Life Insurance Policy Reviews | Reassessing Coverage

Life insurance is more than just a contract—it’s a financial safety net for your loved ones. However, as life unfolds, your insurance needs may change. What was once the perfect coverage for you may no longer be sufficient due to major life events like marriage, having children, career advancements, or changes in financial goals. Many people make the mistake of purchasing a life insurance policy and forgetting about it, assuming it will always meet their needs. But without regular reviews, your policy may fall short when your family needs it most.

This article highlights the importance of life insurance policy reviews, including review essentials, recommended frequency, key considerations, and other elements that can help in ensuring policies continue to meet financial objectives.

Life Insurance Policy Reviews

Many people assume that once they buy a life insurance policy to protect their family, their loved ones are financially secure and the coverage planning is done.

But a life insurance policy is not something to be set and forgotten. Instead, it requires regular periodic check-ins to ensure that it continues to aligns with your financial and personal goals and objectives.

Over time, life events such as marriage, children, career growth, or changes in debt can affect how much coverage you require. Reviewing your policy means taking the time to reassess your coverage, premiums, and beneficiary designations to ensure that your loved ones remain protected. A thorough life insurance policy review can include:

- Evaluating coverage amount to ensure it meets financial obligations

- Checking if the type of policy (term or permanent) still suits needs

- Reviewing beneficiaries to ensure they are accurate and up to date

- Assessing any individual policy riders and additional living benefits

- Comparing policy with current options that may offer better features

Importance of Policy Reviews

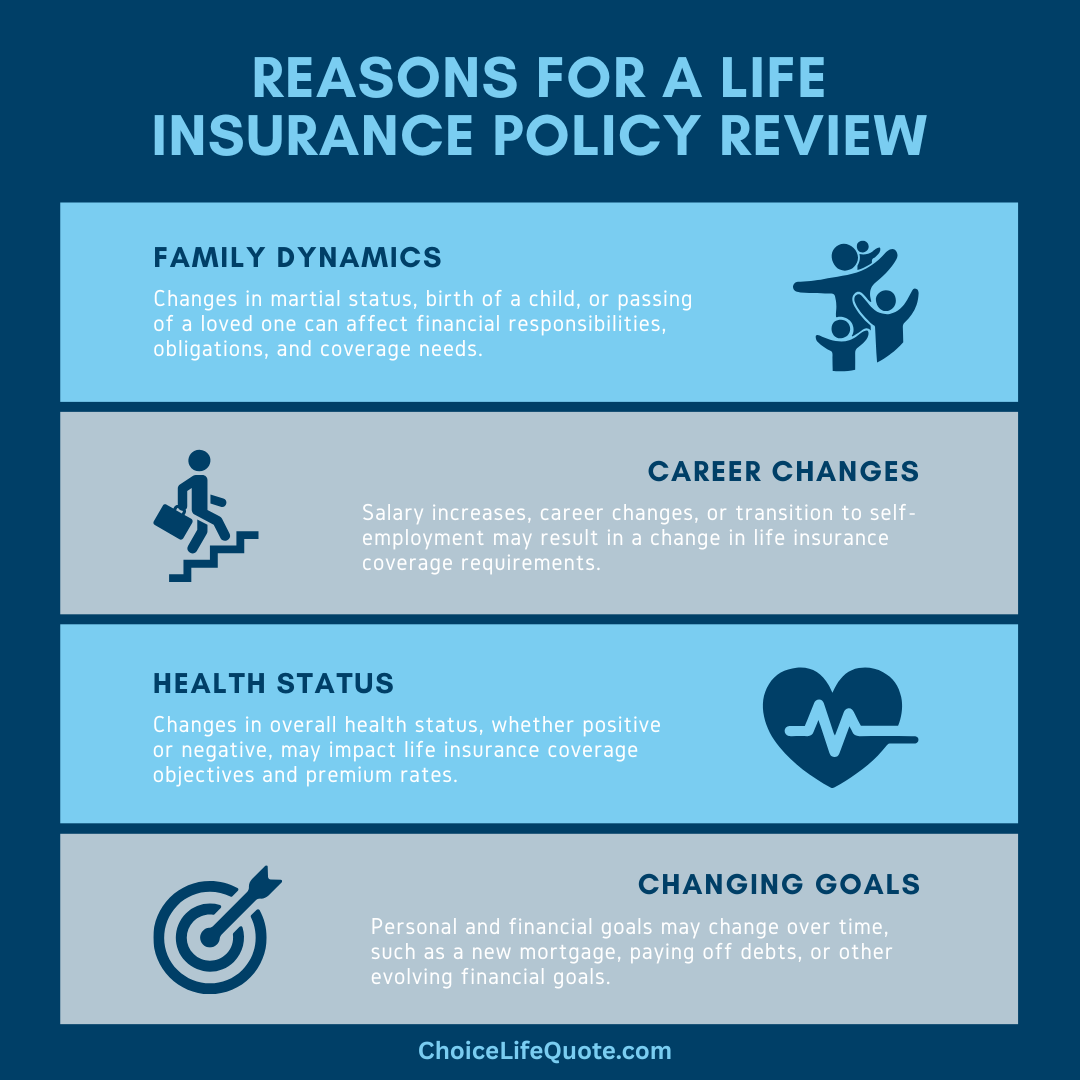

Life is unpredictable, and as your responsibilities and financial situation change, your insurance coverage should evolve too. What was enough coverage five years ago may no longer be sufficient today. A life insurance policy review allows you to adjust your coverage so that it keeps pace with your life circumstances. Imagine it being discovered too late that your policy doesn’t cover your mortgage or that your beneficiaries are outdated. This could lead to unnecessary stress or financial hardship for your loved ones. Here are a few key reasons why reviewing your life policy is crucial:

Changes in Family Dynamics

- Marriage or Divorce: A change in marital status affects financial responsibilities. You may need to increase coverage for your spouse or remove an ex-partner.

- Having Children: Raising a child comes with financial responsibilities like education, healthcare, and daily expenses. Your coverage should reflect these new needs.

- Loss of a Loved One: If a listed beneficiary passes away, updating your policy can ensure your benefits go to the right person or organization.

Career and Income Changes

- A significant salary increase means your family’s lifestyle has changed, and you may need more coverage to match.

- If you’ve lost a job or transitioned to self-employment, adjusting your policy may be necessary to maintain affordability.

Health Status Updates

- Improved health (such as quitting smoking or losing weight) may help you qualify for lower premiums or additional coverage.

- If you’ve been diagnosed with a serious illness, reviewing your policy ensures your loved ones have enough financial protection.

Changes in Debt and Goals

- If you’ve taken on new debt (like a mortgage), your policy should cover the remaining balance in case of your passing.

- If you’ve paid off debts or built additional wealth, you might be able to reduce your coverage and lower your premiums.

