Life Insurance for Overweight Individuals (Insider Tips)

The majority of Americans struggle with weight at some point during their lifetime. As a result, we often receive questions from consumers about life insurance for overweight individuals or how being overweight will affect their life insurance application, underwriting, and premium rates. These concerns are entirely understandable given the number of people who face challenges related to obesity and associated medical conditions. However, it is often possible to qualify for affordable life insurance even if you have challenges with your weight.

This article discusses life insurance for overweight individuals, including information related to life insurance and build, best life insurance companies for weight challenges, and tips for applying for life insurance as an overweight applicant.

Life Insurance for Overweight Individuals

In the United States, being overweight has become an all too common occurrence among all age groups and demographics.

According to the Centers for Disease Control and Prevention, "the prevalence of obesity was 39.8% and affected about 93.3 million of U.S. adults in 2016.” These statistics highlight a major health concern for Americans.

According to the Centers for Disease Control and Prevention, “Obesity-related conditions include heart disease, stroke, type 2 diabetes, cancer, and others..."

In addition to the negative health effects of obesity itself, being overweight may contribute to heart disease, diabetes, and other serious health conditions. Based on negative health effects and associated increased mortality, it is understandable that life insurance companies consider an individual’s build, or height and weight, as an integral part of the medical underwriting process. Consumers challenged with obesity can expect to pay higher premium rates for their life insurance or in severe instances, potentially be declined for coverage altogether. However, in the majority of cases, it is possible for heavier applicants to qualify for affordable life insurance for overweight individuals.

Underwriting Considerations for Build

In considering an individual’s application for life insurance, an insurance company will traditionally ask health-related questions and conduct a physical exam, as well as review medical records, medical information bureau data, and other relevant information.

In the underwriting process, one of the first physical characteristics evaluated is build.

While being overweight is commonly the primary concern, being underweight or recent rapid weight loss can also be cause for scrutiny. An applicant’s build falling outside of select ranges can result in increased premium rates or potentially decline of coverage. Underwriting considerations for build routinely include height, weight, gender, age, and associated health issues. These factors allow the company’s underwriting team to holistically consider life insurance for overweight applicants.

