Collateral Assignment of Life Insurance (Including Process)

In the world of personal finance, bank loans of one type or another are fairly routine. It is also common for business owners to borrow money when starting a new venture or funding the expansion of an existing enterprise. In securing such loans, lenders often require a life insurance policy on the borrower. Some business owners are unfamiliar with this requirement and may have a variety of questions, such as... What is a collateral assignment of life insurance? Is there a difference between absolute assignment vs. collateral assignment? Or... What is involved in the assignment of a life insurance policy?

This article provides insight related to the collateral assignment of life insurance, compares absolute and collateral assignment, and discusses the mechanics of the assignment process, as well as other important considerations.

Collateral Assignment of Life Insurance

In applying for personal or business loans, a borrower’s repayment capacity, credit history, collateral assets, and other factors are routinely evaluated by a prospective lender.

As part of the repayment consideration, the lender may require a life insurance policy on the borrower or other key principles as a condition of the loan.

This requirement is more common with business loans, such as U.S. Small Business Administration (SBA) loans, but may also apply to personal lending in certain circumstances. The type of arrangement is referred to as a collateral assignment and guarantees loan repayment in the event of a borrower’s untimely death. In this scenario, the policy owner is the assignor, and the lender requiring collateral assignment is the assignee.

According to the U.S. Small Business Administration, "lenders should require life or disability insurance where there is a concern over whether the business could survive in the absence of an individual."

In a collateral assignment, the insured borrower’s death benefit would be used to repay the outstanding loan amount, with any remaining benefit being paid to the policy’s listed beneficiaries. The life insurance policy used for collateral assignment may be either an existing policy or a new policy taken out specifically for this purpose.

Please note that a collateral assignment is preferred to simply listing the lender as a beneficiary on the policy since the outstanding loan amount usually decreases over time. Additionally, a collateral assignment will routinely terminate once the perspective loan balance has been paid in full.

Types of Life Insurance for Assignment

If a death benefit only is required by a lender, either type of life insurance (i.e., term or permanent) is normally acceptable for collateral assignment.

On the other hand, if the lender requires “collateral” as a condition of extending the loan, an adequately funded cash value policy or other assets as collateral may be required.

Additionally, either an existing policy that you own or a new policy purchased specifically for collateral assignment may be acceptable.

Term Life Insurance

In many instances, term life insurance is the most logical and economical type of policy for providing a lender-required death benefit. Additionally, if a new policy is being established to meet lender requirements, a policy term length can be selected, which coincides with the terms of the loan.

As an example, a 10-year term life insurance policy could be purchased and collaterally assigned to a 10-year loan. Since term life is “pure” protection and provides no cash value, this type of policy will likely meet collateral assignment requirements for a death benefit only. If a lender requires additional collateral as a condition of loan approval, an existing permanent policy with accumulated cash value may be preferred.

Permanent Life Insurance

A permanent life insurance policy may also be used for collateral assignment. In the case of a permanent life policy, the accumulated cash value may be assessed to repay any outstanding balance in the event of borrower default, as well as providing death benefit protection. On a positive note, this “collateral” may be helpful in qualifying for a loan but also limits the policy owner’s access to the cash value as long as there is an outstanding balance.

In either event, once the loan is paid off, collateral assignment restrictions to both the cash value and death benefit are removed. It is also important to note that the policy owner has a responsibility to ensure that a policy used for collateral assignment remains in force and that required premiums are paid.

Group Life Insurance

In some instances, an individual’s group life insurance (employee benefits) may be used for collateral assignment. This is not common but is offered by some insurance companies as an option for group policy members. If you are considering a collateral assignment of life insurance that is part of a group policy or employee benefits, you should contact your benefits administrator and/or issuing insurance company to determine availability.

Collateral Assignment vs. Policy Loans

In answering questions related to the collateral assignment of life insurance, we sometimes receive inquiries concerning how collateral assignment differs from a policy loan.

First off, a collateral assignment and a life insurance policy loan are completely different processes.

