Life Insurance with Ulcerative Colitis | Key Considerations

Individuals with a history of ulcerative colitis frequently ask how this diagnosis can affect life insurance approval and premium rates. So, is it possible to get life insurance coverage with ulcerative colitis? These concerns are understandable given the potential severity of this condition and overall impact on health and longevity. The short answer is YES… It is often possible to get life insurance coverage with a history of ulcerative colitis.

This article discusses life insurance with ulcerative colitis, including an overview of how this condition may affect rates and policy approval, insurance company recommendations, and insider tips for applying for life insurance with medical conditions.

Understanding Ulcerative Colitis

Ulcerative Colitis is a type of inflammatory bowel disease, that affects the colon and rectum, causing symptoms that range from mild discomfort to severe complications.

Those living with UC experience periods of remission and flare-ups, during which symptoms such as abdominal pain, persistent diarrhea, chronic fatigue, and weight loss can severely disrupt daily life.

According to Health Central, approximately 10% of individuals with UC may develop serious complications after an initial attack, and potentially require hospitalization. Moreover, patients face an increased risk of colorectal cancer, particularly with longer disease duration and greater extent of inflammation. Given the unpredictable nature of UC, proactive disease management is crucial, especially when considering its implications for life insurance.

Life Insurance and Ulcerative Colitis

Insurers evaluate several key factors when assessing applications from individuals with UC. Your medical history, including the severity of your condition, frequency of flare-ups, and treatments received, plays a crucial role. Additionally, the stability of your condition, adherence to treatment plans, and any complications such as increased cancer risk or related disorders are considered in determining eligibility and premium rates.

Medical History: Insurers will review medical records to understand the severity of UC, including the flare-up frequency, treatments received, and any hospitalizations.

Current Health: Your current health status, medications, and ongoing treatments will be considered to gauge disease management and overall health.

Complications: Complications such as liver disorders, osteoporosis, or an increased risk of colorectal cancer associated with UC may impact eligibility and pricing.

Overall Stability: The stability of your condition, including the duration since diagnosis and adherence to treatment plans, plays a crucial role in the insurer's assessment.

Underwriting Questions for Ulcerative Colitis

Coverage Rates with Ulcerative Colitis

In reviewing a life insurance application and assessing coverage rates, insurers evaluate a range of factors to determine policy approval and appropriate premium rates.

For individuals with ulcerative colitis, this evaluation includes considerations such as age, gender, tobacco status, lifestyle choices, medical information related ulcerative colitis, and overall health in general.

When assessing life insurance rates, insurers evaluate a range of factors to determine premiums. For individuals with ulcerative colitis, this evaluation includes considerations such as age, gender, overall health, medical history, and lifestyle choices. The severity of ulcerative colitis symptoms, treatment regimen, and any related complications are pivotal in determining the underwriting class or category assigned to an applicant.

Like other conditions which can impact health and mortality, ulcerative colitis may result in increased premiums based on the assigned underwriting class. Typically, underwriting classes span from "Preferred Plus," representing the most favorable category, to higher-rated categories such as "Standard" or higher. For applicants with ulcerative colitis, the specific underwriting class will depend on factors like disease severity, treatment effectiveness, and overall health condition.

Possible Underwriting Classes

Sample Life Insurance Rates

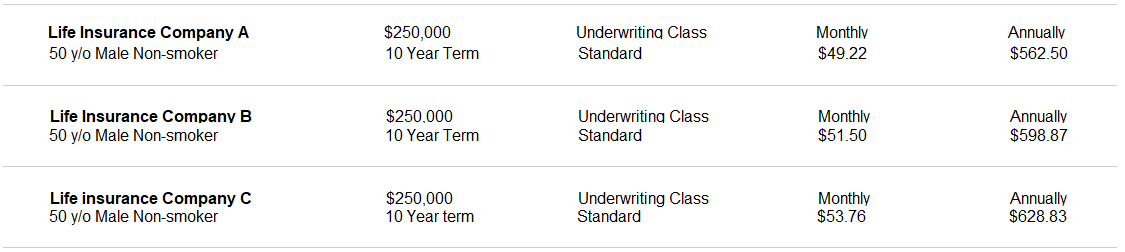

Sample Standard Rates

50 y/o Male Non-smoker

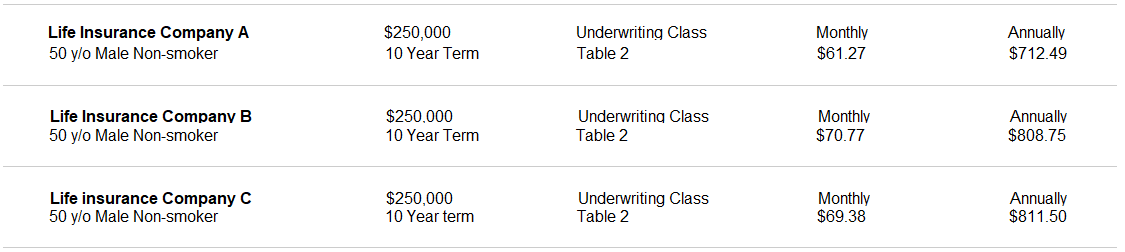

Sample Table 2 Rates

50 y/o Male Non-smoker

Best Companies for Ulcerative Colitis

In comparing life insurance companies for individuals with ulcerative colitis, it's crucial to consider insurers that are likely to approve applicants with this medical history. The type of policy being applied for can also influence underwriting standards. For instance, simplified issue or guaranteed issue policies may offer more lenient underwriting compared to fully underwritten policies.

Moreover, underwriting criteria can vary significantly between insurance companies. Therefore, it's advantageous to collaborate with an experienced independent agent who understands the nuances of different policies and the best companies for specific health conditions like ulcerative colitis. Based on industry knowledge and experience, the following companies are often recommended for individuals seeking life insurance coverage with ulcerative colitis:

These companies are known for their flexible underwriting policies and competitive offerings, making them viable options for applicants managing ulcerative colitis. Working with an independent agent can help navigate the complexities of underwriting and find the best coverage options tailored to individual health circumstances.

Case Study: Ulcerative Colitis

Case Study

Life Insurance with Ulcerative Colitis

Sarah, a 35-year-old marketing executive, and her spouse David, a freelance writer, have been considering their family’s financial security. They have two young children, Emma and Liam. Sarah was diagnosed with ulcerative colitis ten years ago and manages her condition with medication and regular medical check-ups.

After a detailed discussion with their agent and completing a comprehensive health assessment, Sarah and David decided to apply for a $500,000 30-year term life insurance policy. They were pleased to find out that Sarah’s ulcerative colitis did not disqualify her from coverage. Based on current health status and management of the condition, Sarah was approved at a standard rate for the policy.

This life insurance policy provides financial security for their children’s education and future financial needs. In the unfortunate event of Sarah's passing, the policy’s benefit would ensure that her family can maintain their current standard of living, remain in the family home, and cover future expenses.

Conclusion

Life insurance remains a critical financial tool for individuals managing health challenges like ulcerative colitis, ensuring financial security for loved ones in uncertain times. By understanding the insurance application process, advocating for your health management efforts, and exploring diverse coverage options, individuals with health concerns can often secure policies that provide peace of mind and protect their family's future.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.