How to Find a Lost Life Insurance Policy

The death of a loved one can be extremely difficult from an emotional standpoint but also presents certain financial and logistical challenges. It is often the responsibility of surviving family members to make final arrangements and settle the decedent’s estate, which includes life insurance. Given these often unexpected responsibilities, it is understandable that family members may have challenges in determining how to find out if a life insurance policy exists.

This article provides insight into how to find a lost insurance policy, including actionable recommendations, online search information, policy locator resources, and other valuable information that can help in the search for a policy.

How to Find a Lost Life Insurance Policy

The days, weeks, and months after the death of a cherished loved one can be an extremely challenging and emotional time for family, friends, and others left behind.

In addition to the understandable grief experienced, there are also a seemingly overwhelming number of decisions and responsibilities for the person designated to settle the decedent’s personal affairs.

As a part of settling the estate, it is important to determine whether there were any active life insurance policies in force. This may sound simple but can be quite difficult if no one is aware of the policy or there are no obvious policy documents. Adding to this challenge is the fact that there is no comprehensive database of in force life insurance contracts. The following tips are intended to be helpful pointers in how to find out if a life insurance policy exists. As a disclaimer, the information presented is intended for individual(s) designated as executors, administrators, beneficiaries, or others legally authorized to policy information.

Search for Life Insurance Documents

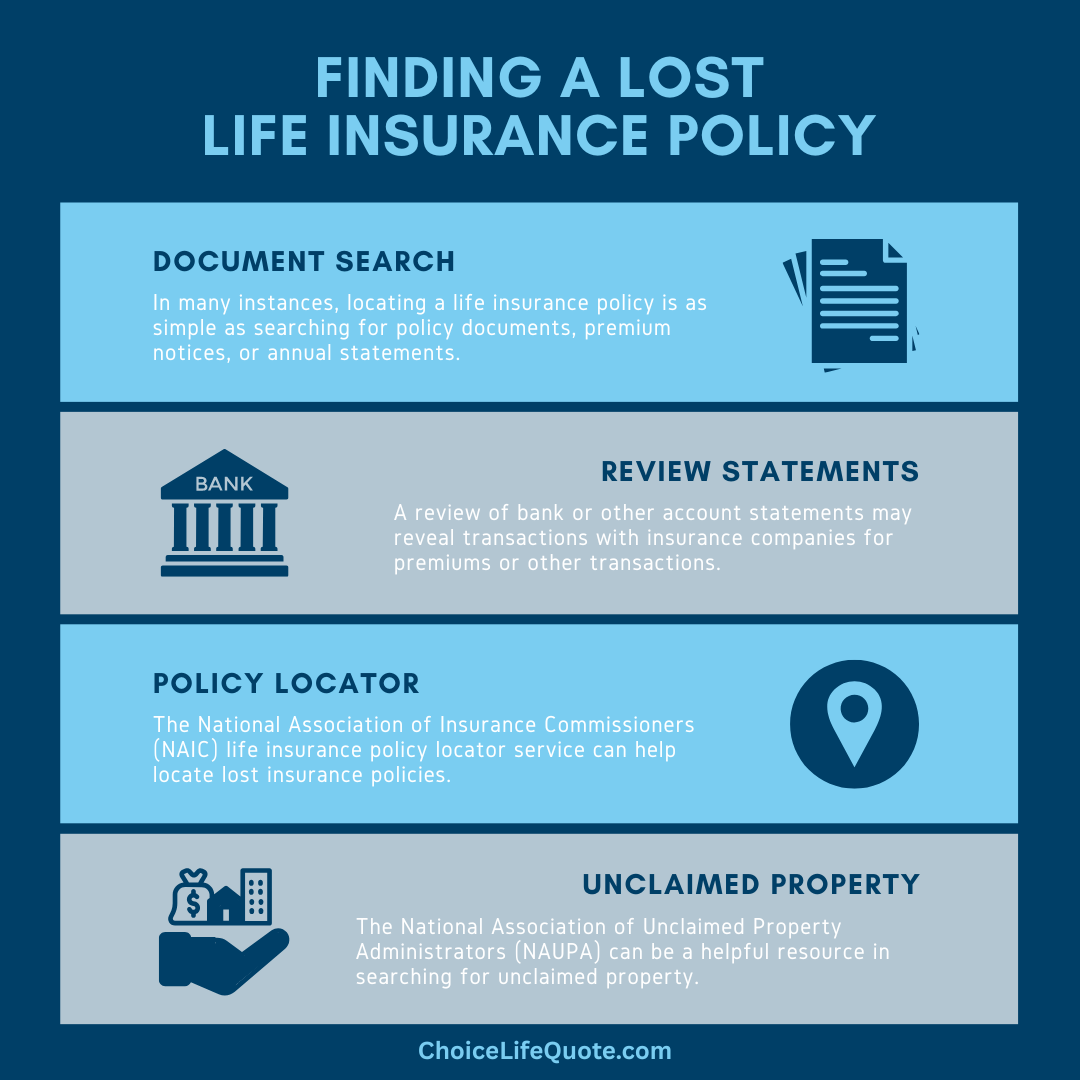

In many instances, locating a life insurance policy is as simple as searching for policy contracts, premium notices, payment receipts, or annual statements.

Given the importance of policy documents, individuals often place them in personal files, lockboxes, or safety deposit boxes.

