Life Insurance with Accelerated Benefits

In considering the purchase of life insurance, the policy death benefit is routinely a primary concern. This death benefit provides a tax-free payment to beneficiaries in the event of an insured's passing. However, families often experience unexpected circumstances that may not necessarily involve the death of a loved one, but still present financial challenges. Common questions often include... Can I use my life insurance benefits while I am still alive? Or, does life insurance pay in the event of a terminal, critical, or chronic illness?

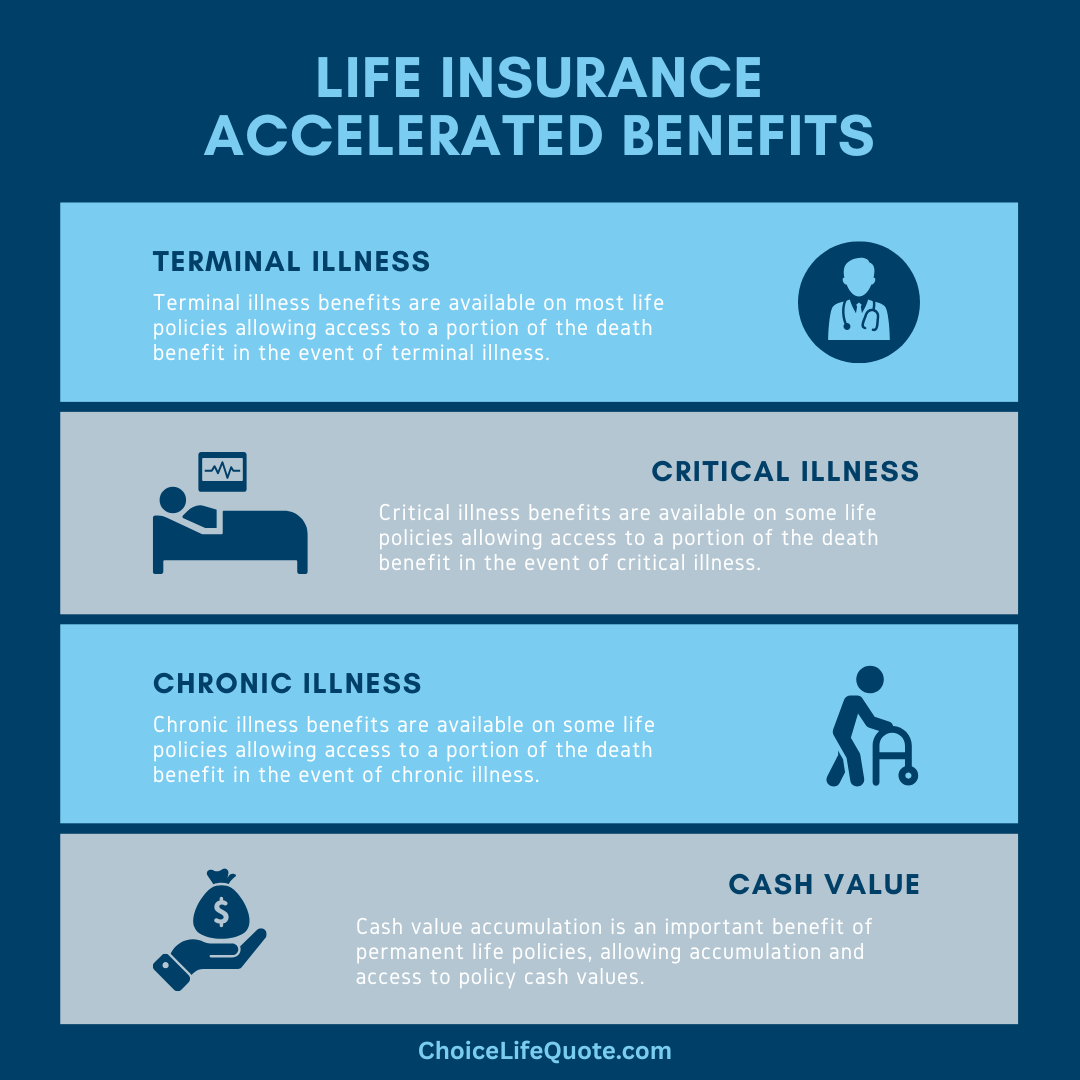

This article discusses life insurance accelerated benefits, providing valuable insight into the various accelerated or living benefits associated with modern life insurance policies, such as critical, chronic, or terminal illness benefits.

Life Insurance Death Benefit

The primary purpose of life insurance is to provide financial protection for a policyholder's loved ones in the event of an unexpected death.

There are essentially two different types of life insurance, term life insurance and permanent life insurance. Term life provides coverage for a specific period of time, or term, typically 10, 20, or 30 years.

While, permanent life insurance, such as whole life or universal life, provides lifelong coverage and also routinely includes a cash value, or savings, component.

