Exploring Social Security Election Options

Are you approaching retirement age, and feeling somewhat overwhelmed by the Social Security election options? Making the right choice can have a significant impact on your financial future. That's why it's crucial to explore your options thoroughly and understand how each decision will affect your benefits and retirement income.

This article highlights the different Social Security election options, and provides you with the knowledge and insight needed to make informed decisions in considering and planning retirement income strategies.

Understanding Social Security Benefits

Social Security retirement benefits are a critical component of most people’s retirement income. As a government program, it provides financial support to retirees, disabled individuals, and surviving spouses and children of deceased workers.

To be eligible for Social Security retirement benefits, you must earn enough credits by working and paying Social Security taxes.

The amount of your benefit is based on your lifetime earnings and the age at which you choose to start receiving retirement benefits.

There are three main types of Social Security benefits: retirement, disability, and survivor benefits. Retirement benefits are available to individuals who reach retirement age and have earned qualifying credits, disability benefits are provided to individuals who are unable to work due to a qualifying disability, and survivor benefits are available to the surviving spouse and children of a deceased worker.

To qualify for retirement benefits, you must have earned at least 40 credits throughout your working life. The amount of your benefit is calculated based on your average indexed monthly earnings (AIME), which is determined by taking the highest 35 years of your earnings and adjusting them for inflation. Your benefit amount is then determined by applying a formula based on your AIME and your full retirement age (FRA).

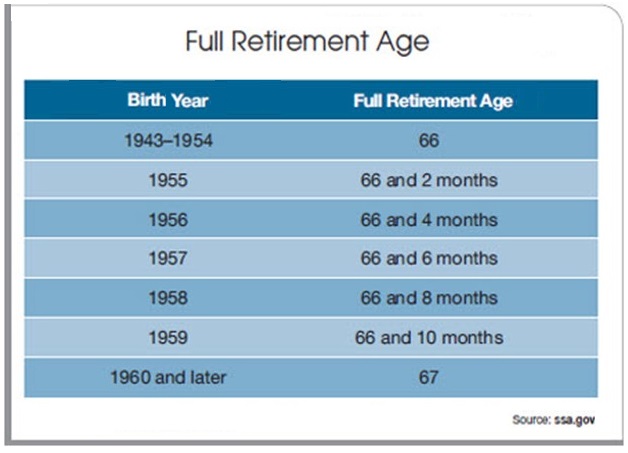

Full Retirement Age by Year of Birth

Full retirement age (FRA) is the age at which you become eligible to receive your full Social Security retirement benefit. It is based on your year of birth and ranges from 66 to 67 years old. If you choose to start receiving benefits before your FRA, your benefit amount will be reduced. On the other hand, if you delay your benefits beyond your FRA, your benefit amount will increase.

For individuals born between 1943 and 1954, the full retirement age is 66. If you were born in 1955 or later, your full retirement age gradually increases by two months per year until it reaches 67 for those born in 1960 or later. It’s important to note that you can still choose to begin receiving benefits as early as age 62, but your benefit amount will be permanently reduced.

The decision of when to start receiving benefits is a personal one and depends on various factors, including your financial situation, health, and life expectancy. If you need income and don’t expect to live a long life, starting benefits early may be the right choice for you. However, if you can afford to wait and expect to live a long life, delaying benefits can significantly increase your monthly benefit amount.

Early Retirement vs Delayed Retirement

One of the most critical decisions you will make when it comes to your Social Security election options is whether to start receiving benefits early or delay them until later. Starting benefits early can be tempting, as it provides immediate financial support. However, it’s important to weigh the pros and cons before making a decision.

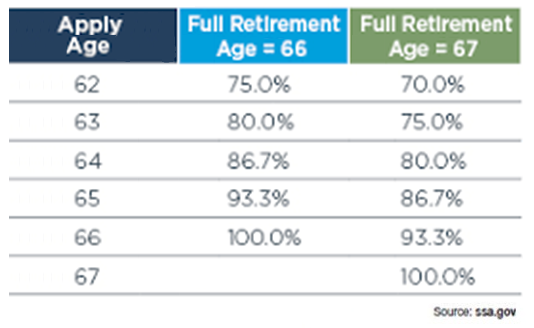

Starting benefits early, typically at age 62, comes with a permanent reduction in your benefit amount. The reduction is based on the number of months you receive benefits before your full retirement age. For individuals with a full retirement age of 66, the reduction is about 6.7% per year for the first three years and an additional 5% for each year before that. This means that if your full retirement age is 66 and you start benefits at age 62, your benefit amount will be reduced by 25%.

On the other hand, delaying benefits beyond your full retirement age can result in an increase in your benefit amount. For each year you delay benefits, your benefit amount increases by about 8% until age 70. This means that if your full retirement age is 66 and you delay benefits until age 70, your benefit amount will increase by 32%.

The decision to start benefits early or delay them depends on your individual circumstances. As previously stated, if you need the income or don’t expect to live a long life, starting benefits early may be the right choice, but delaying benefits can significantly increase your monthly income amount.

Considering Social Security Options

Choosing the right Social Security election options requires careful consideration of various factors. Here are some essential factors to keep in mind when making your decision:

- Financial Needs: Consider your current financial situation and whether you need income from Social Security to cover your expenses. If you have other sources of income or sufficient savings, you may be able to delay benefits and increase your monthly benefit amount.

- Health and Life Expectancy: Your health and life expectancy are crucial factors to consider when deciding when to start receiving benefits. If you have health issues or a family history of shorter life expectancy, starting benefits early may be the right choice for you. However, if you are in good health, delaying benefits can provide you with a higher monthly benefit amount for life.

