Life Insurance with High Blood Pressure (Including FAQs)

In the United States, many Americans struggle with high blood pressure or hypertension, among other chronic conditions. As a common medical condition, we often do not consider the implications of getting life insurance with high blood pressure until applying for coverage. Hypertension can indeed impact insurance underwriting. Questions about qualifying for life insurance with high blood pressure or while taking blood pressure medication are common.

This article provides insight into life insurance with high blood pressure, including the process of getting life insurance coverage, hypertension treatment and medications, potential impact on premium rates, and applying for coverage with medical conditions.

Can I get life insurance with hypertension?

The short answer to this question is usually... YES. It is often possible to get affordable life insurance with high blood pressure or hypertension.

In fact, getting life insurance with a high blood pressure diagnosis can often be easier than you think with a little research and preparation.

Life Insurance with High Blood Pressure

In applying for life insurance with a history of high blood pressure, it is important to understand both your diagnosis and how this condition can potentially affect policy approval. According to Healthline, “high blood pressure, or hypertension, occurs when your blood pressure increases to unhealthy levels. Your blood pressure measurement takes into account how much blood is passing through your blood vessels and the amount of resistance the blood meets while the heart is pumping.” High blood pressure is traditionally classified as either primary or secondary hypertension. These classifications are essentially determined by the underlying cause of the condition.

Primary hypertension often develops slowly as an individual ages, and may be caused by genetics, lifestyle, weight, environment, and other factors.

Secondary hypertension occurs more rapidly, often being caused by medical issues such as kidney disease, respiratory issues, heart problems, drug or alcohol use, and other serious conditions.

Ultimately, your medical history and current condition will be used to determine coverage eligibility.

According to the CDC, "about 11 million U.S. adults with high blood pressure aren’t even aware they have it and are not receiving treatment."

Applying for Coverage with Hypertension

The fact that you are taking high blood pressure medication may or may not affect your life insurance application depending on level of control and other factors.

As part of the application, the life insurance company will review your high blood pressure medication and treatment history (except for certain non-medical policies).

In many instances, depending on the policy and insurance company, a physical exam may be required. The insurance company’s underwriting team may also review medical information bureau data, prescription records, and attending physician statements. So, the final decision will be based on more than just your prescribed medications. Life insurance companies will commonly ask for the following information related to high blood pressure.

Coverage Rates with High Blood Pressure

Life insurance rates with high blood pressure will be based on the information you provide related to your individual medical condition.

Even more importantly, the rates that you actually qualify for will result from consideration of your application, physical exam, medical records, and other health related considerations.

So, what is considered high blood pressure for life insurance? Though underwriting standards vary by insurer, the following provides an example of rate classes based on blood pressure readings. Please note that life insurance company underwriting makes the final decision regarding rates and/or policy approval.

Preferred Plus – Individuals age 0-60 with well-controlled high blood pressure and a reading of 135/85 or less, or those age 61+ with a reading of 140/85, may qualify for a preferred plus rate class.

Preferred – Individuals age 0-60 with well-controlled high blood pressure and a reading of 140/85 or less, or those age 61+ with a reading of 150/85, may qualify for a preferred rate class.

Standard Plus – Individuals age 0-60 with well-controlled high blood pressure and a reading of 145/88 or less, or those age 61+ with a reading of 155/88, may qualify for a standard plus rate class.

Standard – Individuals age 0-60 with controlled high blood pressure and a reading of greater than 145/88, or those age 61+ with a reading of greater than 155/88, may qualify for a standard rate class.

Substandard – Individuals with moderately or poorly controlled high blood pressure with reading greater than outlined above or associated complications may qualify for a substandard or rated underwriting class. This substandard or rated classification can increase rates significantly above standard.

Decline – Individuals with poorly or uncontrolled high blood pressure or associated complications may be declined for coverage. As previously mentioned, applicants decline for coverage based on high blood pressure or other medical conditions are often eligible for guaranteed issue policy options.

As an example of possible life insurance rates, the following illustration provides sample rates for a 10-year level term policy on a 50-year-old male non-smoker at the preferred plus and standard underwriting classes.

Sample Preferred Plus Rates

50 y/o Male - 10 Year Level Term

Note: The rates illustrate above are for a $250,000 10-year term life insurance policy on a 50-year-old male non-smoker qualifying for a Preferred Plus underwriting class.

Sample Standard Rates

50 y/o Male - 10 Year Level Term

Note: The rates illustrate above are for a $250,000 10-year term life insurance policy on a 50-year-old male non-smoker qualifying for a Preferred Plus underwriting class.

Best Life Companies for Hypertension

When shopping for life insurance with high blood pressure, it is important to select the right insurer. As previously discussed, each insurance company has slightly different underwriting standards related to hypertension and other medical conditions. In addition, some insurers will offer preferred rates to applicants taking blood pressure medication while others will not. Based on our experience, the following companies are great options for individuals with a history of high blood pressure.