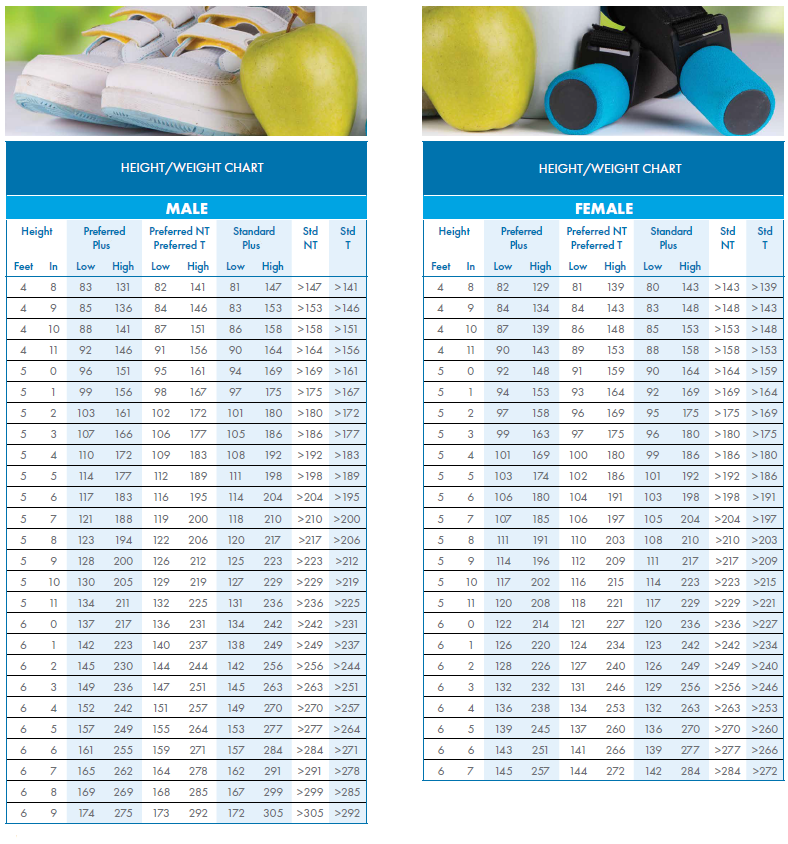

Height/Weight – A life insurance company’s underwriting guidelines traditionally include height/weight charts which outline acceptable ranges for different underwriting classifications based on build. This consideration of ratio takes into account an applicant’s Body Mass Index (BMI), and actuarial data related to height/weight ratios. If you are interested in determining your own BMI, the National Institute of Health provides an interactive BMI Calculator for personal use.

Gender/Age – Build guidelines are often adjusted for gender, taking into consideration differing body types between males and females. Age is also routinely considered, providing senior applicants slightly more lenient height/weight standards to account for normal bodily changes associated with aging. The intent of these underwriting adjustments is to provide an accurate picture of the applicant’s height/weight ratio and its impact on overall health.

Health Problems – In addition to the impact of height and weight on an applicant’s mortality, associated health problems can also be a significant factor when underwriting life insurance for overweight individuals. According to the Mayo Clinic, obesity can contribute to a number of associated serious health problems, including:

Sample Build Chart (Height/Weight)

The following sample build chart provides an illustration of preferred through standard underwriting classes based on height and weight from a well-known insurer.

Tip #1 – Provide Accurate Height/Weight

In our experience applicants, sometimes “shave” a few pounds off or “grow” a few inches when providing their height/weight on a life insurance application, only to have the true numbers revealed during their physical exam. Though this may seem like a good idea, it can actually be somewhat counterproductive when applying for life insurance for overweight individuals. It is extremely important that you provide an accurate height/weight on your life insurance application since even a pound or two can make a difference in premium rates. Having accurate height/weight information provides your agent the data needed to select the insurance company that will be most advantageous and to advise you of build range breakpoints. In some instances, losing a pound or two can make a substantial difference in your premium rates for years to come.

If you do have a history of being overweight, underweight, or have experienced rapid weight loss, the insurance company that you select will likely ask the following or similar questions.

Tip #2 – Select the Right Insurance Company

It is common for different life insurance companies to have varying underwriting standards for height and weight. These variations in build standards often make a difference in premium rates from one company to another, or even whether a policy is approved or declined. When shopping for life insurance with weight challenges, it is important to work with an experienced independent agent who has access to multiple insurance carriers. This independence allows the agent to recommend the company that considers your individual situation most favorably. In our experience, the following companies routinely offer the best life insurance for overweight applicants, subject to individual consumer circumstances.

Tip #3 – Optimize Results During the Exam

If you are applying for fully underwritten coverage, you will most likely be required to take a physical exam as part of the underwriting process. During this exam, you will routinely be asked a series of medical questions, provide a blood and urine sample, and have your height and weight verified. Getting the best results on your life insurance exam is important in getting the policy approved and in order to receive the best premium rates possible. If you are close to qualifying for a lower weight band, it is a good idea to schedule your exam first thing in the morning when your body weight is routinely at its lowest. Also, responsibly losing a few pounds prior to your exam may be helpful in qualifying for the best rates possible.

