Qualifying for Life Insurance with Sleep Apnea

In working with clients, we routinely run across common medical conditions. Sleep apnea is one such diagnosis that often concerns life insurance applicants. So, can you get affordable life insurance with sleep apnea? This question is understandable given the potential health effects of sleep apnea and associated conditions. Luckily, the short answer is YES in many instances.

This article provides information related to life insurance with sleep apnea, underwriting requirements, potential impact on premium rates, and best companies for life insurance with medical conditions.

Understanding Sleep Apnea Diagnosis

Sleep apnea is a common sleep disorder that affects millions of Americans, many of whom may be unaware of their condition.

According to the Mayo Clinic, "sleep apnea is a potentially serious sleep disorder in which breathing repeatedly stops and starts.” This can also influence personal health overall.

3 Types of Sleep Apnea

Obstructive Sleep Apnea – The most common type of sleep apnea, this occurs when the muscles of the throat relax causing a complete or partial airway obstruction.

Central Sleep Apnea – This less common type of sleep apnea occurs when the brain does not appropriately signal the muscles that control breathing.

Complex Sleep Apnea – This combined type of sleep apnea presents when an individual has both obstructive and central sleep apnea.

Common Symptoms of Sleep Apnea

According to the Mayo Clinic, common symptoms associated with both obstructive and central sleep apnea may include but are not limited to the following. If you are currently experiencing these or other sleep-related symptoms, please consult a medical professional.

Treatment for Sleep Apnea

Treatments for sleep apnea will vary depending on the severity of your condition but may include: appropriate weight loss, limiting alcohol intake, altered sleep habits or positions, using a continuous positive airway pressure (CPAP) device, using a bi-level positive airway pressure (Bi-PAP) device, or in certain circumstances airway surgery.

According to the National Sleep Foundation, “about one-third of the adults in a primary care clinic population noted that they had obstructive sleep apnea symptoms.”

Life Insurance with Sleep Apnea

In qualifying for life insurance with sleep apnea, as with other medical conditions, it is important to consider how your diagnosis potentially affects health and mortality.

In addition to sleep apnea, other associated conditions or complications may have an impact on policy approval and rates.

Underwriting Questions for Sleep Apnea

In addition to underwriting implications directly related to sleep apnea, there are several complications that may occur because of this condition that can also influence underwriting and policy approval. Potential complications associated with sleep apnea can include conditions such as high blood pressure, heart problems, type 2 diabetes, metabolic syndrome, liver problems, medication issues, surgical complications, and others issues.

Cost of Coverage with Sleep Apnea

The rates that you pay for life insurance are based on several factors including your age, sex, build, lifestyle, family history, medical conditions, and other considerations.

Since sleep apnea, can have a potentially significant and negative impact on your overall health and mortality.

It stands to reason that a sleep apnea diagnosis can affect the premiums that you pay for life insurance coverage. Provided your policy is approved, premium rates will be based on the underwriting class assigned. An insurer's underwriting classes can range from "preferred plus" (best possible rates) to "standard" (standard rates), or even be assigned a "table rating" (additional charges). There is also the possibility that an application for coverage may be declined altogether. The following are examples of potential underwriting classes based on mild, moderate, and severe sleep apnea. Please note that life insurance company underwriting makes the final decision regarding rates and/or policy approval.

Possible Underwriting Classes

Sample Rates with Sleep Apnea

Sample Standard Plus Rates

50 y/o Male Non-smoker

Sample rates for life insurance with sleep apnea illustrated below are for a $250,000 10 year level term life insurance policy on a 50-year-old male non-smoker qualifying for a standard plus underwriting class based on overall health status.

Note: Insurance company underwriting makes the final decision concerning rate class and policy approval.

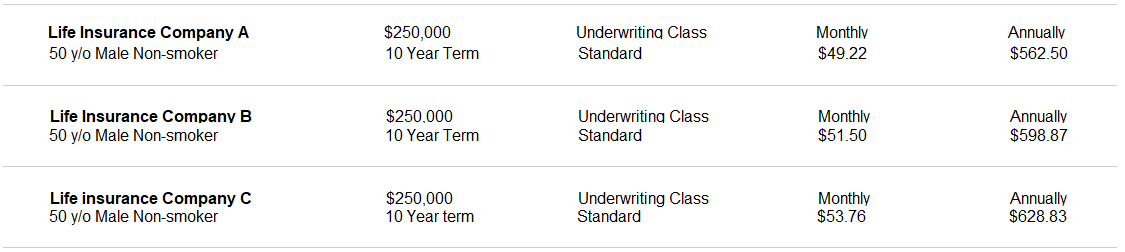

Sample Standard Rates

50 y/o Male Non-smoker

Sample rates for life insurance with sleep apnea illustrated below are for a $250,000 10 year level term life insurance policy on a 50-year-old male non-smoker qualifying for a standard underwriting class based on overall health status.

