Federal Employees Group Life Insurance (FEGLI) Alternatives

The Federal Employees' Group Life Insurance (FEGLI) program has long been a cornerstone of life insurance benefits for federal employees in the United States. However, understanding its structure, limitations, and alternatives in the private marketplace is crucial for federal employees and retirees seeking to optimize their life insurance coverage.

This article discusses Federal Employees Group Life Insurance (FEGLI) and private life insurance marketplace alternatives, highlighting pros and cons, key consideration, and resources to help in making informed coverage decisions.

Understanding FEGLI

FEGLI is a group term life insurance program offered to federal employees. Administered by the Office of Personnel Management (OPM), FEGLI provides basic coverage and optional coverage enhancements that employees can choose based on their needs.

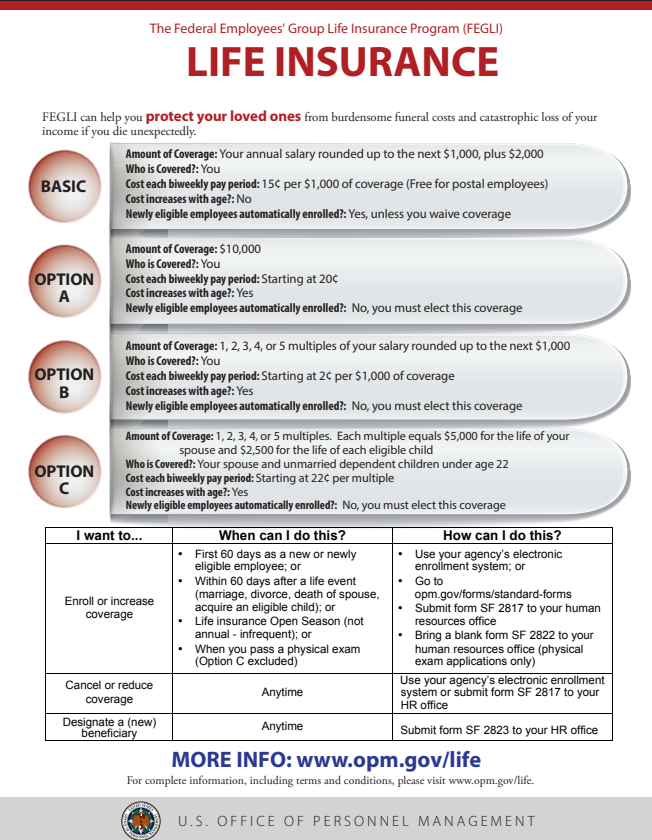

Basic FEGLI and additional coverage options include:

Basic Life Insurance: This coverage provides a death benefit equal to the employee's annual basic pay rounded up to the nearest thousand, plus $2,000.

Option A (Standard Optional Insurance): This is an additional coverage amount of $10,000 in death benefit.

Option B (Additional Optional Insurance): This coverage offers multiples of the employee's annual basic pay (1 to 5 times).

Option C (Additional Family Insurance): This is additional coverage for eligible family members of $5,000 spousal coverage and $2,500 child coverage per unit (1 to 5 units).

Pros and Cons of FEGLI

FEGLI provides an easy way for federal employees to obtain life insurance, but its rising premiums and limited flexibility often make it less appealing compared to private options. Here’s a breakdown of the benefits and drawbacks of FEGLI.

Pros of FEGLI

- No medical exam required – FEGLI is available to all eligible federal employees, regardless of their health status. This makes it an excellent option for employees with pre-existing conditions.

- Convenient payroll deduction – Premiums are automatically deducted from federal employees’ paychecks, making payment seamless and hassle-free.

- Basic coverage is partially subsidized – The government helps cover part of the cost of Basic Insurance, making it more affordable than private policies for younger employees.

- Coverage continues after retirement – Retired federal employees can keep some of their FEGLI coverage, although their options become more limited and expensive.

Cons of FEGLI

- Premiums increase with age – Unlike private term life insurance, which offers fixed premiums, FEGLI’s optional coverages (Options A, B, and C) become more expensive over time.

- No cash value component – Unlike whole or universal life insurance, FEGLI does not build savings or cash accumulation value.

- Limited coverage flexibility – Employees cannot adjust coverage beyond the standard options offered by FEGLI.

- Expensive family coverage – FEGLI’s Option C (Family Coverage) is often more costly than private life insurance, especially for younger employees.

FEGLI Alternatives

While FEGLI provides convenient group coverage, many federal employees and retirees consider alternatives in the private marketplace for various reasons, including cost-effectiveness, flexibility, and tailored coverage options:

Individual Term Life Insurance: Offers customizable coverage amounts and premium structures. Individuals can choose term lengths, typically 10 to 30 years, that align with their financial obligations, such as mortgage payments or children's college tuition.

Individual Permanent Life Insurance: Provides lifetime coverage with a cash value component that grows tax-deferred over time. It offers more flexibility in premium payments and potential for cash accumulation.