With a collateral assignment, a borrower’s life insurance policy death benefit or cash value may be used to repay the outstanding loan balance in the event of borrower death and/or default. In comparison, a life insurance policy loan involves borrowing money directly from the life insurance company using the accumulated cash value as collateral. If you own a permanent life insurance policy (i.e., whole life, universal life, variable life, etc.), and have adequate cash value, a policy loan may be a great option to consider.

In comparing loan options, it is important to consider interest rates, loan terms, and other factors. It is also important to note that with a policy loan, you will be charged interest on the amount borrowed, an unpaid loan may reduce the death benefit paid to beneficiaries, and a policy lapse can have significant tax implications. If you are considering taking out a policy loan on an existing life insurance policy, please consult insurance and tax professionals for advice specific to your individual situation.

Absolute vs. Collateral Assignment

Another question that we receive related to the assignment of life insurance policies involves the difference between an absolute assignment vs. a collateral assignment.

As the name implies, absolute assignment is exactly that, a complete assignment of all interest in a policy which may or may nor be in the best interest of the policy owner.

According to The Economic Times, "absolute assignment shifts the ownership of the insurance policy.” Also, assigning a bank as a beneficiary on a life insurance policy is another common mistake. Being named as the primary beneficiary gives the bank rights to the entire death benefit regardless of the current balance on any loan. Whereas, as discussed above, a collateral assignment only commits policy benefits for the term and/or outstanding balance of the loan. So, after the loan amount is paid, the remaining death benefit would go to the policy’s primary beneficiaries.

To reiterate, NEVER provide an absolute assignment or primary beneficiary designation to a lender if all that is required is collateral assignment.

