Life Insurance and Suicide | Important Considerations

We occasionally receive questions from consumers related to life insurance and suicide. Does life insurance pay for suicidal death? Is it possible to get life insurance after a suicide attempt? These and other similar questions about life insurance and suicide are understandable given the complicated nature of policy contracts. If you or someone you know is having suicidal thoughts, please contact the National Suicide Prevention Lifeline at (800) 273-8255 or www.suicidepreventionlifeline.org.

This article discusses the dynamics of life insurance and suicide, providing information related to life insurance underwriting, policy suicide clauses, contestability periods, applying for life insurance after a suicide attempt, and other high-risk life insurance considerations.

Life Insurance and Suicide

As a financial product, life insurance is somewhat unique in that it can provide financial security for our families and others that we care about in the event of the death of an insured. Common uses for life insurance include income replacement, paying debts, covering final expenses, and other financial obligations.

Policies may also be used in retirement planning, business continuation, estate planning, and other scenarios. However, in order to meet its intended purpose a life insurance policy must actually pay the death benefit to the designated beneficiaries. In most instances, life insurance death benefits are indeed paid to beneficiaries in the event of an insured’s passing. However, there are a small percentage of cases when insurers are not required to pay. So, does life insurance cover suicide? Life insurance and suicide can potentially be one of these non-payment scenarios, depending on a number of relevant factors.

According to the National Institute of Mental Health, “suicide was the second leading cause of death among individuals between the ages of 10 and 34.

In the United States, suicide is an all too common tragedy. According to the National Institute of Mental Health, “suicide is the tenth leading cause of death overall in the United States, claiming the lives of nearly 45,000 people annually.” In many cases, there are contributing factors such as an underlying mental disorder or substance abuse problem. Mental disorders potentially contributing to suicide rates may include depression, bipolar disorder, post-traumatic stress, schizophrenia, and other similar conditions.

In addition to the number of suicides each year, there are an even greater number of suicide attempts and incidents of suicidal ideation or thinking about or considering suicide. Given the impact of suicide, suicide attempts, and mental illness on mortality it is logical that life insurance policy contracts would include specific provisions related to life insurance and suicide. The following policy considerations provide insight into life insurance and suicide, as well as applying for life insurance after a suicide attempt.

Life Insurance Suicide Clause

A life insurance suicide clause is a provision in a life insurance policy stating that the company will not pay the death benefit if an insured commits suicide within a specific time frame after the policy is placed in force.

A policy’s suicide clause essentially addresses life insurance and suicide for the policy.

This time frame may vary by state, but is typically two years from the policy’s effective date. Essentially, if an insured commits suicide during this period, the life insurance company would not be required to pay the claim. In these instances, the insurance company would likely only be required to pay an amount equal to the total premiums paid into the policy.

However, after this period has passed, the life insurance suicide clause would no longer apply, and the company would typically be required to pay the death benefit. The purpose of this type of provision is to protect the insurance company, shareholders, policyholders, and others with a financial interest in the company from situations were a potential insured purchases a life insurance policy with the intent of committing suicide. Subsequently, suicide clauses may also deter individuals from considering such drastic measures in an attempt to solve financial problems.

Policy Contestability Period

A life insurance contestability period is a period of time during which a policy's validity may be challenged by the issuing insurance company.

Essentially, this clause allows the insurance company to investigate your medical history and other factors to ensure that the information provided was accurate.

In most states, the contestability period is two years from the policy's effective date but may be as short as one year in some states. For specifics related to your state of residency, please consult your state insurance department. State-specific contact information is available through the National Association of Insurance Commissioners.

If a death occurs within the contestability period, an insurer will likely investigate to validate the insured’s original application. Misleading an insurance company to obtain policy approval or lower premium rates can be considered material misrepresentation and grounds for policy cancellation, claim denial, or legal action.

Common examples of misrepresentation on life insurance policies may include a smoker claiming not to smoke, an insured failing to disclose a current or previous medical condition, not addressing hazardous avocations or hobbies, or other material omissions. Or, in the case of life insurance and suicide, there may have been an omission of a previous suicide attempt or pre-existing mental illness. In most instances, after the contestability period has elapsed, insurance companies are required to pay death claims regardless, with the exception of fraud or other similar circumstances.

Individual vs. Group Coverage

There is often confusion concerning the differences between individual and group life insurance plans with regard to policy features, benefits, and limitations.

These types of policies have similarities in the death benefit but may differ significantly in other aspects such as portability, policy options, or how suicide is handled.

Individual life insurance is a policy that you buy on your own, separate from your benefits at work. With an individual policy, you choose the type of policy (term, universal life, whole life, etc.), amount of coverage, and other policy options (policy riders, features, etc.). Since you purchase the policy on your own it is “portable” and may be kept when you leave your current employer. However, as discussed above, individual policies have certain limitations related to life insurance and suicide through the suicide clause.

Group life insurance is a policy provided through your employer that is a part of your employee benefits package. These policies are routinely employer-paid, and often do not allow you to select a different policy type or additional features. However, many plans will allow employees to purchase additional optional coverage. Since these policies are an employment benefit, coverage typically ends when you leave the company. Additionally, group life insurance that is employer paid may or may not contain a life insurance suicide clause. However, group policies that an employee pays for themselves will likely be treated as an individual policy in the case of suicide.

