Importance of Life Insurance for Real Estate Investors

As a real estate investor, you understand the value of safeguarding your assets and protecting your financial future, but have you considered the importance of life insurance? Life insurance may not be the first thing that comes to mind when thinking about real estate investments, but it can play a crucial role in securing a legacy for future generations. The real estate business can be extremely volatile, and having a comprehensive life insurance plan can provide financial protection and peace of mind.

This article provides insight into how life insurance can provide valuable benefits for real estate investors, and how it can safeguard both your investments and business legacy providing peace of mind for all parties involved.

Understanding Real Estate Investor Risks

Real estate investing comes with its fair share of risks. Market fluctuations, economic downturns, and natural disasters are just a few examples of uncertainties that can impact investments.

As a real estate investor, it’s important to acknowledge these risks and take steps to protect yourself and your assets in the event of unexpected circumstances.

This is where life insurance can provide a valuable safety net. While life insurance won’t directly protect your real estate investments from market volatility, it can ensure that your loved ones and business partners are taken care of in the event of your untimely demise. By understanding the risks faced by real estate investors and the role that life insurance plays in mitigating those risks, you can make informed decisions about your financial future.

Life insurance can provide financial stability for your loved ones if you were to pass away unexpectedly. It can help cover mortgage payments, property taxes, and other ongoing expenses associated with your real estate investments. This can ensure that your family is not burdened with these financial responsibilities, allowing them to maintain their quality of life even after you’re gone. Additionally, life insurance can protect your business partners by providing them with the funds necessary to buy out your share of the investments and keep the business running smoothly. Understanding these risks and how life insurance can address them is essential for real estate investors looking to safeguard their legacy.

