Differences in Personal and Employee Life Insurance

In today’s uncertain world, financial security has become a top priority for individuals and families alike. One crucial aspect of safeguarding your financial well-being is having the right insurance coverage in place. When it comes to protecting your loved ones, two key types of insurance often come to mind: personal and employee life insurance. While both serve the purpose of providing financial support in the event of an unforeseen tragedy, they differ in several important ways.

This article explores the intricacies of personal and employee life insurance, exploring the features, benefits, and limitations of each type of coverage, empowering you with the knowledge to make the best choice for your financial security.

Understanding Personal Life Insurance

Personal life insurance is a type of insurance policy that individuals can purchase to provide financial protection to their family and beneficiaries in the event of an insured's unexpected or untimely death.

It is designed to provide a lump sum payout, known as the death benefit, to the designated beneficiaries upon the insured person’s passing.

There are several types of personal life insurance policies available in today's marketplace, each with its own unique policy features and benefits. The following provides an overview of the different types of personal life insurance.

Term Life Insurance: This type of policy provides coverage for a specific term, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the insured person passes away during the term of the policy. Term life insurance is known for its affordability and simplicity, making it a popular choice for many individuals.

Whole Life Insurance: Unlike term life insurance, whole life insurance provides coverage for the entire lifetime of the insured person. It combines a death benefit with a savings component known as cash value. The premiums for whole life insurance are generally higher than those for term life insurance, but the policy builds cash value over time, which can be accessed by the policyholder during their lifetime.

Universal Life Insurance: Universal life insurance is a flexible type of policy that allows the policyholder to adjust the death benefit and premium payments. It also includes a cash value component that can earn interest based on market performance. Universal life insurance offers greater flexibility compared to whole life insurance.

Benefits of Personal Life Insurance

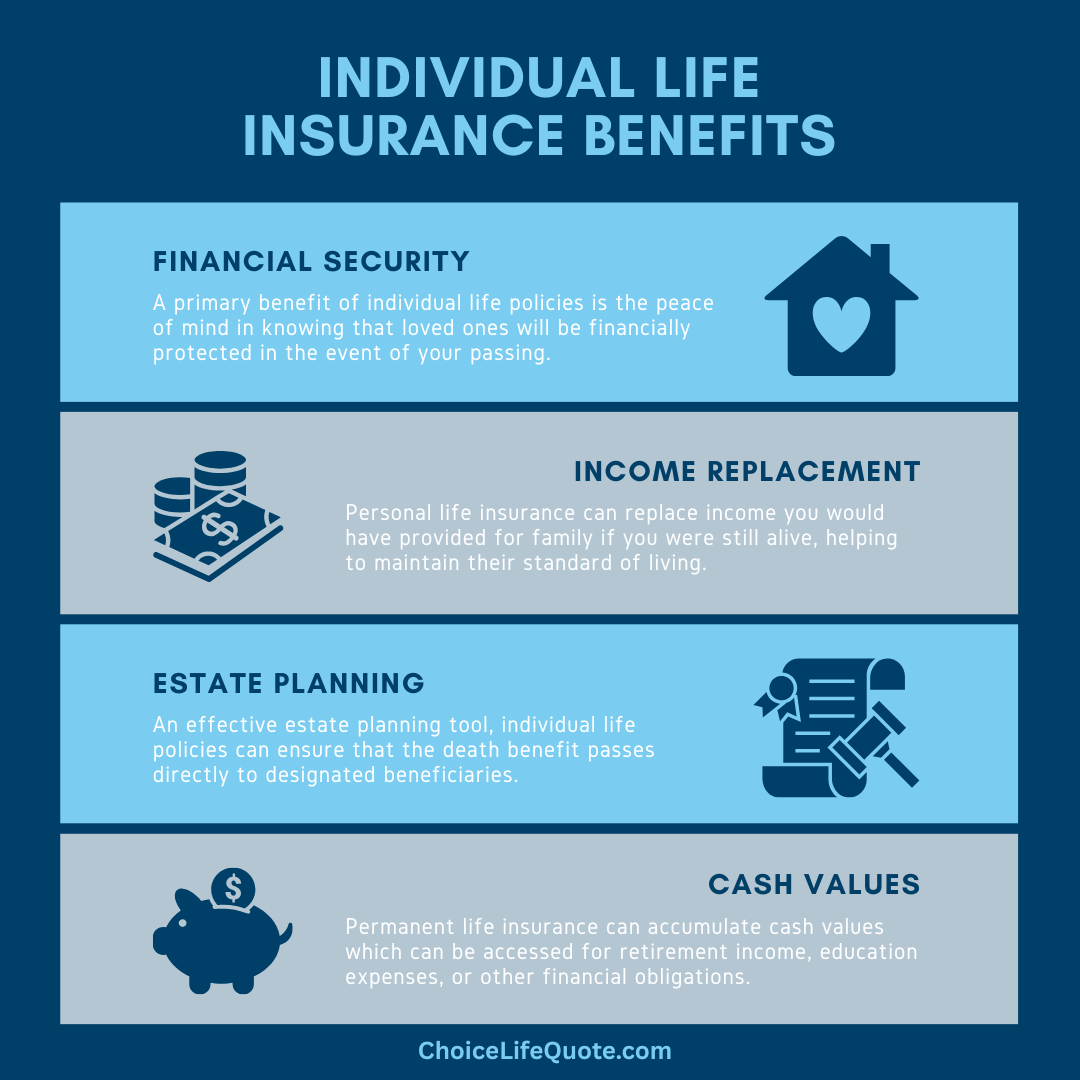

Personal life insurance provides numerous benefits and coverage options that can help protect your loved ones financially in the event of your passing. Here are some key benefits and advantages associated with personal life insurance.

