Life Insurance for Marijuana Users [420 Friendly Insurers]

The use of marijuana has become somewhat more mainstream in recent years, with evolving trends in medical marijuana prescriptions and an increasing number of states legalizing the drug’s recreational use. As a result, our team occasionally receives questions related to life insurance for marijuana users. Common questions include… Can someone who smokes marijuana get life insurance? Do life insurance companies test for marijuana? Or... Will having a prescription for medical marijuana affect my life insurance premium rates?

This article discusses, life insurance for marijuana users, and provides information related to life insurance and marijuana, underwriting considerations, sample rates, recommended insurers, and other considerations for high-risk life insurance.

Life Insurance for Marijuana Users

The use of marijuana by an ever-growing segment of the population is nothing new. However, trends related to the use of medical marijuana and state legalization promise to alter the marijuana landscape. In light of the increase in legalized use, insurance companies are inevitably being presented with a variety of underwriting concerns.

In considering the negative health implications of drug use in general, it is understandable that many insurers approach life insurance for marijuana users from a conservative standpoint. For some companies, this may mean charging standard smoker rates, while for other insurers, marijuana use may result in a decline of coverage altogether. Fortunately for marijuana users, a handful of insurance companies have taken a proactive approach to marijuana underwriting. An important key to qualifying for life insurance as a marijuana user is choosing the right insurance company. In many instances, marijuana users can qualify for affordable life insurance rates (even preferred rates) depending on the frequency of use, delivery method, and the insurance company.

According to the Centers for Disease Control and Prevention, “marijuana use has increased since 2007. In 2013, there were 19.8 million current users—about 7.5 percent of people aged 12 or older—up from 14.5 million (5.8 percent) in 2007.”

In evaluating an application for life insurance, insurers generally assign a classification based on the proposed insured’s health, lifestyle, family history, and other factors.

It is common for an insurer to require a medical examination, medical records, and other information in addition to the basic application for coverage.