Role of Insurance in Safeguarding Legacy

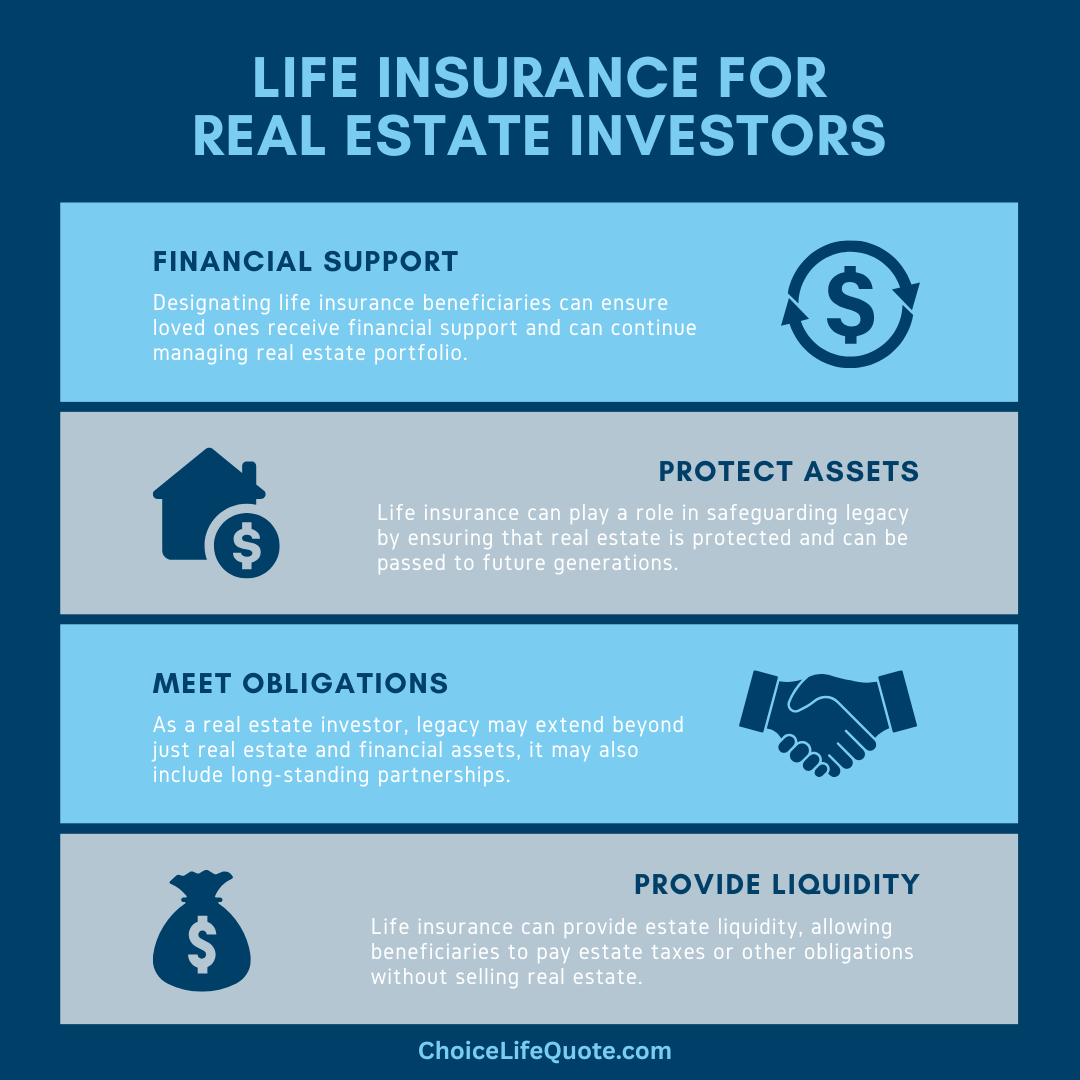

When it comes to real estate investments, your legacy extends beyond just financial assets. It includes the properties you’ve acquired, the businesses you’ve built, and the relationships you’ve fostered. As a real estate investor, preserving your legacy should be a top priority. Life insurance can play a significant role in safeguarding your legacy by ensuring that your assets are protected and can be passed on to future generations. By designating beneficiaries in your life insurance policy, you can ensure that your loved ones receive the financial support they need to continue managing your real estate investments.

Life insurance can also provide liquidity to your estate, allowing your beneficiaries to pay any estate taxes or outstanding debts without having to sell off your real estate assets. This can be particularly beneficial if your investments are not easily liquidated or if you want to provide your loved ones with the opportunity to continue managing the properties. By including life insurance in your estate planning, you can protect your legacy and ensure that your real estate investments are passed on to the next generation in a seamless manner.

Types of Life Insurance for Investors

When it comes to life insurance, real estate investors have several options to choose from. The two main types of life insurance policies to consider are term life insurance and permanent life insurance. Also, determining the appropriate coverage amount for your life insurance policy is another crucial step. You’ll want to consider factors such as your outstanding debts, financial obligations, and the value of real estate investments.

Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. This type of policy is often more affordable and straightforward, making it a popular choice among real estate investors. Term life insurance can provide the necessary coverage to protect your loved ones and business partners during the active years of your real estate investments. However, it’s important to note that term life insurance does not accumulate cash value and only pays out if you pass away during the specified term.

Permanent life insurance, on the other hand, provides coverage for your entire life. This type of policy can accumulate cash value over time, which can be used for various purposes such as supplementing retirement income or funding future real estate investments. Permanent life insurance can provide long-term protection for your loved ones and ensure that your legacy is preserved. However, it’s important to consider the higher premiums associated with permanent life insurance and evaluate whether the additional benefits outweigh the costs.

How Life Insurance Protects Partners

One of the primary reasons real estate investors should consider life insurance is to protect their family and business partners in the event of their death. Life insurance can provide financial support to your loved ones, ensuring that they can continue to maintain their quality of life and meet their financial obligations. This is particularly important if your real estate investments are a significant part of your overall estate.

If you have business partners, life insurance can also play a crucial role in protecting their interests. By having a life insurance policy that covers your share of the investments, you can ensure that your partners have the necessary funds to buy out your share and continue running the business smoothly. This can prevent any potential disputes or financial hardships that may arise in the absence of a proper succession plan.

Life insurance can provide peace of mind to both your family and business partners, knowing that they will be taken care of financially if something were to happen to you. It can alleviate the stress and uncertainty that can arise during difficult times and allow them to focus on managing your real estate investments and preserving your legacy.

