Term Life Insurance | Simple Low-Cost Coverage

In considering life insurance coverage options, consumers often ask about term life insurance, and whether term life coverage is the best option to meet their family's financial goals and objectives. These questions about term life coverage are completely understandable given the amount of consumer information available, reoccurring life insurance ads, and numerous financial gurus promoting this type of insurance coverage day in and day out to consumers.

This article provides insight into term life insurance, including an overview of how term life coverage works, policy riders, premium costs, best term insurance companies, and other elements to help provide consumers with the information to make informed decisions.

Term Life Insurance Overview

Term life insurance offers basic protection in the form of a death benefit for the primary insured, often at the lowest initial cost of available coverage options.

This type of coverage is said to be “pure” insurance since it does not include many of the extra features available with other types of life insurance, such as whole life, universal life , or other policy types.

According to Dave Ramsey, "term life insurance is the least expensive way to get family coverage and allows you to lock in rates for 15, 20, or 30 years."

Term life provides temporary coverage for a predetermined amount of time, or “term,” in which the policy premiums remain level. Typical term policies available in today’s marketplace offer level premium periods of 10, 15, 20, or 30 years. After the expiration of the level term, most term life policies can be renewed at the annually renewable premium rates. This rate is based on the insured’s age at renewal and can represent a significant increase in premiums.

Many term life policies allow conversion to a permanent policy, subject to the issuing company’s guidelines, if the policy owner determines a need for permanent coverage.