Market and Policy Changes

- In a changing marketplace, new insurance products with better features or lower premium rates may be available.

- Inflation affects the purchasing power of your policy’s payout, meaning you may need more coverage over time.

Frequency of Policy Reviews

Life moves fast, and it’s easy to forget about your insurance policy. However, reviewing it regularly can help you avoid surprises down the road. Think of it like a financial check-up—it ensures your coverage is still in good health. Experts suggest reviewing your policy at specific intervals or when major life events occur to keep it relevant. It is recommended that you should review your policy at varying intervals to include:

- Annual Check-in: A quick check ensures everything is still aligned with your financial needs and objectives.

- Major Life Events: When getting married, having a child, buying a house, or changing jobs.

- Every 3 to 5 Years: A more comprehensive review ensures long-term financial goals remain covered.

Policy Review Considerations

A policy review isn’t just about looking at the coverage amount—it’s a deep dive into the details of your policy to ensure it still works for you and your family.

As your life changes, different aspects of your life insurance may need to be adjusting, from the type of policy you have to the names of your beneficiaries. These updates can help to ensure adequate protection.

Ignoring these small but important details can lead to complications in the future. When reviewing your policy, consider the following:

Coverage Amount

- Does the death benefit provide enough financial support for oved ones?

- Have financial obligations changed, requiring higher or lower coverage?

Policy Type

- Is term life or whole life insurance still the best choice for you?

- Should you switch to a different policy offering more flexibility or benefits?

Premium Costs

- Are you paying more than necessary for the current coverage?

- Could you qualify for lower rates based on improved health?

Beneficiary Designations

- Are listed beneficiaries still correct based on financial obligations?

- Do you need to add or remove anyone from the current policy?

Policy Riders and Benefits

- Are there riders you should add, such as long-term care waivers?

- Are there better policies available now than when you bought the policy?

Steps in Conducting a Review

Now that you understand why reviewing your life insurance policy is so important, it’s time to take action. Life changes, financial needs evolve, and what may have been the perfect policy years ago might no longer provide the right protection. Conducting a thorough review doesn’t have to be complicated. By following these steps, you can ensure your policy remains aligned with your current and future needs.

Step 1: Review Policy Documents

Look at your policy’s coverage details, premiums, and any attached riders.

Step 2: Assess any Life Changes

Think about any major life events that may have changed your financial needs.

Step 3: Evaluate Coverage and Costs

Determine whether your coverage amount and premiums are still appropriate.

Step 4: Consult with a Professional

An insurance expert can help explore options, make changes, or find cost-savings.

Step 5: Make Necessary Adjustments

Update your beneficiaries, increase or decrease coverage, or switch policy types.

Conclusion

In conclusion, a life insurance policy is not a set-it-and-forget-it financial product. Just as your life changes, policies should be adjusted to reflect current needs. By regularly reviewing your coverage, you can ensure that your family remains financially secure, you’re not overpaying for coverage, and you’re taking advantage of the best options available. Don’t wait until it’s too late—schedule a policy review today to protect your loved ones and financial future.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.