Life Insurance for Diabetics | Insider Qualification Tips

Individuals with a history of diabetes often ask how this diagnosis can affect life insurance for diabetics. So, can diabetics get affordable life insurance? These questions and associated concerns are completely understandable given the potential severity of this all too common disease that affects millions of Americans. The short answer is YES. It is often possible to get affordable life insurance for diabetics.

This article discusses life insurance for diabetics, including an overview of how diabetes may affect rates and policy approval, insurance company recommendations, and insider tips for applying for life insurance with medical conditions.

Understanding Diabetes Diagnosis

It is important to understand the diagnosis when considering how diabetes may impact an application for life insurance.

According to Health Line. “diabetes is a common group of chronic metabolic diseases that cause high blood sugar (glucose) levels in the body due to defects in insulin production and/or function.”

Common symptoms experienced with diabetes often include fatigue, thirst, hunger, blurry vision, excessive urination, prolonged healing of sores, and others. Additionally, there are different types of diabetes having varying effects on an individual's health.

Type 1 Diabetes: Type 1 diabetes, classified as an autoimmune disease, occurs when the body's immune system attacks insulin-producing cells in the pancreas. This type of diabetes may develop rapidly and most often affects children and young adults (though it may occur at any age). Individuals diagnosed with type 1 diabetes are often required to take insulin regularly to manage the disease. Potential long-term complications associated with diabetes may include nerve damage, blindness, kidney failure, and others.

Type 2 Diabetes: Type 2 diabetes, a less invasive form of the disease, presents as insulin resistance in the body, often developing gradually as an individual gets older. Those who are obese, inactive, and/or have a family history of diabetes are at a significantly higher risk. Essentially, body cells are unable to take in glucose, or blood sugar, which remains in the blood. This increase in blood sugar referred to as hyperglycemia can significantly impair normal bodily functions. Due to slow onset, type 2 diabetes is often not diagnosed until a patient experiences related conditions such as foot pain or numbness, vision problems, a heart attack, or other side effects.

Gestational Diabetes: Gestational diabetes, a condition during pregnancy, occurs when the expectant mother's blood sugar is abnormally elevated. If left untreated, gestational diabetes can result in high birth weight, breathing problems, and other complications in the newborn. This condition routinely resolves after the child's birth but significantly increases the mother's likelihood of developing type 2 diabetes in the future.

Evaluating Life Coverage Needs

In considering the number of American adults affected by diabetes, it only makes sense that a significant percentage of these individuals would have family, business, and other financial commitments requiring life insurance. In evaluating coverage needs, you should consider consumer debts, income replacement, outstanding mortgage, final expenses, and other factors. Luckily, it is often possible to get affordable life insurance with a diabetes diagnosis. Depending on the insurance company, coverage options may include term life, universal life, or whole life insurance for diabetics. However, given potential health considerations and increased mortality, it is also understandable that diabetes may impact underwriting, premium rates, and possibly even policy approval.

According to the American Diabetes Association, "over 30 million American adults have some form of diabetes, to include 25% of all seniors."

Underwriting for Diabetics

In addition to traditional life insurance underwriting considerations (i.e., gender, age, build, tobacco use, general health, family history, and other factors), individuals with a history of diabetes will also be evaluated based on disease history and current medical condition. The outcome will influence approval and rates.

This process will often require attending physician statements (APS) and other records from doctor's offices and medical facilities. These additional requirements can sometimes increase processing times by several weeks. Waiting 6 to 8 weeks for an underwriting decision is not uncommon. It is important to understand that this is a normal part of the underwriting process for those with pre-existing medical conditions.