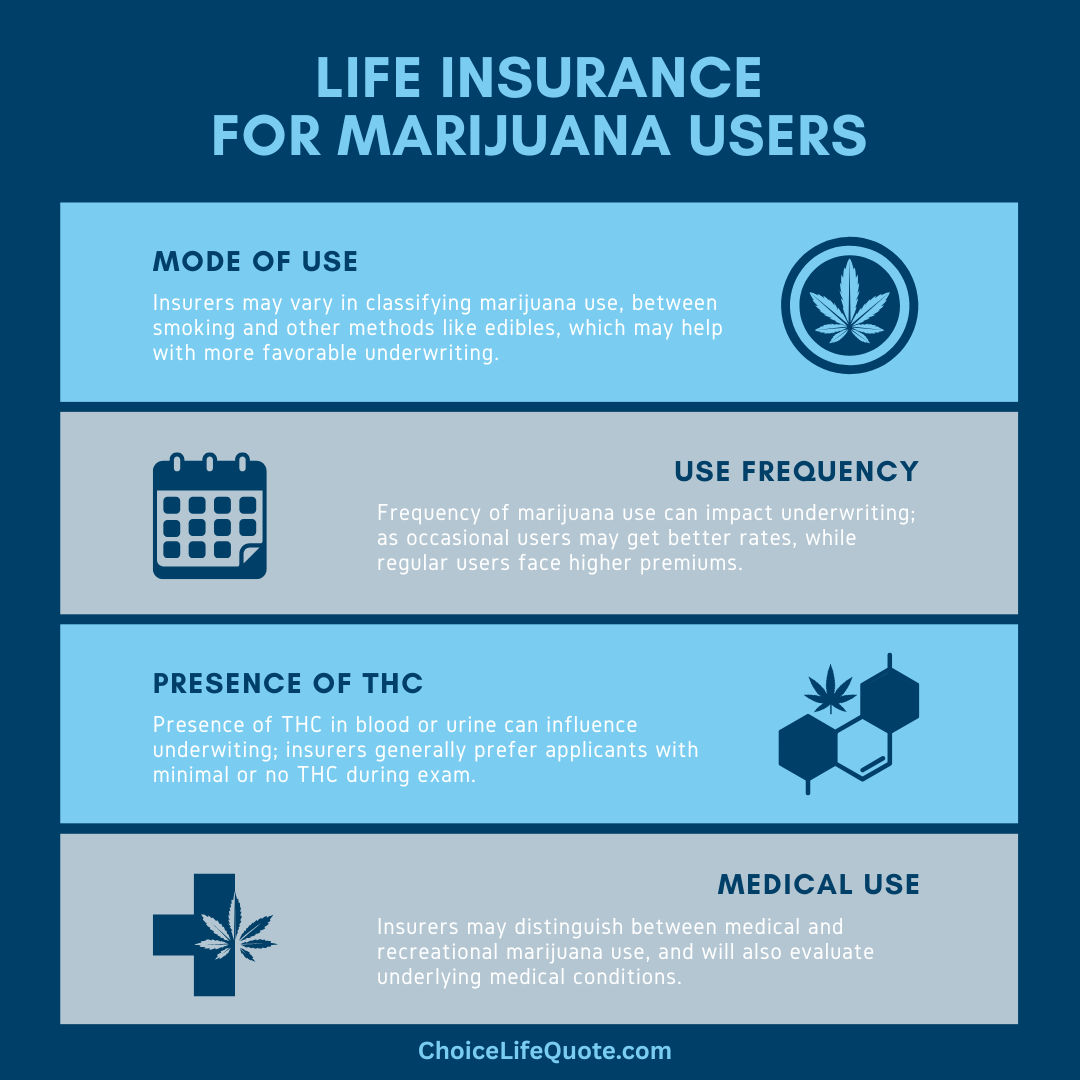

The underwriting considerations related to marijuana will routinely include the mode and frequency of use, whether THC is present in blood or urine, recreational vs. medicinal use, underlying conditions for medical marijuana, and other considerations. In evaluating marijuana use, certain insurance companies may classify applicants who smoke marijuana as tobacco users, while others may offer non-tobacco rates or even preferred pricing.

Mode of Use

The type of marijuana products used is a common consideration in underwriting life insurance for marijuana users. Given the negative health consequences associated with smoking in general, it is understandable that some insurers classify applicants who smoke marijuana as “smokers” or tobacco users. It is important to note the significance of the tobacco vs. non-tobacco classification since premium rates for tobacco users can be DOUBLE that of non-tobacco users. In contrast, some insurers take a somewhat more liberal view of other modes of use such as vaporizers, edibles, oils, sprays, creams, and others.

Frequency of Use

The frequency of an individual’s marijuana use can also have a significant impact on policy approval and premium rates depending on the insurance company. In some ways, these standards can be similar to cigar smoking guidelines allowing occasional use within certain limitations. As an example, with certain insurance companies, if you use marijuana once a month, disclose use, and have no THC in your system, you can possibly get “preferred best” rates provided you are otherwise qualified. Whereas, if you use marijuana three or four times per month, you are likely looking at “standard non-tobacco” rates, which are higher but still less than smoker rates. However, if you use it several times each week, you may be lucky to qualify for tobacco rates or could possibly be declined all together.

Presence of THC

Tetrahydrocannabinol, commonly known as THC, is the compound in marijuana that provides the psychoactive effects or “high.” THC may be consumed by smoking or otherwise using marijuana as vapor, edibles, oil, sprays, and other methods. This substance is also what shows up in the blood and /or urine tests conducted as part of the insurance medical exam. While select insurers are willing to accept traces of THC, most companies are not so forgiving. Therefore, it is best to minimize your risk by being THC-free when applying for life insurance.

According to Healthline, marijuana may be detected in the urine based on quantity and frequency of use as follows:

- Occasional use (less than three times per week) – three days

- Moderate use (four or more times per week) – five to seven days

- Chronic use (daily use for long periods) – ten to fifteen days

- Heavy Use (several times per day) – thirty days or more

Recreational Use

Smoking marijuana for recreational purposes is nothing new. However, its acceptance by certain life insurance companies is a more recent trend. As recreational use of the drug becomes more common and is legalized in additional states, it is likely that insurers will loosen marijuana-related underwriting requirements. However, it is important to understand that underwriting requirements for marijuana users is at the discretion of each individual insurer, with mode and frequency of use being key considerations for even the more “marijuana-friendly” insurance companies.

