Spend Your Children’s Inheritance with Life Insurance

As a parent, you want the best for your children, and work hard to provide for them and leave a lasting legacy. Life insurance can provide peace of mind, knowing that your family will be provided for financially at your passing. However, it can also be an effective means of providing your children with an inheritance separate from other assets. Owning life insurance can allow you to live your life to the fullest, and even spend your children's inheritance, knowing they will still be taken care of when you're gone.

This article provides insight into how life insurance can help in securing your family's financial future, and allow you to enjoy your golden years to knowing that your children’s inheritance is fully intact.

Importance of Life Insurance

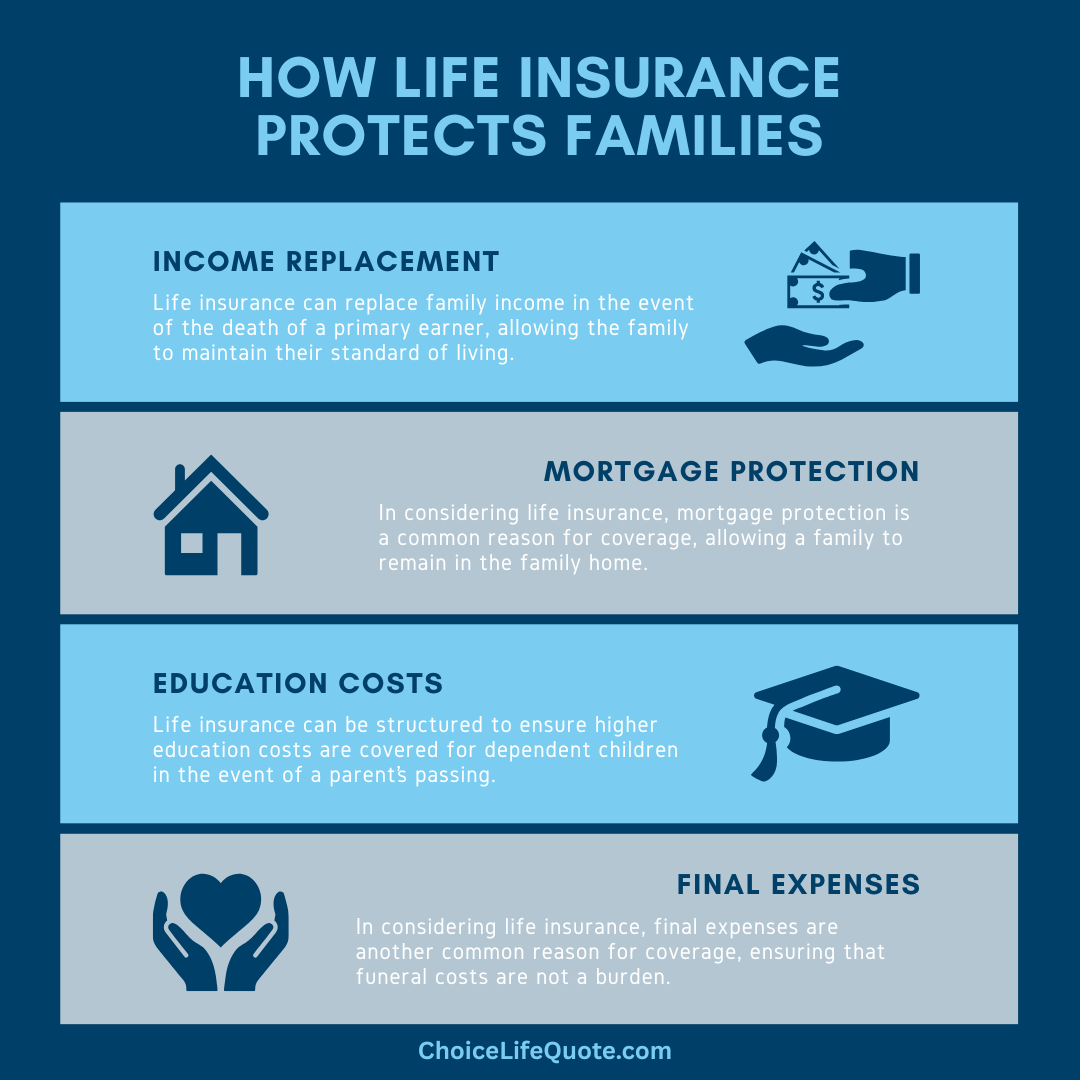

A life insurance policy is an important element in planning for financial security given that it can provide financial protection for your family in the event of an unexpected or untimely death.

