Life Insurance for SBA Loans: Protecting Your Business

In the world of small business, securing a loan through the Small Business Administration (SBA) can be a game-changer. It provides the financial boost needed to turn dreams into reality. However, amidst the excitement of expanding your business, it is crucial not to overlook the importance of protecting your investment and your loved ones. That's where life insurance comes into play. Life insurance is a vital component of SBA loans, as it safeguards both your business and your family in the event of unforeseen circumstances.

This comprehensive coverage ensures that your loan obligations are met, allowing your business to continue thriving even in your absence. In this article, we will explore why life insurance is essential for SBA loans and how it can provide you with the peace of mind you need to focus on building a successful business while protecting what matters most.

Importance of Life Insurance for SBA Loans

When taking out an SBA loan, it’s important to consider the potential risks that could jeopardize the repayment of your loan. Unexpected events such as disability, critical illness, or even death can have a significant impact on your business’s ability to meet its financial obligations. This is where life insurance comes in. By having a life insurance policy in place, you can ensure that your loan will be repaid in the event of your untimely passing. This not only protects your business but also provides financial security for your loved ones.

Life insurance provides a safety net that can help mitigate the financial risks associated with SBA loans. In the unfortunate event of your death, the life insurance proceeds can be used to repay the outstanding loan balance, ensuring that your business doesn’t face financial hardship or the possibility of closure. Additionally, life insurance can provide your loved ones with the necessary funds to cover other expenses, such as funeral costs or ongoing living expenses. By understanding the importance of life insurance for SBA loans, you can take proactive steps to protect your business and your family’s financial future.

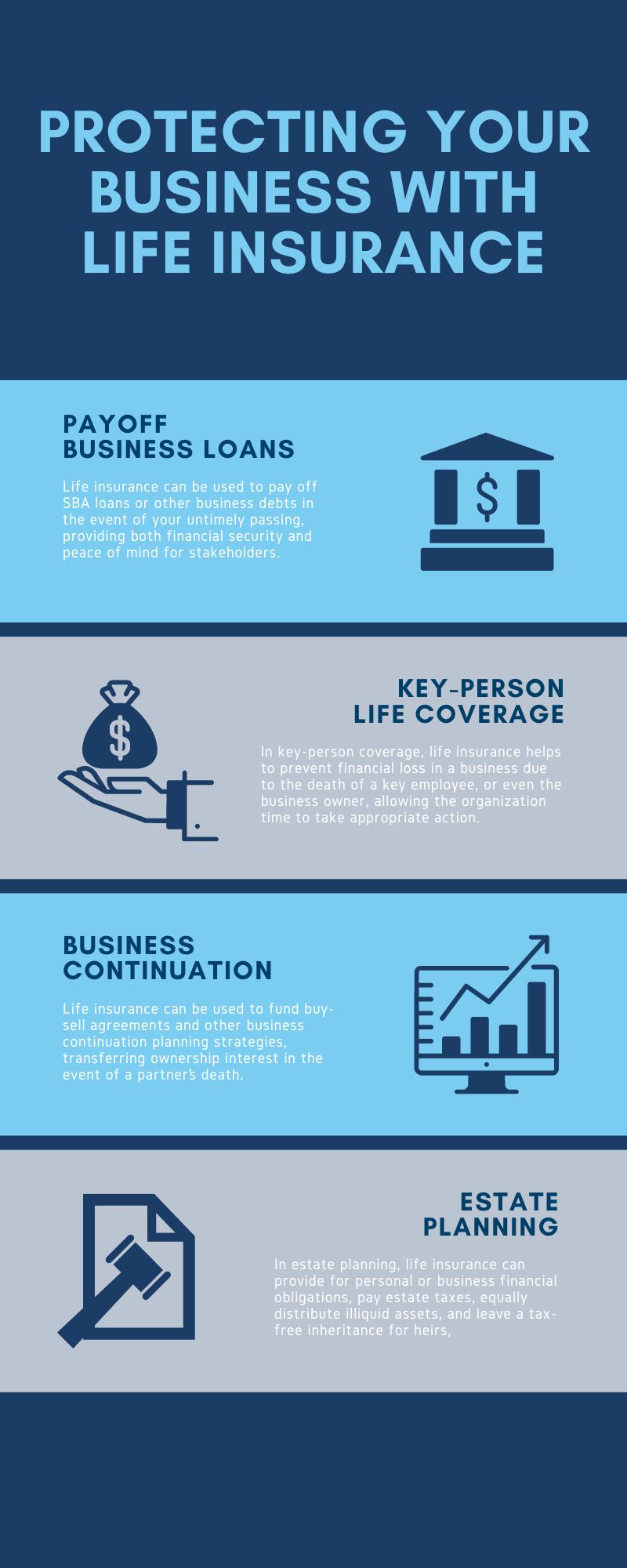

Protecting Your Business with Life Insurance

Your business is more than just a source of income. It’s a culmination of your hard work, dedication, and passion. Protecting your business is essential to ensure its longevity and success. One way to safeguard your business is by having a life insurance policy that specifically covers your SBA loan. This type of policy, often referred to as key person insurance, ensures that your business has the necessary funds to repay the loan in the event of your death.

Key person insurance is designed to protect your business from the financial impact of losing a key individual, such as a business owner or a key employee. By listing the SBA loan, the insurance policy can be structured to provide the necessary funds to repay the loan, allowing your business to continue operating without interruption. This type of coverage not only protects your business but also provides peace of mind to lenders, who are more likely to approve your loan application when they see that you have a solid plan in place to protect their investment.