Medicinal Use

The medicinal use of marijuana has increased significantly in recent years. According to Harvard Medical School, “about 85% of Americans support legalizing medical marijuana, and it is estimated that at least several million Americans currently use it.”

The clinical acceptance of medical marijuana can be helpful in life insurance underwriting. However, the underlying health condition may still be a challenge. Medicinal marijuana is most commonly prescribed for chronic pain control and related conditions. In such situations, the insurance company will routinely require a comprehensive evaluation of the medical condition for which marijuana is prescribed.

Other Considerations

In addition to the underwriting discussion above, other common health and moral factors that may come into play include a history of alcohol or substance abuse, psychiatric conditions, criminal convictions, driving infractions, and other considerations. These factors combined with marijuana use may present a “red flag” to an insurance company and can negatively affect policy approval.

Questions to Expect

In evaluating an application of life insurance for marijuana users, the insurance company will routinely require a standard application and medical exam but may also request medical records and ask additional questions related to marijuana use. The combination of these requirements and information specifically related to marijuana use will be used to determine insurability and rate class. Questions that a marijuana user applying for life insurance could expect may include the following:

- Have you ever used any form of marijuana?

- Do you currently use marijuana products?

- What type of marijuana products do you use?

- What is the frequency of your marijuana use?

- When was the date of last marijuana use?

- Is marijuana use medicinal or recreational?

- If medicinal, do you have a medical marijuana card?

- If medicinal, what is the underlying condition?

- Have you ever had any drug-related convictions?

- Have you ever been convicted of a DUI or DWI?

- Do you have a history of alcohol or substance abuse?

- Do you have a history of psychiatric conditions?

- Have you had any inconsistencies in work history?

Also, we occasionally receive questions related to potential repercussions for disclosing marijuana use to an insurance company when applying for a life insurance policy. Based on health privacy laws, specifically the Health Insurance Portability and Accountability Act (HIPAA), insurance companies are not allowed to share your medical information outside of the underwiring process, Medical Information Bureau (MIB), and other authorized channels. According to the U.S. Department of Health & Human Services, “the HIPAA Privacy Rule establishes national standards to protect individuals’ medical records and other personal health information.”

Please note that underwriting standards vary by individual insurer, so it is important to work with an experienced independent agent who has a working knowledge of various company underwriting policies as related to marijuana use.

In considering an individual’s life insurance application, the insurer evaluates a proposed insured’s age, gender, tobacco status, and other elements along with overall health and lifestyle considerations.

Through this underwriting process, the insurance company determines an applicant’s insurability and rate class.

The premiums an insured pays are based upon age, gender, assigned rate class, policy face amount, and length of coverage and can vary significantly by the insurance company and product. As discussed, rate classes for marijuana users could range from PREFERRED BEST NON-TOBACCO to STANDARD TOBACCO, or even a decline of coverage based on the applicant’s individual situation. The following provides sample life insurance rates for both preferred best non-tobacco and standard tobacco rates for comparison.

Sample Non-tobacco vs. Tobacco Rates

Note: Sample rates provided are based on rate information at the time of publication and are subject to change without notice. Company underwriting makes the final decision concerning rate class and policy approval.