Applying After a Suicide Attempt

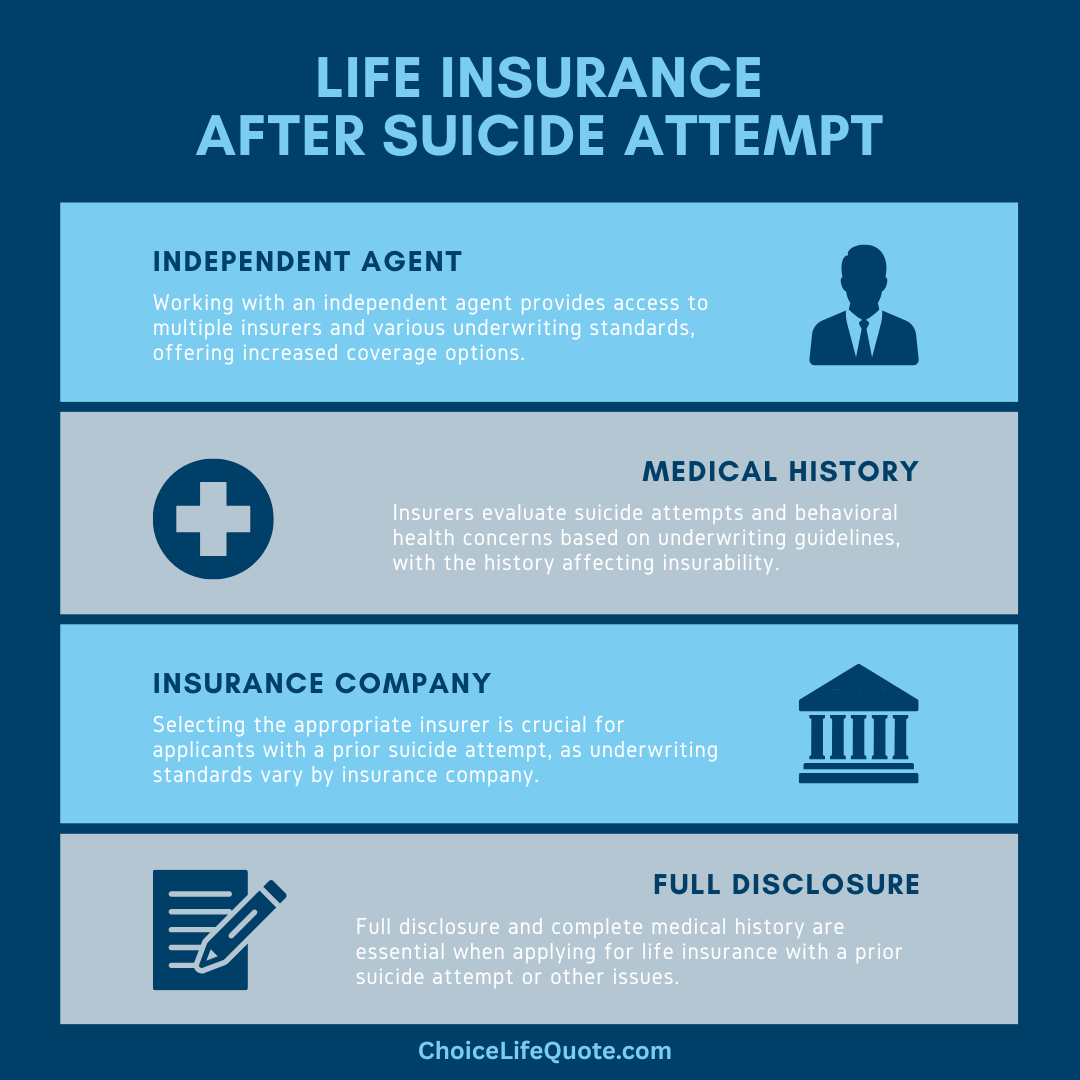

In applying for life insurance after a suicide attempt, there will frequently be a specific waiting period before a proposed insured can be approved for coverage.

These waiting periods related to life insurance and suicide attempts vary by insurance company but routinely range from a one to five year timeframe.

Individual company underwriting standards can be reviewed by an independent agent for carrier-specific information. After this waiting period, a life insurance company will evaluate an application for coverage based on its standard underwriting criteria, considering medical, lifestyle, financial, and other relevant history. A history of multiple suicide attempts will routinely result in a decline of coverage, other than guaranteed issue products.

Suicide Underwriting Questions

In addition to providing a basic medical history and possibly taking a life insurance physical (depending on the type of policy), the insurance company will likely ask the following or similar questions related to life insurance and suicide attempts.

Questions Related to Suicide Attempts

Also, in many instances, there may be a history of mental illness contributing to a suicide attempt. If this is the case, the insurance company will evaluate a proposed insured’s mental health history and current status. The following are common questions for an insurance company to ask related to life insurance and suicide attempts with mental illness.

Questions Related to Mental Illness

In a post-suicide attempt scenario, securing traditional fully underwritten life insurance may be challenging. Even after designated waiting periods, premiums can be rated (significantly increased) for several years. For those unable to qualify for coverage based on a past suicide attempt, guaranteed issue life insurance or accidental death insurance may be options to consider based on individual coverage needs.

Conclusion

In conclusion, navigating life insurance in relation to suicide involves understanding critical factors such as suicide clauses, contestability periods, and underwriting criteria. While policies typically cover deaths by suicide after the initial two-year period, early claims may result in a return of premiums rather than full benefits. It's crucial for applicants to disclose all relevant medical and mental health history transparently. For those affected by suicidal thoughts, seeking immediate support from resources like the National Suicide Prevention Lifeline is essential. By addressing these considerations thoughtfully, individuals can make informed decisions about their life insurance needs.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.