Protecting Loved Ones with Life Insurance

While protecting your business is crucial, it’s equally important to consider the well-being of your loved ones. If something were to happen to you, would your family be able to continue their current lifestyle? With a life insurance policy, you can provide your loved ones with financial security and peace of mind.

Life insurance ensures that your family will be taken care of in the event of your untimely passing. The death benefit provided by the policy can be used to replace lost income, cover ongoing living expenses, pay off debts, and even fund future financial goals such as college education or retirement. By having a life insurance policy in place, you can have confidence knowing that your loved ones will be protected and supported financially, even if you’re not there to provide for them.

How Life Insurance Can Help Secure a Loan

Securing an SBA loan can be a complex process, and lenders often require additional measures to mitigate their risk. Life insurance can play a crucial role in increasing your chances of securing an SBA loan. When lenders see that you have a life insurance policy in place, they have more confidence in your ability to repay the loan, even in the event of your untimely passing.

Life insurance acts as a safety net for the loan, providing lenders with the assurance that the loan will be repaid, regardless of what happens to the borrower. This reduces the lender’s risk and increases the likelihood of loan approval. Additionally, having life insurance in place can possibly help you negotiate more favorable loan terms, such as lower interest rates or longer repayment periods. By incorporating life insurance into your SBA loan application, you not only protect your business but also increase your chances of obtaining the financing you need to grow and thrive.

Types of Life Insurance for SBA Loans

When it comes to protecting your business and loved ones with life insurance for SBA loans, there are different types of policies to consider. The most common types of life insurance policies include term life insurance, whole life insurance, and universal life insurance.

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. This type of policy is often the most affordable option and is ideal for covering short-term financial obligations such as an SBA loan. Whole life insurance, on the other hand, provides coverage for your entire life and includes a cash value component that grows over time. Universal life insurance offers flexibility in premium payments and death benefit amounts. Understanding the differences between these policies can help you choose the one that best suits your needs and aligns with your financial goals.

Considerations in Choosing Life Insurance

When selecting a life insurance policy for SBA loans, there are several factors to consider. First and foremost, consider the coverage amount. The policy should provide enough coverage to repay your outstanding loan balance and meet the financial needs of your loved ones. Additionally, consider the length of coverage. If you have a short-term loan, a term life insurance policy may be sufficient. However, if you have a long-term loan or want lifelong coverage, whole life or universal life insurance may be more suitable.

Another important factor to consider is your budget. Life insurance premiums can vary based on factors such as age, health, and coverage amount. It’s essential to choose a policy that fits within your budget while still providing adequate coverage. Lastly, consider the reputation and financial stability of the insurance company. You want to ensure that the company will be there when you need them, so do your research and choose a reputable insurer.

Steps to Obtain Life Insurance for SBA Loans

Obtaining life insurance for an SBA loan is a straightforward process. Here are the general steps involved:

- Determine your coverage needs: Calculate the amount of coverage needed to repay your loan and provide financial security for your loved ones.

- Research life insurance providers: Compare quotes and research different insurance companies to find one that meets your needs and offers competitive rates.

- Complete the application: Fill out the application, providing accurate and detailed information about your health, lifestyle, and financial situation.

- Undergo a medical exam: Depending on the coverage amount, you may need to undergo a medical examination to assess your health.

- Review and accept the policy: Once your application is processed, carefully review the policy terms, conditions, and premium payments. Accept the policy if you’re satisfied with the terms.

- Make premium payments: Pay your life insurance premiums on time to keep the policy in force and maintain coverage.

Remember, it’s crucial to start the life insurance application process as early as possible, as it can take time to complete the necessary steps. By obtaining life insurance for your SBA loan, you can protect your business, loved ones, and financial future.

Life Insurance for SBA Loan Misconceptions

There are several common misconceptions about life insurance for SBA loans that can prevent business owners from taking advantage of this valuable protection. Let’s debunk some of these misconceptions:

- “I don’t need life insurance because my business is small”: Regardless of the size of your business, life insurance can provide financial security and protect your loved ones from the burden of loan repayment.

- “I can rely on personal savings to repay the loan”: While personal savings can be helpful, relying solely on them to repay an SBA loan can deplete your savings and leave your loved ones financially vulnerable.

- “I have enough coverage through my employer”: While employer-provided life insurance can be beneficial, it may not be enough to cover your loan obligations and adequately provide for your family’s needs.

- “Life insurance is too expensive”: Life insurance premiums can be affordable, especially when considering the financial protection it provides. By comparing quotes and choosing a policy that fits your budget, you can find affordable coverage.

Understanding these misconceptions can help you make informed decisions about life insurance for your SBA loan and ensure that you have the necessary protection in place.

Conclusion

Securing an SBA loan is an exciting step toward growing your small business. However, it’s important not to overlook the importance of protecting your investment and your loved ones. Life insurance is a crucial component of SBA loans, providing the financial security and peace of mind to focus on building a successful business while safeguarding what matters most.

By understanding the importance of life insurance, the types of policies available, and the steps to obtain coverage, you can make informed decisions that protect your business, your family, and your financial future. Don’t let unforeseen circumstances derail your dreams, ensure your business’s continuity and your loved ones’ security with life insurance for SBA loans.

Do you need life insurance for an SBA loan? Choicelifequote.com can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for advice regarding your individual situation.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.