Life Insurance for Physicians | Diagnosing Coverage Needs

As a physician, you dedicate your life to the well-being of others. You tirelessly work long hours and provide exceptional care to your patients. However, amidst your commitment to your profession, have you considered your own financial security and the future of your loved ones? Life insurance is a critical aspect of financial planning for physicians, ensuring that your family is protected in the event of the unexpected. But with the myriad of options available, choosing the right coverage can be overwhelming.

This article discusses essential considerations when selecting life insurance for physicians, from understanding the different policies to determining the coverage amount, we will help to provide the insight needed to make an informed decision.

Life Insurance for Physicians

Life insurance is a crucial component of financial planning for physicians. While you may have a steady income and a promising career, unforeseen events can disrupt your financial stability and leave your loved ones vulnerable.

As a physician, you understand better than anyone the risks and uncertainties that life can bring.

By securing the right life insurance coverage, you can provide your family with the financial protection they need to maintain their standard of living, even in your absence. Life insurance can help cover funeral expenses, outstanding debts, mortgage payments, education expenses for your children, and even replace your income to ensure your family’s financial security. It offers peace of mind, knowing that your loved ones will be taken care of financially if the worst were to happen.

When choosing life insurance, it’s important to consider your unique needs as a physician. Unlike other professions, physicians often have higher earning potential, significant student loan debts, and complex financial situations. This means that a one-size-fits-all approach won’t work when it comes to life insurance. You need a policy that takes into account your specific circumstances and provides the right level of protection. Let’s explore the different types of life policies available and how they can meet your unique needs as a physician.

Physician Unique Coverage Needs

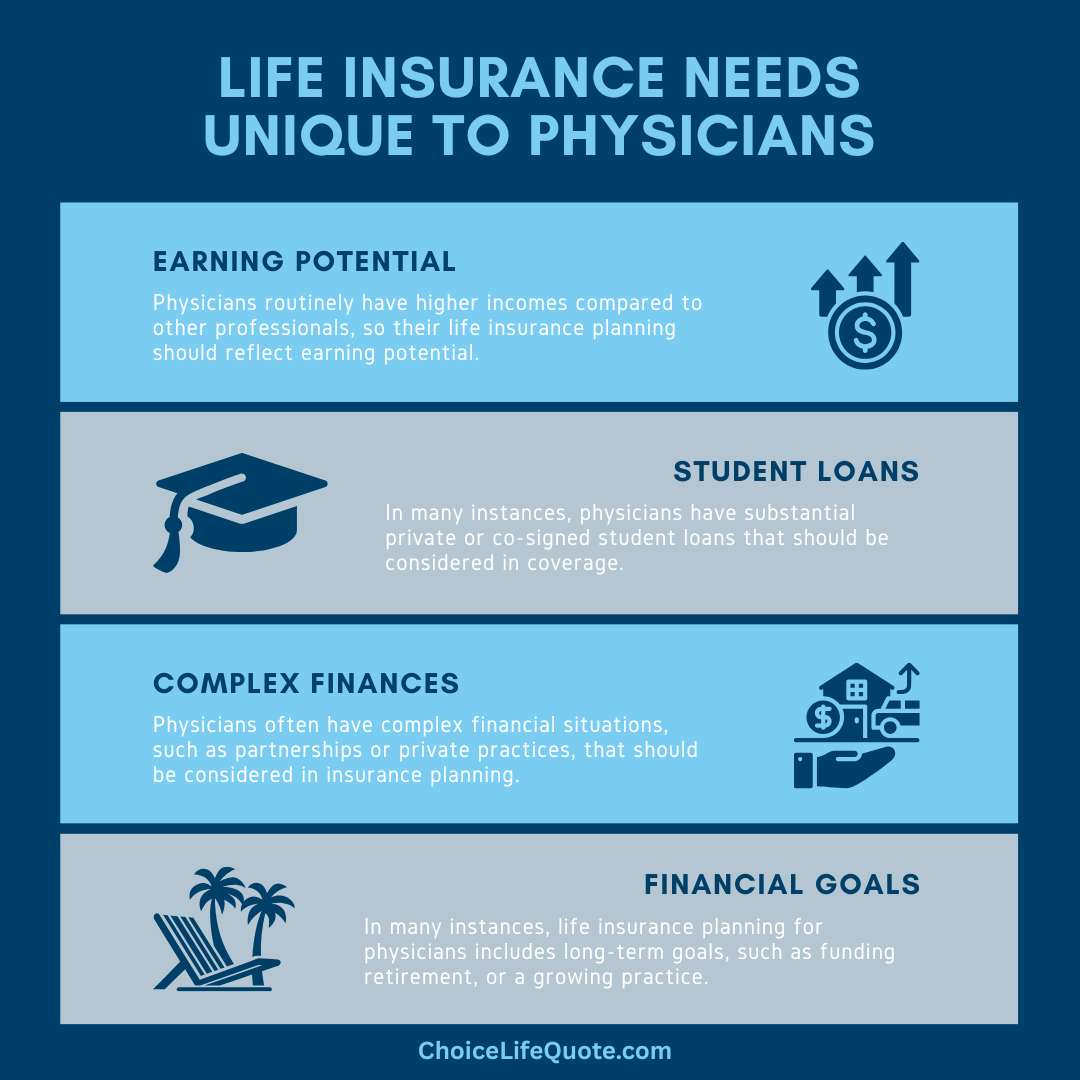

Physicians have distinct financial needs that set them apart from other professionals. Here are some key considerations to keep in mind when choosing life insurance as a physician:

