Types of Life Insurance | Comparing Policy Options

Most Americans believe they need life insurance to provide a foundation of security for their families. However, choosing between the different types of life insurance plans available in the marketplace can be a challenge. This is an important consideration since the coverage you choose can provide not only financial protection but also significant peace of mind for years to come. Having helped consumers navigate the buying process for over two decades, we pride ourselves on making life insurance simple and providing outstanding service.

This article provides insight into the different types of life insurance, including available life policy options, an overview of both term and permanent coverage, recommended life insurance companies, and personalized case studies highlighting coverage benefits.

What is life insurance?

Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their families by offering a financial safety net.

It functions by paying out a lump sum of money, known as the death benefit, to designated beneficiaries upon the primary insured's death.

This financial protection helps cover expenses such as mortgage payments, educational costs, and daily living expenses, ensuring that loved ones are supported financially during a difficult time. Life insurance policies generally fall into two main categories: term life insurance, which provides coverage for a specific period, and permanent life insurance, which offers coverage for the insured's entire life and may accumulate cash value over time. Each type offers unique benefits and features tailored to different financial needs.

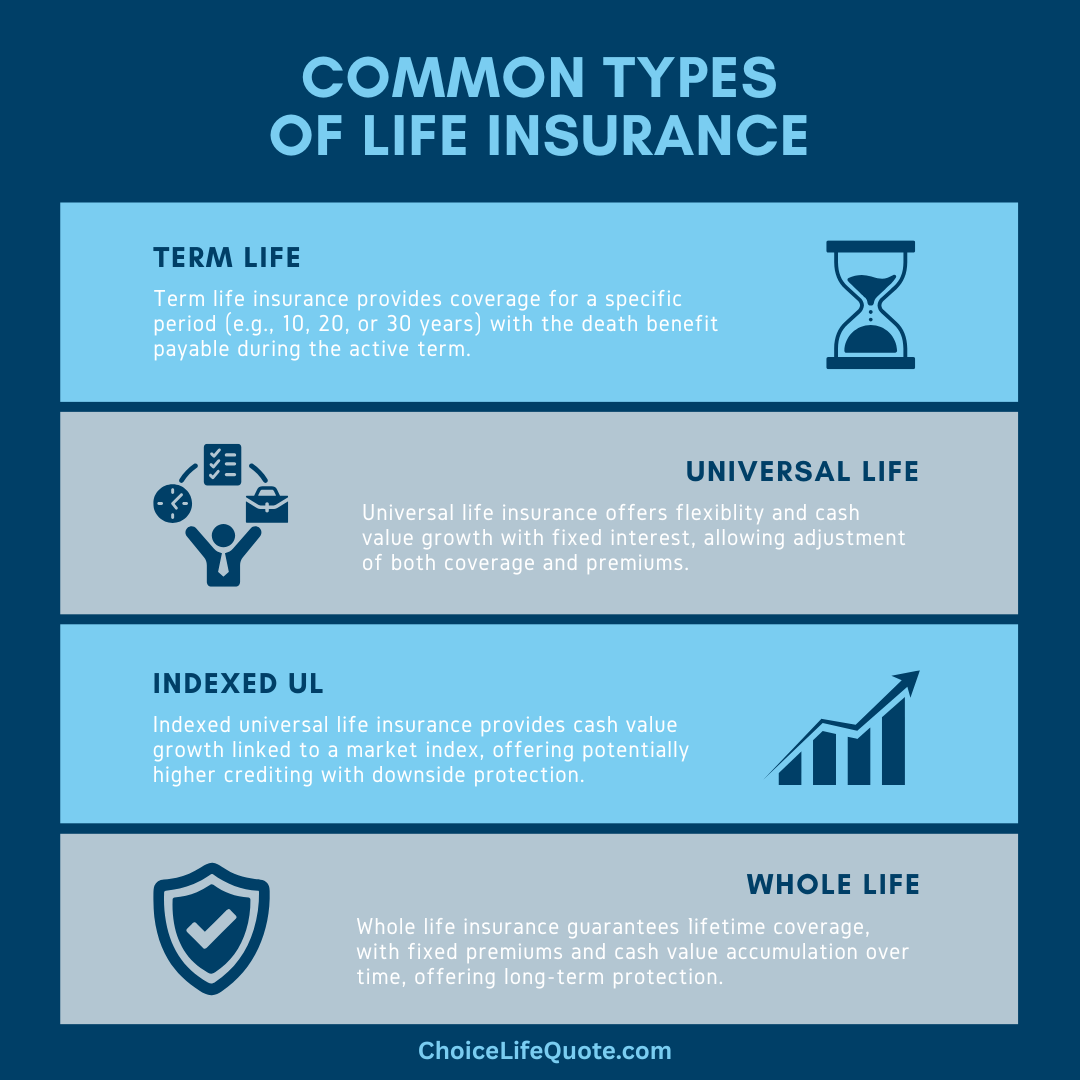

Types of Life Insurance

The different types of life insurance available in today’s marketplace can seem overwhelming, with companies offering numerous policies, features, and benefits. However, essentially all life insurance products can be classified as either term or permanent coverage. Term life insurance is basically designed to provide a specific amount of coverage for a certain period, or term. While, permanent life insurance can provide coverage for an insured’s entire lifetime and accumulate cash value along the way.

Term Life

Permanent Life

Term Life Insurance

Term life insurance is intended to be temporary in nature, providing coverage for a specific time frame or “term.” There are several options when considering term life, the most popular in today’s market being level term. Information related to common term life options has been provided below. Term plans can also be combined, or laddered, to accomplish specific financial goals and objectives.

Annually Renewable Term

Annually renewable term is a type of term life insurance that provides coverage that renews each year based on annually renewable premiums.

The premiums for annually renewable term are initially less expensive than comparable level term plans but will increase each year as the primary insured ages.

These types of life insurance policies are best suited for those who have a short-term need for life insurance protection. Typical uses for annually renewable term may include short-term income protection, coverage required for loans, life insurance mandated by court order, and other circumstances requiring short-term coverage. Since the premiums are based on annually renewable rates, the cost of this type of term life can be very reasonable. However, if kept long-term, annually renewable term can become extremely expensive in later years.

The primary benefits of annually renewable term life insurance are the comparably low initial premiums and short-term coverage option. Likewise, the most significant negative of annually renewable term is that the premium rates are annually renewable and will become prohibitively expensive if kept long-term.

