Term Life Insurance Conversion Policy Options

Term life insurance can be an excellent choice for individuals looking for affordable and straightforward coverage for a specific period of time. However, what happens when coverage needs change unexpectedly or the guaranteed term comes to an end? That's where term life insurance conversion can be a valuable policy option. By converting your existing policy, you can extend your coverage without the hassle of reapplying or going through an additional medical exam.

This article discusses the options, benefits, and process associated with term life insurance conversion, helping you to navigate conversion with confidence in support long-term financial goals and objectives.

Understanding Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years, unlike permanent life insurance, which provides coverage for the insured’s entire lifetime.

Term life is designed to meet specific temporary financial needs, such as providing income replacement, paying off debts, or funding children's future education.

These term policies are generally more affordable compared to permanent life insurance policies, making them an attractive option for individuals looking for cost-effective coverage. Term policies have a predetermined term length, which can vary depending on the individual’s needs and preferences. Common term lengths include 10, 15, 20, or 30 years. During the term, the insured pays regular premiums to maintain the coverage. If the insured passes away within the term, the death benefit is paid out to the beneficiaries. However, if the insured outlives the term, the policy expires, and no death benefit is paid out. This is where term life insurance conversion comes into play, offering a way to extend coverage beyond the initial term without the need for additional underwriting.

What is term insurance conversion?

Term life insurance conversion is a feature that allows policyholders to convert their term life insurance into a permanent policy without undergoing a new medical exam or providing evidence of insurability. Permanent life insurance, such as whole life or universal life insurance, provides lifetime coverage, as long as the premiums are paid. This means that converting a term life insurance policy to a permanent policy offers lifelong coverage and the potential to accumulate cash value over time.

The conversion feature is typically included in the contract of the term life insurance policy and allows policyholders to convert their coverage within a specified conversion period. The conversion period is usually limited to a certain age or number of years from the policy’s inception. It’s important to note that term life insurance conversion is not available for all term life insurance policies, so it’s crucial to review the policy terms and conditions to determine if conversion is an option.

