Maximize Retirement Income with an Immediate Annuity

As retirement approaches, you may be wondering how to optimize income during your golden years. One option is to maximize retirement income with an immediate annuity. An immediate annuity is a type of insurance product that provides guaranteed income for life, or a set period of time, in exchange for a lump sum payment. This can be an attractive option for retirees who want a predictable income stream that they can rely on without having to worry about market fluctuations or other risks.

This article provides insight into the features and benefits of immediate annuities, how lifetime income annuities work, and how to determine if an annuity is the right choice for you and your family in planning for retirement.

Understanding Immediate Annuities

An immediate annuity is a financial product that you can purchase from an insurance company to secure guaranteed income in retirement.

In exchange for a lump sum payment, the insurance company promises to pay a fixed income stream for the rest of your life, or for a selected set period of time. The set time is referred to as a period certain.

This income stream can start immediately after you purchase the annuity, hence the name “immediate” annuity. One of the main benefits of an immediate annuity is that it provides a guaranteed income stream that you can rely on. This can be especially valuable for retirees who want to ensure that they have a predictable source of income to cover their living expenses during retirement. With an immediate annuity, you don’t have to worry about market fluctuations or other risks that can impact the value of your investments.

However, it’s important to note that an immediate annuity is not for everyone. Once you purchase an annuity, you typically can’t access the lump sum payment you used to buy the annuity. This means that you will be giving up control of a significant portion of your retirement savings in exchange for a guaranteed income stream. Therefore, it’s important to carefully consider whether an immediate annuity is the right choice in your situation.

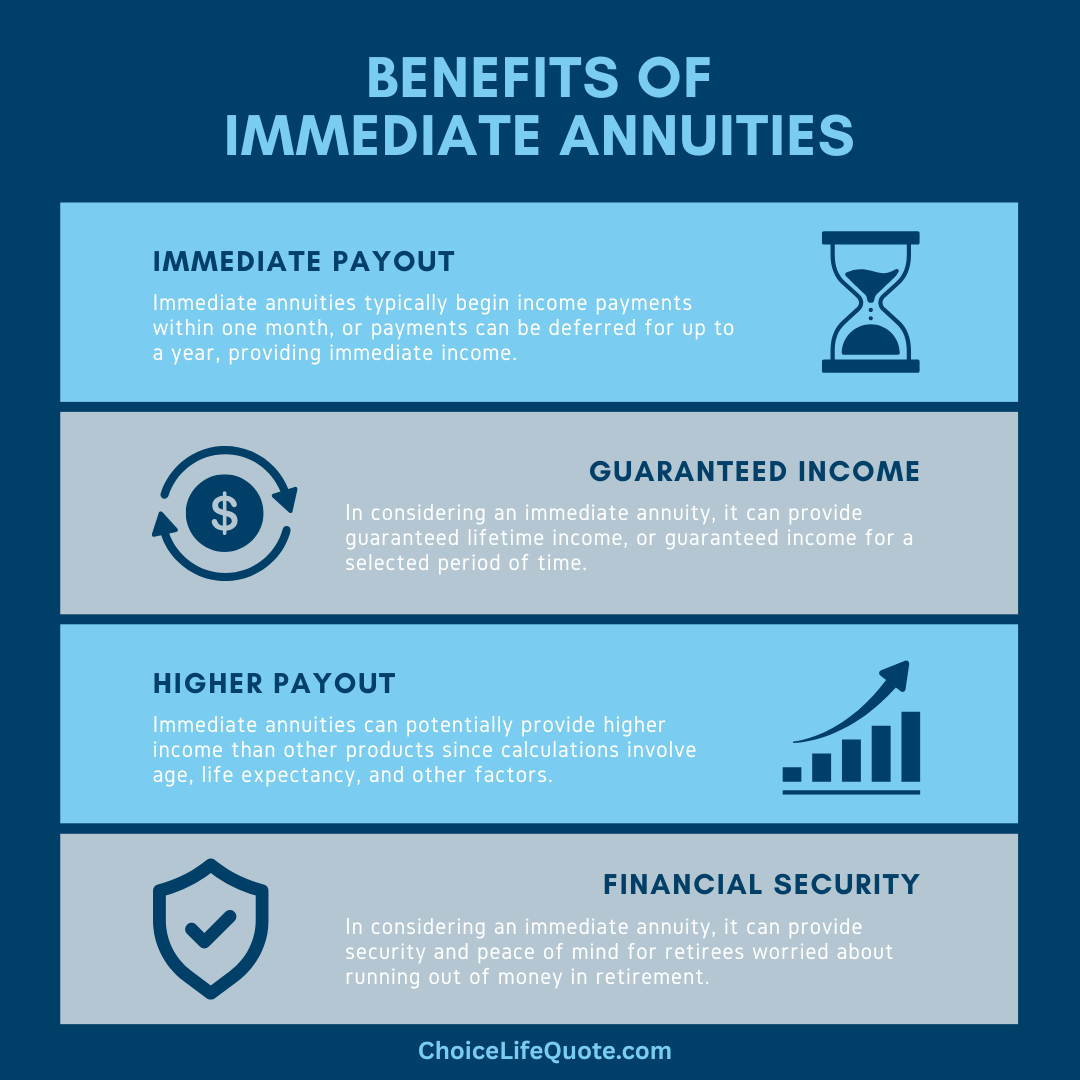

Benefits of Immediate Annuities

One of the main benefits of an immediate annuity is that it provides a guaranteed income stream for the rest of your life or for a set period of time. This can be especially valuable for retirees who want to ensure that they have a predictable source of income to cover their living expenses during retirement. With an immediate annuity, you don’t have to worry about market fluctuations or other risks that can impact the value of your investments.