Case Study

Life Insurance for Overweight

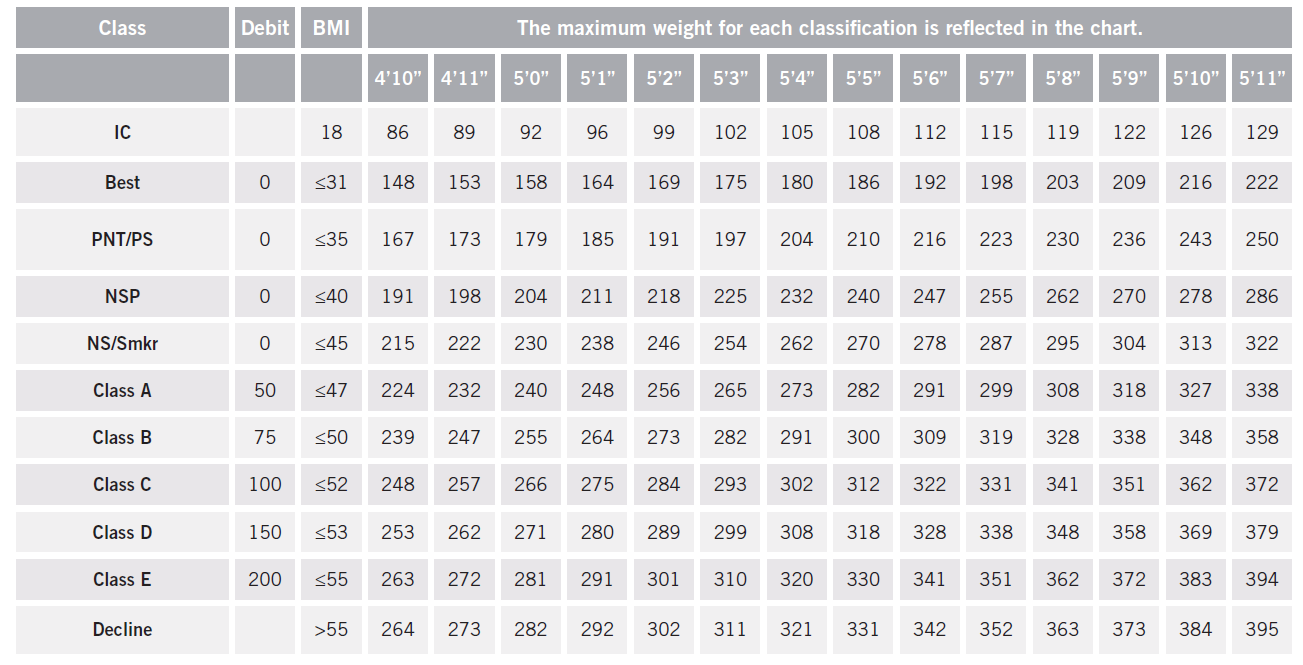

Cecil is a 60-year-old restaurant owner who needs to purchase a $250,000 life insurance policy in order to secure a business loan through the Small Business Administration (SBA). He is concerned that with a height of 5’ 10” and a weight of 312 pounds, he will not be able to qualify for the required coverage, even though he has no other medical issues. In speaking with an independent insurance agent, Cecil learns that there are “A” rated companies that are somewhat liberal with regard to height/weight with life insurance for overweight consumers. By choosing the right insurance company and maintaining steady weight prior to his exam Cecil not only qualified for coverage but received a standard underwriting class and premium rates. Ultimately, he was able to purchase the required life insurance policy at a much lower rate than expected and qualify for his much-needed business loan. Sample build table from a leading insurance company has been provided below for review.

Sample Build Table

Build Table 2 Male and Female – Age 60 and Over

Note: Life insurance rating classification are based on Body Mass Index (BMI) and other factors. Height and weight tables are presented for guidance only. Build requirements will vary by individual insurance company.

Conclusion

In conclusion, while the impact of weight on life insurance rates can be significant, it's important for overweight individuals to understand that affordable coverage is often attainable with the right approach. By disclosing accurate height and weight information, selecting insurers with favorable underwriting standards, and optimizing conditions for physical exams, applicants can improve their chances of securing competitive premiums. Despite challenges associated with obesity, numerous insurance companies offer viable options, ensuring that individuals can find suitable life insurance coverage tailored to their specific needs and circumstances. Taking proactive steps and working with an experienced agent can make a substantial difference in navigating the application process.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.