Navigating the Life Insurance Contestability Period

Are you considering purchasing a life insurance policy? If so, it's essential to understand the life insurance two-year contestability period and its implications. During this time period, the insurance company has the right to investigate any claims made under the policy, searching for any misrepresentation or omissions in the application.

This article highlights the importance of understanding the two-year contestability period, from what triggers the contestability period to how it can affect the claims process, we will explore this critical aspect of a life insurance contract.

What is a contestability period?

The two-year contestability period is a specific timeframe after policy approval during which the insurance company can investigate claims made under a life insurance policy.

It starts from the effective date of the policy and typically lasts for two years but also may vary by state insurance regulations.

During this period, the insurer has the right to review the application and any other relevant information to ensure accuracy and truthfulness. If any material misrepresentation or omission is discovered, the insurer may deny a claim or cancel the policy.

The contestability period is designed to protect insurance companies from fraudulent claims and misrepresentation. It allows them to thoroughly assess the risk of the insured and determine the validity of the claims being made. This period is crucial for both the insurer and the policyholder, as it ensures the integrity of the insurance contract and maintains fairness in the claims process.

It’s important to note that the contestability period routinely applies to the first two years of an policy, but may vary by state. Once this period has passed, the insurer is limited in the ability to contest claims based on information provided in the original application.

How Contestability Works

The contestability period begins on the effective date of the life insurance policy and lasts for two years. During this time, the insurance company has the right to investigate any claims made under the policy. They can review the application, medical records, and any other relevant documents to ensure accuracy and truthfulness.

If the insurer discovers any material misrepresentation or omission during this period, they have the option to deny the claim or cancel the policy. Material misrepresentation refers to providing false or misleading information that would have affected the underwriting decision of the insurer. This can include withholding information about pre-existing medical conditions, dangerous hobbies, or a history of substance abuse.

It’s important to note that the insurance company must prove that the misrepresentation was material and not just a minor error or oversight. They need to demonstrate that the misrepresentation had an impact on the underwriting decision and the risks assumed by the insurer. If the insurer cannot prove material misrepresentation, they cannot typically deny a claim or cancel a policy during this period.

In considering the contestability period, it’s crucial for policyholders to ensure that they provide accurate and truthful information in their application. It’s always better to disclose any relevant information, even if it may increase the premium or affect the coverage. Honesty is key during the application process to avoid any coverage issues.