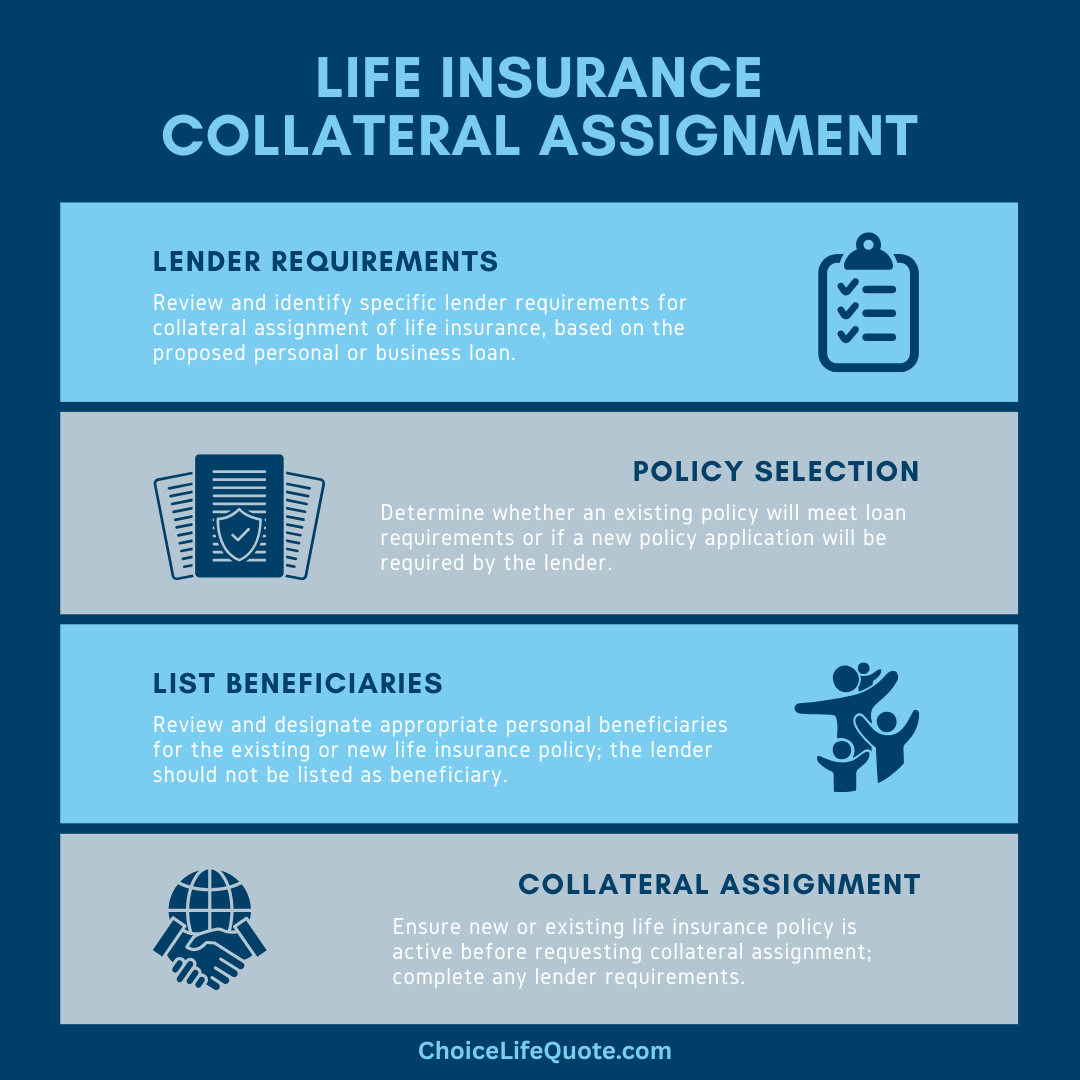

Process for Collateral Assignment

In completing a collateral assignment of life insurance, it is extremely important to follow the requirements of both the proposed lender and prospective insurance company.

The attention to detail through this process can help to ensure that the collateral assignment is accurately completed, meeting ender requirements.

Using an Existing Life Insurance Policy

If you are required to provide a collateral assignment for a loan and have an existing life insurance policy with an adequate face amount, you can reach out to the issuing insurance company’s policy service department to request collateral assignment instructions and any required forms. Most insurance companies allow collateral assignment of life insurance unless otherwise prohibited in the policy contract.

While the insurance company must be notified and will require certain paperwork to process the request, they are otherwise not involved in the loan process. When completing life insurance company collateral assignment forms, be prepared to provide detailed information related to both your existing policy and perspective loan.

Applying for a New Insurance Policy

If you require a collateral assignment for a loan and do not have an existing life insurance policy, you will need to apply for a new policy to meet the terms of your lender. Though the primary purpose of the new policy may be to satisfy lender requirements, it is always advised that you consider comprehensive coverage needs when applying for life insurance. As an example, you may choose to apply for a longer term policy that you plan to keep after the loan has been paid off for personal or business protection.

As with any purchase of life insurance, it is important to select the right type of policy, amount of coverage, and insurance company based on your individual situation. In naming beneficiaries on a life insurance policy purchased for collateral assignment, ensure to name personal beneficiaries (not the lender). This designation is extremely important since named beneficiaries will receive any death benefits above and beyond the outstanding loan amount.

Additionally, since life insurance policy approval may take anywhere from a few days for simplified issue (non-medical) products to up to 4 weeks or more for fully underwritten (requires medical exam) policies, the application and approval timeline should be taken into consideration. It is best to work with an experienced independent agent who can make appropriate recommendations and facilitate the application process. Once your new life insurance policy is approved and in force, you can initiate the collateral assignment process by reaching out to the insurer for instructions and required paperwork.

Key Steps in Collateral Assignment

The following are key steps in the collateral assignment process for most insurance companies and lending institutions. It is important to ensure that you follow the specific instructions provided by your individual insurance company. Additionally, consideration of the policy approval timeline is also advised since life insurance underwriting can take several weeks to complete.

Conclusion

In conclusion, understanding the intricacies of collateral assignment of life insurance is crucial for both personal finance and business ventures where loans are involved. This process not only ensures lenders are protected in case of borrower default but also guarantees that beneficiaries receive appropriate benefits. Differentiating between absolute and collateral assignment, as well as navigating the process of assigning a policy, provides clarity on how best to leverage life insurance as a financial tool. By following these procedures, borrowers can confidently meet lender requirements while safeguarding their financial future.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.