Understanding Required Minimum Distributions (RMDs)

Are you approaching retirement age? If so, it’s crucial to understand Required Minimum Distributions (RMDs) and how they can impact your retirement savings. In this article, we will demystify RMDs and provide you with the essential information you need to know.

RMDs are a requirement set by the Internal Revenue Service (IRS) that states individuals with certain retirement accounts, such as Traditional IRAs and 401(k)s, must withdraw a minimum amount each year once they reach a specific age. Failure to comply with this requirement can result in significant penalties.

Understanding the RMD rules and calculations can be challenging for many individuals, but we’re here to break it down for you. We’ll explain who is subject to RMDs, how to calculate your distributions, and what options you have regarding the funds.

By the end of this article, you’ll have a clear understanding of RMDs, enabling you to make informed decisions about managing and withdrawing your retirement savings.

What are Required Minimum Distributions?

Required Minimum Distributions (RMDs) are a requirement set by the Internal Revenue Service (IRS) that states individuals with certain retirement accounts, such as Traditional IRAs and 401(k)s, must withdraw a minimum amount each year once they reach a specific age. These distributions ensure that individuals do not indefinitely defer paying taxes on their retirement savings. Failure to comply with this requirement can result in significant penalties. The following is a list of different types of retirement plans the require RMDs.

- Traditional IRAs

- SEP IRAs

- 401(k) plans

- 403(b) plans

- 457(b) plans

- Profit Sharing plans

- Other defined contribution plans

Understanding the RMD rules and calculations can be challenging for many individuals, but we’re here to break it down for you. Let’s dive into the specifics of RMDs and how they work.

Importance of Understanding RMDs

RMDs are important because they determine the minimum amount you must withdraw from your retirement accounts each year to avoid penalties. These distributions are necessary because the IRS wants to ensure that individuals begin to spend their retirement savings and pay taxes on any pre-tax contributions or earnings.

By requiring individuals to take distributions, the IRS can generate tax revenue. Additionally, RMDs help to prevent individuals from excessively deferring taxes on their retirement savings, ensuring a steady stream of tax payments as they withdraw funds.

RMD Related Rules and Regulations

To understand RMDs fully, it’s essential to be aware of the rules and regulations that govern them. The following are some key aspects of RMDs:

Age requirement: RMDs generally begin at age 72 for individuals born after June 30, 1949. However, if you turned 70½ before January 1, 2020, you fall under the previous RMD rules and must start taking distributions at age 70½.

Eligible retirement accounts: RMDs apply to certain retirement accounts, including Traditional IRAs, SEP IRAs, SIMPLE IRAs, and employer-sponsored retirement plans like 401(k)s, 403(b)s, and 457(b)s.

Distribution deadline: RMDs must be taken by December 31st of each year, except for the year you turn 72 (or 70½ under the previous rules). For the initial RMD, you have until April 1st of the following year to make the distribution.

RMD calculation: The amount of your RMD is determined by dividing the balance of your eligible retirement account(s) as of December 31st of the previous year by your life expectancy factor, which is based on IRS tables.

Calculating Required Minimum Distributions

Calculating your RMD accurately is vital to ensure compliance with IRS regulations and avoid penalties. Here’s a step-by-step process for calculating your RMD:

Step 1: Determine your eligible retirement accounts: Identify all the retirement accounts subject to RMDs, including Traditional IRAs, SEP IRAs, SIMPLE IRAs, and employer-sponsored retirement plans.

Step 2: Obtain your previous year-end balances: Gather the account balances of your eligible retirement accounts as of December 31st of the previous year.