Another benefit of an immediate annuity is that it can potentially provide a higher income stream than other types of investments, such as bonds or CDs. This is because an immediate annuity is based on actuarial calculations that take into account your age and life expectancy. The insurance company assumes the risk that you will live longer than expected, which means that they can typically offer you a higher payout than other investment options. Therefore, you can maximize retirement income with an immediate annuity.

Finally, an immediate annuity can provide peace of mind for retirees worried about potential running out of money during retirement. With a guaranteed income stream, you can be confident that you will have the money you need to cover your living expenses for life.

How Immediate Annuities Work

An immediate annuity works by converting a lump sum payment into a series of regular payments. These payments can be made for the rest of your life, for a set period of time, or for a combination of both. The amount of the payment depends on several factors, including your age, the amount of your initial investment, and the type of annuity you choose.

Once you purchase an immediate annuity, you start receiving payments immediately. The payments can be made on a monthly, quarterly, or annual basis, depending on your preference. The insurance company guarantees that you will receive these payments for the rest of your life or for the period of time specified in the annuity contract.

It’s important to understand that once you purchase an immediate annuity, you typically can’t access the lump sum payment you used to buy the annuity. This means that you will be giving up control of a significant portion of your retirement savings in exchange for a guaranteed income stream.

Immediate Annuity Options: There are several immediate annuities options for payment timeframes that you can choose from, depending on your individual financial situation and goals. The timeframe that an annuity will be is referred to as the period certain. The most common immediate annuity options include the following:

- Single life immediate annuity: This type of annuity provides a guaranteed income stream for the rest of your life. Once you die, the payments stop, and there are no additional benefits paid to your beneficiaries.

- Joint and survivor immediate annuity: This type of annuity provides a guaranteed income stream for the rest of your life and the life of your spouse or partner. Once both of you die, the payments stop, and there are no additional benefits paid to your beneficiaries.

- Period certain immediate annuity: This type of annuity provides a guaranteed income stream for a set period of time, such as 10 or 20 years. If you die before the end of the period, your beneficiaries will continue to receive the payments for the remainder of the period.

- Life with period certain immediate annuity: This type of annuity provides a guaranteed income stream for the rest of your life, but also includes a period certain component. If you die before the end of the period, your beneficiaries will continue to receive the payments for the remainder of the period.

Considerations for Income Annuities

Before purchasing an immediate annuity, there are several factors that should be considered. It is important to have a clear understanding of your current financial situation, including your income, expenses, and retirement savings. It is also important to have clear financial goals and objectives for the future in retirement. Key factors to consider can include:

Key Factors:

- Your retirement goals: What are your goals for retirement, and how does an immediate annuity fit into those goals?

- Your life expectancy: An immediate annuity is based on actuarial calculations that take into account your age and life expectancy. It’s important to consider your current health and family history when determining your life expectancy.

- Your risk tolerance: An immediate annuity provides a guaranteed income stream, but it also requires you to give up control of a significant portion of your retirement savings. It’s important to consider your risk tolerance before making this decision.

- The insurance company: It’s important to choose a reputable insurance company that has a strong financial rating and a history of paying out annuity benefits to its customers.

While an immediate annuity can provide a guaranteed income stream for the rest of your life, there are also some risks of immediate annuities that should be considered in the decision making process. Potential risks such as unpredictable inflation, interest rate fluctuations, and lack of liquidly should be considered and evaluated. Key risks to consider can include:

Potential Risks:

- Inflation risk: An immediate annuity provides a fixed income stream, which means that it may not keep up with inflation over time. This can erode the purchasing power of your income stream.

- Interest rate risk: An immediate annuity is based on current interest rates, which means that changes in interest rates could potentially impact what your money could have earned in other financial products.

- Liquidity risk: Once you purchase an immediate annuity, you typically can’t access the lump sum payment you used to buy the annuity. This means that you will be giving up control of a significant portion of your retirement savings in exchange for a guaranteed income stream.

Conclusion

In conclusion, an immediate annuity can be an attractive option for retirees who want a guaranteed income stream that they can rely on without worrying about market fluctuations or other risks. However, it’s important to carefully consider whether an immediate annuity is the right choice for your individual financial situation. Before making this decision, be sure to consider your current financial situation, retirement goals, life expectancy, risk tolerance, and the best insurance company. With careful consideration and planning, you can maximize retirement income with an income annuity and provide peace of mind during retirement.

Our team can assist in choosing the right plan and the best insurance company for your individual situation. Give us a call at (800) 770-8229 or request an instant quote today!

FAQs

An immediate annuity is a financial product that converts a lump sum of money into a steady stream of lifetime income or a set payment schedule. Once you fund an annuity, income payments begin almost immediately — often within one month — making it a reliable way to secure predictable retirement income.

Yes — potentially. Immediate annuities can provide predictable payments for life, which can help ensure you don’t outlive your savings. By locking in a steady, dependable income stream, annuities help cover essential expenses and reduce the risk of running out of money in retirement. This makes them particularly effective for retirees who value income certainty and financial stability.

There are several different types of immediate annuities, including life-only annuities (which pay income for the rest of your life), joint and survivor annuities (which continue payments to a spouse or partner), and period certain annuities (which guarantee payments for a set number of years). The right choice of an immediate annuity depends on your retirement goals and income needs.

Yes — income from an immediate annuity is generally taxed as ordinary income when you receive payments. The taxable portion depends on how the annuity was funded; if it was purchased with after-tax dollars, part of each payment may be considered a return of principal and not fully taxable.

An immediate annuity may be a good option for retirees or near-retirees who want a guaranteed income stream to cover essential retirement expenses, such as housing, healthcare, and daily living costs. It’s especially useful for individuals concerned about longevity risk — the possibility of outliving their savings.

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers for ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help provide consumers with a variety of educational content on life insurance and annuities.