Prudential Insurance Company Review

Prudential Financial and its subsidiaries such as The Prudential Insurance Company of America, Pruco Life Insurance Company, and others are well-known and highly respected names in the insurance and financial services industry on a global scale.

But, does being well-known actually mean that Prudential life insurance is among the best? And... What types of life insurance coverage does Prudential Financial offer to personal and business consumers?

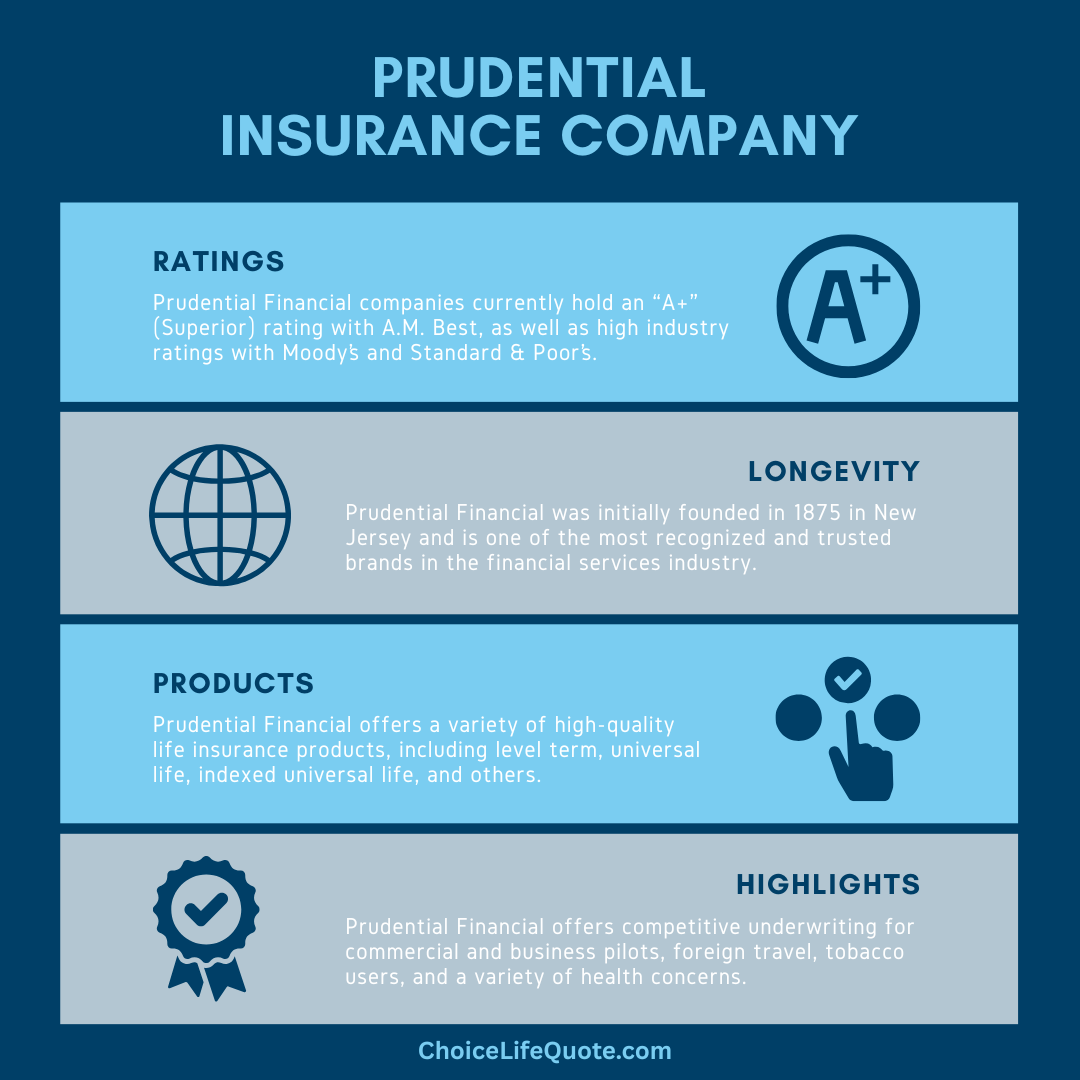

In our experience, Prudential Financial, and their group of companies, are highly rated and have a rich history of quality service to policyholders and consumers.

This article highlights Prudential Insurance Company, providing an overview of the company’s history, financial information, company ratings, insurance products, and other considerations when comparing the best life insurance companies.

Prudential Insurance Company Overview

Prudential Financial is an insurance and financial services company based in New Jersey for over 150 years.

The company, and its subsidiaries, offer a wide range of insurance and financial services products designed to assist individuals and business customers in protecting, growing, and preserving wealth for future generations.

"At the core of our success are our values, the principles that guide us daily: Worthy of Trust, Customer Focused, Respect for Each Other, and Winning with Integrity" - Prudential Leadership

Initially, founded in 1875, Prudential is one of the most recognized and trusted names in the financial services industry. The Prudential Financial group of companies include The Prudential Insurance Company of America, Pruco Life Insurance Company, Pruco Life Insurance Company of New Jersey, Prudential Annuities Life Assurance Corporation, and others. Though all are members of the Prudential Financial family, each of these companies is independently responsible for its own financial condition and obligations. As of 2018, Prudential reports reflected $1.4 trillion of assets under management and over 50 million customers globally.