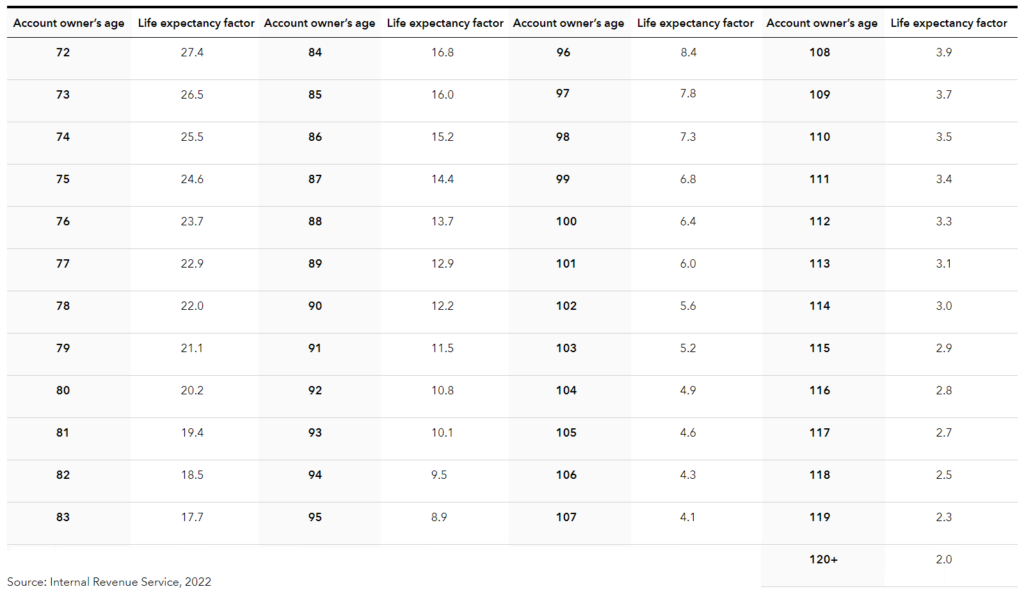

Step 3: Determine your life expectancy factor: Consult the appropriate IRS life expectancy tables to find your life expectancy factor based on your age and marital status.

Step 4: Calculate your RMD: Divide the total balance of your eligible retirement accounts by your life expectancy factor to determine your RMD.

The following table is an example of the IRS life expectancy tables in use at the time of publication. Please review IRS guidelines as appropriate in making individual calculations.

It’s crucial to note that failing to take the correct distribution amount can result in a steep penalty of 50% of the amount not withdrawn. Therefore, it’s essential to accurately calculate your RMD each year.

As an example, Madison is a retiree with a 401(k) from her previous employer, who turned 72 years old on April 30th of this year. Her 401(k) balance as of December 31st of last year was $1,000,000. To calculate her Required Minimum Distribution for this year she would divide $1,000,000 (account balance as of 12/31 last year) by her life expectancy factor of 26.5 (based on age this year). Therefore, Madison’s Required Minimum Distribution for this year would be $37,735.85.

Account Balance / Life Expectancy Factor = RMD

$1,000,000 / 26.5 = $37,735.85

Common Mistakes Associated with RMDs

When it comes to taking RMDs, there are some common mistakes that individuals make. Being aware of these pitfalls can help you avoid costly errors. Here are a few key mistakes to watch out for:

Forgetting to take the distribution: Missing the RMD deadline or failing to take the required distribution entirely can result in significant penalties. Stay organized and ensure you take your RMD each year before the deadline.

Calculating the RMD incorrectly: If you miscalculate your RMD amount, you may withdraw too little or too much, both of which can have adverse consequences. Take the time to accurately calculate your RMD or seek guidance from a financial advisor.

Not considering multiple accounts: If you have multiple eligible retirement accounts, ensure you calculate and take the appropriate RMD for each account. Each account has its own RMD calculation, and failing to comply with any one account can result in penalties.

Incorrect beneficiary designations: Failing to update beneficiary designations or not designating beneficiaries can complicate the RMD process for your heirs. Review and update your beneficiary designations regularly to ensure a smooth transition of your retirement assets.

By being aware of these common mistakes, you can navigate the RMD process with confidence and avoid unnecessary penalties.