Benefits of Term Conversion

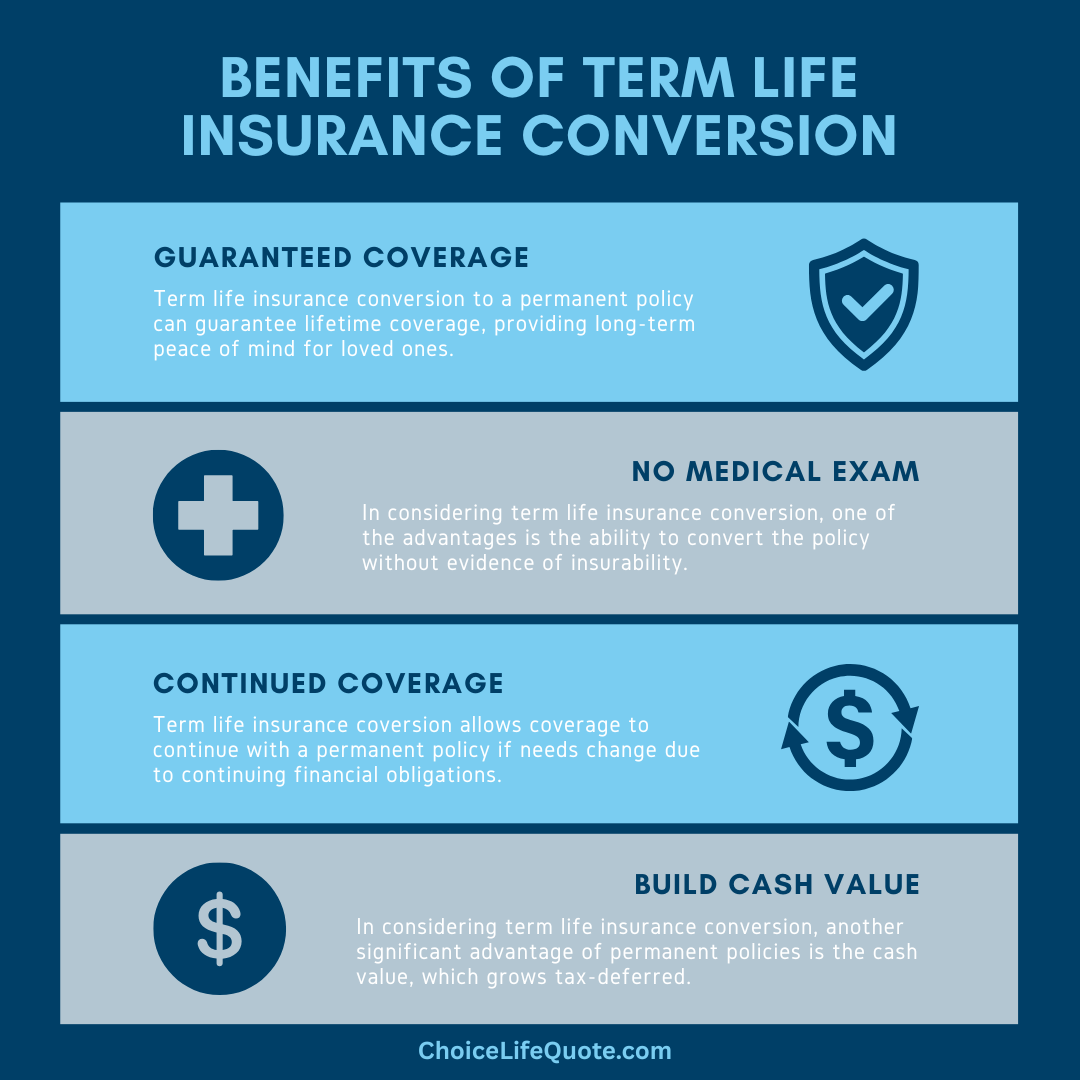

Term life insurance conversion offers several benefits for policyholders, making it a valuable feature to consider. Here are some of the key advantages:

Guaranteed coverage: Converting your term life insurance policy to a permanent policy guarantees coverage for the rest of your life, as long as you continue to pay the premiums. This provides peace of mind knowing that your loved ones will receive a death benefit regardless of when you pass away.

No medical exam: One of the biggest advantages of term life insurance conversion is the ability to convert without undergoing a new medical exam or providing evidence of insurability. This is especially beneficial if your health has deteriorated since you first obtained the term life insurance policy, as it allows you to secure permanent coverage without the risk of being denied or charged higher premiums due to your current health condition.

Continued Coverage: Converting a term life insurance policy allows you to continue coverage with a new permanent life insurance policy. This can be important if your coverage needs have changed since initially purchasing term coverage. The need for continued life insurance coverage can involve a variety of circumstances, such as continued financial obligations, special needs family members, or the desire to leave an inheritance.

Cash value accumulation: Permanent life insurance policies, including those obtained through term life insurance conversion, have the potential to accumulate cash value over time. Cash value is a portion of the premium payments that grows tax-deferred and can be accessed during the insured’s lifetime through policy loans or withdrawals. This can provide a source of funds for various financial needs, such as supplementing retirement income or covering unexpected expenses.

Eligibility for Term Conversion

Not all term life insurance policies offer the option to convert, and there may be specific eligibility requirements that need to be met. The conversion eligibility criteria can vary between insurance companies and policies, so it’s essential to review your policy documents or consult with your insurance agent to understand the specific requirements. However, here are some common eligibility factors to consider:

Conversion period: Term life insurance conversion is typically available within a specific conversion period, which is defined in the policy terms. This period can range from a few years to the end of the term or a specific age, such as age 65 or 70. It’s important to convert before the conversion period expires, as you may lose the opportunity to convert once this period has passed.

Insurability: While term life insurance conversion does not require a new medical exam or evidence of insurability, it’s important to note that the eligibility for conversion is based on the original underwriting of the term life insurance policy. If you were initially approved for the term life insurance policy, you should generally be eligible for conversion, regardless of any changes in your health. However, if you were originally rated or declined during the underwriting process, conversion may not be available.

Policy type: The availability of term life insurance conversion may vary depending on the type of policy you have. Some policies may offer conversion options to multiple types of permanent life insurance, such as whole life or universal life, while others may have limitations or restrictions. It’s crucial to review your policy documents or consult with your insurance agent to understand the conversion options available to you.

How Term Conversion Works

Term life insurance conversion is a standard process that allows policyholders to convert their term policy into a permanent policy. Here’s a step-by-step overview of how term life insurance conversion typically works:

- Review your policy: Start by reviewing your term life insurance policy documents to understand the conversion options available to you. Pay close attention to the conversion period, conversion options, and any limitations or restrictions.

- Contact insurance company: If you’re interested in converting your term life insurance policy, reach out to your insurance company or agent to initiate the conversion process. They will guide you through the necessary steps and provide you with the required documentation.

- Select the conversion option: Depending on your policy and the options available, you may have the choice to convert to different types of permanent life insurance, such as whole life or universal life. Consider your financial needs and goals to determine the most suitable conversion type for you.

- Complete conversion application: Once you’ve selected the conversion option, you will need to complete a conversion application. This application typically requires basic information about yourself, the policy details, and the desired conversion. Your insurance company will provide you with the necessary forms and instructions.

- Pay the premium: To convert your term life insurance policy, you will need to pay the premium associated with the permanent policy. The premium amount will depend on various factors, including your age, health rating, desired coverage amount, and the conversion type selected. Your insurance company will provide you with the premium details and payment options.