Earning Potential: Physicians often have higher incomes compared to other professionals. This means that your life insurance coverage should reflect your earning potential to ensure your family’s financial well-being.

Student Loan Debt: Many physicians may have substantial private or co-signed student loan debts that need to be taken into account when determining the coverage amount. In the event of your untimely death, your family should not be burdened with your outstanding student loans.

Complex Situations: Physicians often have complex financial situations, including partnerships, private practices, and retirement plans. Your life insurance policy should be tailored to accommodate these unique circumstances and ensure that your assets are properly protected.

Long-Term Goals: As a physician, you may have long-term financial goals such as saving for retirement, funding children’s education, or starting a business. Your life insurance policy should align with these goals and provide the necessary financial support to achieve them.

Types of Life Insurance Available

When it comes to life insurance, there are essentially two main types of life insurance policies to consider: term life insurance and permanent life insurance. It is important to consider coverage needs, financial objectives, and other factor in selecting a life insurance policy.

Term Life Insurance:

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a straightforward and cost-effective solution, making it a popular choice for physicians. With term life insurance, you pay a fixed premium for the duration of the policy, and if you pass away during the term, your beneficiaries receive the death benefit. Term life insurance is ideal for physicians who want to ensure their family’s financial security during the years when they have the highest financial obligations, such as paying off student loans, purchasing a home, or raising children.

Permanent Life Insurance:

Permanent life insurance, as the name suggests, provides coverage for your entire life. Unlike term life insurance, permanent life insurance policies also have a cash value component that grows over time. There are different types of permanent life insurance, such as whole life insurance, universal life insurance, and variable life insurance. Permanent life insurance offers lifelong coverage and can be an attractive option for physicians wanting to accumulate cash value over time or have a need for coverage beyond the term of a term life insurance policy.

Identifying Coverage Requirements

Determining the right coverage amount for your life insurance policy is crucial to ensure that your family’s financial needs are met. Here are some factors to consider when determining your coverage needs as a physician:

- Outstanding Debts: Consider any outstanding debts you have, such as student loans, mortgages, or personal loans. Your life insurance coverage should be sufficient to cover these debts and prevent them from becoming a burden on your family.

- Income Replacement: Calculate how much income your family would need to maintain their current standard of living in your absence. This should take into account your current income, future earning potential, and any retirement savings or investments you have.

- Education Expenses: If you have children, factor in their education expenses, including college tuition fees. Your life insurance coverage should provide enough funds to cover these expenses and ensure that your children can pursue their educational goals.

- Final Expenses: Consider the costs associated with your funeral, burial, or cremation. These expenses can be significant, and your life insurance policy should provide enough coverage to alleviate this financial burden on your family.

By considering these factors, you can determine the ideal coverage amount for your life insurance. However, choosing the right policy and coverage amount is just the beginning. There are several other factors to consider in selecting a life insurance policy as a physician.

Considerations in Policy Selection

In evaluating and selecting a life insurance policy as a physician, it’s essential to consider a handful of important considerations specific to being a medical doctor and potentially a medical practice owner.

While coverage for physicians is often similar to other professionals and small business owners, it is essential to review the following considerations.

- Financial Strength: Before purchasing a life insurance policy, research the financial stability and strength of the insurance company. A reputable and financially sound company is more likely to honor its obligations and provide the necessary support to your beneficiaries.

- Policy Riders and Options: Explore the different riders and options available with the life insurance policy. Riders can enhance your coverage and tailor the policy to your specific needs. For example, a disability income rider can provide an additional source of income if you become disabled and are unable to work.

- Underwriting Process: Understand the underwriting process of the insurance company. Some companies specialize in underwriting physicians, which can result in better rates and more favorable underwriting decisions. Look for insurers who have experience working with physicians and understand the unique risks associated with your profession.

- Policy Flexibility: Consider the flexibility of the policy. Does it allow for adjustments in coverage amounts or premium payments as your needs change over time? A policy with flexibility can provide peace of mind knowing that you can make necessary adjustments to your coverage as circumstances evolve.

Conclusion

In conclusion, life insurance is a vital aspect of financial planning for physicians. It provides the financial security your family needs in the event of the unexpected. By understanding your unique needs as a physician, exploring the different types of life insurance policies, and considering the factors that influence coverage needs, you can make an informed decision.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.