Level Term

Level premium term is a type of term life insurance that provides coverage for a guaranteed period, typically 10, 20, or 30 years, during which time premiums remain level.

Though, there are products on the market which allow customized term lengths and allow you to dial in a specific timeframe.

The premiums for level term are initially more expensive than annually renewable term but remain level for the specified coverage period. Traditionally, the longer the level period, the higher the initial premium. However, these level plans usually represent significant savings over holding annually renewable term for the same time frame. These types of life insurance policies are ideal for individuals having a need for life insurance coverage for a certain number of years. Typical uses for level term life include income replacement, mortgage protection, college planning, and other coverage needs based on different stages of life.

Level term life premiums routinely remain level for the specified period and traditionally represent a good value when compared to other life insurance options. Additionally, many level term plans are renewable and convertible to a permanent policy at a certain point. The main benefit associated with level term life insurance is that premiums remain level for the selected period, representing a significant value when compared to many life insurance options. However, if kept beyond the level period, premiums for level term policies will routinely increase yearly based on annually renewable rates.

The following illustration provides sample rates for 10, 20, and 30-year level term policies on a 35-year-old male non-smoker qualifying for a Preferred Plus underwriting class.

Sample Rates

10 Year Level Term

Sample Rates

20 Year Level Term

Sample Rates

30 Year Level Term

Note: The rates illustrated above are for a 10, 20, and 30 year term life insurance policies on a 35-year-old male non-smoker qualifying for a Preferred Plus underwriting class.

Return of Premium Term

Return of premium term is a variation of level term life insurance with a return of premium feature. Essentially, with a return of premium policy, all premiums paid are returned at the end of the selected period in either the form of cash or paid-up insurance.

Return of premium policies traditionally offer up to a 30-year term with premiums decreasing based on longer accumulation periods.

As an example, a 30-year return of premium policy would cost less than a 15-year policy with the same death benefit based on the return of premium feature. These types of life insurance policies are best suited for those who are willing to pay a little more in premiums over the life of their policy to receive a return of premiums paid. Essentially, getting FREE life insurance! As with traditional level term policies, typical uses for return of premium term include income replacement, mortgage protection, college planning, and other temporary coverage needs.

Policy premiums for this type of coverage typically remain level for the chosen period and represent a significant value since premiums are eventually returned. As with level term, many return of premium policies can be renewed or converted to a permanent plan subject to policy guidelines. The primary benefit of return of premium term is quite simply the promise of a return of all premiums paid. This policy option allows an individual to engage in “forced savings” and essentially provides FREE coverage. However, in paying the higher costs associated with these types of life insurance policies, opportunity costs must be considered.

Decreasing Term

Decreasing term is a type of term life insurance that provides coverage that decreases over the life of the policy to meet a decreasing obligation.

