Protective Life Insurance Company Review

Protective Life Insurance Company has a reputation for both high quality insurance products and outstanding customer service for policy owners.

But... How do the company’s insurance products and services stack up against other industry leaders?

And... What types of life insurance coverage does Protective offer personal and business consumers?

In our experience, Protective Life Insurance Company is an innovative provider of high-quality life insurance and annuity products, and is a carrier of choice for many independent agents and brokers.

This article highlights Protective Life Insurance Company, providing information related to the company’s financial data, industry financial ratings, insurance product offerings, premium rates, and other considers.

Protective Life Insurance Company

Protective Life Insurance Company is a southern-based insurance and financial services organization with home offices in Birmingham, Alabama.

The company’s product portfolio includes a variety of life insurance, annuity, and other specialty insurance products.

According to Protective senior leadership, “key organizational priorities include investing in talent and culture, and customer experience...”

Protective is a go-to life underwriter for many independent agents serving individual and business markets. The organization’s beginnings date back to 1907 as the “flagship” company for the overarching Protective Life Corporation and encompass more than 100 years of “value-driven” service to policyholders and consumers. In recent decades, Protective has grown significantly through acquisitions which have included Chase Insurance Group, United Investors Life, MONY Life Insurance, Liberty Life, and others. As of 2018, Protective's financials reflected $862 billion of life insurance in force and 8.3 million policyholders worldwide.

Protective Life By The Numbers

Source: Protective

Protective Life Insurance Company Ratings

Insurance industry ratings provide an overview of the financial stability and general trustworthiness of a given insurance company.

These ratings are valuable to consumers in evaluating a company’s fiscal responsibility when considering life insurance and retirement products.

It is important for policyholders to feel confident in their insurer’s ability to meet current and future financial obligations.

Protective Life Insurance Company currently holds an “A+” (Superior) rating with A.M. Best, as well as high ratings with Standard & Poor’s, Moody’s, and Fitch. Protective's industry ratings by various rating services have been provided below for review.

Source: Protective (2018)

Protective Life Insurance Products

Protective Life Insurance Company offers a comprehensive life insurance product portfolio designed to meet personal and business consumer’s financial needs now and into the future.

The company’s offerings include both term and permanent life insurance products to include a variety of different policy types.

Protective’s life insurance product portfolio includes the following...

Term Life Insurance

Term life insurance provides protection for a specified period, often being used for income protection, mortgage protection, college funding, or other temporary needs for coverage. Protective Life’s term products offer coverage for periods ranging from 10 to 30 years and death benefits ranging from $100,000 to $50 million. These plans provide guaranteed level premiums, a tax-free death benefit, and a terminal illness rider subject to state availability.

Term Life Highlights

Universal Life Insurance

Universal life insurance offers permanent coverage with maximum flexibility, allowing policyholders to adjust premiums and/or death benefits as their individual needs change. Protective’s universal life products offer lifetime coverage, affordability and flexibility, cash value accumulation, a decreasing coverage benefit, and other valuable features. It is important to note that with universal life insurance, adequate premiums must be paid in order to maintain active coverage.

Universal Life Highlights

Indexed Universal Life Insurance

Indexed universal life insurance, like traditional universal life, offers permanent coverage and flexible premiums. However, with this type of policy, cash value accumulation is based on the performance of a market index. This crediting method offers interest based on a stock market index, but also provides protection from downside risk. Protective Life’s indexed universal life product offers permanent coverage, premium flexibility, cash value growth, downside protection, and other features. It is important to note that with indexed universal life insurance, adequate premiums must be paid to maintain active coverage.

Indexed Universal Life Highlights

Variable Universal Life Insurance

Variable universal life insurance, like traditional universal life, provides long-term coverage with flexible premiums. However, it differs in that premiums can be allocated to investment subaccounts offering potentially greater cash value accumulation, along with potentially greater risks. It is important to understand that a variable universal life policy’s cash value will fluctuate with the underlying investments and is not guaranteed.

Variable Universal Life Highlights

Whole Life Insurance

Whole life insurance is a form of permanent life insurance offering a lifetime death benefit, guaranteed level premiums, and a guaranteed cash value component. Protective’s whole life insurance provides lifetime coverage, fixed interest rates, optional policy riders, and other benefits. Given the guarantees associated with whole life insurance, it is traditionally more expensive than other types of life insurance coverage.

Whole Life Insurance Highlights

Protective Life's "Find a Policy" Tool

In selecting the right life insurance policy to meet your individual coverage needs, it is important to evaluate the features and benefits of available policy options.

Protective offers a great consumer resource in their Find a Policy tool, which helps consumers identify the best policy options based on a series of needs-based questions.

