand the primary objective of life insurance coverage.

Simply stated, life insurance coverage can provide a tax-free death benefit to listed beneficiaries when the insured named individual passes away.

According to the Insurance Information Institute, “Many financial planners consider life insurance to be the cornerstone of sound financial planning.”

If someone depends upon you for financial support, there is a good chance that you have a need for life insurance. However, determining the amount of coverage that you need can be slightly more complicated. Identifying an appropriate amount of life insurance coverage basically involves determining the dollar amount of your immediate and long-term financial obligations, then subtracting the value of assessable assets. The difference or “gap” between financial obligations and available assets often provides an answer to the question of… How much life insurance do I need? Individual, family, and financial considerations in evaluating a person's need for life insurance coverage may include questions such as...

In addition to these basic personal financial obligations, there are also special circumstances related to business owners, corporate executives, high net worth individuals, and others which can create a need for the death benefit only life insurance can provide. However, for most consumers, income protection is the primary reason for purchasing a life insurance policy. It is also important to consider the fair market value of the contributions of stay-at-home parents or spouses in evaluating the need for family coverage.

“Rules of Thumb” Calculating Coverage

In determining the amount of life insurance that is appropriate, it is best to conduct a comprehensive needs-based analysis with an experienced insurance professional.

However, there are several “Rules of Thumb” which are commonly used by agents and consumers alike to calculate a rough estimate of life insurance coverage needs.

Though these methods are no substitute for a comprehensive analysis, in most instances, having some life insurance coverage is better than no coverage at all. The following are commonly used methods for estimating life insurance needs.

Income Multiple Method

As a quick method of determining coverage needs, advisors sometimes recommend a specific multiple of a proposed insured’s annual income. As an example, if someone wants to replace current income, they could purchase life insurance equal to 20 times their salary and leave instructions for the proceeds to be invested upon their death. Even with the death benefit earning a modest interest rate, this strategy could likely replace the decedent’s income indefinitely.

On the other hand, a policy owner may choose to replace current income for a specific amount of time, such as 5 or 10 years providing a financial “transition period” for beneficiaries. The transition period strategy will also traditionally be less expensive since less of a death benefit is required. An income multiple of 10 times current income is a common rule of thumb when purchasing life insurance which often balances both death benefit needs and premium costs. However, simply using a multiple of someone’s income does not always accurately account for specific needs, available assets, and other important considerations.

