Importance of Life Insurance Beneficiary Review

As we go through life, we accumulate assets that we want to protect and pass on to our loved ones. From bank accounts to real estate and life insurance, we work hard to build a legacy that will provide our families with financial stability and security. However, as important as it is to accumulate wealth, it's equally important to protect it. One way to do this is by conducting a regular beneficiary review. Making sure that beneficiaries are up-to-date and accurately reflect your wishes is critical to ensure that your assets are distributed according to your wishes.

This article highlights the importance of regular beneficiary reviews for life insurance and other various assets, which can be helpful in ensuring that your life insurance continues to meet financial goals and objectives.

Life Insurance Beneficiary Reviews

A beneficiary review is the process of examining and evaluating the beneficiaries of your assets and making sure they are current and accurate.

This includes reviewing the beneficiaries designated on your life insurance policies, retirement accounts, bank accounts, and any other assets that require a beneficiary designation to ensure accuracy..

A beneficiary review is an essential part of estate planning, as it ensures that your assets are distributed according to your wishes and can help to avoid potential legal disputes that may arise from outdated or inconsistent beneficiary designations.

Beneficiary reviews are crucial since they insure that your assets are distributed according to your wishes. Life is unpredictable, and circumstances can change in an instant. It’s a good idea to conduct a beneficiary review whenever you experience a significant life event, such as marriage, divorce, or the birth of a child.

For example, if you have a child or a grandchild, you may want to add them as a beneficiary to your life insurance policy. Without regularly reviewing beneficiaries, your assets may end up in the hands of someone you did not intend to receive them. This simple planning process can help ensure that beneficiaries on various policies and accounts are up to date.