Group Employer-Sponsored Plans: Many private employers offer group life insurance plans that may provide similar or enhanced coverage compared to FEGLI, often at competitive rates.

Factors to Consider

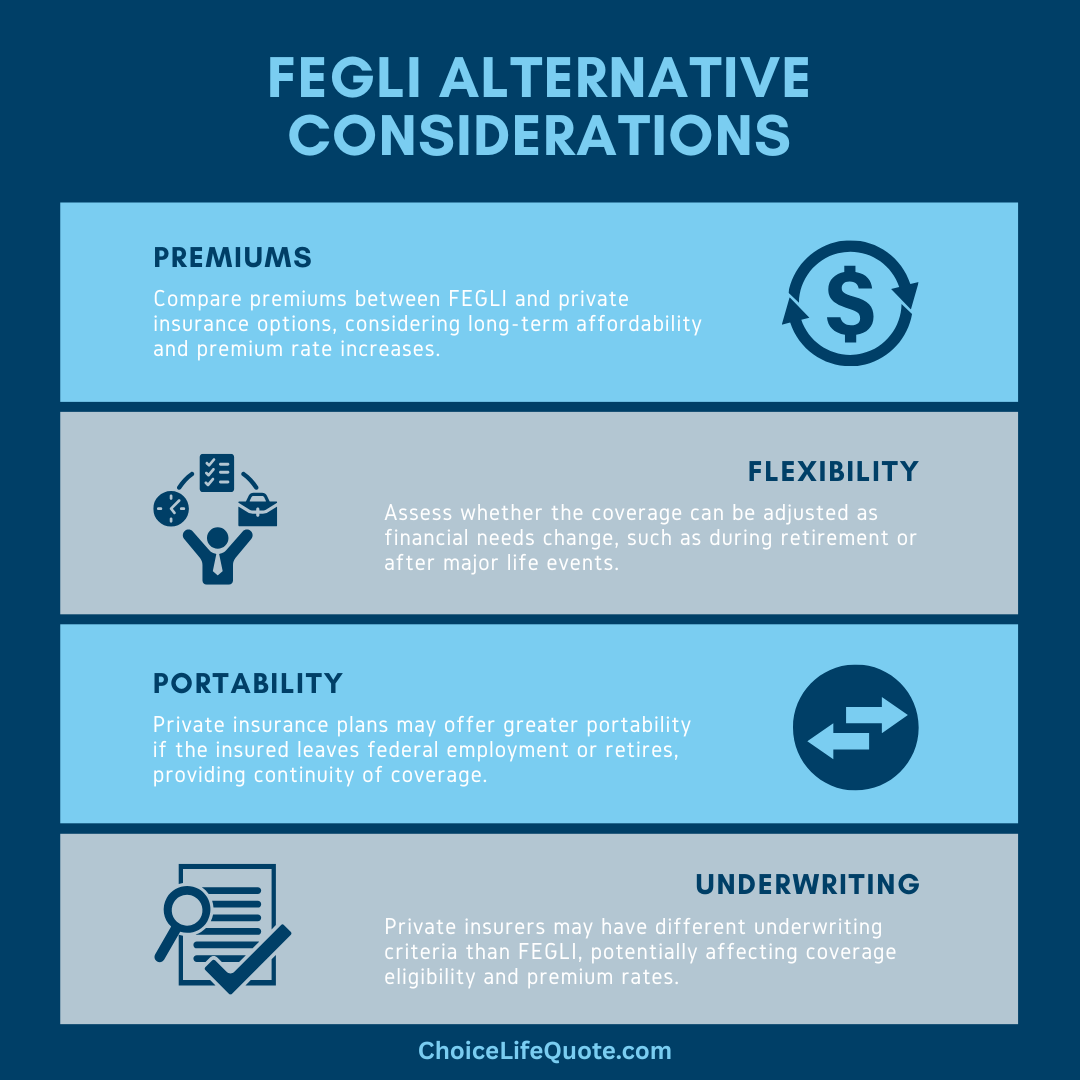

In evaluating alternatives to FEGLI, consider comparing costs and long-term affordability, assessing flexibility in adjusting coverage to changing needs, and noting the portability advantages of private insurance plans when transitioning from federal employment or retirement. Additionally, be aware of how private insurers' underwriting criteria may impact eligibility and premium rates based on health and lifestyle factors.

Premiums: Compare premiums between FEGLI and private insurance options, considering long-term affordability and potential for rate increases.

Flexibility: Assess whether the coverage can be adjusted as financial needs change, such as during retirement or after major life events.

Portability: Private insurance plans generally offer greater portability if the insured leaves federal employment or retires, providing continuity of coverage.

Underwriting: Private insurers may have different underwriting criteria than FEGLI, potentially affecting eligibility and premium rates based on health and lifestyle factors.

Making Informed Decisions

Conclusion

In conclusion, understanding FEGLI and exploring alternatives in the private marketplace empowers federal employees and retirees to make informed decisions that safeguard their financial futures. By weighing the benefits and limitations of each option, individuals can secure adequate life insurance coverage tailored to their unique needs and objectives.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.