Quick Analysis Methods

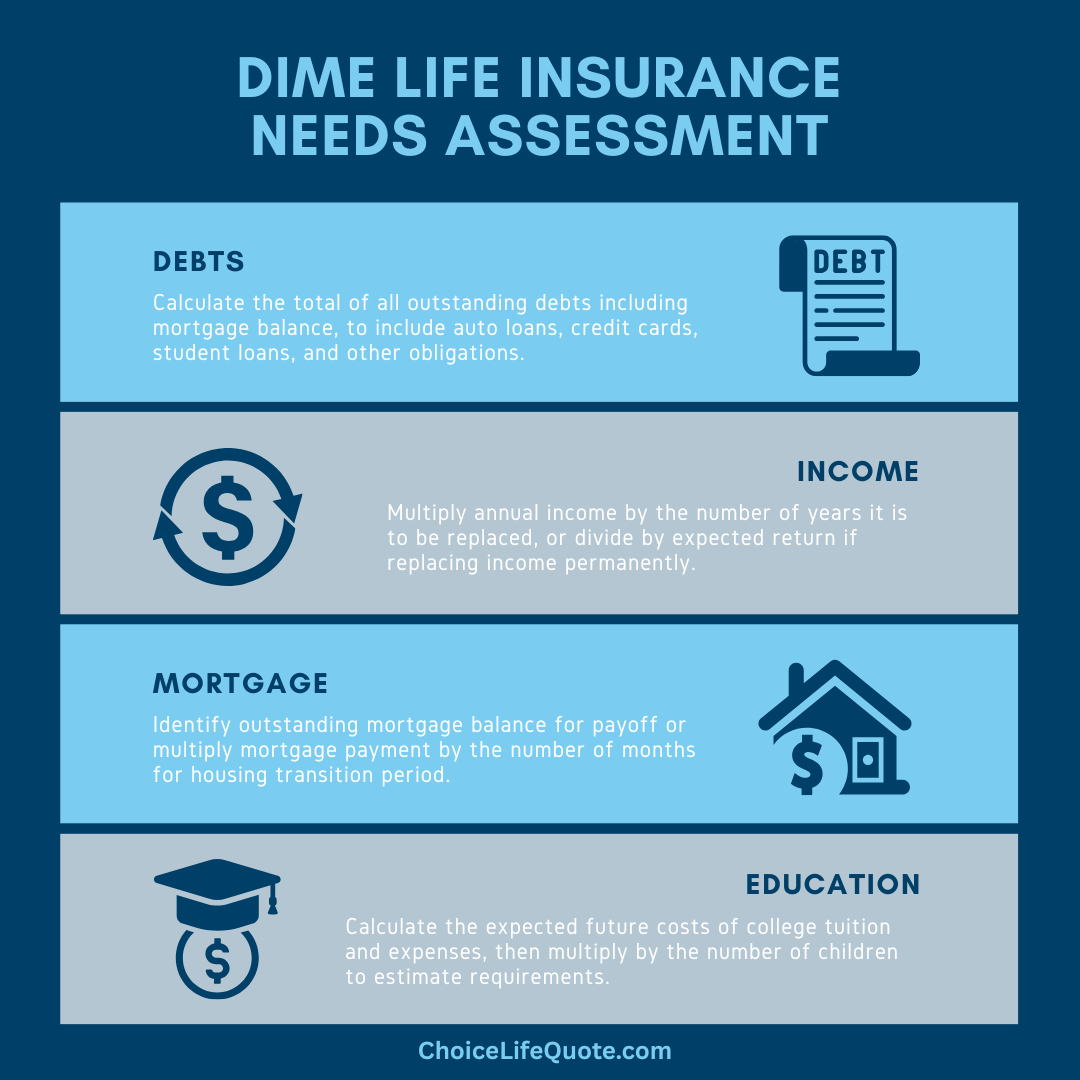

There are also several quick needs analysis methods that use various acronyms to help guide policy owner’s in determining appropriate life insurance coverage. Common needs analysis acronyms include LIFE (liabilities, income, final expenses, and education), DIME (debts, incomes, mortgage, and education), and others limited only by the imaginations of creative agents and insurance companies.

As an example, the DIME method could include the following with the total providing a snapshot of estimated coverage needs.

D.I.M.E. Quick Needs Analysis

Debts – Calculate the total of all debts excluding mortgage, to include auto loans, credit cards, student loans, and others.

Income – Multiply income by the number of years it is to be replaced to provide an income transition period or divide by the expected rate of return to replace income permanently.

Mortgage – Include current outstanding mortgage balance for payoff or multiply monthly mortgage payment by the number of months it is to provide a housing transition period.

Education – Calculate the expected future cost of college tuition, expenses, and fees and multiply by the number of dependent children.

The use of these and other acronyms allow agents and consumers to quickly access ballpark life insurance needs and are often more accurate than simply relying on a multiple of one’s income. However, these methods alone do not take into account available assets and resources such as savings, retirement accounts, government benefits, supplemental sources of income, and other considerations.

Comprehensive Life Needs Analysis

As previously stated, the preferred and ideal method of determining an appropriate amount of life insurance coverage is to conduct a comprehensive needs analysis with an experienced insurance professional.

This type of assessment allows the agent and consumer to work collaboratively to identify coverage needs, as well as resources.

This process often involves an initial fact-finding interview and should include periodic reviews to adjust for potential changes in family dynamics, income level, financial goals, and overall objectives. As an example, a comprehensive life insurance needs-based analysis could include the following, with the outcome providing an overview of coverage needs.

Sample Needs Analysis

Income Needs

Total annual income required

(estimate 75% current income)

$_______________

Income earned from other sources

(spouse's job, pension, etc.)

$_______________

Replacement income requirement

(subtract other from total requirement)

$_______________

Income fund required

(divide income required by .05)

$_______________

Financial Obligations

Mortgage balance outstanding

$_______________

Other debts, loans, and obligations

$_______________

Funds for college education

(estimate $75K per child)

$_______________

Funeral and other final expenses

(estimate $12K to $15K)

$_______________

Total Amount Required

(add income fund to total obligations)

$_______________

Available Assets

Savings and investments

(savings, mutual funds, etc.)

$_______________

Retirement Accounts

(401(k), IRA, Roth IRA, etc.)

$_______________

Existing life insurance

(individual and group policies)

$_______________

Other miscellaneous assets

(other available assets)

$_______________

Total Assets

(add up all assets)

$_______________

Total Life Insurance Need

(subtract assets from amount required)

$_______________

Interactive Life Insurance Calculators

In considering life insurance coverage needs, there are a variety of resources available to modern consumers.

The combination of ever-evolving industry technology and consumer demand for convenience has led to the development of online interactive life insurance needs calculators and recommendations.

These calculators are provided as a free resource by many insurance companies and industry organizations. Interactive life insurance needs calculators allow consumers to evaluate coverage needs in a matter of minutes from the comfort of their home or office. It is still important to discuss life insurance needs with an experienced professional as part of the buying process, but these and other similar calculators allow consumers to do their own research. And, in many instances answer the question of “how much life insurance do I need” for themselves. Examples of interactive life insurance need calculators include the following:

Advanced Life Insurance Planning

In addition to basic individual life insurance needs, there are certain individuals and/or organizations that may benefit from advanced life insurance planning.

These scenarios often require in-depth analysis and collaboration between an individual or organization’s attorney, accountant, insurance agent, and others.

This collaboration can help to develop an overall plan and determine an appropriate amount of coverage. In advanced planning cases, life insurance can facilitate the payment of estate (death) taxes, allow business or farm continuation, provide an endowment for charity, significantly multiply existing assets, or provide funding for other final wishes. It is extremely important to work with an experienced insurance professional when evaluating these or other life insurance planning considerations. Advanced life insurance planning scenarios may include, but are not limited to, the following...

Conclusion

In conclusion, determining an appropriate amount of life insurance involves a careful consideration of individual and family financial obligations, alongside available assets. While "Rules of Thumb" like income multiples or quick needs analysis methods provide initial estimates, a comprehensive needs analysis with a knowledgeable insurance professional remains paramount. This process not only ensures that coverage aligns with specific needs but also allows for adjustments as circumstances evolve. Ultimately, by taking these steps, individuals can secure the peace of mind that comes with knowing their loved ones will be financially protected in the event of the unexpected.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.