- Spousal Benefits: If you are married, you should also consider the impact of your Social Security election on your spouse’s benefits. Spousal benefits can provide additional income for your spouse, even if they have never worked or have lower earnings. Coordinating your Social Security elections can help maximize the overall benefits for both you and your spouse.

- Tax Implications: Your Social Security benefits may be subject to federal income tax, depending on your total income. If you start benefits early and continue to work, your benefits may be subject to a higher tax rate. On the other hand, delaying benefits can help reduce the tax impact by increasing your overall income.

By carefully considering these factors and consulting with a financial advisor, you can make an informed decision that aligns with your financial goals and personal circumstances.

Calculating Social Security Benefits

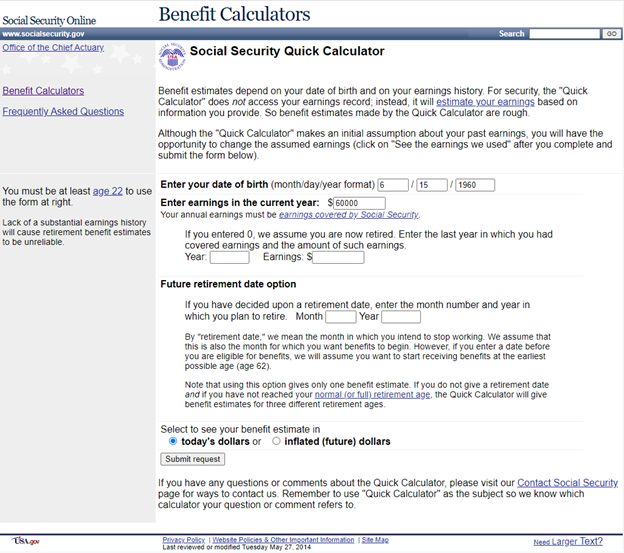

Calculating your Social Security benefits can help you understand how much income you can expect to receive in retirement. The Social Security Administration provides several tools and resources to help you estimate your benefits.

The first step in calculating your Social Security benefits is to determine your average indexed monthly earnings (AIME). This is done by taking the highest 35 years of your earnings, adjusting them for inflation, and calculating the average. The Social Security Administration provides a detailed guide on how to calculate your AIME on their website.

Once you have your AIME, you can use the Social Security Administration’s benefit formula to determine your Primary Insurance Amount (PIA). The PIA is the monthly benefit amount you would receive if you start benefits at your full retirement age. The benefit formula is weighted to provide higher benefits to individuals with lower lifetime earnings.

To estimate your benefits at different ages, you can use the Social Security Administration’s online Retirement Estimator. This tool allows you to input your date of birth, earnings history, and expected retirement age to get an estimate of your monthly benefit amount.

Keep in mind that these estimates are based on current law and are subject to change. It’s essential to regularly review your estimates and adjust your retirement plan accordingly. You can estimate future benefit payments using the Social Security Administration benefits calculator on the agency website at https://www.ssa.gov/OACT/quickcalc, or by clicking the image below.

Working While Receiving Social Security

Many individuals choose to continue working even after they start receiving Social Security benefits. However, it’s important to understand how working can affect your benefits.

If you start receiving benefits before your full retirement age and continue to work, your benefits may be subject to an earnings limit. In 2021, the earnings limit was $18,960 per year. If you earn more than this limit, your benefits would be reduced by $1 for every $2 you earn above the limit. Once you reach your full retirement age, there is no earnings limit, and you can continue working without any reduction in your benefits.

It’s important to note that even if your benefits are reduced due to working, you will not lose those benefits permanently. Once you reach your full retirement age, your benefits will be recalculated to account for the months in which they were reduced.

If you are considering working while receiving Social Security, it’s essential to understand the impact on your overall retirement income and tax situation. Consult with a financial advisor or tax professional to ensure you make decisions that align with your financial goals.

Common Mistakes in Electing Benefits

When it comes to electing Social Security benefits, there are several common mistakes that individuals often make. These mistakes can result in reduced benefits or missed opportunities for maximizing benefits. Here are some common mistakes to avoid:

Not Understanding the Rules: Social Security rules can be complex, and it’s essential to understand how they apply to your situation. Take the time to educate yourself about the various rules and provisions to ensure you make informed decisions.

Starting Benefits Too Early: While it may be tempting to start receiving benefits as soon as you turn 62, this can result in a permanent reduction in your benefit amount. Carefully consider your financial needs and life expectancy before making an election.

Not Considering Spousal Benefits: If you are married, it’s important to consider the impact of your Social Security election on your spouse’s benefits. Coordinating your elections can help maximize the overall benefits for both you and your spouse.

Not Considering Tax Implications: Your Social Security benefits may be subject to federal income tax, depending on your total income. Consider the tax implications of your Social Security election and how it may impact your overall tax situation.

Not Seeking Professional Advice: Social Security planning can be complex, and the rules are subject to change. Seeking advice from a financial advisor who specializes in Social Security planning can help you make informed decisions and avoid costly mistakes.

By avoiding these common mistakes and taking the time to educate yourself about the Social Security rules, you can make the best choices for your financial future.

Conclusion

In conclusion, choosing the right Social Security election options is a crucial step in securing your financial future. By exploring your options thoroughly and considering the various factors that influence your decision, you can make an informed choice that aligns with your financial goals and personal circumstances.

Our team can assist in choosing the right plan and the best insurance company for your individual situation. Give us a call at (800) 770-8229, or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.