Life Insurance for Cancer Patients and Survivors

A cancer diagnosis, or the diagnosis of a family member, often causes people to take a hard look at planning for their family’s financial future and other considerations. As part of this planning process, clients often ask questions about getting life insurance coverage for cancer patients and survivors. Questions related to life insurance with cancer are understandable given the impact that a proposed insured’s medical history can have on policy approval.

This article discusses life insurance for cancer patients and survivors, providing information related to coverage options and expectations for those considering life insurance for cancer patients, life insurance for cancer survivors, or other coverage with medical conditions.

Cancer and Life Insurance

In today’s world, it is difficult to find anyone who has not been affected by a cancer diagnosis, whether directly or indirectly.

We have all had family members, friends, or acquaintances who have struggled with this devastating disease. It can be difficult enough to focus on recovery without the stresses of family financial concerns.

In fact, according to the National Cancer Institute, "approximately 38% of men and women will be diagnosed with cancer at some point during their lifetimes.” The most common types of cancer tend to be breast cancer, lung cancer, prostate cancer, colon cancer, and melanoma of the skin. Mortality rates based on type of cancer differ slightly in men and women.

Most Dangerous in Men

Most Dangerous in Women

Source: UnityPoint Health.

Faced with a potentially life-altering cancer diagnosis, it is only natural to consider the “what if” scenarios associated with an uncertain future. Part of this planning often includes evaluating family finances, including life insurance coverage. Ideally, an individual has adequate life insurance in force prior to a cancer diagnosis. There are also a number of helpful resources in considering how to manage cancer costs.

In general, qualifying for traditional life insurance for cancer patients can be nearly impossible and can prove challenging for those with a history of cancer. In fact, even a family history of cancer can negatively impact policy underwriting and premium rates.

However, on a positive note, it is often possible to qualify for life insurance coverage with a history of cancer after a certain waiting period. Factors considered may include the type of life insurance, type and location of cancer, current patient or survivor status, length of time in remission, medical prognosis, and other factors.

Life Insurance for Cancer Patients

Can you get life insurance if you have cancer? In light of statistics surrounding cancer deaths, it is understandable that insurance companies will traditionally not offer life insurance for cancer patients.

For individuals currently diagnosed and/or receiving treatment for cancer, a guaranteed issue life insurance policy is often the only coverage option.

This type of policy is generally approved with no health questions but is more expensive than other types of coverage and often requires a graded benefit. A graded benefit means that the policy will only pay a return of premiums plus interest for an initial period (usually two years), after which the full death benefit is payable. Guaranteed issue policies usually offer lower face amounts ranging from $5,000 to $25,000 and are designed primarily for final expenses. From a positive standpoint, many guaranteed issue policies are whole life insurance. So, once the graded benefit period is over, the policy will pay the full death benefit and cannot be canceled by the insurance company so long as premiums are paid.

According to the National Cancer Institute, "in 2018, an estimated 1,735,350 new cases of cancer were predicted to be diagnosed in the United States, and 609,640 deaths were predicted from the disease."

Employer-sponsored life insurance programs may also be an option for life insurance for cancer patients. If you are employed, life insurance coverage may be available through your employee benefits. In many instances, employees receive and/or can purchase life insurance up to a certain amount based on their annual salary. You should be able to find out what benefit options are available by speaking with your human resources department and/or benefits representative. However, it is important to understand that employer-sponsored life insurance traditionally ends with employment.

Another option for those who may need a larger amount of accident only coverage is accidental death insurance. These policies routinely do not have medical underwriting requirements and are surprisingly affordable. However, the coverage is limited to accidental death only and should not be considered a substitute for traditional life insurance.

Life Insurance for Cancer Survivors

Can you get life insurance if you have cancer history? How will a cancer diagnosis impact underwriting?

It is truly a blessing to receive a clean bill of health as a cancer survivor. Due to advances in cancer detection and treatment technology, the number of survivors is steadily growing.