Financial Security: The primary benefit of personal life insurance is the peace of mind it provides, knowing that your loved ones will be financially protected in the event of your untimely death. The death benefit can be used to cover funeral expenses, outstanding debts, mortgage payments, education expenses, and other financial obligations.

Income Replacement: Personal life insurance can replace the income you would have provided to your family if you were still alive. This can help your loved ones maintain their current standard of living and meet their financial needs even in your absence.

Estate Planning: Personal life insurance can be an effective tool for estate planning. It can help cover estate taxes, ensuring that your assets can be passed on to your beneficiaries without the burden of hefty tax liabilities.

Cash Value Accumulation: Whole life insurance and universal life insurance policies build cash value over time. This accumulated cash value can be accessed by the policyholder during their lifetime for various purposes, such as supplementing retirement income, funding education expenses, or covering emergencies.

Considerations with Personal Life Insurance

When choosing a personal life insurance policy, several factors should be taken into consideration to ensure you make the right decision:

Coverage Amount: Assess your financial needs and determine the amount of coverage required to protect your loved ones adequately. Consider factors such as outstanding debts, mortgages, education expenses, and future financial goals.

Premium Cost: Evaluate the premium payments and ensure they fit comfortably within your budget. Remember that the premiums will vary depending on the type of policy, coverage amount, and your age and health status.

Policy Duration: Decide whether you need coverage for a specific term or for your entire lifetime. This will help you choose between term life insurance and permanent life insurance options.

Additional Riders: Consider any optional riders or add-ons that can enhance your policy’s coverage. Examples include critical illness riders, disability income riders, and accelerated death benefit riders.

Financial Stability: Research the financial stability and reputation of the insurance company offering the policy. Look for ratings from independent rating agencies to ensure you choose a reliable and financially secure provider.

Understanding Employee Life Insurance

Employee life insurance, also known as group life insurance, is a type of coverage often provided by employers to their employees as part of an overall employee benefits package.

It typically offers a death benefit equal to a multiple of an employee's salary to the beneficiaries of the covered employee if they pass away while with the company.

Employee life insurance is typically offered at no cost or at a subsidized cost to the employee, making it an attractive perk of employment. While personal and employee life insurance share the goal of providing financial support in the event of an individual’s death, there are several key differences between personal and employee life insurance.

Ownership and Control: Personal life insurance policies are owned and controlled by the policyholder, who has the flexibility to customize the coverage and make changes as needed. In contrast, employee life insurance policies are owned by the employer, and the coverage is typically a fixed amount based on the employee’s salary or a multiple thereof.

Portability Considerations: Personal life insurance is portable, meaning it remains in effect even if you change jobs or leave your current employer. You have the freedom to take your policy with you and continue paying the premiums independently. On the other hand, employee life insurance is tied to your employment. If you leave your job, you may lose the coverage or possibly have the option to convert it to an individual policy, usually at a higher cost.

Underwriting Requirements: Personal life insurance policies typically require medical underwriting, which involves a detailed evaluation of your health history, lifestyle, and other risk factors. The underwriting process helps determine the insurability and premium rates. Employee life insurance, in most cases, does not require medical underwriting, making it easier to obtain coverage without undergoing a medical examination or providing extensive health information.

Coverage Limitations: Personal life insurance policies allow individuals to choose the coverage amount based on their specific needs and financial goals. The coverage limits for employee life insurance are generally predetermined by the employer and may be limited to a certain multiple of the employee’s salary or a fixed amount.

Comparing Personal & Employee Life

While employee life insurance provides a valuable benefit, it should not be solely relied upon for comprehensive coverage. Having a personal life insurance policy in addition to employee life insurance can offer enhanced financial protection and flexibility. Personal life insurance allows you to customize your coverage to meet your specific needs, provides portability, and offers the potential for cash value accumulation. It ensures that you have adequate coverage even if you leave your current job or your employer’s coverage is insufficient.

By having both personal and employee life insurance, you can create a robust insurance portfolio that addresses your short-term and long-term financial goals. It’s crucial to regularly review your insurance needs, especially during significant life events such as marriage, the birth of a child, or purchasing a home. This will ensure that your coverage remains adequate and aligned with your evolving needs.

Both personal and employee life insurance have pros and cons. Here’s a closer look at some of the advantages and limitations of each type of coverage:

Pros & Cons of Life Insurance

Personal Life Insurance

Pros:

- Customizable coverage based on individual needs

- Portability and flexibility to adjust coverage as circumstances change

- Potential for cash value accumulation and access to funds during the policyholder’s lifetime

Cons:

- Generally higher premiums compared to employee life insurance

- Requires medical underwriting, which can be time-consuming and may result in higher premiums for individuals with health issues

- No employer subsidy or contribution toward premiums

Employee Life Insurance

Pros:

- No or low-cost coverage provided by the employer

- No medical underwriting is required in most cases

- Convenient enrollment process through the employer’s benefits program

Cons:

- Limited coverage amount based on salary or predetermined multiples

- Lack of customization options for coverage

- Loss of coverage if you leave your job or change employers

Conclusion

In conclusion, personal and employee life insurance are distinct types of coverage that serve different purposes and have their own set of advantages and limitations. Personal life insurance offers customization, flexibility, and potential cash value growth, making it an essential component of a comprehensive financial plan. Employee life insurance, on the other hand, provides a valuable benefit offered by employers, but it is typically limited in coverage amount and lacks the customization options of personal life insurance. Remember, financial security matters, and having the right life insurance coverage is a crucial step toward achieving peace of mind for yourself and your family.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers at ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help to provide consumers with a variety of educational content related to life insurance and annuities.