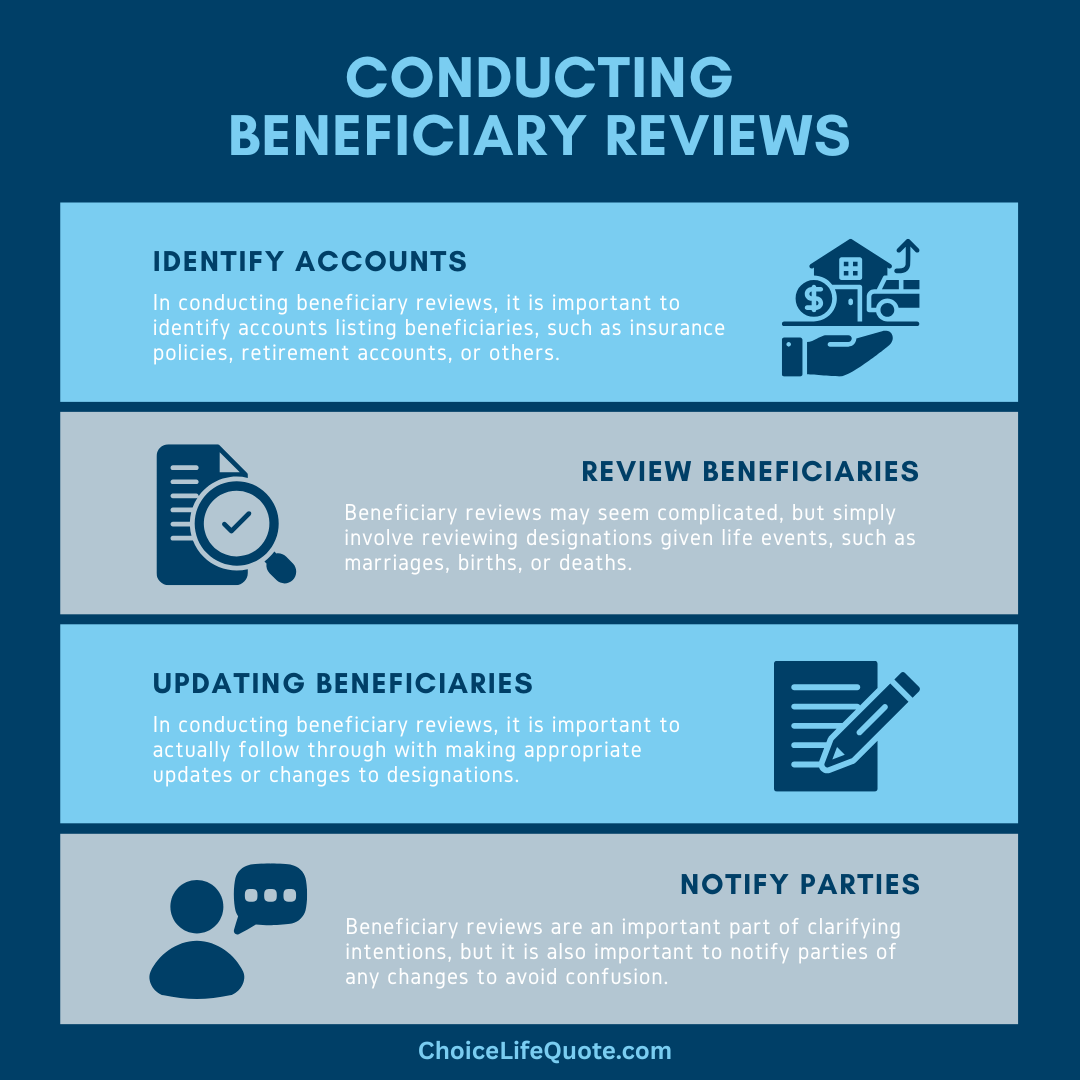

Steps in Conducting Beneficiary Review

The first step in conducting a beneficiary review is to make a list of all your assets that require a beneficiary designation. This includes your life insurance policies, retirement accounts, bank accounts, and any other assets that require a beneficiary designation.

Next, review your beneficiary designations and make sure they are current and accurate. If you have experienced any significant life events since your last beneficiary review, make sure to update your beneficiaries accordingly.

Finally, make sure to communicate your wishes to your loved ones and any professionals involved in your estate planning, such as your attorney or financial advisor. This will ensure that everyone is aware of your wishes and can help you achieve your estate planning goals.

Common Mistakes in Beneficiaries

One of the most common mistakes people make in beneficiary designations is not designating a contingent beneficiary. A contingent beneficiary is someone who receives your assets if your primary beneficiary is no longer alive or able to receive them. If you do not have a contingent beneficiary, your assets may end up in probate, which can be a lengthy and expensive process.

Another mistake people make is not updating their beneficiaries after significant life events, such as marriage, divorce, or the birth of a child. If you fail to update your beneficiaries, your assets may go to someone you did not intend to receive them. Given these considerations, it’s important to review and update your beneficiaries regularly to ensure that your assets are distributed according to your wishes.

Conclusion

In conclusion, a regular beneficiary review is a critical part of estate planning and ensuring that your assets are distributed according to your wishes. By conducting a beneficiary review every few years and after any significant life events, you can ensure that your beneficiaries are up-to-date and accurately reflect your wishes. With careful planning and regular reviews, you can protect your assets and provide financial security for your loved ones.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

FAQs

Regularly reviewing your life insurance beneficiaries ensures that benefits will go to the right people if you pass away. Life events such as marriage, divorce, birth, adoption, or the death of a beneficiary can change intentions, and keeping beneficiary designations up to date prevents confusion and legal issues.

You should review your life insurance beneficiaries at least once a year and any time you experience a major life event, such as a marriage, divorce, birth of a child, or other significant financial change. These reviews can ensure your policy continues to reflect your current wishes and individual life situation.

A primary beneficiary is the first person or entity entitled to receive the life insurance payout upon a policyholder's death. A contingent beneficiary only receives the benefit if the primary beneficiary cannot or does not accept it. Naming both helps ensure the benefit is paid in accordance with your wishes.

Yes — you can update your life insurance beneficiaries at any time by submitting a beneficiary change form with your insurance company. It’s a good idea to keep copies of confirms that changes are processed correctly.

If you do not name a beneficiary, or if all named beneficiaries have predeceased you, the insurance proceeds typically become part of your estate. This may result in delays and additional legal steps, such as probate, before your loved ones receive the payout. Naming beneficiaries helps avoid these complications.

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers for ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help provide consumers with a variety of educational content on life insurance and annuities.