Note: Insurance company underwriting makes the final decision concerning rate class and policy approval.

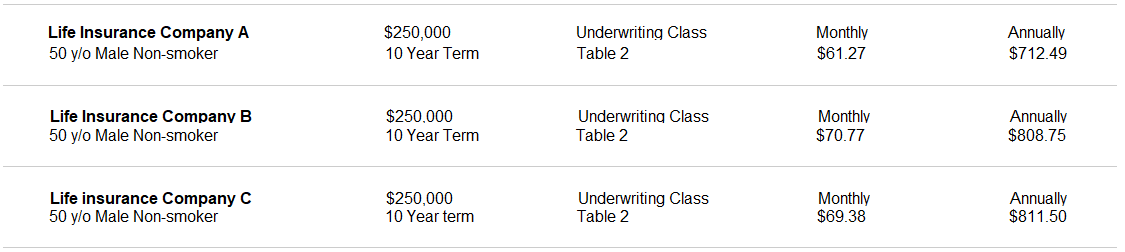

Sample Table 2 Rates

50 y/o Male Non-smoker

The rates for life insurance with sleep apnea illustrated below are for a $250,000 10 year level term life insurance policy on a 50-year-old male non-smoker qualifying for a table 2 underwriting class based on overall health status.

Note: Insurance company underwriting makes the final decision concerning rate class and policy approval.

Best Companies for Sleep Apnea

There are several top-rated life insurance carriers that will offer life insurance with sleep apnea history. In comparing insurers, it is important to compare premium rates, but you should also consider company ratings, policy offerings, underwriting standards, and other relevant factors. If you have a history of sleep apnea, or other medical conditions, even minor differences in underwriting policies can have a significant impact on policy approval, underwriting class, and premium rates. In our experience, the following companies are recommended for individuals with a history of sleep apnea.

When selecting life insurance companies for individuals with a history of sleep apnea, it's crucial to assess beyond just premium rates. Factors like company ratings, policy offerings, and underwriting standards play a pivotal role.

Case Study: Controlled Sleep Apnea

Case Study

Life Insurance with Sleep Apnea

Eric is a 55-year-old business executive with a wife (Lindsey) and three young children (Christian, Caleb, and Christina). Since his salary provides the family’s only source of income, Eric is considering purchasing a life insurance policy for income replacement. However, due to a recent sleep apnea diagnosis he is concerned about qualifying for coverage. In speaking with an independent insurance agent, Eric learns that since his sleep apnea is moderate and well-controlled he can likely qualify for affordable life insurance coverage with several “A” rated companies. After considering his family’s coverage needs, Eric applies and is approved for a $1 million 15 year level term policy at standard rates. In this case, Eric was able to get affordable life insurance with sleep apnea in his medical history.

Conclusion

In conclusion, obtaining life insurance with sleep apnea is feasible for many applicants. Despite concerns over its potential health implications, individuals diagnosed with sleep apnea can secure affordable coverage from various reputable insurance providers. By understanding the underwriting process, potential impact on premiums, and the best companies offering policies tailored to medical conditions like sleep apnea, applicants can navigate the insurance landscape effectively. Whether managing mild, moderate, or severe cases, proactive management and compliance with treatment play crucial roles in achieving favorable underwriting outcomes and ensuring financial protection for loved ones.

Our team can assist in choosing the right type of policy, an appropriate amount of coverage, and the best insurance company for your situation. Get the quality coverage you need at affordable rates. Give us a call at (800) 770-8229 or request an instant quote today!

Disclaimer: Information is intended to be educational in nature and should not be considered financial, tax, or legal advice. Please consult a qualified professional for individual assistance.

Dr. James Shiver is the Managing Principal at ChoiceLifeQuote.com, an online life insurance service in the family and small-business markets. He also serves as a university business professor, as well as being an Accredited Financial Counselor® and financial literacy advocate.