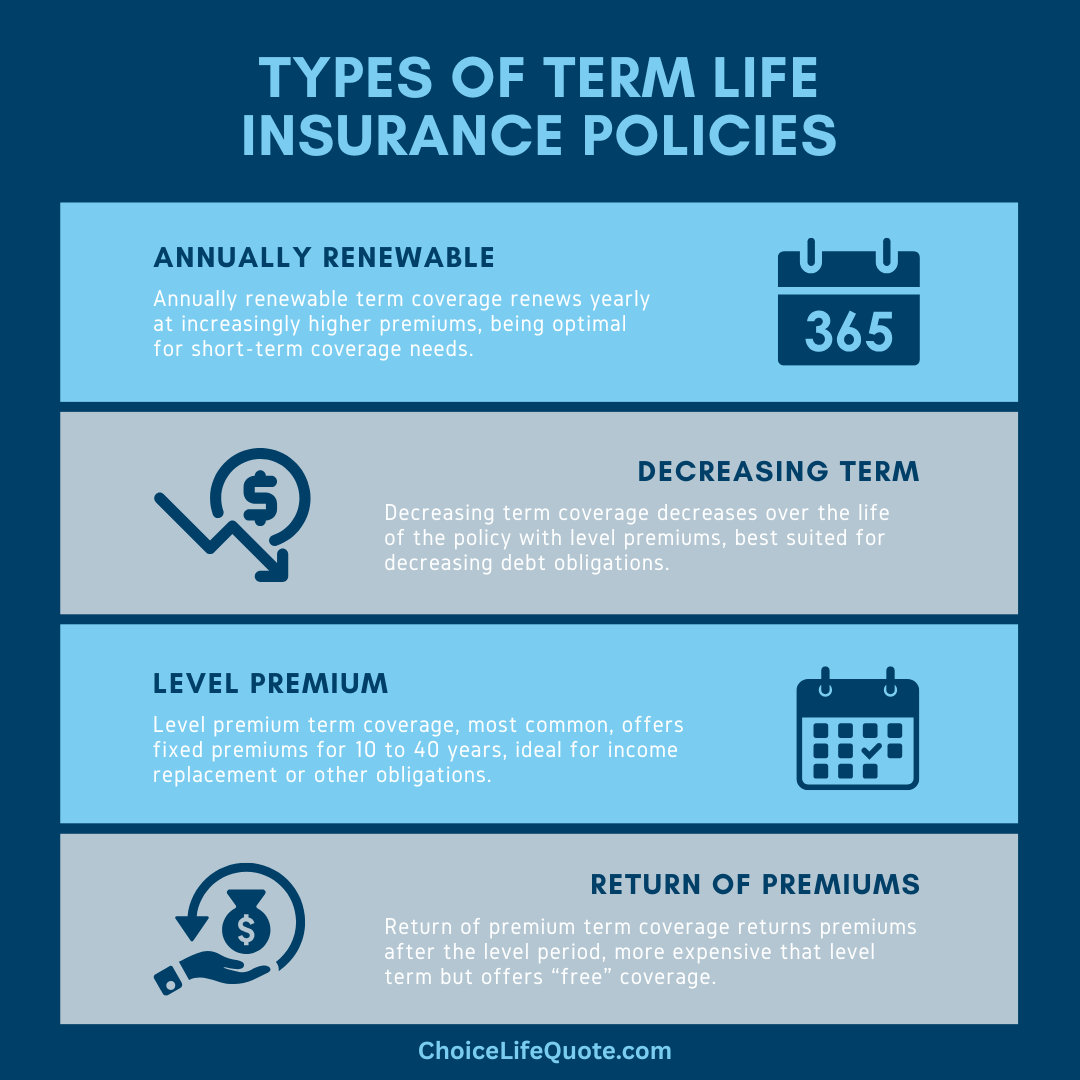

Types of Term Life Policies

The basis for all term life policies essentially comes down to an amount of coverage, or death benefit, and the length of the term or level period. Based on this simplicity, there are several term policy options available for consumers. In choosing a term policy, it is important to consider the length of time that you will have a need for coverage. Common term policy options have been provided below for review.

- Annually Renewable Term – Annually renewable term is a type of term life insurance where coverage is renewed each year at the annually renewable premium rate. The coverage is typically guaranteed to remain in force so long as the premiums are paid as scheduled. This type of term policy is best suited for those with a short-term need for life insurance since the premiums will eventually become prohibitively expensive. Most level term policies switch to the annually renewable premium rate after the guaranteed level period.

- Decreasing Term – Decreasing term is a type of term life insurance where the coverage amount periodically decreases over the life of the policy. Premiums for decreasing term policies typically remain level as the death benefit decreases. Not as commonly used today, this type of term policy is best suited for those with a decreasing need for coverage, such as a mortgage or other decreasing financial obligations.

- Level Premium Term – The most common type of term life on the market, level premium term is a type of term life insurance where the premiums remain level for a selected period or term. Typical level premium term policies in today’s marketplace offer level periods of 10, 15, 20, or 30 years. It is important to consider future coverage needs when purchasing a level term policy since the premiums can increase substantially after the initial period. This type of policy is best suited for those with coverage requirements for a specific period of time, such as income replacement, mortgage protection, planning for college, or other milestones. As previously stated, most level premium term policies revert to annually renewable rates once the level premium period has expired.

- Return of Premium Term – Return of premium term is a type of term life insurance where all, or a portion of, premiums paid are returned to the policy owner at the end of the level period. Due to the return of premium component, these policies have slightly higher premiums than traditional level term policies. Similar to level premium term policies, return of premium term plans typically offer 15, 20, and 30-year level periods. The return of premium feature associated with such policies may be a part of the base contract or a policy rider, depending on the issuing insurance company. This type of policy is best suited for those who are willing and able to pay slightly higher premiums over the life of their policy to receive a return of premiums paid. Essentially, a return of premium policy could be considered FREE life insurance since premiums are returned. However, opportunity costs should be factored in when considering a return of premium policy.

Term Insurance Policy Riders

Though term life policies do not have many of the living benefits associated with permanent life insurance, there are several policy riders available that may provide additional benefits. These riders range from accidental death and children’s coverage to accelerated benefits and waiver of premium. In some instances, riders are included in the base policy at no additional charge, and in other instances, there is an additional charge for certain benefit riders.

Specific riders, and associated costs, for a given policy, are at the discretion of the issuing insurance company. Common term policy riders have been provided below for review.

Accidental Death Rider – An accidental death benefit rider pays an additional amount if the primary insured’s death is caused by accidental injuries. This rider is typically a multiple of the base face amount. For example, an accidental death benefit rider may pay an additional amount equal to the original face amount. Accidental death benefit riders typically expire once the primary insured reaches a certain age.