Tax Benefits of Life Insurance for Investors

In addition to the financial protection it provides, life insurance can also offer tax benefits to real estate investors. One of the key advantages is the tax-free status of the death benefit.

The proceeds from a life insurance policy are generally not subject to income tax, allowing your beneficiaries to receive the full amount without any deductions.

This can be particularly advantageous if your real estate investments have appreciated significantly over time and would be subject to capital gains tax upon sale. Another tax benefit of life insurance is the ability to build cash value on a tax-deferred basis. With permanent life insurance policies, a portion of your premium payments goes towards the cash value component, which can grow over time.

The growth of the cash value is not subject to income tax, allowing you to accumulate wealth more efficiently. This can be especially valuable for real estate investors looking to diversify their investment portfolio and create a tax-efficient strategy for their financial future.

It’s important to consult with a tax professional to fully understand the tax implications of life insurance for your specific situation. They can help you navigate the complexities of the tax code and identify the most advantageous strategies for your real estate investments.

Choosing a Life Insurance Provider

Choosing the right life insurance provider is an important decision that can have a significant impact on the protection of your legacy. When evaluating potential providers, there are several factors to consider.

- Financial Strength: Look for a provider with a strong financial rating to ensure that they will be able to fulfill their obligations in the future. This is particularly important for long-term policies such as permanent life insurance.

- Policy Options: Consider the types of policies offered by the provider and whether they align with your needs as a real estate investor. Evaluate the flexibility and customization options to tailor the policy to your specific circumstances.

- Customer Service: Research the provider’s reputation for customer service and claims handling. You’ll want to work with a company that is responsive, transparent, and reliable when it comes to supporting policyholders and their beneficiaries.

- Premiums and Affordability: Compare the premiums offered by different providers to ensure that they are within your budget. Keep in mind that the cost of life insurance can vary based on factors such as age, health, and coverage amount.

- Underwriting Process: Understand the provider’s underwriting process can be beneficial in securing coverage. Some providers may have stricter underwriting guidelines, particularly for individuals with pre-existing health conditions.

By taking these factors into account, you can make an informed decision when choosing a life insurance provider. It can be helpful to ensure that both the insurance company and your selected life insurance agent align with your values and business as a real estate investor.

Applying for Life Insurance Coverage

Applying for life insurance as a real estate investor involves a series of steps to ensure that you secure the appropriate coverage. In reality, the process is the same as for other applicants, only with your real estate and financial objectives in mind. Here are some key steps to consider:

- Coverage Needs: Determine the coverage amount and type of policy that aligns with your financial goals and risk tolerance. Consider factors such as outstanding debts, future financial obligations, and the value of your real estate investments.

- Gather Documents: Prepare the necessary documentation to support your life insurance application. This may include financial statements, tax returns, and medical records, depending on the provider’s requirements.

- Shop Around: Obtain quotes from multiple providers to compare premiums, policy options, and customer service. This will allow you to make an informed decision based on your specific needs.

- Underwriting Process: Complete the application and undergo the underwriting process, which may involve a medical examination, interviews, and a review of your financial and medical history. Be prepared to provide accurate and detailed information to ensure a smooth application process.

- Review the Policy: Carefully review the terms and conditions of the policy before signing. Ensure that you understand the coverage, premiums, exclusions, and any additional riders or benefits associated with the policy.

- Pay the Premiums: Once your application is approved, pay the premiums on time to maintain the coverage. Consider setting up automatic payments to ensure that your policy remains active.

By following these simple steps, you can successfully navigate the life insurance application process and secure the coverage needed to safeguard your investment properties and legacy as a real estate investor.

Conclusion

In conclusion, real estate investing can be a rewarding and lucrative endeavor, but it also comes with certain risks. It’s important to protect your assets and secure your legacy for future generations. As a real estate investor, your legacy extends beyond just financial assets. It encompasses the properties you've acquired, the businesses built, and the relationships you’ve formed. By incorporating life insurance into your estate planning, you can ensure that your legacy is preserved and your real estate investments are passed to future generations.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.