Benefits of Laddering Term Life Insurance Policies

Are you looking for a cost-effective and flexible life insurance solution? Look no further than laddering term life insurance policies. Laddering term life insurance involves purchasing multiple policies with different term lengths. By staggering the coverage, you can tailor your protection to meet your evolving needs and financial goals.

This article explores the various benefits of laddering term life insurance, including lower premium costs, increased coverage options, and the ability to align coverage with major financial milestones.

Understanding Term Life Insurance

Term life insurance is a type of life insurance policy that provides coverage for a specific period or term, typically ranging from 10 to 40 years in duration.

Unlike permanent life insurance, which provides coverage for your entire life, term life insurance is designed to cover you during your working years when financial obligations are typically higher.

Term life insurance offers a death benefit to your beneficiaries if you pass away during the policy term. It provides financial protection to ensure that your loved ones are taken care of in the event of your untimely death. Term life insurance policies are initially more affordable compared to permanent life insurance policies, making them an attractive choice.

What is laddering term life insurance?

Laddering term life insurance involves purchasing multiple policies with different term lengths. By staggering the coverage, you can tailor your protection to meet your evolving needs and financial goals. For example, you might purchase a 10-year term policy and a 30-year term policy, each with different coverage amounts to provide protection for certain timeframes or specific financial obligations.

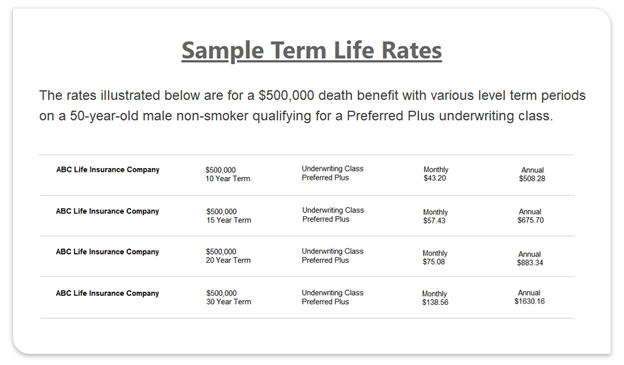

The idea behind laddering is that as you progress through different stages of life, your insurance needs may change. By having multiple policies with varying term lengths, you can ensure that you have the right amount of coverage at each stage without paying for more coverage than you need. An example of a rate comparison has been provided below.

Benefits of Laddering Term Policies

Laddering term life insurance offers several benefits that make it an attractive option for individuals and families in developing a comprehensive life insurance planning strategy.

In a laddering strategy there are a number of valuable benefits that consumers can implement. Let’s explore some of these benefits in detail...

Laddering term life insurance offers several benefits that make it an attractive option for individuals and families. Let’s explore some of these benefits in detail:

Lower premium costs: One of the primary advantages of laddering term life insurance is the potential for lower premium costs. By purchasing policies with different term lengths, you can take advantage of the fact that shorter-term policies tend to have lower premiums compared to longer-term policies. This can help you save money while still maintaining adequate coverage.

Increased coverage options: Laddering term life insurance provides you with increased flexibility and coverage options. Instead of relying on a single policy you can customize your coverage based on specific needs at different stages of life. This allows you to have adequate coverage when you need it most, such as when you have young children at home or an existing mortgage obligation.

Alignment with financial milestones: Another significant benefit of laddering term life insurance is the ability to align your coverage with major financial milestones. As you progress through life, your financial responsibilities and obligations may change. Laddering allows you to adjust your coverage to match milestones, such as buying a home, starting a family, or planning for retirement. This can help to ensure that you have the appropriate level of protection during each stage of life.

Support Overall Financial Plan: In addition to the benefits of lowering overall premium costs, increasing coverage options, and aligning with significant financial milestones, laddering of term life insurance policies can help to support your overall financial plan. The death and living benefits associated with various term life policies can serve as a foundation for comprehensive financial planning.

How to Create a Laddering Strategy

Creating a laddering strategy for your term life insurance policies involves careful planning and consideration. Here are some steps to help you create an effective laddering strategy:

- Assess your financial goals and needs: Start by evaluating your current financial situation and identifying your long-term goals. Consider factors such as your age, income, debts, and dependents. This will help you determine the amount of coverage you need and the duration of each policy.

- Determine the required term lengths: Decide on the term lengths for each policy based on your financial goals and needs. Consider the duration of your financial obligations, such as your mortgage or your children’s education, as well as your retirement plans.

- Calculate the required coverage amounts: Calculate the coverage amounts for each policy based on your financial obligations and the needs of your beneficiaries. Take into account factors such as income replacement, debt repayment, and future expenses.

- Compare quotes from multiple insurers: Shop around and compare quotes from different insurance providers to ensure you are getting the best rates for your laddering strategy. Consider factors such as the insurer’s premium rates, financial stability, and customer service.

- Regularly review your laddering strategy: Life is unpredictable, and your financial needs may change over time. It’s essential to regularly review your laddering strategy and make adjustments as necessary. This may involve increasing or decreasing coverage amounts, or even adding additional policies.

By following these steps, you can create a laddering strategy that aligns with your financial goals and provides the right level of protection for you and your loved ones.

Factors in Laddering Term Policies

When laddering term life insurance policies, there are several factors you should consider to ensure you make informed coverage decisions. Some of these factors include:

Insured Age: Your age plays a significant role in determining the cost of life insurance premiums. Generally, the younger you are when you purchase your policies, the lower your premiums will be. Consider purchasing policies early to lock in lower rates.

Insured Health: Your health is another crucial factor that affects life insurance premiums. Insurance companies typically require a medical examination to assess your health and determine your risk profile. Maintaining a healthy lifestyle and addressing any health issues can help lower your premiums.

Financial obligations: Consider your current and future financial obligations when laddering term life insurance policies. This includes factors such as mortgages, debts, education expenses, and other financial responsibilities. Ensure that your coverage amounts align with these obligations.

Duration of needs: Estimate the duration of your financial needs to determine the appropriate term lengths for your policies. For example, if you have a 20-year mortgage, consider a policy with a term length that matches the length of your mortgage.

Future insurability: Keep in mind that your insurability may change over time. Factors such as health conditions, lifestyle choices, and occupation can impact your ability to secure life insurance in the future. Consider purchasing policies with longer terms to ensure you maintain coverage even if your insurability changes.

By carefully considering these factors, you can make informed decisions when laddering term life insurance policies and ensure that your coverage meets your specific needs.

Conclusion

In conclusion, laddering term life insurance can provide individuals and families with a cost-effective and flexible life insurance solution. By purchasing multiple policies with different term lengths, you can tailor your coverage to meet your evolving needs and financial goals. The benefits of laddering term life insurance include lower premium costs, increased coverage options, and the ability to align coverage with major financial milestones.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.