Providing Complete Health History

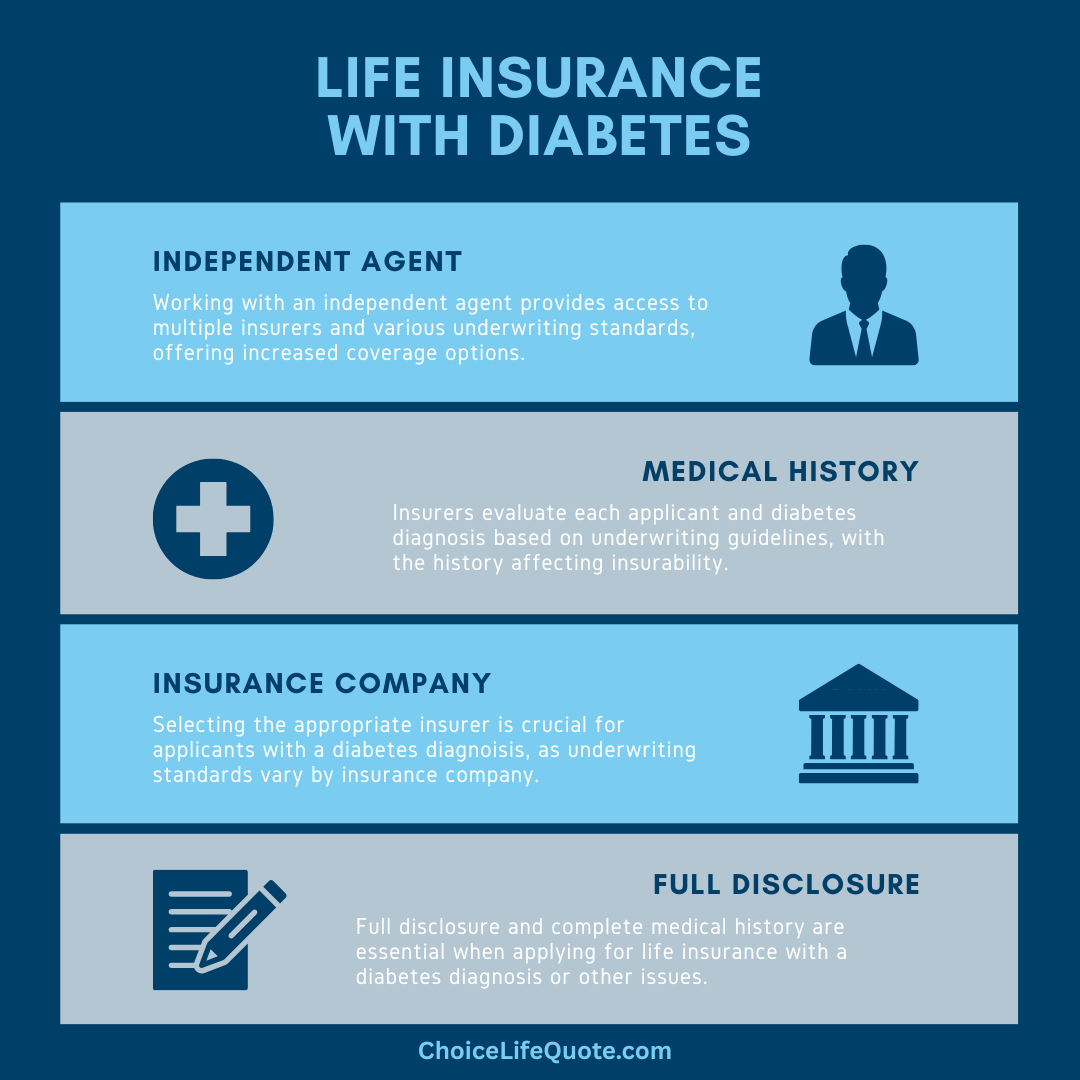

It is extremely important to provide complete and accurate information concerning your condition and medical history when completing your life insurance application and medical exam (if required). This will allow the insurance company’s underwriting team to make a decision based on all pertinent information. In many instances, missing, incomplete, or conflicting applicant data may cause an application to be declined when it possibly could have been approved otherwise. Specific factors considered with life insurance for diabetics, or those with a history of diabetes, may include the following.

Expect Higher Premium Rates

Like other health and lifestyle considerations, a diabetes diagnosis can significantly affect the premiums paid for life insurance.

The extent to which diabetes impacts individual premiums will ultimately depend upon medical history, current condition, and other factors as discussed above.

It is also important to keep in mind that life insurance company underwriting standards often vary from company to company which can affect premium rates. The following represents examples of best-case scenarios in our experience dealing with individuals with a history of diabetes.

Life Insurance for Diabetics Type 1 - Type 1 diabetes may qualify for underwriting classes ranging from a Table D to a complete decline of coverage based on disease history, complications, treatment, prognosis, and other factors. At a minimum, type 1 diabetics should expect premiums approximately two times that of a standard risk.

Life Insurance for Diabetics Type 2 - Type 2 diabetes, being a less severe diagnosis, may qualify for underwriting classes ranging from a Table B to a complete decline of coverage based on the above-mentioned considerations. As a best scenario, type 2 diabetics should expect premiums approximately one and a half times that of standard risk. Regardless of type, diabetes involving additional disease processes such as coronary artery disease or complications such as neuropathy or disability will likely result in a decline of coverage.

Selecting the Best Company

Choosing the best life insurance companies for diabetics can seem a bit overwhelming to say the least. Given the number of insurers in the marketplace, each having its own underwriting standards, a fair amount of research can go into making an educated decision. When comparing companies, it is important to consider how favorably each will view your diabetes diagnosis, as well as traditional considerations of company ratings, policy options, customer service, and other factors. Based on our experience, the following companies are favored options for individuals with diabetes.

Independent Agent Support

In applying for life insurance with diabetes, it is important to work with an independent agent who has access to multiple insurance companies. This will allow your agent to match you with the best insurance companies based on your individual situation. Also, be prepared to provide a complete medical history, list of prescribed medications, physicians' contact information, and other required information. By choosing the right insurance company and providing complete and accurate medical information, it is often possible to get affordable life insurance with diabetes.

Conclusion

In conclusion, while obtaining life insurance with a diabetes diagnosis may present challenges, it is indeed feasible and often affordable with careful planning and consideration. Understanding the impact of diabetes on insurance rates and approval processes is crucial. By providing comprehensive health information, working with a knowledgeable independent agent, and exploring options from various insurers, individuals can navigate the underwriting process effectively. Remember, each insurance company has its own criteria and policies, so research and consultation are key to finding the best coverage tailored to your specific needs and health circumstances.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.