Life Insurance Coverage for Stay-at-Home Parents

In many instances, families make the decision for one parent to stay home to care for young children while the other works to provide financially for the household. Given that the stay-at-home parent makes significant contributions to the family but may not have a source of income, the need for life insurance can be somewhat confusing. As a result, we often receive questions such as… Do I need life insurance as a stay-at-home parent? How much life insurance coverage should I have as a stay-at-home mom? Or... What is the best type of life insurance for stay-at-home parents?

This article discusses Life Insurance for Stay-at-Home Parents, provides information related to coverage options and benefits, and highlights the true value of stay-at-home parents and the need for adequate life insurance protection.

Life Insurance for Stay-at-Home Parents

In navigating the inevitable chaos of family life, some couples with young children choose to have one parent stay home while the other works to support the family financially.

This arrangement can be ideal for families who are fortunate enough to have the means to allow a parent to stay home.

In most instances, Stay at Home Moms (SAHM) take on these responsibilities. However, in recent decades, the number of stay-at-home fathers has increased.

According to the Pew Research Center, over 11 million parents (almost 1 in 5) in the United States did not work outside the home.

These stay-at-home parents may or may not have a source of income but nonetheless provide services essential to the household. SAHM responsibilities routinely include childcare, meal planning, housekeeping, laundry, homework, medical visits, extracurricular activities, and more driving than some New York City taxi drivers. Given the responsibilities of stay-at-home parents, their contributions to a household can be significant. However, since many do not earn a traditional "income," this value can be overlooked when considering life insurance.

Life insurance is purchased most often to provide protection against the loss of a primary breadwinner’s income in the event of an untimely death. Though the emotional impact of losing a loved one can be overwhelming, life insurance can allow a family to remain in “their world” financially. In considering life insurance coverage, families routinely focus on the financial impact of losing the primary income earner but often do not truly consider the challenges of losing a stay-at-home parent.

In fact, the loss of a stay-at-home parent can have a significant financial impact on the family when considering the cost of childcare, household management, missed time from work, and other factors. It is important to include these considerations in a family’s insurance planning and secure adequate coverage for parents who both work outside and inside the home.

Stay-at-Home Parents Financial Value

In placing a value on a parent’s ability to stay home with children, there is no question of the intangible benefits of quality time with children during their formative years.

However, the purely economic value of a stay-at-home parent is often overlooked in many instances.

As previously mentioned, nearly one in five parents have made the decision to take on the role of SAHM (or Dad). In instances where a parent leaves the workforce to stay home, the family routinely experiences a decrease in income as they transition to a single-income household. The focus in this situation tends to be more on income lost, as opposed to the economic value of a parent staying home. If you consider the various roles involved in the day-to-day activities of a stay-at-home parent, it quickly becomes clear that this “position” involves significant value.

According to Sarah Reynolds, Vice President at Salary.com, “the role of Mom requires a diverse skill set that commands serious market value in the talent market, and with new demands on Mom’s time arising every day, we only expect their market value to increase in the future.”

A recent Salary.com analysis of a Mom’s job value revealed a hypothetical annual salary of over $178K, including responsibilities shared by daycare teachers, dietitians, housekeepers, recreational therapists, social media specialists, and others. In the opinion of many, this number is somewhat excessive yet very vividly brings to light the significant value provided by SAHMs. If considering only the savings in childcare expenses, a say at home parent makes a significant financial contribution. According to Fortune, the national average cost for childcare is almost $10K annually and is higher than college tuition in many states.

Given these costs, it is understandable that a surviving parent’s ability to replace even a portion of these services could present financial challenges. Additionally, in the modern economy, many stay-at-home parents also earn some level of income through a home-based business or part-time work. When conducting a life insurance needs analysis for families with a stay-at-home parent, it is important to include the potential costs of replacing vital services as well as any income. Fortunately, many insurance companies will allow life insurance for stay-at-home parents equal to the coverage in force on the working parent within certain limitations.

Best Coverage for Stay-at-Home Parents

Essentially, all life insurance policies can be classified as either term or permanent. Term life insurance policies provide protection for a specific period of time (term) and traditionally do not accumulate cash value, while permanent life insurance policies are designed to last a lifetime and often build cash value for future financial needs.

In addition, many life insurance products on the market today include certain living benefits such as terminal illness, critical illness, chronic illness, disability, or other benefit riders.

In selecting the best type of life insurance for stay-at-home parents it is important to consider whether the need for coverage is temporary or permanent in nature. For most families, term life insurance is often the most cost-effective way to get life insurance for stay-at-home parents. In circumstances involving a disabled child requiring lifelong care, or if other long-term coverage needs exist, a permanent policy may be appropriate. The financial security of having life insurance for stay-at-home parents can provide peace of mind for the family.