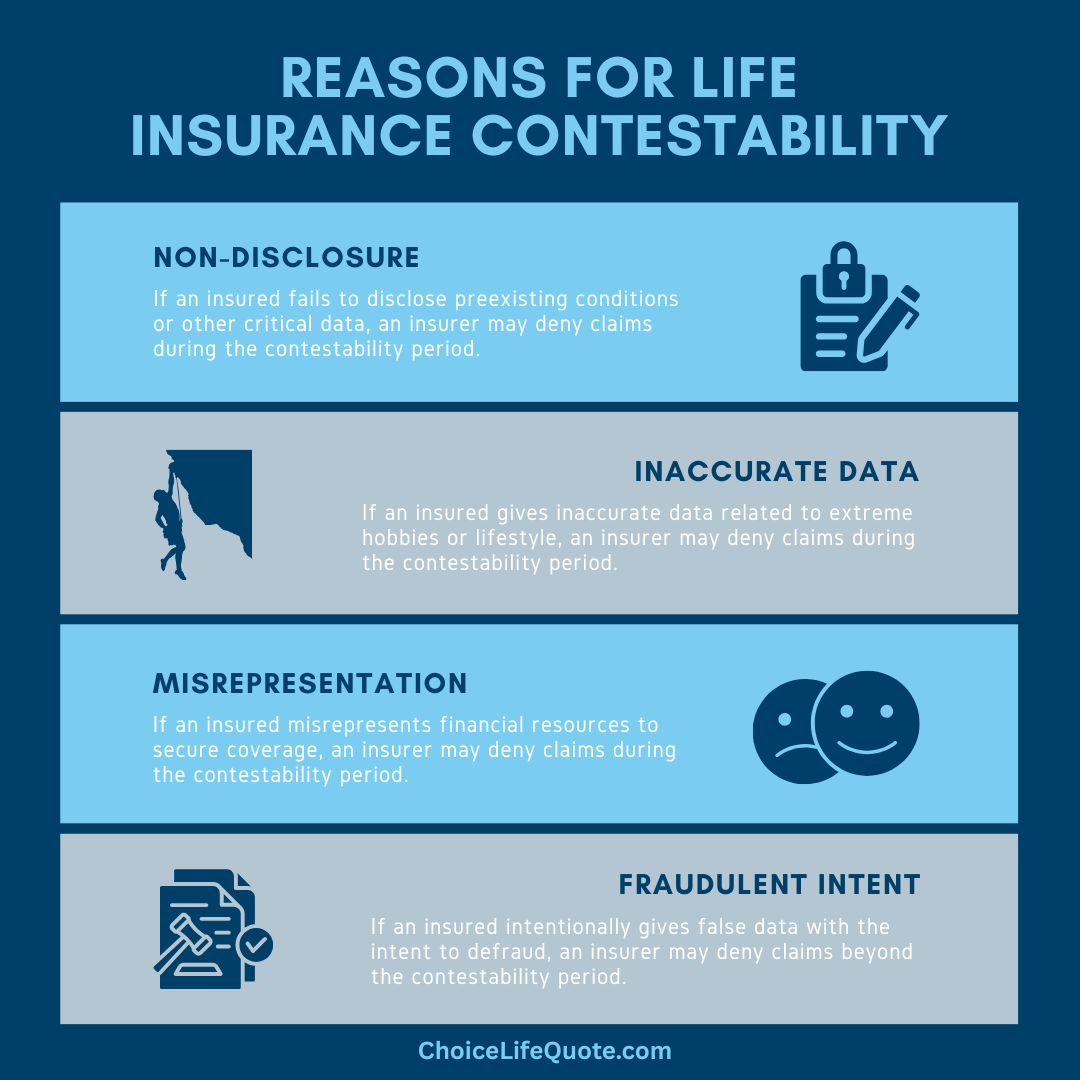

Reasons for Contestability

During the contestability period, there are several common reasons why an insurance company may potentially deny a claim or cancel a life insurance policy.

These reasons typically revolve around material misrepresentation or omissions made by the policyholder during the application process. Here are some examples of reasons for contestability:

Non-disclosure of conditions: If the insured fails to disclose any pre-existing medical conditions that could have affected the underwriting decision, the insurer may deny the claim. For example, if the insured had a history of heart disease but did not disclose it in the application.

Inaccurate lifestyle information: Policyholders are required to disclose dangerous hobbies, such as skydiving or rock climbing, as these activities increase risk. If a policyholder fails to disclose these activities and later dies as a result of them, the insurer may deny the claim based on material misrepresentation.

Misrepresentation of income: Some insurance policies, such as income replacement policies, require the policyholder to provide accurate information about their income. If the insured inflates their income to secure a higher coverage amount, the insurer may deny the claim based on misrepresentation.

Fraudulent owner intentions: In some cases, individuals may intentionally provide false information during the application process with the intention of defrauding the insurance company. This can include fabricating medical records or misrepresenting financial information.

It’s important to note that insurance companies must prove material misrepresentation or fraud during the contestability period. They cannot deny a claim or cancel a policy based on minor errors or non-material information. The burden of proof lies with the insurer to demonstrate that the misrepresentation had a significant impact on underwriting.

After Contestability Period

After this period, the policy is considered incontestable, meaning that the insurer is bound to pay the death benefit or honor any other claims made under the policy, as long as the policyholder has fulfilled all requirements.

It’s important to note that the contestability period does not protect policyholders from fraud or intentional misrepresentation. If the insurer discovers fraudulent activity or intentional misrepresentation after the contestability period, they may still be able to deny a claim or cancel a policy based on these grounds.

Once the contestability period has expired, policyholders can have peace of mind knowing that their life insurance policy is in full effect and that their beneficiaries will receive the death benefit in the event of their passing. However, it’s still crucial to review and update the policy periodically to ensure it aligns with any changes in personal circumstances or financial goals.

Importance of Full Disclosure

Full disclosure is of utmost importance when applying for a life insurance policy. Insurance companies rely on the information provided by applicants to assess risk and determine the appropriate premium. Failing to disclose relevant information can result in denial of claims or cancellation of the policy during the contestability period.

When completing the application, policyholders should provide accurate and truthful information about their health, medical history, lifestyle habits, and any other factors that may impact the underwriting decision. It’s better to err on the side of caution and disclose any information that could potentially affect the policy.

By providing full disclosure, policyholders can ensure that an insurance policy accurately reflects their risk profile and that beneficiaries will be protected in the event of their passing.

Conclusion

In conclusion, the two-year contestability period is a critical aspect of life insurance that policyholders need to understand and navigate effectively. It serves as a safeguard for insurance companies to deter fraudulent claims and misrepresentation. During this period, the insurer has the right to investigate claims and review the accuracy of the information provided in the application. To avoid any issues policyholders must provide accurate and truthful information during the application process.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your individual situation. Get quality coverage at affordable rates. Give us a call at (800) 770-8229, or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.