- Review new policy: After completing the conversion process you will receive a new permanent life insurance policy. Take the time to review the policy documents and ensure that all the details, including the coverage amount, premium, and beneficiaries, are accurate.

- Continue paying premiums: Once your term life insurance policy is converted to a permanent policy, you will need to continue paying the premiums to maintain the coverage. Make sure to understand the premium payment schedule and options.

Term Conversion Considerations

Term life insurance conversion can be a beneficial option for many policyholders, but it’s essential to consider several factors before making the decision to convert.

By researching, reviewing, and considering the considerations associated with term life insurance conversion you can ensure that you are making informed decision. Here are a few key conversion considerations:

Financial affordability: Converting a term life insurance policy to a permanent policy typically results in higher premiums. Before converting, assess your financial situation and ensure that you can comfortably afford the increased premium payments. Consider your current income, expenses, and long-term financial goals to determine if the conversion aligns with your budget.

Coverage needs: Evaluate your current coverage needs and how they may change in the future. If your financial obligations, such as mortgage payments or education expenses, are temporary and will be fully paid off within the remaining term of your term life policy, conversion may not be necessary. On the other hand, if you have ongoing financial responsibilities or want to leave a legacy for your loved ones, converting to a permanent policy can provide lifelong coverage.

Health condition: While term life insurance conversion does not require a new medical exam, it’s important to consider your health condition in converting. If your health has significantly deteriorated since you first obtained the term life insurance policy, conversion might be an effective way to continue coverage since you may not be able to qualify for a new policy in the future. Assess your health and consult with your insurance agent to understand how your current health may impact future insurability.

Cash accumulation: If cash value accumulation is a priority for you, converting to a permanent policy can provide the opportunity to build cash value over time. However, it’s crucial to understand the cash value growth potential and the associated costs, such as policy fees and charges. Evaluate the projected cash value growth and determine if it aligns with your financial goals.

Alternative options: Before converting, explore alternative options to meet your coverage needs. For example, you may consider purchasing a new term life insurance policy if you require temporary coverage for a specific period. Comparing the costs and benefits of different options can help you make an informed decision.

Alternatives to Term Conversion

Term life insurance conversion may not be the best option for everyone. Depending on your specific needs and circumstances, alternative options may be more suitable. Here are some alternatives to consider:

Purchasing a new life insurance policy: If your coverage needs are temporary and limited to a specific period, purchasing a new term life insurance policy may be a more cost-effective option. This allows you to tailor the coverage amount and term length to your current financial situation and obligations.

Supplementing with additional coverage: Instead of converting your entire term life insurance policy, you may consider supplementing it with additional coverage. This can be achieved by purchasing a new permanent life insurance policy alongside your existing term policy. This approach provides the flexibility of both temporary and lifelong coverage.

Exploring other permanent life options: If you’re interested in permanent coverage but don’t want to convert your term policy, explore other permanent life insurance options available in the marketplace.

Conclusion

In conclusion, term life insurance conversion is a feature that allows a policyholder to convert their term life insurance into a permanent life insurance policy without undergoing a new medical exam or providing evidence of insurability. This can be a great option if you have a need for continued coverage and are interested in the potential to accumulate cash value over time. It is important to work with a qualified insurance professional to determine coverage objectives and available options.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your individual situation. Get quality coverage at affordable rates. Give us a call at (800) 770-8229, or request an instant quote today!

FAQs

Term life insurance conversion is a feature that allows you convert your term policy into a permanent policy without undergoing new medical underwriting. This means you can secure lifelong coverage even if your health or lifestyle has changed since you initially purchased your original term policy.

The conversion period varies by insurer, but most term life insurance policies allow conversion anytime before the term expires or up to a specific age stated in your original contract. It’s important to check your policy’s conversion window and options so that you don’t miss the opportunity to convert.

Depending on your insurer, you may be able to convert your term life insurance to whole life, universal life, or indexed universal life insurance. The available conversion options are defined by your policy’s terms, so reviewing your contract or consulting with an agent can help you choose the best fit.

No — one of the major advantages of term conversion is that you usually do not need a medical exam or health questions to convert. Your coverage is based on the original issue age of the policy, which can be especially valuable if your health has changed since you first bought the term policy.

People often convert term life insurance when they want permanent protection, cash value growth, or coverage that lasts beyond the term period. Converting can be a smart option if you’ve outlived the original purpose of your term coverage but still want life insurance without re-qualifying medically.

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

The Staff Writers for ChoiceLifeQuote.com are insurance and financial services professionals with significant industry experience. The team’s experience and expertise help provide consumers with a variety of educational content on life insurance and annuities.