The ongoing and systematic decreases in coverage traditionally take place on an annual basis with premiums typically remaining level for the length of the term life insurance policy.

These types of life insurance policies are ideal for individuals having a need for life insurance protection that will systematically decrease over time. Typical uses for decreasing term policies include mortgage protection, coverage for personal or business loans, and protection for other decreasing obligations. In the current marketplace, decreasing term policies are not as popular as they have been in years past, given the flexibility and affordability of modern level term products.

Recommended Term Companies

Most companies in the marketplace offer multiple term life insurance policy options. The following companies are recommended in our experience based on company ratings, underwriting standards, premium rates, customer service, and other relevant factors.

Permanent Life Insurance

Permanent life insurance is intended to be permanent in nature, as the name suggests, providing coverage throughout an insured’s entire lifetime. Another common feature associated with permanent life insurance policies is that cash accumulation values typically grow within the policy on a tax-deferred basis. There are numerous policy options when considering permanent life insurance, each having a variety of features and benefits. An overview of common permanent life options has been provided below for review.

Whole Life

Whole life, or ordinary life, is a type of permanent life insurance that provides guaranteed lifetime coverage in exchange for either a single premium or fixed periodic premiums.

These periodic premiums are traditionally paid monthly or annually and can remain level for the life of the policy.

As is common with many permanent life insurance policies, whole life builds cash accumulation value through the payment of premiums and interest credited. These cash values may be accessed by the policy owner through withdrawals or loans. Cash accumulation value is an available living benefit associated with permanent life insurance. Whole life policies may be either participating or non-participating depending on the insurance company. Participating policies often pay dividends to policyholders if the insurance company is sufficiently profitable. Additionally, policy dividends are normally not taxable since they are technically considered a return of premiums paid.

These types of life insurance policies are best suited for those having a long-term need for life insurance coverage and a desire for strong death benefit and premium guarantees. Many policy owners consider whole life coverage the cornerstone of their financial plan, providing long-term life insurance protection and accumulating cash value for future financial needs. Smaller whole life policies are also commonly used for final expenses or burial coverage. The required premiums associated with whole life policies are traditionally higher than term life and many other permanent life insurance policies, but whole life plans offer substantial lifetime guarantees not available with other policies.

Universal Life

Universal life is a type of permanent life insurance that offers significant flexibility related to premiums and other elements of the policy.

These plans incorporate the low-cost protection associated with term life and the cash accumulation values available with permanent plans.

Essentially, premiums and interest paid contribute to the policy’s cash value, while administrative and cost of insurance charges are deducted. As long as these charges are covered, the policy will remain in force. However, if adequate premiums are not paid or cash value is not available to cover expenses the policy will lapse. The cash accumulation value within a universal life policy may be accessed by the policy owner through withdrawals and/or policy loans like other permanent life insurance policies. Based on the flexible structure of a universal life policy, excess premiums may be contributed to the cash value, subject to regulatory guidelines.

Given this feature, universal life insurance policies are often utilized to accumulate cash value to pay off mortgages, supplement retirement savings, and support other long-term financial objectives. Since cash values accessed through policy loans are not considered taxable income, this can be an extremely effective strategy. These types of life insurance policies are best suited for those having a need for flexible life insurance coverage and a desire to accumulate cash value. Minimum premiums associated with universal life policies can be significantly lower than other types of permanent life insurance. However care must be taken to ensure that adequate premiums are paid to keep the policy in force. The primary benefit of universal life insurance is the flexibility afforded the policy owner related to premiums, death benefit, cash value, and other elements of the policy.

Guaranteed Universal Life

Guaranteed universal life is a variation of universal life insurance, which guarantees that the policy will remain in force for the insured’s lifetime provided the specified premiums are paid.

Premiums for these guaranteed policies are calculated based on the minimum required to maintain lifetime coverage.

Given this design, these types of life insurance policies are often the most cost-effective way to obtain guaranteed lifetime coverage. Since these policies are designed primarily to provide a guaranteed lifetime death benefit at the lowest possible premiums, cash value accumulation may be minimal depending on the policy selected. It is also extremely important to ensure that the specified premiums are paid as required, otherwise the guarantee feature may be forfeited.

These types of life insurance policies are ideal for individuals who need lifetime coverage at the lowest possible price, and are not necessarily concerned with cash value accumulation. Sometimes referred to as “lifetime term,” guaranteed universal life is often used for coverage needs similar to term life such as income replacement, mortgage protection, college planning, and other obligations when the insured has long-term coverage needs. The primary benefit associated with guaranteed universal life insurance is the ability to secure lifetime coverage at the lowest possible cost.