Prudential Financial by the Numbers

Source: Prudential

Prudential Insurance Company Ratings

In the financial services world, a company’s ratings provide consumers with a snapshot of an insurance company's overall financial stability and trustworthiness.

It is important that consumers consider financial strength and other ratings when selecting an insurance company and purchasing life insurance, annuities, and other related products. This research can be vital for potential personal and business insurance consumers in product selection.

The research conducted, and ratings awarded, by rating companies allow consumers to feel secure in their financial decisions. Prudential Financial companies currently hold an “A+” (Superior) rating with A.M. Best, as well as high industry ratings with Moody’s, Fitch, and Standard & Poor’s. Financial strength ratings for selected Prudential Financial companies have been provided below for review.

Source: Prudential (2018)

Prudential Insurance Company Awards

In line with the belief that an organization’s true reputation lies in what others have to say about their service and commitment to consumers, Prudential has accumulated an impressive list of industry awards and accolades. According to Prudential's Annual Report, “Prudential’s commitment to doing business the right way, strengthening communities and providing an inclusive work environment is reflected in the awards and recognition we have proudly received from national and global organizations.”

Prudential Insurance Company Products

Prudential Financial, and their subsidiary companies such as The Prudential Insurance Company of America, Pruco Life Insurance Company, Pruco Life Insurance Company of New Jersey, Prudential Annuities Life Assurance Corporation, and others, offer an extensive portfolio of life insurance products to meet consumer's diverse financial needs.

Prudential life insurance offerings include both term and permanent coverage options. The following chart provides the basic features and benefits of the different types of life insurance products available through Prudential.

Term Life Insurance

Term life insurance coverage is designed for a specified period, or term, and is often the most economical initially. Term life offers a tax-free death benefit, low-cost coverage, level premiums, living benefit options, convertibility, and other features. This type of policy is often a great fit for consumers who have a temporary need for life insurance, such as income replacement, mortgage payoff protection, and other time-based scenarios.

Term Life Highlights

Return of Premium Term

Return of premium term life insurance provides coverage for a specified period, like traditional term life, but offers a return of premiums paid at a certain point in the life of the policy. ROP term offers a tax-free death benefit, level premiums, potential return of premiums, living benefit options, convertibility, and other features. Like ordinary term insurance, return of premium term is designed for those with a temporary need for protection but who are also willing to pay more now to have their premiums returned later.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance offering significant flexibility with premiums and the death benefit. Universal life offers a tax-free death benefit, lifetime coverage, flexible premiums, cash value accumulation, living benefit options, and other features. This type of policy is an option for consumers with a long-term need for life insurance coverage and a desire for policy flexibility.

Indexed Universal Life Insurance

Indexed universal life insurance, like traditional universal life, can provide lifetime coverage and significant flexibility, but with cash value accumulation based on an equity index as opposed to a fixed interest rate. This interest crediting strategy offers interest rates linked to a market index but can also provide downside protection. Indexed universal life offers a tax-free death benefit, permanent coverage, flexible premiums, cash value accumulation based on an equity index, living benefit options, and other features. This type of policy is a great fit for consumers who need long-term life insurance protection and have a desire to optimize cash value accumulation but also want protection from potential market losses.

Variable Universal Life Insurance

Variable universal life insurance, like traditional universal life, provides long-term protection and flexible premiums. However, with VUL the cash values can be invested in equity subaccounts. This strategy involves investment directly in equities, offering potentially higher gains but also exposing cash values to market risk. Variable universal life offers a tax-free death benefit, long-term coverage, flexible premiums, cash value accumulation, equity investment options, and other features. This type of policy is ideal for consumers with a long-term need for life insurance coverage and a desire to invest directly in equity markets.

Prudential Life Insurance Rates

Prudential Financial companies to include The Prudential Insurance Company of America, Pruco Life Insurance Company, Pruco Life Insurance Company of New Jersey, Prudential Annuities Life Assurance Corporation, and others, offer a variety of high quality and affordable life insurance policy options. The sample rates below have been provided as an example of Prudential term life insurance premiums.

Sample Male Rates

Note: Sample rates provided are based on rate information at the time of publication and are subject to change without notice. Company underwriting makes the final decision concerning rate class and policy approval.

Sample Female Rates

Note: Sample rates provided are based on rate information at the time of publication and are subject to change without notice. Company underwriting makes the final decision concerning rate class and policy approval.

Conclusion

In conclusion, Prudential Financial stands as a cornerstone in the insurance and financial services industry, with over a century of trusted service to millions globally. Through its subsidiaries like The Prudential Insurance Company of America and Pruco Life Insurance Company, Prudential offers a comprehensive array of life insurance products designed to meet diverse personal and business needs. With a steadfast commitment to financial strength and customer satisfaction, evidenced by its top-tier ratings and numerous industry accolades, Prudential continues to exemplify excellence in the insurance sector.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.