Best Companies for Marijuana Users

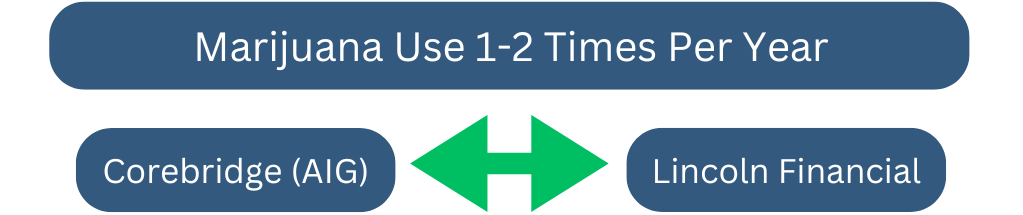

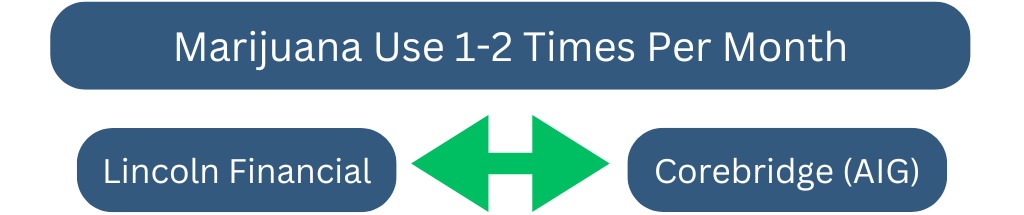

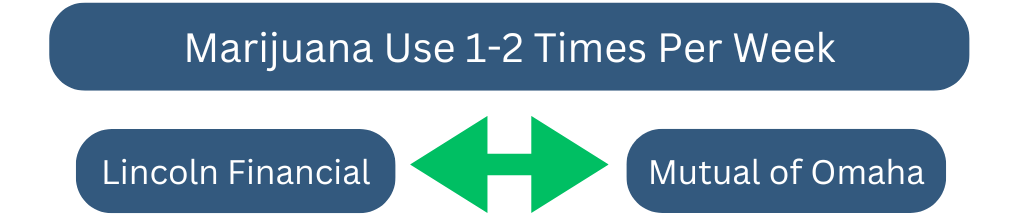

In researching top-rated insurers, there are a handful of life insurance companies that offer somewhat favorable underwriting consideration to life insurance for marijuana users. Due to the complicated nature of marijuana underwriting, if is advised that you work with an experienced independent agent having a working knowledge of the various company underwriting policies.

Also, please be aware that individual company underwriting policies are subject to change at any time. The following companies are recommended based on our experience related to underwriting standards, marijuana policies, financial strength, and premium rates.

Tip #1 – Work with an Experienced Independent Agent

The first tip in getting affordable life insurance for marijuana users is to work with an experienced independent agent or broker. Independent agents have access to a number of top-rated companies and also routinely have a working knowledge of various underwriting policies. This autonomy allows independent agents to recommend the insurance companies that best fit the individual applicant’s situation. As an example, an independent agent may recommend one company for an applicant who smokes marijuana once per year and another company for someone who uses marijuana once per week, based on the different underwriting policies of each insurer.

Tip #2 – Provide Complete and Accurate Information

In some instances, marijuana users applying for life insurance may consider whether full disclosure is in their best interest. However, in our experience, honesty is always the best policy. After all, it is likely that evidence of the drug’s use will show up in lab tests or medical records anyway, and if not disclosed, could result in a decline from even the more “marijuana-friendly” insurers. Whereas, if you provide complete and accurate information upfront, your agent can recommend the insurer that considers your specific situation most favorably. Also, in addition to being dishonest, lying on an insurance application can be considered misrepresentation or even fraud.

Tip #3 – Choose the Best Life Insurance Company

In comparing underwriting policies among top-rated life insurance companies, there are often significant differences in rate classes assigned to various medical and lifestyle factors. The use of marijuana is one such lifestyle choice that may be viewed differently depending on the insurance company that you select for coverage. As an example, one insurer may approve occasional marijuana use for preferred best non-tobacco rates, while another could assign standard tobacco rates, and others may decline coverage all together. This variance in underwriting class between companies could result in the policyholder paying twice as much in policy premiums. Choosing the "best insurance company” refers to selecting the insurer that most favorably views your type and frequency of marijuana use and other individual underwriting considerations. This choice can mean the difference in policy approval, as well as thousands of dollars in premiums over the life of the policy.

In conclusion, navigating life insurance as a marijuana user requires careful consideration of insurer policies and underwriting practices. As societal views and legal landscapes evolve, so too do the options available for marijuana users seeking coverage. While some insurers may categorize users under higher-risk classifications akin to smokers, others offer more lenient terms, potentially even granting preferred rates depending on usage. Ultimately, transparency and working with an experienced independent agent remain pivotal in securing affordable and suitable life insurance that meets the unique needs of marijuana users in today’s changing insurance market.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.