Guaranteed Universal Life | Affordable Lifetime Coverage

Many consumers have a need for long-term life insurance coverage but are not necessarily interested in accumulating cash value with the policy. It is also important to many policy owners to have the flexibility to make adjustments to their policy as life circumstances change. In cases where lifetime guarantees and flexibility are important, guaranteed universal life insurance may be the right fit. Given the numerous variations of permanent life insurance available in today’s marketplace, it is completely understandable that consumers can become overwhelmed with policy options.

This article discusses guaranteed universal life insurance, providing an overview of guaranteed universal life, highlighting sample rates, identifying best insurance companies, and discussing how these policies compare to other types of life insurance.

Guaranteed Universal Life Insurance

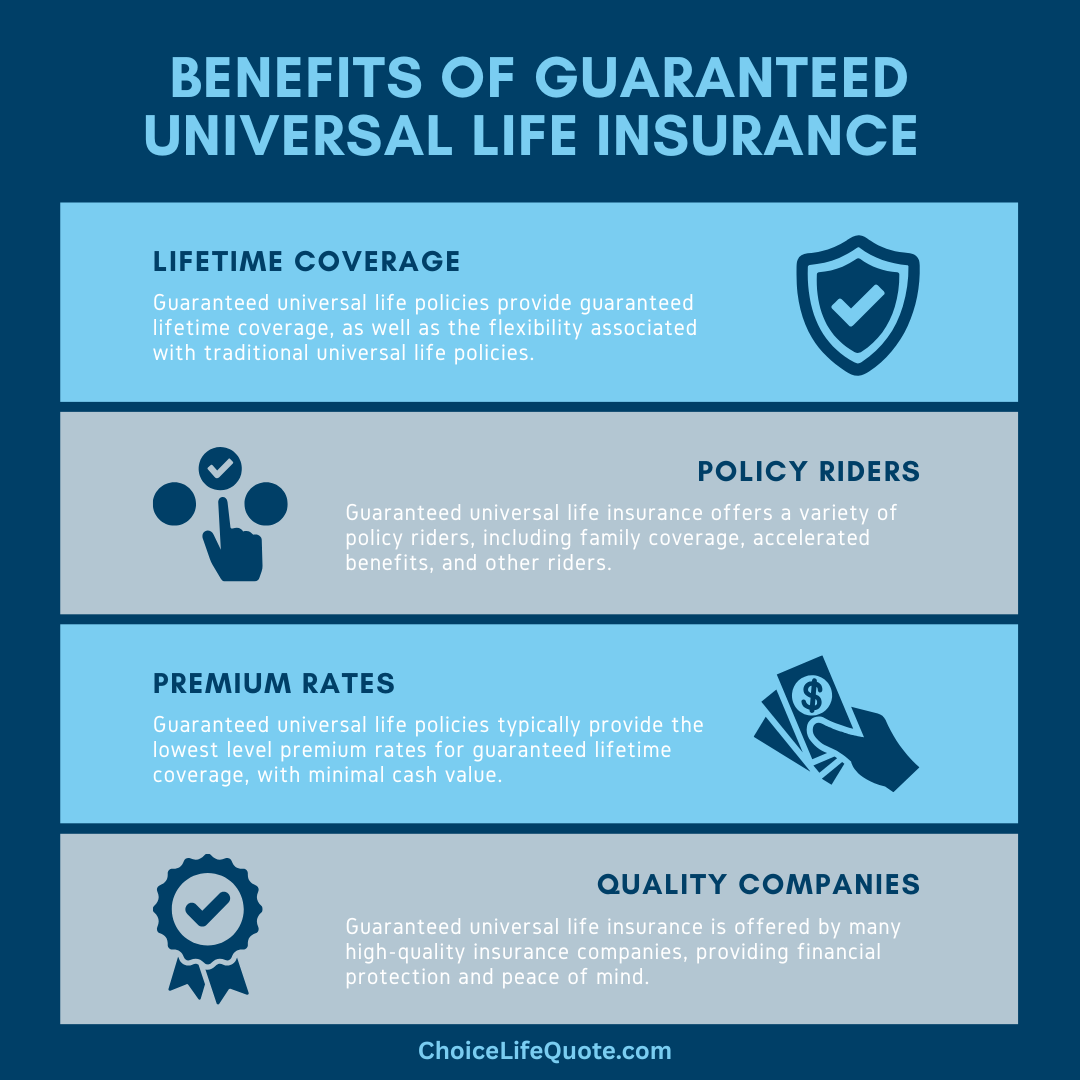

Guaranteed universal life (GUL) insurance, or no-lapse universal life, is a type of permanent life insurance that combines many of the benefits of term and permanent coverage.

Essentially, a GUL insurance policy provides lifetime coverage at the lowest possible guaranteed premium.

While term life policies typically provide level premiums for 10, 20, or 30 years, a GUL policy can be designed to have level premiums for an insured’s entire lifetime. These plans will often allow a policy owner to choose a policy length, such as until age 90, 95, 100, or beyond (maximum age is usually 121). Since this type of policy is designed primarily to provide lifetime coverage at the lowest guaranteed premium, cash value is often a secondary consideration. If policies do accumulate cash value, it is typically a lower amount than other permanent policies with higher premiums. As universal life plans, these policies offer flexibility with regard to death benefit and premiums. However, it is extremely important that policy owners meet minimum premium requirements to maintain policy guarantees.