The following illustration provides sample premium rates for a guaranteed universal life policy on a 35-year-old male non-smoker qualifying for a Preferred Plus underwriting class.

Sample Rates

Guaranteed Universal Life to Age 100

Note: The rates illustrated above are for a 10, 20, and 30 year term life insurance policies on a 35-year-old male non-smoker qualifying for a Preferred Plus underwriting class.

Indexed Universal Life

Indexed universal life is a variation of universal life insurance which credits interest to cash values based on the performance of an equity index, such as the S&P 500.

These types policies will routinely base interest credited on the selected market index limited to a certain percentage or interest rate cap.

Indexed universal life policies often have a minimum guaranteed interest rate which provides protection during market downturns. Essentially, such policies allow policy owners to benefit indirectly from market gains while having the security of a guaranteed minimum interest rate. Like other universal life policies, these plans can be designed to provide guaranteed lifetime coverage provided sufficient premiums are paid.

These types of life insurance policies are best suited for policy owners who have a need for permanent life insurance coverage and want to participate indirectly in the upside potential of equity markets without the downside risk. The trade-off for this downside protection is the limiting percentage or cap placed on interest rates. The owner of an indexed universal life policy may not receive interest equal to market gains but is also not subject to market risks.

Given the long-term potential to accumulate significant cash values, IUL policies can be a great option when supplementing retirement savings. The primary benefit associated with indexed universal life insurance is the ability to indirectly participate in market gains without being exposed to market risk.

Variable Life

Variable life is a form of whole life insurance offering fixed premiums and the ability to invest cash accumulation values in equities (stocks and bonds), similar to mutual funds.

With these policies, investment gains or losses are directly linked to selected investments.

Variable life policies can provide a guaranteed minimum death benefit, which may potentially increase based on investment performance. Variable life policies offer fixed premiums, a guaranteed death benefit, and the ability to participate in equity investments. These types of life insurance policies are ideal for individuals who have a long-term need for life insurance coverage with fixed premiums and a guaranteed death benefit but also want to invest directly into equity investments. However, it is important to understand that cash values in a variable life policy are subject to gains or losses based on the performance of the underlying investments.

Variable Universal Life

Variable universal life is a form of universal life insurance offering flexible premiums, and like variable life, the ability to invest cash accumulation values in equity investments (stocks and bonds), similar to mutual funds.

With this type of policy, investment gains or losses are also directly linked to selected investments.

As securities, these policies fall under both federal securities and state insurance laws. Variable universal life policies provide flexible premiums, a guaranteed death benefit, and the ability to participate in equity investments. These types of life insurance policies are best suited for policy owners who have a long-term need for life insurance coverage with flexible premiums but also want to invest directly into equity investments. As with variable life, it is important to understand that cash values in a variable universal life policy are also subject to losses based on the performance of the underlying investments.

Recommended Permanent Companies

Most companies in the marketplace offer a variety of permanent life insurance policy options. The following companies are recommended in our experience based on company ratings, underwriting standards, premium rates, customer service, and other relevant factors.

Case Studies: Life Coverage

Case Study (Level Term Life)

Blake is a 32-year-old retail manager, and his wife Sarah is a 30-year-old registered nurse. The couple has two young children and have recently purchased their first home. Blake and Sarah both need a life insurance policy to provide mortgage protection in the event of an untimely death. Their primary objective is to ensure that the surviving spouse and children would be able to remain in the family home. After reviewing policy options, Blake and Sarah choose two $350,000 30-year level term policies for mortgage protection. Level term life insurance will meet the couple’s 30-year coverage need, with premiums being level for the duration.

Case Study (Guaranteed Universal Life)

Kendra is a 40-year-old single mother of a special needs child who will likely require care and support into adulthood. As the sole provider in her household, Kendra wants to ensure that her son will continue to be taken care of financially after her death. Given her circumstances, she essentially has a need for lifetime life insurance coverage but also wants the most economical plan possible. After speaking with an independent insurance agent, Kendra learns that a guaranteed universal life insurance policy would provide the lifetime coverage that she needs at a cost much lower than many other permanent plans. After analyzing her coverage needs, Kendra decides on a $1,000,000 guaranteed universal life policy. Guaranteed universal life insurance will meet Kendra's coverage needs providing long-term security for her son at the best possible level premium rates.

Conclusion

In conclusion, choosing the right life insurance policy is crucial for securing financial stability and peace of mind for your loved ones. Whether opting for the affordability of term life insurance or the lifelong benefits of permanent policies like whole life or universal life, each option offers unique advantages suited to different financial needs and goals. Understanding these distinctions empowers consumers to make informed decisions and long-term plans.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229, or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.