Understanding Court-Ordered Life Insurance in Divorce

A divorce can be a complex and emotionally challenging process, and one aspect that often gets overlooked is court-ordered life insurance. While it may not be the first thing that comes to mind when considering the division of assets, understanding court-ordered life insurance in divorce can be crucial for protecting the financial well-being of all parties involved.

This article provides insight into the intricacies of court-ordered life insurance in divorce, covering what you need to know in navigating this often-overlooked aspect of the process, whether you’re going through a divorce or simply considering the financial obligations.

Court-Ordered Life Insurance in Divorce

When going through a divorce, court-ordered life insurance routinely serves as a financial protection mechanism for both parties involved.

The life insurance policy ensures that in the event of the insured party’s death, the other party or parties named as beneficiaries will receive a predetermined amount of money in the form of the death benefit.

This can be particularly important when child custody and support are involved, as it helps guarantee financial stability for the children if the supporting parent passes away. Court-ordered life insurance also provides an added layer of security for any financial obligations, such as alimony or spousal support, that may be ordered by the court.

The importance of court-ordered life insurance lies in its ability to mitigate the financial risks associated with divorce. It helps protect the financial interests of all parties involved, providing peace of mind and ensuring that the financial obligations agreed upon in the divorce settlement can still be fulfilled, even in the event of the insured party’s death. By understanding the purpose and importance of court-ordered life insurance, individuals can make more informed decisions during divorce proceedings, safeguarding their financial future and that of their dependents.