Term

Permanent

Stay-at-Home Parents Premium Rates

The thought of increasing expenses by adding life insurance for stay-at-home parents can be a concern for many single-income households.

However, the cost of coverage for SAHMs is often more affordable than one would expect.

In fact, life insurance for stay-at-home parents can be among the lowest groups to insure as a whole. This affordability of life insurance for SAHMs is the result of several contributing factors which include type of coverage, gender, age, and health.

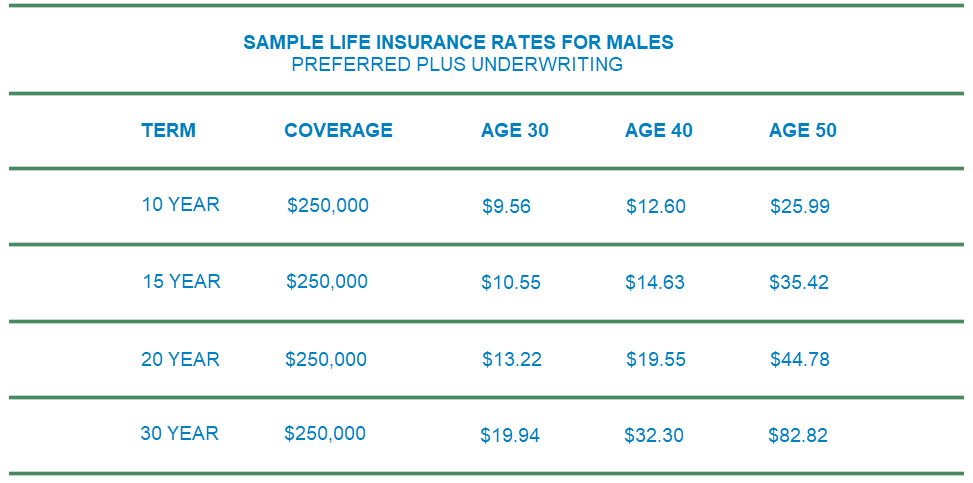

First, term life insurance is often the best coverage option and also happens to offer the lowest initial premium rates when compared to other types of policies. Secondly, the majority of stay-at-home parents are relatively healthy and younger females, all of which contribute to lower premium rates. With that said, life insurance policy approval and rates are at the sole discretion of the insurance company based on an applicant’s age, gender, tobacco use, health, lifestyle, and other considerations. The following rates have been provided as an example of preferred best premium rates for review.

Note: Sample rates provided are based on rate information at the time of publication and are subject to change without notice. Company underwriting makes the final decision concerning rate class and policy approval.

Best Insurers for Stay-at-Home Parents

In evaluating insurance companies when considering life insurance for stay-at-home parents, it is important to research an insurer’s financial strength ratings, product portfolio, premium rates, customer service, and other relevant factors. This selection is important since your family's financial security can depend on the choice.

If an applicant is reasonably healthy, it makes sense to go with a company having the best rates having an A rating. However, if medical issues are a concern, it may be beneficial to apply with the company that offers the most favorable underwriting for a given medical condition having an "A" financial strength rating. In either event, an experienced independent agent can be helpful in navigating the application process.

The following insurers are recommended based on our experience related to financial ratings, product portfolio, premium rates, customer service, and other factors.

Case Study: Stay-at-Home Mom (Liz)

SAHM Case Study

Liz is a 30-year SAHM with two young boys, Max (5) and Sam (2). She and her husband Jeremy have decided that she will stay home while the boys are in school, and he will provide for the family financially through his career as an IT manager. The couple purchased a $500K term life insurance policy on Jeremy a couple of years ago to protect the family’s income, and are now considering life insurance on Liz. In evaluating her coverage needs, Liz and Jeremy consider household debts, childcare, extracurricular activities, and other factors. The couple decided on a $250K term life policy to coincide with Jeremy’s coverage. This policy will allow Jeremy to keep the boys in “their world” should anything happen to Liz, which gives them both significant peace of mind.

Conclusion

In conclusion, life insurance for stay-at-home parents can serve as a crucial safeguard for families, acknowledging the invaluable contributions these parents make to their households. While traditionally focused on replacing lost income, the need for coverage extends far beyond financial compensation. It encompasses the immeasurable value of parental care, household management, and childcare, which are essential for a family's well-being. By securing adequate coverage, families can ensure continuity in their daily lives and protect loved ones from unforeseen challenges. Ultimately, recognizing and valuing the role of stay-at-home parents in insurance planning is essential for a family's financial security.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.