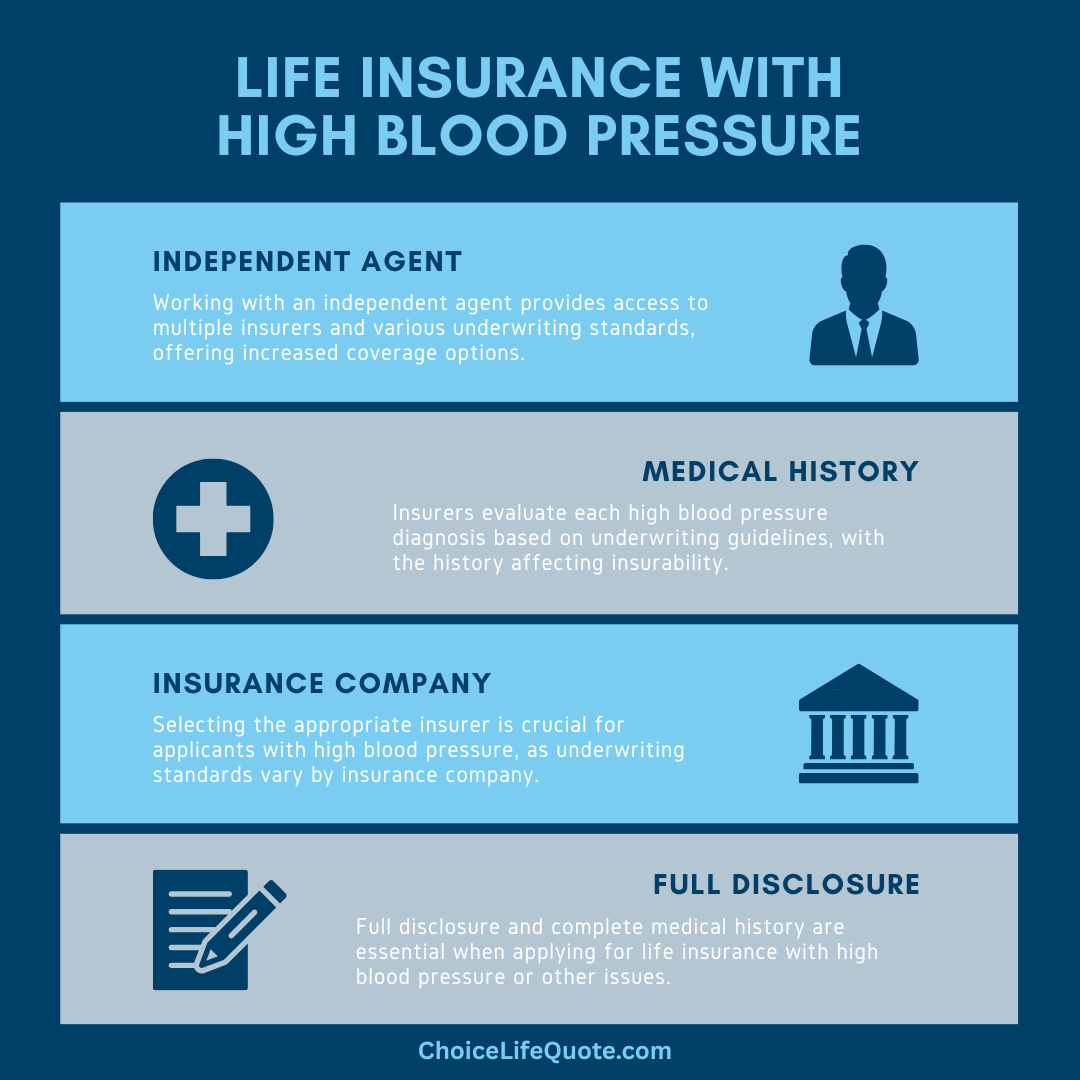

Ultimately, it is often possible to qualify for affordable life insurance with a history of high blood pressure. Working with an experienced independent agent can be extremely helpful in navigating the application and approval process.

Conclusion

In conclusion, obtaining life insurance with high blood pressure is feasible for many individuals, often requiring thorough understanding and preparation. While hypertension can impact premium rates and underwriting decisions, well-controlled conditions can lead to favorable outcomes. By providing comprehensive medical history, current treatment details, and collaborating with knowledgeable agents, applicants can navigate the process effectively. Whether qualifying for preferred rates or exploring guaranteed issue options, there are pathways to secure coverage that meets individual needs. Remember, selecting the right insurer with tailored underwriting standards can significantly influence the outcome, ensuring protection that aligns with health and financial goals.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.