Critical Illness Rider – A critical illness rider is an accelerated benefit rider that allows the primary insured to access a portion of a life insurance policy’s death benefit in the event of a critical illness diagnosis. The amount of accelerated benefit may range from the full amount to a portion of the policy death benefit, depending on the specific insurance company. This type of rider will typically define a critical illness as diagnosis such as a heart attack, stroke, cancer, or other critical medical conditions. A chronic illness rider allows the primary insured to utilize a portion of the policy proceeds while still living, possibly at a critical time of medical or financial hardship.

Chronic Illness Rider – A chronic illness rider is an accelerated benefit rider that allows the primary insured to access a portion of a life insurance policy’s death benefit in the event of a chronic illness diagnosis. The amount of accelerated benefit may range from the full amount to a portion of the policy death benefit, depending on the specific insurance company. This type of rider will typically define a chronic illness as a primary insured’s inability to perform a certain number of activities of daily living, such as bathing, continence, dressing, eating, toileting, transferring, etc. A chronic illness rider allows the primary insured to utilize a portion of the policy proceeds while still living, possibly at a critical time of medical or financial hardship.

Terminal Illness Rider – A terminal illness rider is an accelerated benefit rider that allows the primary insured to access a portion of a life insurance policy’s death benefit in the event of a terminal illness diagnosis. The amount of accelerated benefit may range from the full amount to a portion of the policy death benefit, depending on the specific insurance company. This type of rider will typically define a terminal illness as being diagnosed with 12 to 24 months or less to live (periods may vary based on state law). A terminal illness rider allows the primary insured to utilize a portion of the policy proceeds while still living, possibly at a critical time of medical or financial hardship.

Waiver of Premium Rider – A waiver of premium rider is a rider that waives policy premiums in the event of a primary insured becoming totally disabled. This type of rider typically only applies to the base policy and requires a waiting period of a certain number of months before future premiums are waived. Some insurance companies also limit waiver of premium riders to policies of less than a certain death benefit. A waiver of premium rider allows the primary insured to maintain their policy at no cost, possibly at a critical time of medical or financial hardship.

Common Uses for Term Life

Term life insurance is extremely popular in today’s marketplace because it provides appropriate coverage for most individual life insurance needs. Often a person’s need for coverage is tied to common life events and a desire to provide for those we love and pay what we owe.

Typical life events prompting a need for life insurance coverage may include getting married, purchasing a home, having children, planning for college, saving for retirement, and other financial obligations. Essentially, if you have a temporary need for life insurance coverage, term life is often the simplest and most economical option.

The following case studies provide insight into common scenarios where the use of term life insurance is appropriate.

Case Study #1

Income Protection

Jennifer is a 42-year-old single parent with three teenage children and is the only income earner for her family. Her annual income is $75,000, and she plans to continue providing financially for her children until they finish college. She has decided to purchase a 10-year $750,000 term life insurance policy for income protection. In the event of Jennifer's untimely death, the policy proceeds would replace her income through the children's college years.

Case Study #2

Mortgage Protection

John is a 42 year old married man with two children, and is the primary bread winner for his family. He and his wife Emily have recently purchased a new family home and have a 30 year $300,000 mortgage. The couple has decided to purchase a 30 year $300,000 term life insurance policy for mortgage protection. In the event of John's untimely death, the policy proceeds would pay off the remaining mortgage balance, allowing Emily and the children to remain in the family home.

Cost of Term Life Insurance

Since term life insurance offers basic (pure) life insurance coverage for a limited period of time and does not accumulate cash value like many permanent policies, it is routinely the most economical form of coverage available. With that said, there can be significant differences in premium rates from one insurance company to another, and longer level premium periods traditionally increase the cost of premiums.

According to LifeHappens.org, "86% say they haven't bought life insurance because its too expensive, yet overestimate its true cost by more than 2 times."

When shopping for term life insurance, it is important to select an appropriate term period and amount of coverage based on your specific needs. Even though longer terms increase policy cost, it is to your benefit to select an appropriate term length, as opposed to choosing a shorter-term length and potentially paying significantly higher annually renewable rates to extend coverage in the future. On this note, beware of rising premiums by ensuring that the level term period you select is guaranteed.