In addition to physical storage locations, you should check digital storage files, such as computer hard drives and cloud-based storage accounts. It can also be a good idea to check both the decedent’s regular mail and email for several months after their passing since insurance companies often provide annual policy statements and other documents.

Review Financial Institution Statements

It is said that you can learn a lot about a person by how they spend their money.

This sage adage also holds true when searching for a deceased loved one’s life insurance policy. Their bank statements can help to highlight insurance policies or other financial accounts

A quick review of their bank, brokerage, and other account statements may reveal payments to insurance companies for premiums or dividend deposits, policy loans, or other payments. If you identify payment or deposit activity from a life insurance company, this may indicate the existence of an active life insurance or annuity policy. Additionally, it may be beneficial to reach out directly to financial institutions where your loved one did business to inquire about life insurance coverage associated with their account. In many instances, institutions offer complimentary or low-cost coverage to savings, checking, or credit card holders. The Bank Branch Locator is a free resource that can help in locating national and regional banks.

Contact Insurance and other Advisors

In reaching out to financial services providers, it makes sense to first contact the decedent’s insurance agent to inquire about any in force life insurance policies.

This outreach should also include contacting auto and homeowner’s insurance agents to inquire about possible supplemental life insurance policies that may exist.

With that said, the process of planning for an individual’s financial security rarely happens in a vacuum. In other words, there are often a number of financial, legal, and other professionals involved or at least consulted. Current or previous accountants, attorneys, financial planners, or other service providers may be able to assist in determining how to find out if a life insurance policy exists. In order to identify and locate these professionals, please refer to the information provided above related to searching personal effects for evidence of service providers. Also, the Financial Industry Regulatory Authority (FINRA) BrokerCheck may be used to research financial brokers and advisors, while the American Bar Association’s (ABA) Lawyer Licensing site is a great resource for locating licensed attorneys.

Review Employer and Association Benefits

Insurance and other benefits are often associated with an individual’s employment or membership in certain civic or professional organizations.

It is common for a company’s employees, or an association’s members, to receive complimentary or low-cost life insurance.

In many instances, employees may have purchased supplemental coverage or signed up for survivor benefit plans such as those available to military retirees. For this reason, it is important to contact the decedent’s current or previous employers, unions, professional associations, membership organizations, or other groups with which they may have been involved. Also, if the decedent was married, it is a good idea to reach out to the spouse’s current or former employer to inquire as to whether spousal coverage was in force. To aid in your search, The Department of Labor’s Professional Association Finder is a great resource for locating professional associations, while the Internal Revenue Services’ Tax Exempt Organization Search can be helpful in identifying non-profit membership organizations.

Search NAIC Life Insurance Policy Locator

As previously mentioned, there is no comprehensive database containing information on all life insurance policies.

However, the National Association of Insurance Commissioners (NAIC) has a Life Insurance Policy Locator Service to assist in locating insurance and annuity contracts.

When a policy locator request is initiated, the NAIC will forward your inquiry to participating life insurance companies nationwide, who will, in turn, search policy records for an active contract in the name of the decedent. This process can take up to 90 business days, and you will only receive a response if a participating insurance company locates a policy. Though participation in this service is voluntary for insurance companies, many insurers are more than willing to assist possible beneficiaries in their search. There are also a number of state insurance departments that offer free policy search services to individuals looking for a decedent’s life insurance contract. Contact information for insurance departments in all 50 states can be obtained through the NAIC’s Map of States and Jurisdictions.

Order MIB Policy Locator Service Report

The Medical Information Bureau (MIB) underwriting service is a resource used by many modern life and health insurance companies as an integral part of the underwriting process.

Though no comprehensive list of active life insurance policies exists, there is a database of all applications processed since 1996.

However, unlike the free NAIC policy search, the MIB Policy Locator Service charges a fee. According to the MIB website, “executors or administrators of a decedent's estate are permitted to order a report of life insurance application activity. If no executor or administrator has been appointed, then a surviving spouse or the decedent's closest surviving relative may request an MIB Policy Locator Service report.” It is important for consumers to note that the majority of MEB Policy Locator Service searches produce no actionable results.

Search Unclaimed Property Associations

Last on our list, but definitely not to be discounted, is contacting the National Association of Unclaimed Property Administrators (NAUPA) to inquire about the possible existence of unclaimed property.

The NAUPA facilitates the sharing of information among State Treasurers.

This state-wide search attempts to connect unclaimed property with its rightful owner. If an insured individual passes away and the insurance company is unable to locate policy beneficiaries, the death benefit is ultimately transferred to the state as unclaimed property. A quick search using the NAUPA endorsed website MissingMoney.com may help in identifying an otherwise lost life insurance policy. As a side note, a search for unclaimed property is not only useful in how to find a life insurance policy exists but also for any other unclaimed property. In doing research for this article, I actually found unclaimed property in three states worth a few hundred dollars for myself and two other family members. So, I highly recommend a quick search. Best of luck!

Conclusion

In conclusion, navigating the aftermath of a loved one's passing involves emotional and practical challenges, including the search for a potentially lost life insurance policy. This process can be daunting without clear guidance, given the absence of a centralized database for policies. However, by employing the strategies outlined, searching personal documents, consulting financial institutions, contacting relevant advisors, exploring employer benefits, utilizing specialized locator services, and checking unclaimed property databases families can significantly improve their chances of locating any existing policies.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.