As a cancer survivor, depending on the type of cancer and length of time in remission, you may qualify for traditional term or permanent life insurance, final expense level or graded benefit coverage, or other options for life insurance for cancer survivors.

According to the National Cancer Institute, "in 2016, there were an estimated 15.5 million cancer survivors in the United States. The number of cancer survivors is expected to increase to 20.3 million by 2026."

However, even being cancer free may not be enough to qualify for life insurance for cancer survivors right away. Insurers routinely require a specific waiting period, depending on the type of cancer, before they will approve life insurance for cancer survivors. As an example, the waiting period for basal cell carcinoma can be as little as a few months, while waiting periods for breast, lung, colon, or prostate cancer can be 5 to 10 years.

Once the waiting period required for your specific type of cancer has passed, it is often possible to qualify for standard underwriting rates, subject to selected company underwriting. Prior to meeting the waiting period requirement, as with life insurance for cancer patients, a guaranteed issue life insurance policy may be your only option.

Cancer Status | Coverage Options |

|---|---|

Life Insurance for Cancer Patients (current diagnosis) | |

Life Insurance for Cancer Survivors (within waiting period) | |

Life Insurance for Cancer Survivors (after waiting period) |

*Note: Policy approval subject to individual company underwriting standards.

Applying for Coverage After Cancer

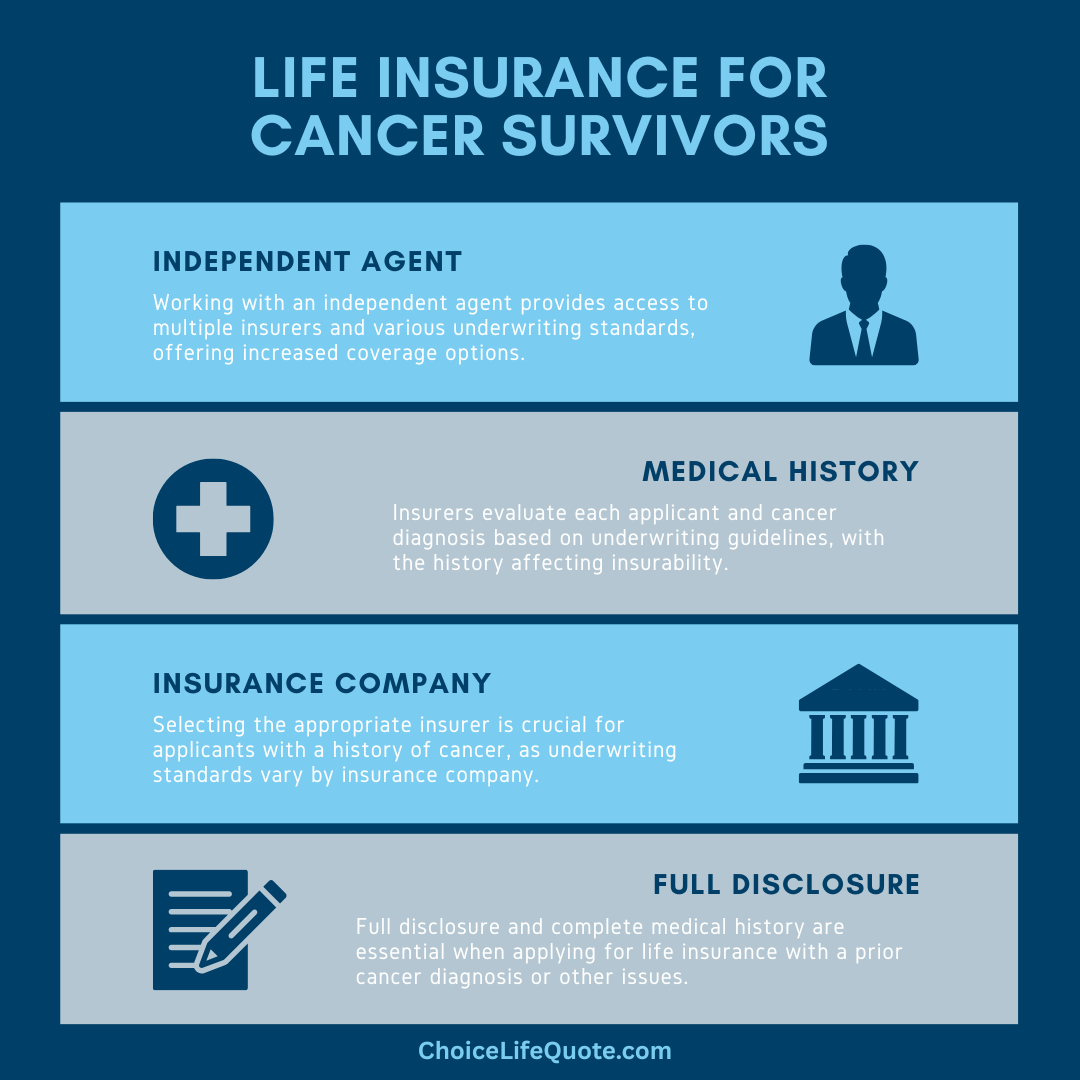

In applying for life insurance after cancer, it is important to work with an experienced independent agent who can guide you through the process of selecting the best life insurance company for cancer based on your individual situation.

Your insurance professional can also facilitate the application process.

The following should be considered when applying for life insurance after cancer.

Evaluate Coverage Needs – It is important to evaluate your need for life insurance coverage considering factors such as income replacement, consumer debts, outstanding mortgage, education costs, final expenses, and other obligations. However, you also need to be realistic about the types of policies and amount of coverage that you may qualify for based on medical history. Your life insurance agent can assist you in conducting a comprehensive needs analysis.

Review Policy Options – As previously discussed, your life insurance policy options will depend on the type of cancer that you had, current medical condition, length of time in remission, and other factors. Based on whether you are applying for life insurance for cancer patients or life insurance for cancer survivors, policy options may include traditional term or permanent life insurance, final expense life insurance, guaranteed issue life insurance, or accidental death coverage. It is important to understand the benefits and limitations of the available plans in making a buying decision. It is also important to understand that based on your medical history, you can likely expect higher premium rates. Your agent will be able to address coverage options, policy limitations, premium rates, and other considerations.