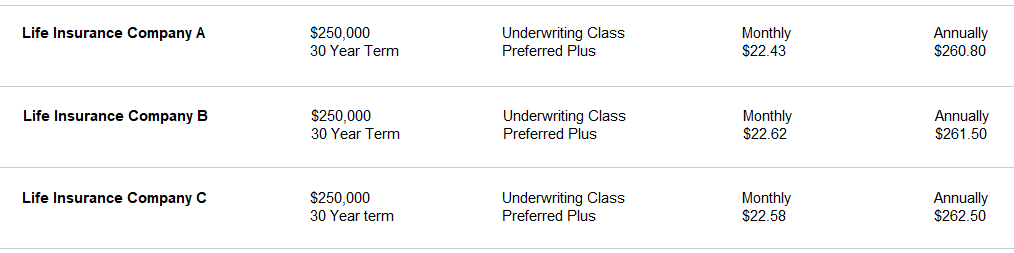

Basically, purchasing what you need and not a penny more helps to ensure that you get the most value for your premium dollars. It is also important to compare rates from several insurance companies to find the most economical coverage. Working with an independent life agent will allow you to compare rates from several top-rated companies before making a decision. An example of a typical rate comparison has been provided below for review.

Sample Term Life Rates

The rates illustrated below are for a $250,000 30 year term life insurance policy on a 35-year-old male non-smoker qualifying for the Preferred Plus underwriting class.

Best Term Life Companies

Choosing the best life insurance company for your individual situation can be a challenge, especially with numerous companies and policy options available. When comparing insurance companies, it is important to compare premium rates, but it is also wise to consider company ratings, policy offerings, underwriting standards, customer service, and other relevant factors. Being an informed consumer and having a basic understanding of how life insurance works is to your advantage. There are a number of outstanding companies in the marketplace, but below are a few of our recommended companies for term life.

Conclusion

Term life insurance offers a straightforward and cost-effective solution for those seeking temporary financial protection. It focuses on providing a death benefit at a low initial cost compared to other types of life insurance, term policies cater well to specific time-based coverage needs like income replacement, mortgage protection, or funding educational expenses. By understanding coverage options and choosing wisely, consumers can secure affordable coverage that meets their family's needs during critical life stages.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

FAQs

Term life insurance provides life insurance protection for a set period of time or "term," such as 10, 20, 30, or even 40 years. If the insured passes away during the term, the beneficiaries receive the death benefit. If the term ends while the insured is still living, the coverage expires unless it’s renewed or converted.

Choosing the right term length depends on your financial obligations and objectives. Common term lengths should align with major life milestones — such as covering income replacement during working years, paying off a mortgage balance, or supporting children until they become financially independent.

In most instances — Yes. Term life insurance premiums are generally initially more affordable than permanent life insurance because term coverage only provides a death benefit for a limited time and does not build cash value. This makes term life a cost-effective option for many families. However, it's also important to understand that if a policy is kept beyond the level period, premiums typically increase annually, and the policy can eventually become prohibitively expensive.

Many term life policies offer renewal or conversion options. Renewal lets you extend coverage at the end of the term, often at a higher premium. Conversion allows you to convert your term policy into a permanent life insurance policy (such as whole life or universal life) without a new medical exam, which can be valuable if your health changes. Term life conversion can be an extremely valuable benefit, giving policyholders options for future long-term coverage.

Term life insurance is a strong fit for individuals who want affordable protection during specific financial periods — like raising children, paying off a mortgage, or covering income loss. It’s ideal for people seeking straightforward life insurance without the additional features (like cash value) found in permanent policies.

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.

2 Comments

Mia Evans

I totally agree when you said that it is important to choose the right term period and amount of coverage depending on the needs that you have. With that in mind, it is best to also work with experts to understand the processes and requirements to be approved with your claims. For example, a life insurance accelerated benefit program would have different details in it compared to other coverages, so being educated about them will definitely be for your benefit.

James Shiver, DBA

Good morning, thank you for the response and feedback. I agree that it is important for policyholders to fully understand any living benefits associated with their life insurance policy. These benefits can provide financial support for policyholders and families during a challenging time. Please let us know if we can ever be of assistance, have a great day!