This insurance protection can help to cover your family’s living expenses, pay off your debts, and even provide for your children’s education in the future.

The death benefit that life insurance provides can help your family maintain their standard of living and cover any unexpected expenses that may arise.

Another important reason to have life insurance is to give your family peace of mind. Knowing that they will be taken care of if something happens to you can help alleviate any anxiety and stress they may be feeling. This can allow them to focus on healing and moving forward, without having to worry about finances.

How Life Insurance Can Provide

Life insurance provides a death benefit to your beneficiaries in the event of your untimely death. This benefit can help your family cover any outstanding debts, funeral expenses, and living expenses. Depending on the amount of coverage you have, the death benefit can also be used to provide for your children’s education or to pay off your mortgage.

Additionally, life insurance can help provide a steady income to your family after you’re gone. For example, a spouse or child can receive a monthly income from the policy’s death benefit, which can help cover their living expenses.

Benefits of Life Insurance for Children

Life insurance can provide numerous benefits for your children. First and foremost, it can provide financial security for them if something were to happen to you. This can help ensure that their future is protected, and that they have the resources they need to succeed in life.

Additionally, some life insurance policies offer cash value accumulation. This means that as you pay your premiums, a portion of that money is invested and grows over time. This cash value can be used to help fund your children’s education or provide a down payment on a home.

To maximize the benefits of life insurance for your family, it’s important to choose the right policy and coverage amount. Additionally, you should update your policy regularly to ensure that it still meets your family’s needs.

It’s also important to discuss your life insurance policy with your beneficiaries and make sure that they understand the policy and coverage. This can help to avoid an confusion or misunderstandings for family members and policy beneficiaries in the future.

Choosing the Right Insurance Policy

There are two main types of life insurance policies available, term and permanent coverage.

Term policies provide coverage for a set period of time, such as 10, 20, or 30 years. These policies are typically less expensive than permanent policies and are a good option if you only need coverage for a specific period of time.

Permanent policies, on the other hand, can provide coverage for your entire life. These policies are more expensive than term policies but offer cash value accumulation and other benefits. There are several types of permanent policies, including whole life, universal life, and variable life.

Choosing the right life insurance policy for your family can be a daunting task. There are many factors to consider, such as your age, health, and financial goals. Here are some tips to help you choose the right policy:

- Determine how much coverage you need: Consider your family’s living expenses, outstanding debts, and future financial goals.

- Choose a policy type: There are two main types of life insurance policies: term and permanent. Term policies provide coverage for a set period of time, while permanent policies can provide coverage for your entire life.

- Compare quotes for coverage: Shop around and compare quotes from different insurance providers to find the best rate.

- Consider the financial stability of the insurer: Make sure the insurance company you choose is financially stable and has a good reputation.

Life Insurance for Inheritance

One of the lesser-known benefits of life insurance is that it can allow you to spend your children’s inheritance while still ensuring that they are financially secure at your eventual passing. Essentially, allowing you to spend your children's inheritance.

If you have an appropriate life insurance policy in place, you can use retirement savings and other assets to fund your retirement or travel the world, knowing that your children will still be taken care of when you’re gone. In many instances, the security of knowing that their family will be financially secure can allow retirees to live a more fulfilling live in retirement.

There are many misconceptions about life insurance, such as the belief that it’s only necessary for older individuals or those with health issues. However, life insurance is important for people of all ages and health statuses.

Another common misconception is that life insurance is too expensive, which can be relative depending on the situation. However, there are often many affordable options available, and the cost of coverage can frequently be customized to fit your budget.

Conclusion

In conclusion, life insurance is an important tool for securing your family’s future. It can provide financial protection in the event of your untimely death, help cover living expenses, and even allow you to spend your kids’ inheritance. By choosing the right policy and coverage amount, you can ensure that your family is secure, no matter what the future holds.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.