How Court-Ordered Insurance Works

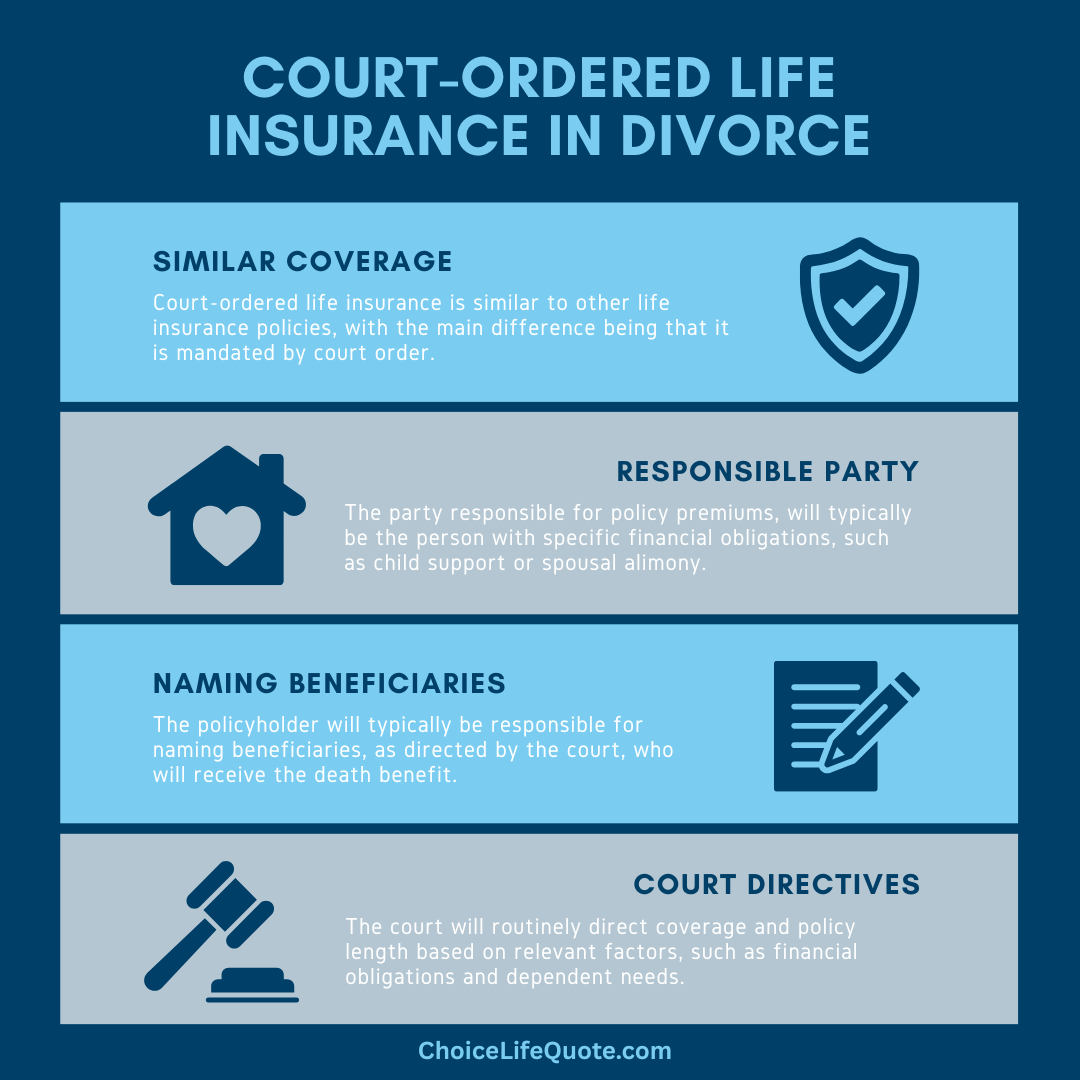

Court-ordered life insurance functions similarly to any other life insurance policy, with the main difference being that it is mandated by a court order as part of a divorce settlement. The policyholder—the party responsible for paying the premiums—will typically be the party with the financial obligations, such as child support or alimony. The policyholder will name one or more beneficiaries who will receive the death benefit in the event of their passing.

The court will determine the coverage amount based on factors such as the financial obligations involved, the income of the insured party, and the needs of the beneficiaries. The court may also specify the length of time for which the policy should be maintained, which is often until the financial obligations are fulfilled or until the children reach a certain age. It’s important to note that court-ordered life insurance policies are typically term policies, meaning they provide coverage for a specific period rather than the insured’s entire life.

To ensure compliance with the court order, the policyholder must pay the premiums on time and keep the policy in force. Failure to do so can result in legal consequences, including potentially being held in contempt of court. Understanding how court-ordered life insurance works is essential for both the policyholder and the beneficiaries, as it allows for proper planning and ensures the intended financial protection is in place.

Court-Ordered Coverage Obligations

When determining the need for court-ordered life insurance in a divorce settlement, several factors come into play. The court will take into account the financial obligations involved, such as child support or alimony, and the income of the party responsible for these obligations. The primary goal is to ensure that in the event of the supporting party’s death, the financial needs of the beneficiaries can still be met.

Additionally, the court will consider the age and needs of the beneficiaries, as well as any existing life insurance coverage already in place. If the insured party already has sufficient life insurance coverage to meet the financial obligations, the court may decide that court-ordered life insurance is unnecessary. However, if the existing coverage is deemed insufficient or non-existent, the court is likely to order the inclusion of court-ordered life insurance as part of the settlement.

It’s important for individuals going through a divorce to be transparent about their financial situation and existing life insurance coverage to ensure the court can make an informed decision regarding the need for life insurance. By considering these factors, the court can ensure that the financial well-being of all parties involved is adequately protected.

Types of Life Insurance Policies

When it comes to court-ordered life insurance, there are generally two types of policies that may be ordered by the court: term life insurance and whole life insurance.

Term life insurance is the most common type of court-ordered life insurance policy. It provides coverage for a specified period, typically ranging from 10 to 30 years. Term life insurance policies are often more affordable compared to whole life insurance policies, making them a popular choice in divorce settlements. The coverage amount and duration of the policy are determined by the court based on the financial obligations.

Whole life insurance, on the other hand, provides coverage for the insured’s entire life. It also includes a cash value component that accumulates over time. While whole life insurance offers lifelong coverage and a cash value component, it is generally more expensive than term life insurance. As a result, whole life insurance is less commonly ordered in divorce settlements unless there are specific circumstances that warrant its inclusion.

The type of court-ordered life insurance policy ordered by the court will depend on various factors, including the financial obligations, the income of the insured party, and the needs of the beneficiaries. By understanding the different types of policies available, individuals can better navigate the court-ordered life insurance process during divorce proceedings.

