Qualifying for Life Insurance with Depression

It is fairly common for patients to seek advice and treatment for depression or anxiety-related conditions. It is so common that this information is often initially omitted when applying for life insurance with depression or a similar diagnosis. So, is depression a preexisting condition that should be disclosed when applying for life insurance? If so, is it possible to get affordable life insurance with depression? In both cases, the answer is YES. It is important to fully disclose all medical conditions when applying for life insurance. With that said, it is often possible to qualify for affordable life insurance with a depressive mood disorder.

This article discusses qualifying for life insurance with depression, including life insurance with various depressive mood disorders, underwriting considerations, and recommended insurers when applying for life insurance with medical conditions.

Understanding Depression

Depression is a common yet potentially serious mood disorder affecting millions of Americans each year in the United States..

According to the National Institute of Mental Health, mood disorders diagnosed as clinical depression or major depressive disorder can result in severe symptoms affecting how an individual thinks, feels, and functions.

These conditions may develop and present in a variety of ways depending on the individual patient. It is important to understand your specific diagnosis and how it may affect you in qualifying for life insurance with depression. Common forms of depressive mood disorders include but may not be limited to the following.

Common Types of Depression

Persistent Depressive Disorder – Persistent depressive disorder, also known as dysthymia, refers to a depressive mood disorder that persists for a period of two years or more. This condition may vary in symptom severity over time but is marked by long-term persistence.

Postpartum Depression – Postpartum depression refers to a depressive mood disorder affecting a large number of women post child delivery. Some expectant mothers experience depression during, as well as postpartum. This condition may impact a new mother’s ability to perform daily activities and properly care for their newborn.

Psychotic Depression – Psychotic depression refers to a combination of severe depression and episodes of psychosis, such as delusions, hallucinations, or other symptoms. This condition may involve a specific reoccurring theme associated with the psychotic episodes.

Seasonal Affective Disorder – Seasonal affective disorder refers to seasonal depression often occurring during the winter when daylight hours are decreased. This condition routinely presents as a withdrawal from social activity, increased sleep requirements, seasonal weight gain, and other similar symptoms.

Bipolar Disorder – Bipolar disorder is technically a different diagnosis from depression but can present similar symptoms as depressive mood disorders with of episodes extremely “low moods (depression), as well as extremely “high moods” (mania).

Treatment for Depressive Mood Disorders

In the majority of cases, clinical depression can be successfully treated utilizing medication or psychotherapy. These forms of treatment often provide significant relief for those suffering from this potentially debilitating condition. When treating depressive mood disorders with medication, some form of antidepressant is routinely prescribed. Both medication and/or psychotherapy for depression can potentially impact life insurance underwriting. According to the National Institute of Mental Health, antidepressants commonly used to treat depression may include the following...

Commonly Prescribed Antidepressants

According to the Anxiety and Depression Association of America, "the most commonly diagnosed form of depression is Major Depressive Disorder."