Select the Right Company – Once you have evaluated your coverage needs and reviewed policy options, it is important to select the right life insurance company when applying for life insurance for cancer survivors. Since each life insurance company has slightly different underwriting standards, companies may view your cancer history and insurability from a different perspective. Selecting from the companies that will view your individual situation most favorably can significantly increase your chances of getting approved for coverage at the best rates possible. This is an area where it is extremely important to work with an experienced independent agent who will have access to a number of insurance companies and experience with their individual underwriting policies and niches.

Provide Medical History – In applying for life insurance with cancer history, it is extremely important to provide complete and accurate information related to your medical history and treatment. This will allow the insurance company to evaluate your insurability. In many cases, missing or incomplete information can result in a decline of coverage for those applying for life insurance for cancer survivors. In evaluating your application for a fully underwritten policy, the insurance company will routinely ask questions about your medical history, treatment, and current condition, as well as request your medical records. The following are some questions that you can expect related to life insurance for cancer survivors.

It may also be helpful to include a cover letter highlighting positive aspects of your cancer recovery, healthy lifestyle, medical outlook, and other relevant information. Your agent can assist with your life insurance application, but ultimately the company’s underwriting team makes the final decision concerning insurability and premium rates.

Conclusion

In conclusion, navigating life insurance options for cancer patients and survivors involves careful consideration of medical history, waiting periods, and policy types. Despite the challenges posed by cancer diagnoses, there are viable solutions available. For current cancer patients, guaranteed issue policies offer coverage albeit with certain limitations. Survivors, after passing waiting periods specific to their cancer type, may be able to qualify for standard policies. Working closely with an experienced agent to assess needs, review policy options, and select favorable insurance companies is crucial. By providing thorough medical histories and understanding policy specifics, it is often possible to secure coverage that can provide financial security and peace of mind for the future.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.