Beneficiaries in Court-Ordered Life

In court-ordered life insurance, the listed listed beneficiary plays a crucial role in ensuring that the intended financial protection is received in the event of the insured’s death.

The beneficiary is the individual or entity named to receive the death benefit, and in the case of court-ordered life insurance typically to provide for the children.

In court-ordered life insurance, the beneficiary plays a crucial role in ensuring that the intended financial protection is received in the event of the insured party’s death. The beneficiary is the individual or entity named by the policyholder to receive the death benefit. In divorce cases, the beneficiary is often the ex-spouse or children of the insured party, depending on the financial obligations and custody arrangements.

It’s essential for both the policyholder and the beneficiary to communicate openly and clearly regarding the court-ordered life insurance policy. The beneficiary should be aware of the policy’s existence and how to access the necessary information in the event of the insured party’s passing. Likewise, the policyholder should inform the beneficiary of any changes to the policy, such as a change in coverage amount or a change in beneficiary designation.

By maintaining open lines of communication and ensuring the beneficiary’s understanding of the court-ordered life insurance policy, both parties can work together to ensure the intended financial protection is in place. This collaboration is especially important in cases involving minor children, as it allows for proper planning and ensures the financial well-being of the children in the event of the supporting parent’s death.

Obtaining Court-Ordered Life Insurance

Obtaining court-ordered life insurance typically involves several steps to ensure compliance with the court order. The process may vary depending on the jurisdiction and the specific requirements of the court, but it generally follows a similar structure.

- First, the court will issue an order specifying the need for court-ordered life insurance and the details of the policy, such as the coverage amount and duration. This order will typically be included in the divorce decree or settlement agreement.

- Next, the policyholder—the party responsible for paying the premiums—will need to research and select an appropriate life insurance provider. It’s important to choose a reputable insurer that offers the desired coverage amount and policy duration.

- Once a provider has been selected, the policyholder will need to apply for the court-ordered life insurance policy. This typically involves filling out an application, providing any required documentation, and undergoing any necessary medical examinations or underwriting processes.

- Upon approval, the policyholder will receive the policy documents and must make the necessary premium payments to keep the policy in force. It’s important to ensure timely premium payments to avoid any legal consequences or policy lapses.

The beneficiary should be aware of the policy’s existence and how to access the necessary information in the event of the insured party’s passing. By following the necessary steps and maintaining open lines of communication, individuals can navigate the process of obtaining court-ordered life insurance in divorce smoothly and ensure compliance with the court order.

Considerations in Court-Ordered Life

While court-ordered life insurance serves an important purpose in divorce settlements, there can be various challenges and considerations to keep in mind. One challenge is affordability. Depending on the coverage amount and duration determined by the court, the premiums for the court-ordered life insurance policy can be significant. This can pose a financial burden for the policyholder, especially if they are already facing other financial obligations resulting from the divorce.

Another consideration is the potential for changes in circumstances. Life is unpredictable, and circumstances can change over time. It’s important to regularly review the court-ordered life insurance policy to ensure it still aligns with the financial needs and obligations. If changes are necessary, it may require seeking a modification from the court.

Additionally, it’s crucial to understand the limitations of court-ordered life insurance. While it provides financial protection in the event of the insured party’s death, it does not cover other potential risks, such as disability or critical illness. Individuals may need to explore additional insurance options to address these risks adequately.

By being aware of these considerations, individuals can approach court-ordered life insurance in divorce with a realistic understanding of its limitations and plan accordingly.

Conclusion

In conclusion, court-ordered life insurance in divorce is essential for protecting the financial well-being of all parties involved. It serves as a crucial tool for ensuring that financial obligations are met, especially in cases involving child custody and support. By understanding the purpose and significance of court-ordered life insurance, individuals can make informed decisions during divorce proceedings and safeguard their financial future. Remember, divorce is a complex and emotionally challenging process, and court-ordered life insurance is just one aspect to consider. It’s important to seek guidance from legal and financial professionals who can provide personalized advice based on your unique situation.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your individual situation. Get quality coverage at affordable rates. Give us a call at (800) 770-8229, or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.