One of the most common reasons for purchasing life insurance is to replace income in the event of a bread winner’s premature death. This can help to pay expenses such as mortgage payments, outstanding debts, living expenses, funeral costs, and others. In addition to the life insurance death benefit, there are also a number of potential accelerated benefits that can be associated with modern life insurance policies.

Life Insurance Accelerated Benefits

Life insurance accelerated benefits are a type of living benefits that allow policyholders to access a portion of the policy death benefit while they are still alive in the event of certain illnesses or conditions.

These accelerated benefits are available with some life insurance policies and are designed to provide financial support in the case of a variety of circumstances.

In instances of terminal illness, critical illness, or chronic illness can provide significant resources for families. These benefits can help policyholders pay for medical expenses, living expenses, and other costs associated with their illness. It's important to note that accelerated benefits are not available on all insurance policies and also typically reduce the death benefit of the policy, so policyholders should consider these options carefully.

Terminal Illness Benefits

Terminal illness benefits are available in most life insurance policies and allow policyholders to access a portion of the death benefit early if they are diagnosed with a terminal illness, typically with a life expectancy of less than 12 months.

This policy benefit can provide financial support to help pay for medical expenses or other needs during the policyholder's final months.

Critical Illness Benefits

Critical illness benefits are available on some life insurance policies and can provide financial support to policyholders who are diagnosed with a specified critical illness, such as a heart attack, stroke, or cancer.

This policy benefit can be used to pay for medical expenses or other needs related to the policyholder’s critical illness.

Chronic Illness Benefits

Chronic illness benefits are available on some life insurance policies and can provide financial support to policyholders who are unable to perform two or more activities of daily living, such as bathing, dressing, or eating.

This policy benefit can be used to pay for in-home care or other expenses related to the policyholder's chronic illness.

Case Studies: Accelerated Benefits

Terminal Illness Case Study

Tyler is a 55-year-old man who was diagnosed with terminal lung cancer. His doctor has given him a life expectancy of less than 12 months. Tyler has a $500,000 universal life insurance policy that he purchased several years ago.

Faced with the overwhelming expenses associated with his illness, Tyler decided to explore the possibility of accessing his life insurance death benefit while he is still alive. After speaking with his insurance agent, he learned that his policy includes a terminal illness benefit.

This benefit allows him to access a portion of his death benefit, in this case 75%, while he is still alive. Tyler decided to take advantage of this benefit and requested a lump sum payment of $375,000. The insurance company processed his request and issued the payment within a few weeks.

Tyler used the money to pay for his medical expenses, including chemotherapy and radiation treatments. He also used some of the funds to pay for home modifications to make his home more comfortable during his illness.

Tyler was glad that he had made the decision to take the terminal illness benefit, it helped him and his family to have a sense of security during difficult times. He was able to focus on his health and spend his remaining time with his loved ones.

It's important to note that in this case the payment of a terminal illness benefit reduced the death benefit of the policy from $500,000 to $125,000. Policyholders should consider the decision carefully and consult with their insurance agent and financial advisor to understand the terms and conditions of these benefits and how they will impact their overall financial plan.

Critical Illness Case Study

Brian and Jennifer are a young couple with two small children. They have a combined household income of $100,000 and are new homeowners with a mortgage. They are both young and healthy but do have a family history of cancer.

The couple spoke with a life insurance agent to discuss options for protecting their family income in the event of an unexpected death or critical illness. After reviewing their family’s financial situation, the agent recommended that Brian and Jennifer purchase term life insurance policies with living benefits which include terminal, critical, and chronic illness.

They each purchased a $250,000 term life insurance policy with living benefits as recommended. These living benefits provide immediate financial piece of mind for the young couple given their family medical histories.

Five years later, Jennifer was diagnosed with breast cancer and had to take an extended leave of absence from her work for medical treatment. The household and medical bills started piling up and the family was struggling to make ends meet each month.

The couple contacted their life insurance agent to inquire about the policy’s living benefits. The critical illness component of Jennifer’s life insurance policy allowed her to access a portion of her death benefit, in this case 50%, while she is still alive.

This money was a significant help to the family during this difficult time. They were able to cover medical bills, make mortgage payments, and cover living expenses.

Jennifer’s life insurance policy, with a critical illness benefit, proved to be a lifesaver during her cancer diagnosis and treatment. The benefit payment allowed the couple to focus on Jennifer’s recovery without worrying about the family finances. She was able to take the time that she needed to successfully recover.

It's important to note that in this case the payment of the critical illness benefit reduced the death benefit of the policy from $250,000 to $125,000. Again, policyholders should consider the decision carefully and consult with their insurance agent and financial advisor to understand the terms and conditions of these benefits and how they will impact their overall financial plan.

Conclusion

In conclusion, life insurance accelerated benefits can offer valuable financial support to policyholders facing serious illnesses or other unexpected life events. These valuable policy options can provide policyholders with access to terminal illness benefits, critical illness benefits, and chronic illness benefits while they are still alive. It is important to work with an experienced insurance professional when considering a life insurance purchase to ensure that the policy and associated benefits meet your individual objectives.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.