The following chart provides an overview of features and benefits offered by different types of life insurance policies available through Protective Life Insurance Company.

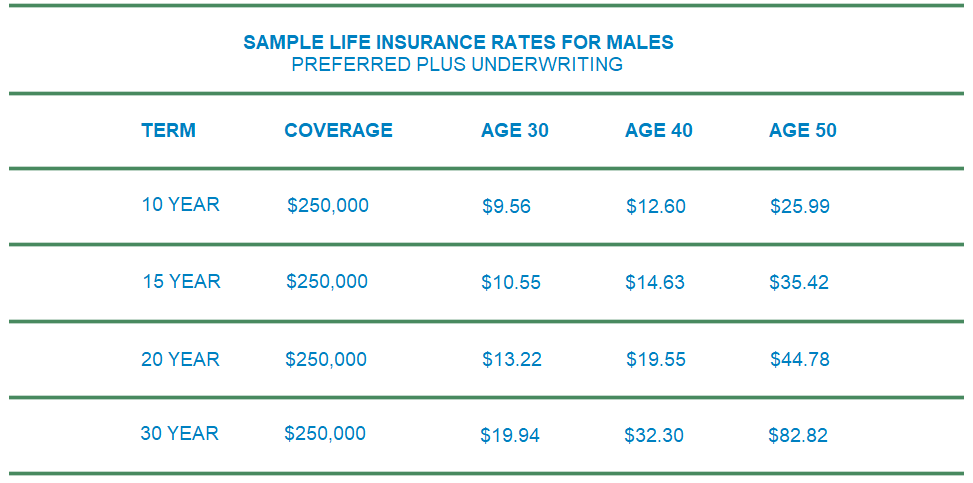

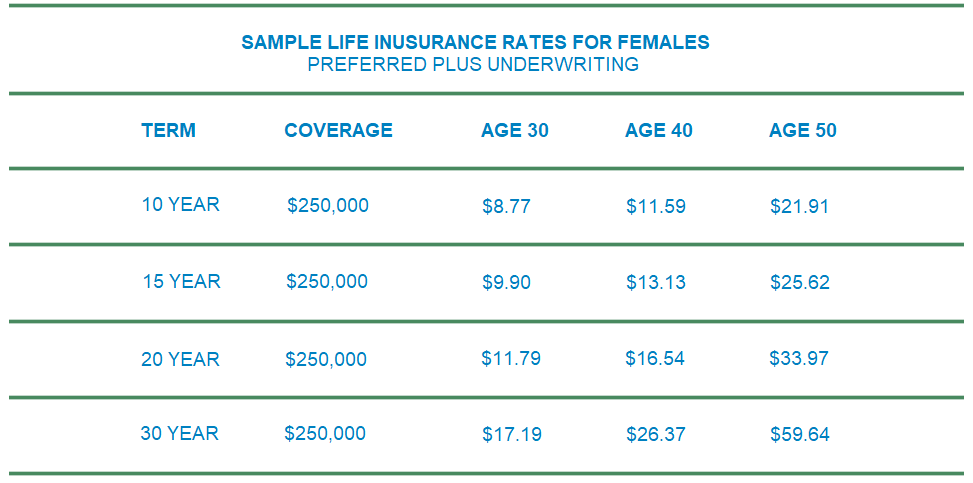

Protective Life Insurance Rates

In comparing the cost of life insurance among highly-rated insurers, there are a few companies that are routinely on the shortlist based on value. Protective Life is not only highly-rated, but also offers extremely affordable life insurance coverage. In fact, when comparing rates from popular term life companies, Protective is consistently among the most affordable. In selecting a life insurance company, affordable rates and superior ratings are often a winning combination. The sample rates below have been provided as an example of Protective Life Insurance Company's term life premiums.

Sample Male Rates

Note: Sample rates provided are based on rate information at the time of publication and are subject to change without notice. Company underwriting makes the final decision concerning rate class and policy approval.

Sample Female Rates

Note: Sample rates provided are based on rate information at the time of publication and are subject to change without notice. Company underwriting makes the final decision concerning rate class and policy approval.

Conclusion

In conclusion, Protective Life Insurance Company stands out as a reputable provider in the insurance industry, recognized for its robust portfolio of life insurance and annuity products. With a century-long commitment to quality service and financial security, Protective offers both personal and business consumers a wide array of options, from term life to universal and whole life policies. Their competitive rates, combined with superior industry ratings such as an "A+" from A.M. Best, underscore their reliability in meeting policyholders' needs. Whether you're seeking flexible coverage or guaranteed benefits, Protective Life Insurance Company remains a trusted choice backed by decades of experience and financial strength.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.