Strategies for Maximizing RMD Funds

While RMDs may seem like a burden, there are strategies you can employ to maximize their benefits. Consider the following approaches to optimize your RMDs:

Reinvesting RMDs: If you don’t need the funds from your RMD for immediate expenses, consider reinvesting them in a taxable brokerage account or a Roth IRA. This strategy allows your RMDs to continue growing tax-free, providing additional income in the future.

Charitable contributions: If you’re philanthropically inclined, consider using your RMDs for charitable donations. Qualified charitable distributions (QCDs) allow individuals aged 70½ or older to donate up to $100,000 from their retirement accounts directly to eligible charities without including the distribution in their taxable income.

Strategic tax planning: Work with a financial advisor or tax professional to develop a tax-efficient withdrawal strategy. By carefully managing your RMDs alongside other sources of income, you may be able to minimize your overall tax burden.

By employing these strategies, you can make the most of your RMDs and potentially enhance your retirement income.

Reinvesting Required Minimum Distributions

When it comes to reinvesting your RMDs, you have several options to consider. Here are a few possibilities:

Taxable brokerage account: If you want to continue growing your RMDs, consider reinvesting them in a taxable brokerage account. This allows you to invest in a diverse range of assets, potentially generating additional income or capital appreciation.

Roth IRA: If you already have a Roth IRA or are eligible to contribute to one, consider converting your RMDs into Roth IRA contributions. Roth IRAs offer tax-free growth and tax-free withdrawals in retirement, providing a valuable source of tax-free income.

Health savings account (HSA): If you have a high-deductible health plan and an HSA, you can use your RMDs to fund your HSA contributions. HSA contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses.

By exploring these options, you can make strategic decisions about how to reinvest your RMDs to align with your financial goals and priorities.

Taxation of Required Minimum Distributions

RMDs have significant tax implications that must be considered. Here are a few key points to understand:

Taxable income: RMDs are generally considered taxable income and must be reported on your tax return. The amount of your RMD is added to your other sources of income, potentially increasing your tax liability.

Withholding taxes: Depending on your preference, you can opt to have taxes withheld from your RMD distributions. Consider consulting with a tax professional to determine the optimal withholding strategy for your situation.

State tax considerations: While RMDs are subject to federal income tax, state tax laws vary. Some states do not tax retirement income, while others do. Research the tax laws in your state of residence to understand the state tax implications of RMDs.

To navigate the tax implications of RMDs effectively, consult with a qualified tax professional who can provide personalized advice based on your unique circumstances.

Planning for Required Minimum Distributions

Planning for RMDs is essential to ensure a smooth transition into retirement. Here are a few steps to help you prepare:

Step 1: Understand your retirement accounts: Familiarize yourself with the retirement accounts subject to RMDs and their respective rules. Each account may have different RMD requirements and calculations.

Step 2: Estimate your future RMDs: Use online calculators or consult a financial advisor to estimate your future RMD amounts. This can help you anticipate and plan for your annual distributions.

Step 3: Consider tax-efficient strategies: Work with a financial advisor or tax professional to develop a tax-efficient withdrawal strategy. By optimizing your withdrawals, you can potentially minimize your tax liability and preserve more of your retirement savings.

Step 4: Review beneficiary designations: Regularly review and update your beneficiary designations to ensure your retirement assets are distributed according to your wishes.

By taking these steps, you can proactively plan for RMDs and ensure a smooth transition into retirement.

Conclusion

Required Minimum Distributions (RMDs) can seem complex and overwhelming, but with the right knowledge and strategies, you can navigate them successfully. By understanding the rules and calculations, avoiding common mistakes, and exploring reinvestment options, you can make the most of your RMDs and optimize your retirement income. Work with financial professionals to develop a personalized plan that aligns with your goals and priorities. With careful planning and informed decision-making, you can confidently manage your RMDs and enjoy a financially secure retirement.

Do you need a deferred or immediate annuity? Choicelifequote.com can assist in choosing the right type of annuity and the best insurance company for your situation. Give us a call at (800) 770-8229 or request more information today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for advice regarding your individual situation.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.