Life Insurance and Depression

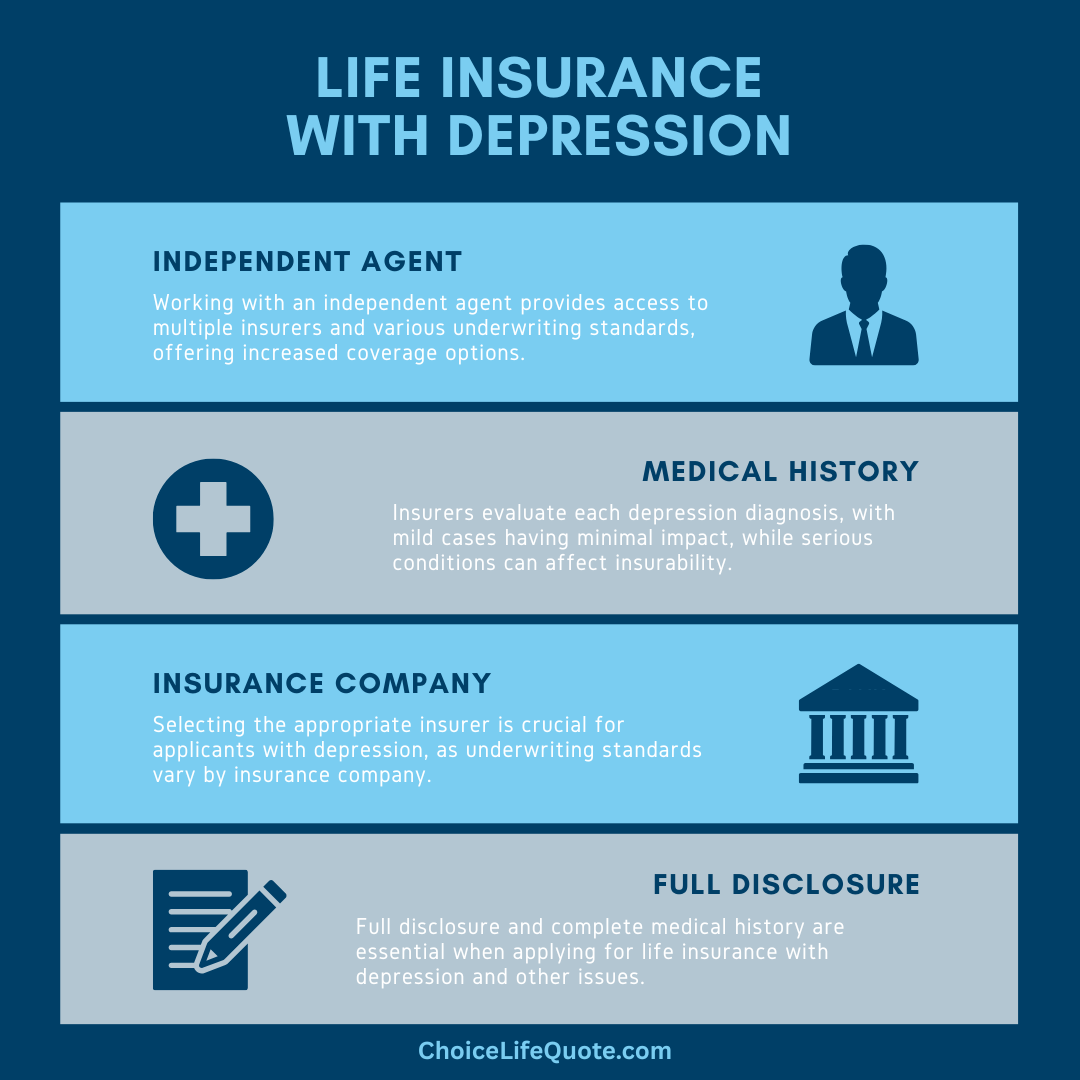

In applying for life insurance with a history of depression, it is important to consider how your diagnosis and associated treatment may impact your ability to qualify for coverage.

Since severe or even moderate depression can significantly affect a person’s overall health, it can also affect life insurance underwriting, policy approval, and rates.

In even minor cases, an applicant can expect inquiries into their medical history and potentially higher premium rates. While in severe instances or cases with a negative prognosis, coverage may be declined altogether. The underwriting process in applying for life insurance will involve a review of the information provided on your application to include medical history. If you have a history of depression, the insurance company will likely request additional information related to your specific diagnosis, treatment history, and current condition. It is important that you provide complete and accurate information related to your medical history. The following are questions that you can expect from life insurance company underwriting related to depression.

Underwriting Questions for Depression

Coverage Rates with Depression

In calculating life insurance rates, an insurer considers an applicant’s age, gender, build, lifestyle, health, family history, and other relevant factors.

Given that depression can have a significant impact on an individual’s overall health and mortality, it makes sense that this condition would influence policy premiums.

So yes, you will likely pay more for life insurance with a history of depression diagnosis and treatment. Provided your life insurance policy is approved, the rates for coverage will be based on the assigned underwriting class or category. In general, these underwriting classes range from “Preferred Plus,” which is the best possible category, to a “Standard” or higher rating. In the case of an applicant with a history of depression, assigned ratings will depend on the severity of depression, treatment history, and other considerations.

The following provides potential underwriting classes based on mild, moderate, and severe depressive mood disorder. As an example, an applicant with mild depression that is well-controlled with using a single medication may possibly qualify for a Preferred underwriting class. Whereas an applicant suffering from severe depression with recent suicidal ideations will likely be declined. Please note that life insurance company underwriting makes the final decision regarding rates and policy approval.

Possible Underwriting Classes

Best Companies for Depression

In comparing life insurance companies, there are several insurers that will potentially approve an applicant with a history of mild or moderate depression. The type of coverage that you are applying for can also make a difference in underwriting standards. As an example, a final expense policy may offer more liberal underwriting than a fully underwritten level term policy. It is also important to consider that underwriting standards may vary from one company to another. For these reasons, it can be beneficial to work with an experienced independent agent who is familiar with the policy options and best companies for mental health, depression, anxiety, and other similar conditions. In our experience, the following companies may be recommended for individuals seeking life insurance with depression.

Case Study: Mild Depression

Erica is a 40-year-old elementary school teacher with a husband (Matt) and two school-age children (Chelsea and Rebecca). In reviewing the family finances, the couple realizes that they both need additional life insurance coverage for income protection. In considering their options, Erica is concerned that her history of mild depression will prevent her from qualifying for the much-needed coverage. In speaking with an independent insurance agent, they learn that it is often possible to qualify for affordable life insurance with depression in an applicant’s medical history. After completing a needs assessment, Matt and Erica both apply and are approved for a $250,000 20 year term life insurance policy. In this case, Erica was able to qualify for affordable life insurance with depression history.

Conclusion

In conclusion, qualifying for life insurance with depression hinges on transparently disclosing your medical history. Depression, whether mild or severe, can impact policy premiums and approval. While underwriting considers factors like treatment history and current health status, many insurers do offer affordable options for those with well-managed conditions. It's crucial to work with an experienced agent who understands the nuances of mental health underwriting to navigate this process effectively. By providing accurate information and exploring suitable insurers, it is possible to secure coverage, ensuring financial protection for loved ones in the face of life's uncertainties.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.