GUL Insurance Policy Riders

Similar to other universal life policies, these plans typically include a range of additional features known as policy riders, which vary depending on the base policy and the insurance company issuing coverage. These riders enable policy owners to enhance their plan benefits with minimal additional cost, providing flexibility and customization tailored to individual needs. The specific riders available often depend on the insurance provider and the type of life insurance coverage selected, offering a versatile array of options to suit different financial strategies and personal circumstances.

Pros and Cons of GUL Policies

As with different types of life insurance products, GUL policies come with their own set of advantages and disadvantages, which can vary based on the insured individual's coverage requirements. GUL policies provide lifetime coverage, ensuring peace of mind for policyholders and their beneficiaries, with the added benefit of offering the lowest-cost option among permanent life insurance products. These policies also feature various riders for customization, addressing specific needs like critical illness or long-term care.

According to Life Happens, "unlike term insurance, a permanent insurance policy will remain in force for as long as you continue to pay your premiums."

However, they tend to be more expensive than term life insurance due to lifetime coverage guarantees and included riders, and they typically accrue minimal cash value compared to other permanent life insurance plans, necessitating premium guarantees that may lead to stricter payment schedules and potentially higher premiums over time. These considerations help individuals evaluate whether a GUL policy aligns with their long-term financial planning and protection goals.

Pros

Cons

Sample GUL Premium Rates

Premiums for GUL plans typically fall between the lower costs of term policies, which provide coverage for a limited duration, and the higher premiums of typical permanent policies that may accrue more cash value over time. The cost of premiums for this type of policy can vary significantly among insurance companies based on the specific policy structure and included features. Below is an illustration of sample rates for GUL policies, considering a 35-year-old male non-smoker eligible for a Preferred Plus underwriting class. These rates serve as a guideline to understand the pricing range available in the market for this particular demographic and health profile.

Sample Rates

GUL to age 90

Note: The rates illustrated above are for a $250,000 GUL insurance policy to age 121 on a 35-year-old male non-smoker qualifying for the Preferred Plus underwriting class.

Sample Rates

GUL to age 100

Note: The rates illustrated above are for a $250,000 GUL insurance policy to age 121 on a 35-year-old male non-smoker qualifying for the Preferred Plus underwriting class.

Sample Rates

GUL to age 121

Note: The rates illustrated above are for a $250,000 GUL insurance policy to age 121 on a 35-year-old male non-smoker qualifying for the Preferred Plus underwriting class.

Consumers Best Suited for GUL

GUL insurance is often used by individuals who have a long-term need for coverage (beyond what term policies offer) to meet a variety of financial obligations.

Given its permanent nature, this type of policy can be ideal for long-term income replacement and other permanent financial obligations and objectives.

Best GUL Insurance Companies

Most companies in today’s marketplace offer GUL policies, recognizing their appeal as a cost-effective option for lifetime coverage. Choosing the right life insurance company involves considering your unique situation, financial needs, and objectives. It's crucial to evaluate factors such as company ratings, the range of products available, competitive premium rates, customer service reputation, and additional benefits. Based on our experience, the following companies come highly recommended for their comprehensive offerings and strong performance across these criteria, ensuring you find a policy that aligns with your insurance goals and expectations.

Case Studies: GUL Coverage

Case Study #1

Income Protection

Molly is a 35-year-old single mother of a son with special needs who requires ongoing home health care. Since Molly’s job as a human resources manager is the family’s only source of income, she is concerned about her son Brad’s financial support when she passes away. In her situation, Molly needs lifetime life insurance coverage but is not necessarily concerned with cash value accumulation. In speaking with her insurance agent, Molly learns that a guaranteed universal life policy would provide the permanent coverage that she needs at the lowest possible premiums. After reviewing her coverage needs, Molly chose a $500,000 guaranteed universal life insurance policy. Guaranteed universal life will meet Molly’s long-term coverage needs at the lowest premiums.

Case Study #2

Estate Planning

Dale is a 65-year-old farmer with three grown children. His son Jim works on the family farm with him and would like to take over the business someday. Dale’s other two children, Sam and Tami, have chosen careers not related to the family business. In considering his estate, Dale wants to give the farm to Jim when he retires but would also like for Sam and Tami to receive their share of his estate when he passes. In speaking with his life insurance agent, Dale learns that guaranteed universal life policies can be used to leave an inheritance to Sam and Tami upon his death, keeping the farm intact for Jim. After analyzing his coverage needs, Dale decides on a $2,000,000 guaranteed universal life insurance policy with Sam and Tami as beneficiaries. Guaranteed universal life insurance will meet Dale’s coverage needs allowing all three of his children to share equally in the fruits of his life’s work.

Conclusion

In conclusion, guaranteed universal life insurance offers a compelling solution for individuals seeking long-term coverage without the need for cash value accumulation. Its ability to provide lifetime benefits at competitive premiums makes it an attractive option in today's insurance landscape. With flexibility to adjust policies as life circumstances change and the assurance of guaranteed benefits, GUL policies can cater to diverse financial planning needs. However, navigating the variety of permanent life insurance options available can be daunting. By understanding the nuances of GUL policies, comparing sample rates, and evaluating top insurance companies consumers can make informed decisions in selecting appropriate coverage.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.